Why ‘Mini Retirements’ Could Be the Key to a Happier Career: If the idea of working until age 65 before you finally start living sounds exhausting, you’re not alone. A growing number of professionals across the U.S. are rejecting the traditional life script and embracing a smarter, more intentional approach to work-life balance: Mini retirements. Instead of waiting for decades to enjoy life, people are choosing to pause their careers earlier for a few months—or even a full year—to travel, reset, pursue a passion, or just rest. These aren’t aimless escapes; they’re planned, purposeful breaks that can actually lead to longer, healthier lives and happier, more sustainable careers. So what exactly are mini retirements, and why are they becoming the new American dream? Let’s break it down.

Why ‘Mini Retirements’ Could Be the Key to a Happier Career

Mini retirements are more than trendy time-outs—they’re deliberate decisions to live life on your terms. By stepping back temporarily, you can rediscover what matters, recalibrate your purpose, and return to your career (or launch a new one) with clarity and renewed energy. As burnout becomes the norm, mini retirements offer a smart, strategic antidote to the chaos of modern work. With planning, intention, and a bit of courage, they can change your life—and even extend it. Don’t wait until 65 to start living. Take control of your timeline now.

| Topic | Details |

|---|---|

| Definition | Mini retirements are self-directed, extended breaks (3 to 12 months) from work, taken before traditional retirement. |

| Main Benefits | Reduces burnout, improves clarity, promotes physical/mental health, sparks creativity, and encourages purposeful living. |

| Top Stat | 76% of U.S. workers report burnout, per Gallup (2023). |

| Ideal Duration | 3–12 months, depending on your financial and career goals. |

| Common Uses | Travel, caregiving, health reset, entrepreneurship, education, creative projects. |

| Primary Risk | Financial instability if not planned properly. |

| Resource | Investopedia Mini-Retirement Guide |

What Is a Mini Retirement?

A mini retirement is a break from the workforce that typically lasts between three months and one year. It’s distinct from a vacation, sabbatical, or career break in its intention and duration.

Unlike sabbaticals—which are usually employer-granted and tied to academic or corporate settings—mini retirements are self-funded and self-directed. They’re driven by personal goals rather than employer benefits.

Tim Ferriss, author of The 4-Hour Workweek, introduced the term widely in the early 2000s. His idea was simple: rather than wait until you’re old and tired to enjoy retirement, sprinkle those “retirement moments” throughout your working life.

And guess what? It works.

Why ‘Mini Retirements’ Could Be the Key to a Happier Career: The Science Behind the Break

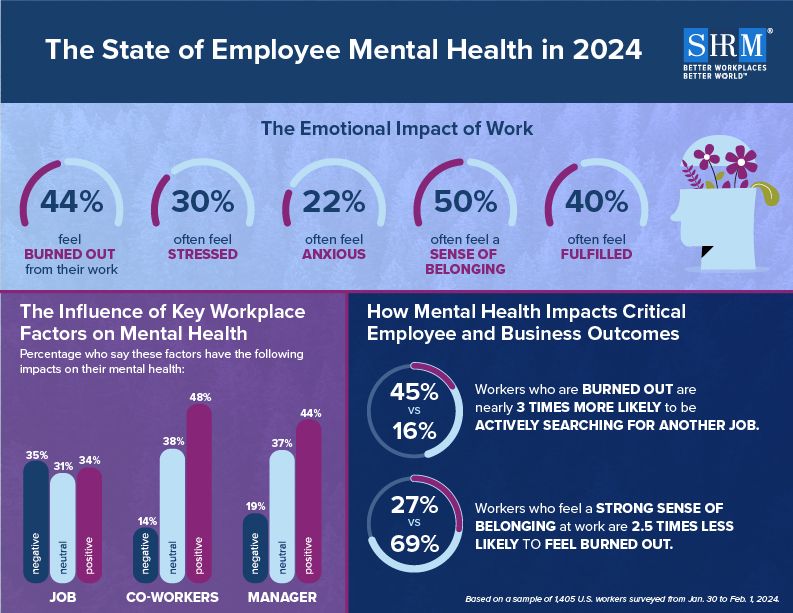

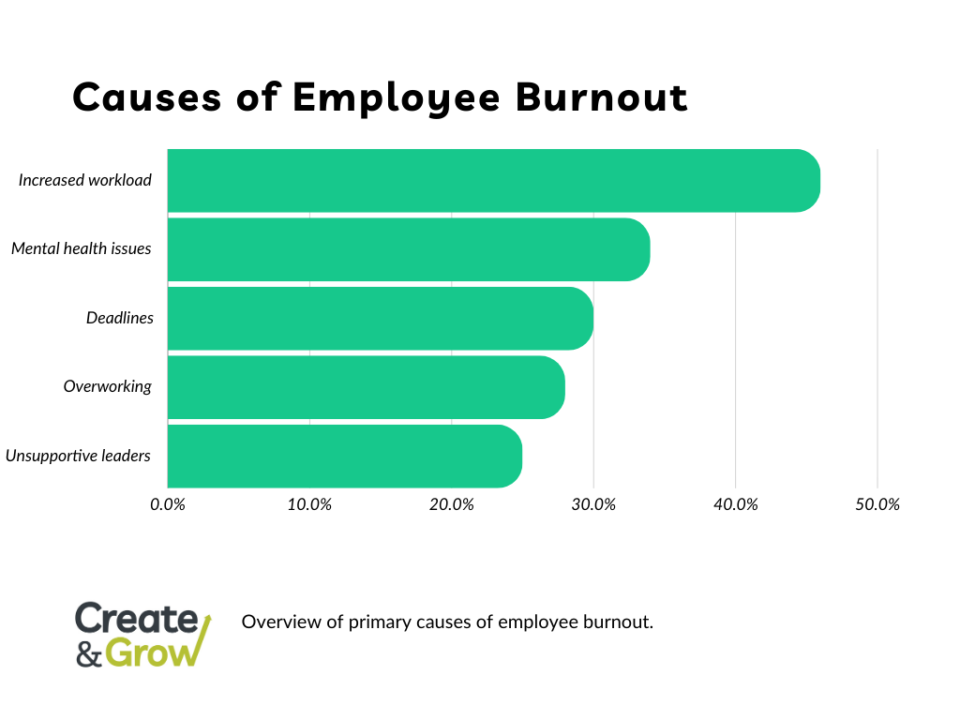

They Prevent Burnout

According to a 2023 Gallup report, nearly 3 in 4 workers experience burnout at least some of the time. And burnout isn’t just about feeling tired—it’s tied to heart disease, anxiety, depression, insomnia, and reduced life expectancy.

Mini retirements provide a deep, sustained rest, helping to recalibrate your nervous system, reduce cortisol levels, and protect your long-term health.

They Foster Self-Discovery

Career breaks give you time to think, reflect, and realign. Psychologist Abraham Maslow’s Hierarchy of Needs places self-actualization at the top of human desire—and we rarely achieve it in the 9-to-5 grind.

Mini retirements offer the space to pursue:

- Creative passions

- New languages or cultures

- Volunteerism

- Spiritual or personal growth

They Improve Work Performance (Long-Term)

Breaks sharpen performance. According to the University of California, people are 50% more creative after spending time in a non-work environment. Employers increasingly recognize that refreshed employees are more focused, innovative, and resilient.

They May Extend Your Life

A 2021 study published in the Journal of Occupational Health Psychology found that regular rest periods and life satisfaction are positively correlated with longevity and reduced all-cause mortality.

How Mini Retirements Compare to Other Work Breaks?

| Type | Duration | Initiated By | Paid? | Common Uses |

|---|---|---|---|---|

| Vacation | 1–4 weeks | Employer | Yes | Rest, short-term travel |

| Sabbatical | 3–12 months | Employer | Sometimes | Research, academic projects |

| Career break | 1+ years | Employee | No | Parenting, relocation |

| Mini retirement | 3–12 months | Employee | No | Life realignment, self-discovery, health |

The Global Movement Toward Career Pauses

Across the globe, career breaks are normalizing:

- Australia: “Gap years” for adults are common, often funded by part-time gigs.

- Europe: Countries like Denmark and the Netherlands offer flexible leave policies supporting career breaks.

- U.S.: The rise of remote work and burnout culture is pushing Americans to rethink work-life timelines.

You don’t have to retire to take a break anymore.

How to Plan a Mini Retirement (Without Going Broke)

1. Set Your Why

Start by defining your goals:

- Do you want to travel the world?

- Write a book?

- Spend more time with your kids?

- Recover from burnout?

The clearer your “why,” the easier it is to plan.

2. Estimate Costs

Tally up 6–12 months of living expenses:

- Rent/mortgage

- Utilities

- Groceries

- Transportation

- Health insurance

- Optional travel or project costs

Tools: Use platforms like YNAB, Goodbudget, or Personal Capital to forecast your budget.

3. Save Consistently

Aim to save 25%–35% of your income until you hit your mini retirement goal. Consider:

- Downsizing or house hacking

- Eliminating high-interest debt

- Automating savings transfers

4. Handle Legal & Tax Details

- Health Insurance: Use ACA Marketplace or COBRA.

- Taxes: Be mindful of income thresholds and 401(k) withdrawal penalties.

- Visas: If traveling, research visa requirements and residency rules abroad.

5. Communicate With Employers

- Frame your leave as a growth experience, not a quitting spree.

- Give 60–90 days’ notice.

- If possible, negotiate unpaid leave or a contract pause.

6. Plan Reentry

- Schedule career coaching or job search prep during the final weeks of your break.

- Refresh your résumé to highlight skills gained, such as:

- Cross-cultural communication

- Project execution (writing, freelancing, etc.)

- Personal development milestones

Real-Life Examples of Mini Retirements

Danielle, 29 – Burned-Out Tech Marketer

Danielle quit her high-pressure job in San Francisco after severe anxiety. She traveled through Costa Rica and Guatemala for five months, practiced yoga, and now works remotely with a nonprofit in a lower-stress role.

Tony & Melissa, 38 – Parents on Pause

This couple took a 9-month RV road trip with their two kids to see all 50 states. They homeschooled from the road and now run an educational YouTube channel full-time.

Mark, 52 – Midlife Reinventor

After a corporate layoff, Mark took a one-year sabbatical to care for his mother and complete a certification in life coaching. He returned to work part-time and started his own business.

Mini Retirement Readiness Checklist

- Clear reason for taking the break

- Financial safety net (6–12 months of expenses)

- Plan for healthcare and taxes

- Exit strategy from current job

- Timeline with milestones

- Communication plan with family or dependents

- Reentry plan and résumé strategy

Mini Retirement Myths (Debunked)

Myth: It’s just for rich people.

Reality: Many middle-income earners do this by budgeting, side hustling, or geoarbitrage (living where the cost is lower).

Myth: It’ll destroy your career.

Reality: A well-framed mini retirement can enhance your résumé and leadership story.

Myth: You need to quit your job.

Reality: Some people negotiate unpaid leave or a sabbatical instead of quitting outright.

Myth: You have to go somewhere exotic.

Reality: Some mini retirements are local and focused on health, family, or creativity.

Expert Offers Guidance for Couples Planning Retirement With Limited Savings

Waze Co-Founder Shares Candid Retirement Advice After Years of Entrepreneurship

4 Financial Mistakes Americans Keep Making That Wreck Their Budgets