Your Fall Benefits May Arrive Differently: If you rely on Social Security or VA benefits, get ready for a major shift this fall. The way you receive your monthly payments is about to change — and if you’re still cashing paper checks, it’s time to act. The U.S. Treasury and Social Security Administration (SSA) are making a big push to modernize benefit delivery. Starting in September 2025, most paper checks will disappear. Instead, benefits will be sent via direct deposit or a prepaid debit card. Let’s break it down in simple terms, what it means for you, and what you need to do.

Your Fall Benefits May Arrive Differently

The future of benefit payments is digital — and it’s arriving faster than many expected. With over half a million Americans still relying on paper checks, the September–October 2025 deadline is a wake-up call. But here’s the good news: switching is simple, safe, and secure. You don’t have to be tech-savvy — just take a few steps now and avoid potential delays or scams later. Whether you’re a retiree, a disabled veteran, or a caregiver helping someone else, this transition is your chance to take control and protect your income in a smarter way.

| Topic | Details |

|---|---|

| Change | Paper checks phased out by September 2025 |

| Impact | Over 540,000 recipients affected, including Social Security, SSI, and VA beneficiaries |

| Options | Direct Deposit or Direct Express® Debit Card |

| Deadline | October 2025 — No more paper checks issued |

| Reason | Increase payment security, prevent fraud, cut government costs |

| Risk | Missed or delayed payments if action isn’t taken |

| Official Resource | https://www.ssa.gov |

Why Is This Happening?

The move to eliminate paper checks is rooted in security and cost-efficiency. Mailing checks costs the government significantly more than direct deposits — about $1 per check compared to 10 cents for a digital transfer. The U.S. Treasury reports over $120 million saved annually with electronic disbursements.

Fraud is also a major concern. In 2023 alone, the Federal Trade Commission (FTC) reported more than $10 million in benefit fraud linked to stolen or rerouted paper checks. With identity theft on the rise, electronic payments offer tighter security and better tracking.

This transition also supports disaster preparedness. During events like hurricanes or wildfires, mail delivery can be disrupted for weeks. Electronic transfers ensure recipients receive their money no matter where they are.

Who’s Affected By Fall Benefits May Arrive Differently?

The change affects over 540,000 Americans — particularly seniors and disabled individuals — who still receive paper checks through:

- Social Security Retirement Benefits

- Supplemental Security Income (SSI)

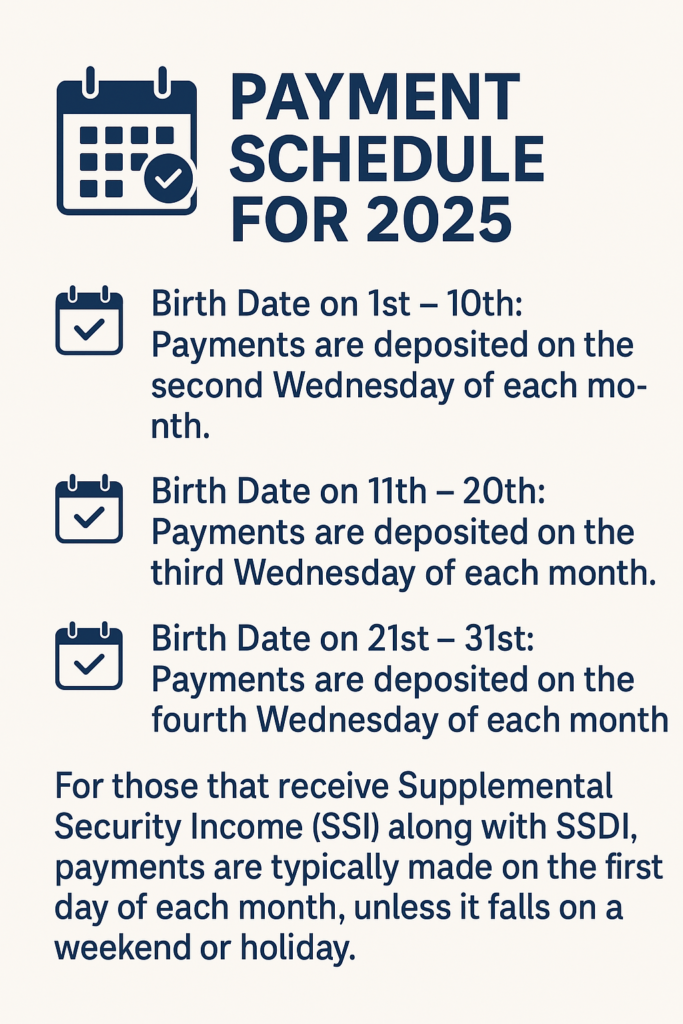

- Social Security Disability Insurance (SSDI)

- Veterans Affairs (VA) Disability and Pension Payments

If you or someone you care for fits this profile, it’s important to prepare now.

What Are Your Payment Options?

You have two main options, and both are proven to be safe, convenient, and efficient.

1. Direct Deposit

Direct deposit sends your benefits straight to your checking or savings account. It’s the fastest and safest way to receive payments.

How to set it up:

- Sign in to your My Social Security account at ssa.gov/myaccount

- Provide your bank routing and account numbers

- You can also call SSA or visit your local Social Security office for assistance

Direct deposit gives you flexibility. You can use your funds immediately, pay bills online, or withdraw cash at your bank.

2. Direct Express® Debit Mastercard®

This option is designed for those who don’t have a traditional bank account. It’s a reloadable prepaid card backed by Comerica Bank and approved by the U.S. Treasury.

Key Features:

- No monthly fees or credit check

- Funds added automatically each month

- Use at ATMs, stores, and to pay bills online or by phone

- Comes with fraud protection and customer support

Step-by-Step Guide to Switching Payment Methods

Step 1: Identify Your Current Method

Check whether you’re currently receiving a paper check. If so, you’ll need to act before the deadline.

Step 2: Choose Your Preferred Payment Method

Decide between direct deposit and Direct Express. If you have a bank account, direct deposit is likely the better choice. If you don’t, Direct Express is a safe and convenient alternative.

Step 3: Gather Your Information

- For direct deposit: you’ll need your bank routing and account numbers

- For Direct Express: you’ll need basic personal info and may be asked to verify your identity

Step 4: Enroll

- Online: Visit ssa.gov or va.gov

- By phone: SSA: 1-800-772-1213, VA: 1-800-827-1000

- In person: Visit your local SSA or VA field office

Step 5: Confirm Your Information

Make sure your mailing address, phone number, and email (if applicable) are current in case the agencies need to contact you.

How to Help Elderly or Disabled Loved Ones?

Many seniors or disabled recipients may not be comfortable with technology. Here are practical ways you can help:

- Offer to walk them through the sign-up process

- Assist them in setting up online banking

- Help them recognize phishing emails and scam phone calls

- Encourage them to set up account alerts to monitor deposits

Churches, community groups, and local libraries can also organize “Digital Benefit Help Days” to assist older adults in the transition.

Avoiding Scams During the Switch

Unfortunately, whenever there’s a big shift in how the government sends out money, scammers come out of the woodwork. Here’s how to protect yourself or your loved ones:

- Never share your Social Security number, Direct Express card number, or bank info over the phone or via email

- The SSA or VA will never call, text, or email you asking for payment or personal info

- Only use trusted sites like ssa.gov, va.gov, and usdirectexpress.com

- Report suspected fraud immediately to https://oig.ssa.gov

Real Talk: Why It Matters

This isn’t just about going digital — it’s about making sure your money lands in your hands securely and without delay.

In recent years, delayed mail and check fraud have caused major headaches for benefit recipients. That’s why this shift is essential. It protects your income, your identity, and your peace of mind.

As SSA spokesperson Darren L. James recently said, “Our goal is to ensure every beneficiary receives their money securely and on time. We’re urging people to act now to avoid any disruption.”

Here’s When the Next Round of Social Security Payments Is Expected to Arrive

To Qualify for the $5,108 Maximum Social Security Benefit, Here’s the Income You Need

Pro Tips to Stay Ahead

- Keep your contact info updated with SSA or VA

- Set up email or text alerts with your bank or Direct Express

- Use auto-pay for bills to avoid late fees

- Review your deposits monthly to catch any errors early

- If you suspect fraud, call 1-800-269-0271 or visit oig.ssa.gov