Why SSA Beneficiaries May See Delays or Changes in Their Upcoming Payments: As many Social Security Administration (SSA) beneficiaries are already aware, receiving your monthly payment is crucial for budgeting, planning, and making sure that life goes smoothly. But sometimes, things don’t go according to plan. Whether it’s a delay, a change in the amount of your payment, or even a temporary pause, these disruptions can cause anxiety. Let’s dive into why SSA beneficiaries may see delays or changes in their upcoming payments, what might cause them, and what you can do to stay ahead of any issues. This guide is built to make the complexities of SSA payment issues clear and actionable, no matter your experience level with these systems.

Why SSA Beneficiaries May See Delays or Changes in Their Upcoming Payments?

| Key Information | Details |

|---|---|

| Why Delays and Changes Happen | Overpayments, staffing shortages, changes in SSA policy, and compliance issues are common causes. |

| Notable Causes of Payment Disruptions | Overpayment recovery, staffing issues, electronic payment transition, compliance issues with reporting, and calendar-related delays. |

| How to Prevent Payment Disruptions | Regularly update information with SSA, monitor payments, transition to electronic payments, and comply with SSA reporting requirements. |

| Important Deadlines | Transition to electronic payments by September 30, 2025 to avoid future payment disruptions. |

| Helpful Resources | Official SSA Website |

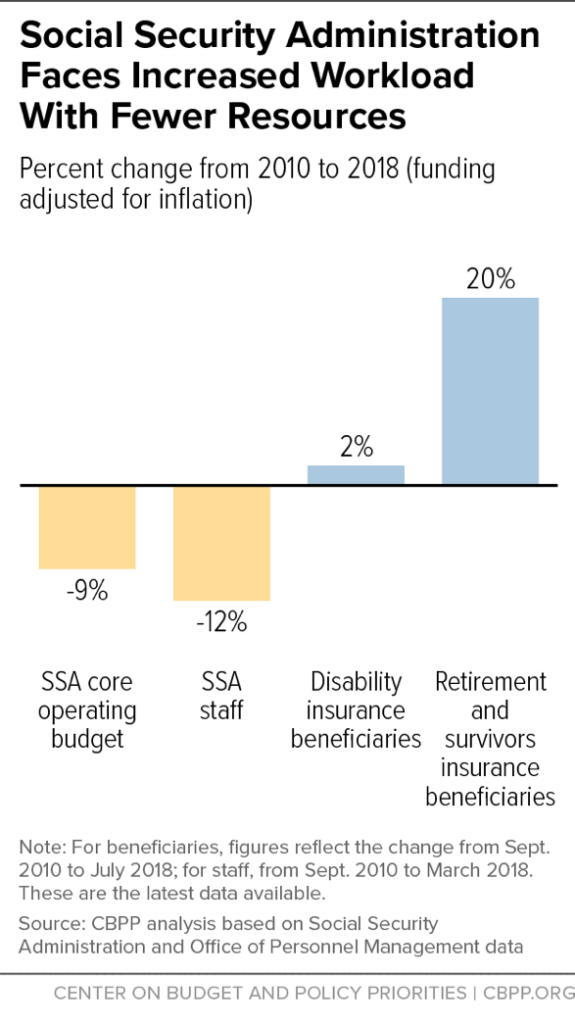

| Statistics and Facts | In 2025, staffing shortages are expected to lead to delayed processing. 7,000 SSA jobs are being eliminated, which increases wait times. |

Introduction: Why SSA Payments Matter

For millions of Americans, Social Security benefits are more than just a monthly check—they’re a lifeline. From retirees to people with disabilities, and even survivors of loved ones, Social Security benefits are a key part of maintaining financial stability. So when the SSA payment schedule gets disrupted, it can create a ripple effect that’s felt across many lives.

In this article, we’ll take a look at the reasons why SSA payments may be delayed or changed, and offer practical advice on what to do if you’re affected. Understanding these factors can help prevent unnecessary confusion and financial stress down the road.

Why SSA Beneficiaries May See Delays or Changes in Their Upcoming Payments?

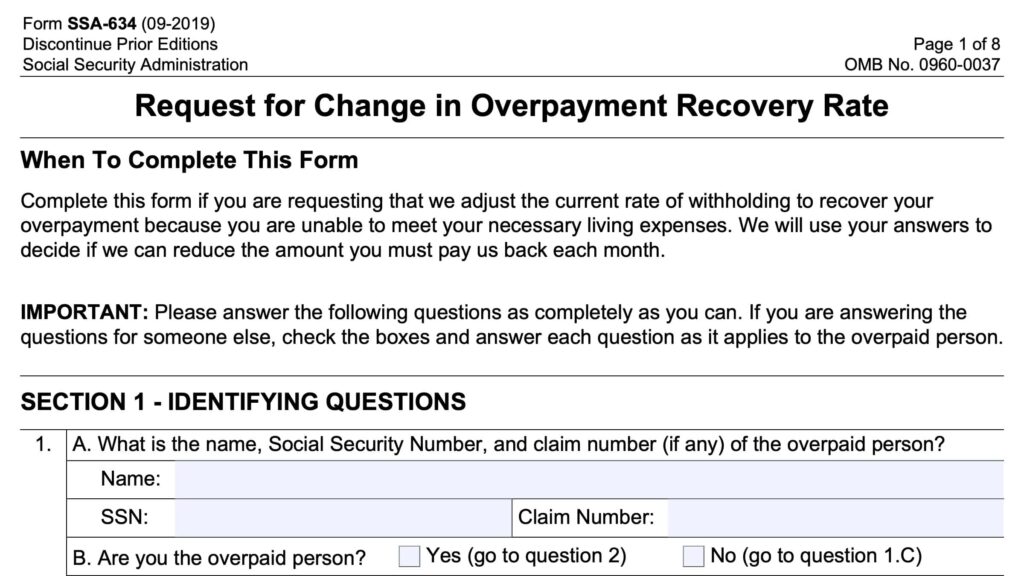

1. Overpayment Recovery: When the SSA Takes Back Money

It’s not uncommon for recipients to find out that they were overpaid at some point. An overpayment occurs when the SSA mistakenly gives out more money than you are entitled to. This could happen due to errors in reporting, changes in your financial situation that weren’t reported on time, or other mistakes.

In such cases, the SSA will recover the overpaid amount by reducing future payments or even taking a chunk of one large payment. If you’re in this situation, you may receive a notice explaining how much you owe and the process for repayment.

Example:

A woman in Tennessee was shocked to see her Supplemental Security Income (SSI) payment drop to just $14 a month after the SSA claimed she had been overpaid $12,000. The error stemmed from a miscalculation of her husband’s income. These situations can feel frustrating, but it’s crucial to stay on top of any communication from SSA and address it quickly.

2. Staffing Shortages: Fewer Hands on Deck

Another common reason for delays is staffing shortages within the SSA. Due to budget cuts, about 7,000 SSA jobs are being eliminated in the coming years. The reduction in personnel means that fewer people are available to process payments, handle customer service, and resolve any issues that arise.

This can create a backlog, leading to longer wait times on the phone, slower processing of your claim, and possible payment delays. In the worst-case scenario, some beneficiaries have faced months-long delays in receiving their payments.

Example:

In 2025, the SSA’s plan to eliminate 7,000 jobs may mean that some recipients experience longer wait times or missed deadlines, making it harder to get quick answers to payment questions.

3. Electronic Payment Transition: Say Goodbye to Paper Checks

Did you know that the SSA is transitioning all payments to electronic formats? As of September 30, 2025, paper checks will no longer be an option. Everyone will need to switch to direct deposit or a Direct Express card. While this is designed to increase efficiency and reduce fraud, it could cause delays for those who are still using paper checks.

If you haven’t made the switch yet, it’s important to do so now. Beneficiaries who don’t comply may face disruptions in receiving their benefits.

Example:

If you haven’t updated your payment preference to direct deposit, your payments may be delayed after the SSA’s deadline of September 30, 2025. Don’t wait—make the change now!

4. Reporting Requirements: Get Your Info in on Time

Social Security benefits are not set it and forget it. To ensure you’re receiving the correct amount, you must keep the SSA updated on your income, living arrangements, and other personal details. If you fail to report changes—like a change in your job status, marital status, or household income—your benefits may be suspended, delayed, or even reduced.

Example:

If you fail to report a death or change in household income, your payment could be delayed. Make sure to report any changes within 10 days of the change.

5. Calendar-Related Payment Delays: When Dates Matter

It may seem trivial, but even the calendar can impact when payments are received. Sometimes, when the calendar falls in a certain way—like when a payment falls on a weekend or holiday—there may be delays in processing. This is typically a one-time issue but can still cause problems if you’re counting on a payment to come in on time.

Example:

In May 2025, Social Security payments were delayed because the second Wednesday of the month, which is when the first batch of payments is distributed, fell on May 14, the latest possible date.

How to Stay Ahead: Practical Tips for SSA Beneficiaries

If you’re a Social Security beneficiary, here are some steps you can take to avoid disruptions and stay on top of your payments:

1. Regularly Check Payment Status

Keep an eye on your payments. If you notice anything unusual or haven’t received your payment when expected, check the SSA website or call their customer service line. Don’t wait too long to address any issues; quick action is essential.

2. Update Your Information

Make sure your contact information, income, and living arrangements are up-to-date with the SSA. If anything changes, let them know as soon as possible. This can help prevent issues like payment suspension or delays.

3. Switch to Electronic Payments

If you’re still receiving paper checks, it’s time to make the change to direct deposit or a Direct Express card. This can prevent issues with payment delays, especially when the SSA transitions fully to electronic payments by 2025. The change is free, easy to set up, and ensures timely payments.

4. Respond Promptly to Notices

If the SSA sends you any notices or requests for information, respond quickly. Delays in providing the required info can lead to payment disruptions. Even if you don’t think you owe anything, it’s always best to confirm with the SSA.

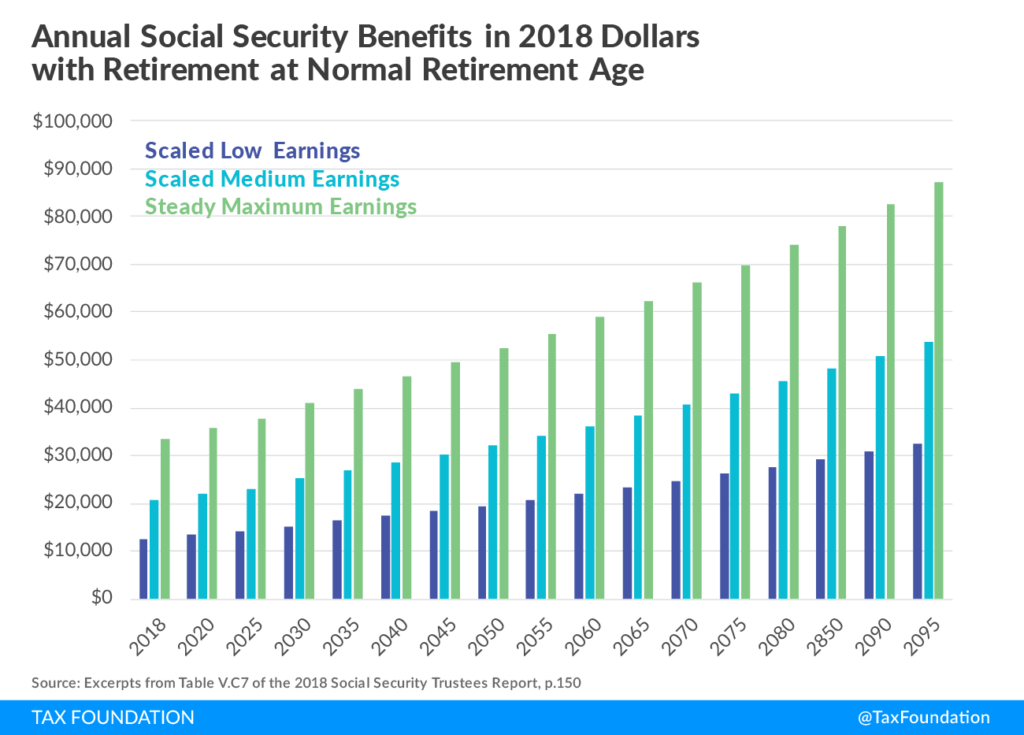

$5,108 Social Security Checks Arrive in July—Here’s Who Qualifies

Social Security Projected to Cut Benefits by 2033, Affecting Retired Workers