Why Some State Pensioners Receive Lower Payments: You’re not alone—and it’s not a mistake in most cases. The truth is, several little-known rules and historic quirks in the UK pension system mean some people receive lower payments than others. These differences often depend on when you retired, how many years you worked, if you paid National Insurance, and even where you live now. The Department for Work and Pensions (DWP) has released reports and data explaining these disparities, and today we’ll walk you through everything—clearly, honestly, and with practical steps you can take to check your own pension and possibly claim more.

Why Some State Pensioners Receive Lower Payments

Not all State Pensions are equal—and it’s not your fault. The system is full of rules, exceptions, and quirks that can leave honest workers short-changed. The good news? You can do something about it.

Check your forecast, fill in gaps, claim missing payments, and explore top-ups like Pension Credit. And most importantly—don’t assume the system got it right. Ask questions, demand answers, and get what you’re owed.

| Issue | Who It Affects | Impact & Statistics |

|---|---|---|

| Old vs. New Pension System | Retirees before/after April 2016 | Old: ~£176/week max; New: ~£230/week max |

| NI Record Gaps | Part-time workers, unpaid carers, unemployed individuals | Missing years reduce pension; each year costs ~£4–£6/week |

| Contracted-Out Deductions | Workers in occupational/private pensions before 2016 | Reductions of £10–£30/week are common |

| Frozen Pensions Abroad | UK pensioners living in certain countries overseas | No annual uprating; pension loses real value over time |

| DWP Underpayment Errors | Mostly women, widows, over-80s | £804.7 million repaid to 130,948 pensioners; average payout ~£6,147 |

Understanding the Two Pension Systems: Old vs New

Before April 6, 2016, pensioners received the Basic State Pension, which was a flat amount (around £119/week in 2016), plus possible additions like SERPS (State Earnings Related Pension Scheme). You needed 30 qualifying years of National Insurance (NI) to get the full amount.

After April 6, 2016, a New State Pension system came in. The full rate is now £221.20/week (as of 2025), but you need 35 full years of NI contributions to get that. If you have fewer years, the amount is reduced proportionally.

This difference alone creates massive variation between pensioners—two people with nearly identical work histories could have very different outcomes just because one retired a year earlier.

National Insurance Gaps: The Silent Pension Killer

Your NI record is the foundation of your pension. If you have “gaps” (years where you didn’t pay NI or get credits), you’ll receive a reduced pension. Common causes of gaps include:

- Taking time off work to raise children

- Caring for relatives full-time

- Working part-time or freelance without paying Class 2 or Class 3 NI

- Studying or traveling abroad

- Unemployment without claiming benefits

For each missing year, you lose roughly 1/35th of the full new State Pension, which works out to about £6.32/week or £328/year. That adds up—5 missing years could reduce your pension by over £1,600 a year

Contracted-Out Contributions: A Hidden Deduction

If you worked in the public sector or paid into a private pension scheme before 2016, you may have been “contracted out.” This means you and your employer paid lower NI contributions and opted out of building up a second state pension (like SERPS or S2P).

The trade-off? When you reach retirement, the DWP deducts money from your pension to account for the years you were contracted out.

This deduction is permanent and typically ranges from £10 to £30 per week, depending on how long you were contracted out and your earnings at the time. The DWP shows this deduction on your pension forecast as a “contracted-out deduction” or “COPE” amount.

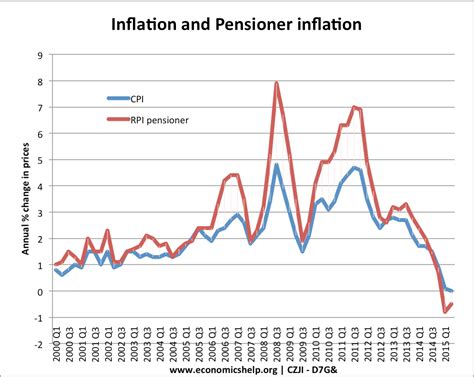

Frozen State Pensions Abroad

More than 500,000 UK pensioners live overseas. Many of them live in countries where the UK Government does not apply annual increases (called uprating) to their State Pension.

This means if you retire to a country like Canada, Australia, India, South Africa, or the Caribbean, your pension will be frozen at the rate you first received. Over time, inflation eats into its real-world value.

For example, a pensioner who moved to Canada in 2005 and began receiving £150/week would still be receiving that same amount today, while someone in the UK would now get over £220/week.

The reason? The UK only uprates pensions in countries where there’s a reciprocal social security agreement that includes pension increases.

DWP Underpayment Errors: Are You Owed?

A National Audit Office (NAO) investigation found that tens of thousands of people—mostly women—were underpaid for years due to outdated processes and human error.

The DWP’s review from 2021 to 2025 revealed:

- 130,948 pensioners had been underpaid

- £804.7 million has been repaid so far

- The average repayment was £6,147

- Married women: £5,553

- Widows: £11,725

- Over-80s: £2,203

Errors were typically due to:

- DWP failing to automatically increase pensions after a spouse’s death

- Failing to award the correct “Category B” pension for married women

- Not applying the over-80s uplift

How to Check Why Some State Pensioners Receive Lower Payments and Boost Your State Pension?

Here’s a straightforward action plan:

- Check Your Pension Forecast

Visit gov.uk/check-state-pension to see how much you’re on track to receive. - Review Your National Insurance Record

Use the NI record tool: gov.uk/check-national-insurance-record - Identify and Fill Gaps

Pay voluntary Class 3 contributions for up to 6 past years (and potentially more under temporary rules). Each year costs about £824. - Explore Pension Credit

If you’re over State Pension age and on a low income, you may qualify for Pension Credit, which tops up your income. - Reclaim Missed Payments

If you think you’ve been underpaid, contact the DWP or a pensions advisor. Groups like Age UK, Citizens Advice, and LCP offer free help.

Real-World Case Study: Peter and Mary

Peter and Mary, both aged 72, worked full-time for most of their careers. Peter retired in 2015 under the old system, while Mary retired in 2017 under the new system.

- Peter receives £176/week

- Mary receives £222/week

Why the difference? Mary had 35 NI years under the new rules, and Peter, despite working longer, was under the old scheme where his SERPS earnings weren’t as high.

Later, Peter realized he missed claiming additional State Pension from his deceased wife. After contacting the DWP, he received £9,420 in back-pay.

Tax Implications of a Lower Pension

While lower pensions may mean less income, they can also help keep you below the tax threshold. The UK Personal Allowance is currently £12,570, meaning:

- If your pension is under this amount, you likely pay no income tax

- If you have private pensions or rental income on top, you could still owe tax

- Pension Credit recipients are typically below the tax threshold

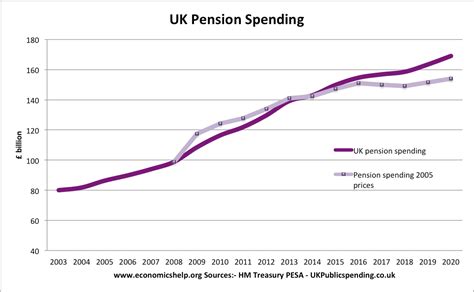

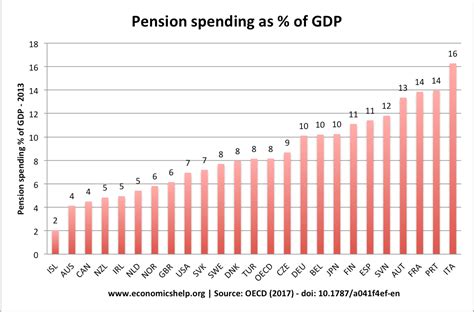

What’s Changing: Pension Policy in the Years Ahead

A few things on the horizon that could affect your State Pension:

- The State Pension age is rising to 67 by 2028, with further increases likely

- The triple lock guarantee is under financial pressure and may change

- The 2025 General Election could reshape pension and benefit policy

- More digital services are being rolled out, making it easier to manage your pension online

Staying informed ensures you’re not caught off guard by sudden changes to your retirement income.

Thousands in Backdated State Pension Payments Up for Grabs—How to Check If You Qualify?

UK’s Retirement System Faces Pressure—Why the Government May Need to Raise the Pension Age Again?

Pensioners Born Before This Date Could Be Owed Extra Monthly Payments