You Could Get £333 a Month From DWP: “You Could Get £333 a Month from DWP” is more than just a headline—it’s a serious opportunity for thousands of unpaid carers across Great Britain. If you spend time every day supporting a loved one and feel stretched, you may qualify for Carer’s Allowance, a financial boost up to £83.30 a week. We’ll explore who qualifies, how to apply, and all the extra ways this allowance can help, written clearly enough for even a ten-year-old to grasp—but packed with enough insight to guide advisors, policymakers, and professionals.

You Could Get £333 a Month From DWP

Carer’s Allowance is more than a benefit—it’s recognition of your hard work and sacrifices. And with the new update in 2025, more of you now qualify for £333 each month to help cover living expenses, reduce stress, and give room to care without losing your income. If this might apply to you, please take a moment today to check your eligibility, gather documents, and submit your claim. You deserve support, and the UK government offers it in appreciation of the essential care you provide.

| Feature | Details |

|---|---|

| Benefit Name | Carer’s Allowance |

| Weekly Payment | £83.30/week (approx. £333/month) |

| New Weekly Income Threshold | £196/week (after tax, National Insurance, pension, work expenses) – up from £151/week |

| Care Requirement | At least 35 hours/week caring for someone |

| Age and Residency | Aged 16+, resident in England, Scotland, or Wales (2 of the last 3 years) |

| Education Limit | Not in full-time education (≥ 21 hours/week) |

| Qualifying Benefits for Caree | Personal Independence Payment (PIP) daily living part, Disability Living Allowance (middle/highest), Attendance Allowance, Armed Forces Independence Payment |

| Added Perks | National Insurance credits, Council Tax Support, Carer’s Credit, Universal Credit top ups |

| Official Source | gov.uk/carers-allowance |

Why Carer’s Allowance Matters?

More than 1.3 million people in the UK provide unpaid care, equivalent to a full-time job—but without pay. Caring can be rewarding yet exhausting, and without financial support, many families live under stress. The Carer’s Allowance offers financial relief, National Insurance credits toward pensions, and can unlock access to other benefits. With the income limit updated in April 2025, thousands more can now qualify.

What Is Carer’s Allowance?

Carer’s Allowance is a means-tested benefit awarded by the Department for Work and Pensions (DWP). It’s designed for individuals aged 16 or older who provide unpaid care for at least 35 hours a week to someone receiving qualifying disability benefits. You don’t need to be related or live with them—what counts is the care you give, whether that’s helping with meals, baths, appointments, or personal tasks. You can work or study part-time and still qualify, as long as income and care requirements are met.

The Big Change in 2025

As of April 2025, the earnings cap increased from £151 to £196 per week (after deductions). This £45 weekly increase is significant. The DWP estimates about 60,000 more people are now eligible. For individuals working part-time or caring while earning modest wages, this update opens a financial safety net without needing drastic changes in their schedule.

Am I Eligible? Let’s Break It Down

Age and Residency

- You must be 16 or older.

- Must have lived in England, Scotland, or Wales for at least 2 of the last 3 years.

- UK citizenship isn’t required—you can be a resident if other conditions are met.

Caring Responsibilities

- Provide 35 hours or more of unpaid care each week.

- The person you care for must receive one of these benefits:

- Personal Independence Payment (PIP) – Daily Living component

- Disability Living Allowance (DLA) – Middle or High Care rate

- Attendance Allowance

- Armed Forces Independence Payment

Income and Work

- Weekly income must be £196 or less after deductions such as tax, National Insurance, pension contributions, and allowable work expenses.

- You can work part-time or be self-employed, as long as your earnings stay under that threshold.

Education

- You must not be in full-time education, defined by DWP as 21+ guided study hours per week.

- Evening classes or occasional study typically don’t count toward this limit.

Other Benefits or Pension

- You can receive Carer’s Allowance on top of Universal Credit, but it may reduce other means-tested benefits.

- You can still earn National Insurance credits, which count toward your State Pension.

Real-Life Scenarios

Scenario 1: Sophia’s Story

Sophia, 42, cares for her mum with mobility issues. She works part-time, earns £180/week take-home, and isn’t in full-time education. Mum receives PIP (Daily Living component). Before April 2025, Sophia didn’t qualify due to the earnings limit. Now, with the new threshold, she’s eligible and gains £333/month, helping with bills and giving peace of mind. She also receives National Insurance credits toward her pension.

Scenario 2: Daniel’s Situation

Daniel, 28, cares for a friend with severe disability while finishing a two-year nursing diploma (18 hours guided study/week). Daniel works 15 hours/week, earning £150 after deductions. He meets all criteria and applies successfully. Other students in similar positions might find that this allowance helps them stay afloat while studying.

Step-by-Step Guide: How to Apply So You Could Get £333 a Month From DWP

1. Check Your Eligibility

- Use reliable benefits calculators:

- Turn2Us

- EntitledTo

- These tools estimate eligibility and show what additional support you might qualify for (e.g. Council Tax Support, Carer’s Credit).

2. Gather Documents and Information

You will need:

- Your National Insurance number

- Pay and income details – payslips, records, self-employed statement

- Education or course info if applicable (institutions, hours)

- Care recipient’s evidence: name, date of birth, DWP benefit details

- Residency proof: driving license, council tax bill (if requested)

3. Apply Online or by Phone

- Apply online via GOV.UK Carer’s Allowance

- Or call 0800 731 0297 to have a paper form sent or apply by phone

4. Track and Manage Your Claim

- Claims may take 6–8 weeks, sometimes longer if documents are delayed.

- Payments can be backdated to the date you first applied, so don’t wait!

- You can track the progress via your My GOV.UK account or get updates by calling DWP.

5. Report Changes Promptly

Report anything that affects eligibility, including:

- Working more hours or earning above the threshold

- Reduced caring hours (below 35/week)

- Changes in your study program

- Changes in the care recipient’s benefit status

What to Watch Out For?

Tax and Benefit Impact

- Carer’s Allowance is taxable income, potentially affecting your tax bracket or Universal Credit award.

- The person you care for could lose the Severe Disability Premium as DWP may consider you unaware—that can reduce their benefit package.

Earnings Calculations

- Understand what deductions are allowed when calculating your £196/week threshold—tax, National Insurance, pension payments, and some work expenses may apply.

Education and Study Hours

- If you’re studying, keep records of guided study hours to show your study is part-time.

Backdating Limit

- If there was a delay in applying after eligible care began, you can still backdate up to 3 months (or longer in special circumstances), but after that, you lose the time benefit.

Extra Benefits You Might Qualify For

- National Insurance Credits: helps build up your State Pension should your income stay low

- Carer’s Credit: if your income goes up too much, you still get credits if you care for 20 hours/week

- Council Tax Support: check with your local council

- Help with travel costs: e.g., Motability Scheme if you have access to a vehicle

- Mental health and well-being support: via Carers UK and local carer support centers

- Respite care services: providing short-term relief from caring duties

Supporting Your Application with Data

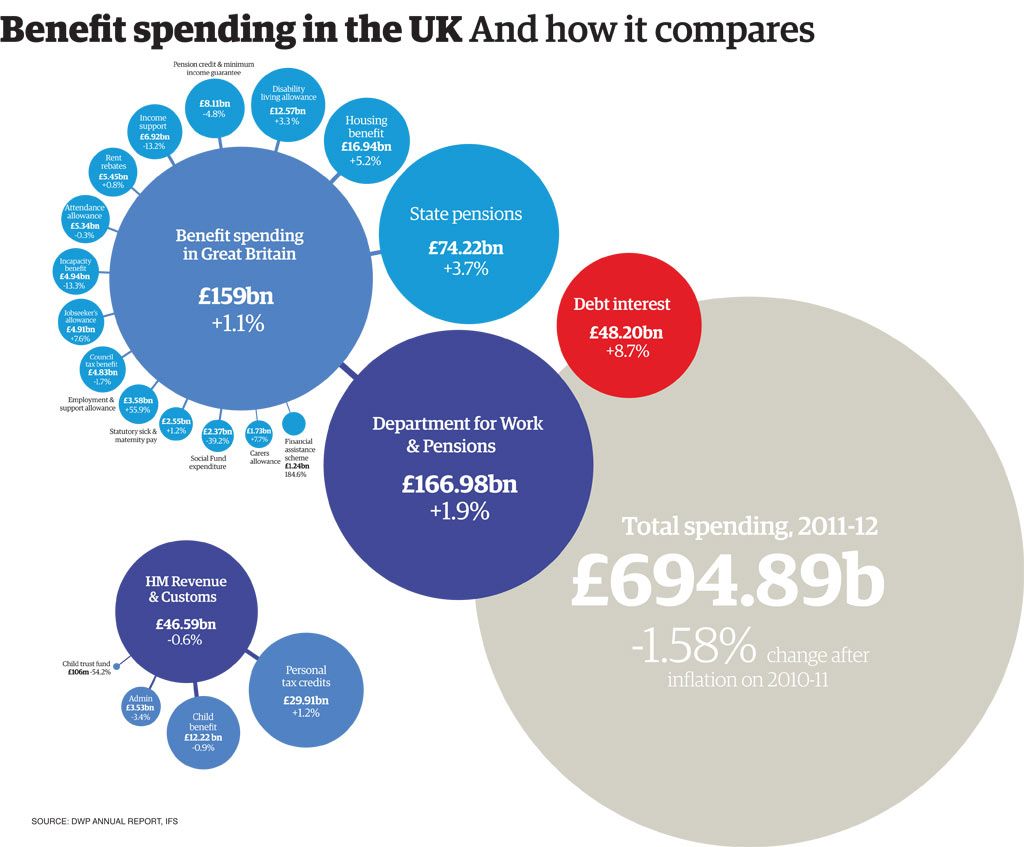

With more than 1.3 million unpaid carers in the UK, many don’t realise they’re entitled to Carer’s Allowance or related benefits. According to Carers UK, unpaid carers contribute around £162 billion per year in care—that’s more than what the NHS spends annually.

And with the £45 weekly earnings increase in 2025, you could now earn up to £10,192 a year before you’re no longer eligible. The DWP estimates roughly 60,000 new claims a year are expected due to this change.

DWP Confirms Payment Update for 24 July— Check Who Could Be Affected

UK’s Retirement System Faces Pressure—Why the Government May Need to Raise the Pension Age Again?

DWP Winter Fuel Payment Dates Announced for 2025—Here’s When You’ll Get Paid

Tips to Strengthen Your Application

- Keep a carer diary: note days and hours to support your care-hours claim.

- Save payslips and invoice records if you’re self-employed.

- Check your expenses to reduce your net income calculation legally.

- Stay informed—benefits change often. GOV.UK and Carers UK newsletters are helpful.

- Get practical support—local carer centers can lend practical and emotional support.