You Could Get a $1,611 Social Security Payment This July: If you’re 65 in 2025 and thinking about finally tapping into your Social Security benefits, there’s a number you need to know: $1,611. That’s the average monthly Social Security retirement payment for individuals around this age, according to the Social Security Administration (SSA).

But here’s the thing—that number isn’t a guarantee. It’s an average based on a combination of earnings, years worked, and when you start drawing benefits. So how do you know if you’ll get that amount—or more, or less? This article explains it all in plain English, with expert guidance, helpful examples, and practical advice. Whether you’re planning for retirement or already claimed benefits, understanding what to expect in July 2025 could make a real difference.

You Could Get a $1,611 Social Security Payment This July

If you’re turning 65 in 2025, the opportunity to claim Social Security is finally on the table. The average benefit of $1,611 may or may not be your number—but it’s a strong benchmark to measure against. By understanding how your benefits are calculated, what filing early really costs, and what tools are available to you, you can take control of your retirement income. Be smart. Stay informed. And make sure every dollar you earned works for you in retirement.

| Key Detail | Information |

|---|---|

| Average Benefit at Age 65 | $1,611/month |

| Earliest Filing Age | 62 (with reduced benefits) |

| Full Retirement Age (FRA) | 67 (for those born in 1960 or later) |

| COLA Adjustment for 2025 | 2.5% (Approx. $50/month increase) |

| July 2025 Payment Dates | July 3, 9, 16, 23 (depending on when you filed and your birthday) |

| Official Website | ssa.gov/benefits/retirement |

What Is the $1,611 Social Security Payment?

The $1,611 figure is the average monthly retirement benefit for someone who starts receiving Social Security around age 65. This figure comes from late 2024 SSA data and includes individuals with varied work histories, career types, and filing ages.

Social Security is meant to replace part of your pre-retirement income. It’s not a full pension or a guaranteed income for life at any set amount. What you’ll receive is tied to how much you earned, how long you worked, and when you choose to start benefits.

Some retirees collect as little as $900/month, while others receive over $3,000/month, especially if they waited until age 70 and had high earnings.

How Are Social Security Benefits Calculated?

Understanding how your benefit is calculated can help you plan better.

The SSA uses the following steps:

- Average Indexed Monthly Earnings (AIME): Your highest 35 years of earnings are adjusted for inflation.

- Primary Insurance Amount (PIA): This is the amount you’ll get if you claim benefits at your Full Retirement Age (FRA).

- Filing Age Adjustment: If you file before or after FRA, the benefit is reduced or increased accordingly.

For example, if your average salary was around $60,000 over your working life, and you claim at 65 (two years before FRA if born in 1960), your benefit may be reduced by about 13-14% from your full PIA.

Who Qualifies for Social Security at 65?

To be eligible for Social Security retirement benefits, you must:

1. Have at Least 40 Work Credits

This equals about 10 years of work in jobs that paid into Social Security. In 2025, you earn one credit for every $1,730 in earnings, up to 4 credits per year.

2. Be Age 62 or Older

You can apply for benefits as early as 62, but doing so permanently reduces your monthly check. At 65, you’re still a couple of years shy of Full Retirement Age (FRA), so expect a reduction unless you wait.

3. Be a U.S. Citizen or Lawful Resident

Most recipients are U.S. citizens. Some non-citizens may qualify if they meet legal residency and work history requirements.

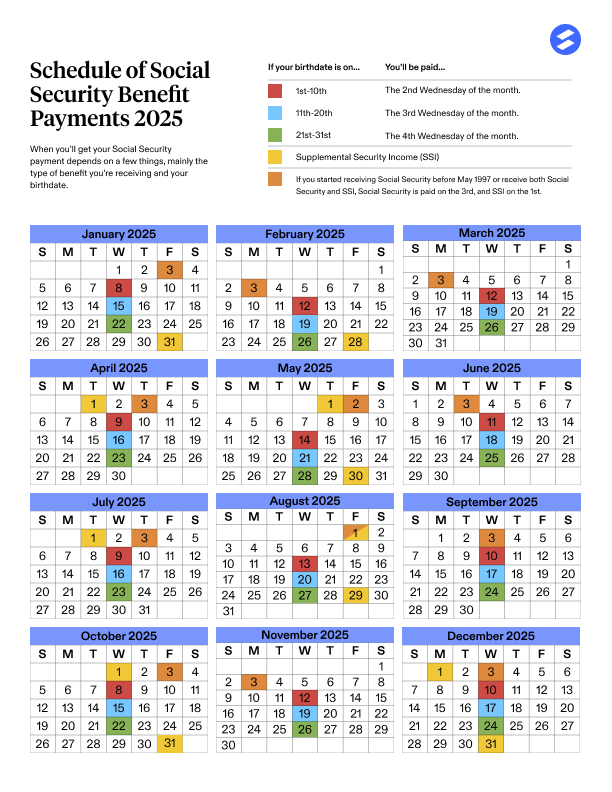

July 2025 Social Security Payment Schedule

Your payment date depends on:

- When you filed for benefits

- Your birth date

If You Filed After May 1997:

| Birth Date | Payment Date |

|---|---|

| 1st–10th of the month | July 9, 2025 |

| 11th–20th | July 16, 2025 |

| 21st–31st | July 23, 2025 |

If You Filed Before May 1997:

- Your payment arrives on July 3, 2025

Payments are sent via direct deposit or paper check, with direct deposit being faster and safer.

Early vs. Delayed Retirement: What You Need to Know

Filing age has a huge impact on your monthly benefit.

| Claim Age | Monthly Benefit (If PIA is $1,800) |

|---|---|

| 62 | ~$1,260 (30% reduction) |

| 65 | ~$1,560 (13% reduction) |

| 67 (FRA) | $1,800 |

| 70 | ~$2,232 (24% increase) |

Waiting until 70 gives you the maximum monthly payout. But if you need the money earlier, filing at 65 might be the right move.

Real-Life Examples: What People Actually Get

Let’s look at two fictional but realistic cases:

1. Steve, Construction Worker

- Retired at 65

- Worked for 40 years

- Average income: $52,000/year

- Monthly benefit: $1,490

2. Maria, Teacher (with pension)

- Retired at 65

- Some years outside Social Security system

- Average income: $68,000/year

- Due to WEP (Windfall Elimination Provision), her benefit: $1,100

Note: As of 2025, WEP and GPO repeal may change how pensions impact Social Security benefits.

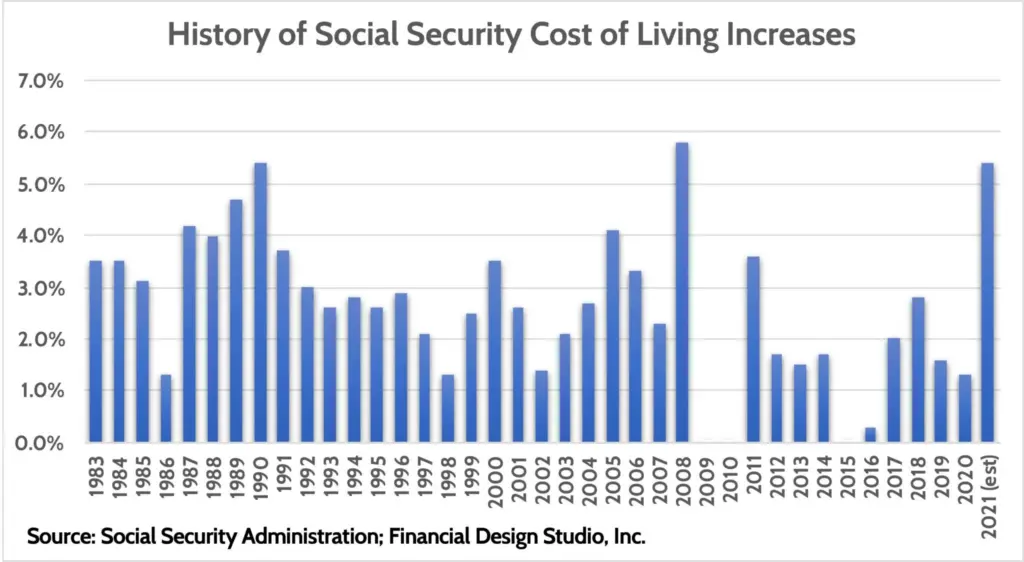

What’s New in 2025: COLA and Overpayment Rules

Cost-of-Living Adjustment (COLA)

For 2025, SSA implemented a 2.5% COLA. That’s about $50/month extra for the average retiree.

Overpayment Clawbacks

SSA updated its rules: Overpayments may now result in 50% deductions from future checks (up from 10%), unless you file a hardship waiver.

How to Maximize Your $1,611 Social Security Payment This July?

Even if you’re already 65, there are still ways to optimize your Social Security benefits.

- Delay Filing (if you can)

Each year you wait, you earn delayed retirement credits—up to 8% per year until age 70. - Keep Working

Earnings after 65 can still replace lower-earning years in your 35-year average. - Avoid the Earnings Test

If you file before FRA and earn over $22,320 (2025 limit), your benefits may be temporarily reduced. - Coordinate Spousal Benefits

Married? You might qualify for spousal or survivor benefits, even if you never worked yourself.

Watch Out for Scams

With more Americans collecting benefits, scammers are on the prowl. The SSA will never:

- Threaten to suspend your number

- Ask for payment via gift cards or wire transfers

- Demand personal information over the phone

What About Taxes on Social Security?

Yes—your benefits can be taxed.

For individuals:

- If your combined income is over $25,000, up to 50%-85% of your benefits may be taxable.

For joint filers:

- Taxes kick in if combined income exceeds $32,000.

“Combined income” = Adjusted Gross Income + nontaxable interest + ½ of your Social Security benefits.

State-by-State Cost of Living

While the federal benefit is consistent, your actual lifestyle depends on where you live.

For example:

- In Florida, $1,611 may cover basics and rent.

- In California or New York, it might barely cover housing.

Why Some Social Security Recipients Might See Their Payments Slashed by 50%

Millions of Americans Could See Their Social Security Checks Cut by 50 Percent