What’s Inside the New “Big, Beautiful Bill”: In July 2025, President Trump signed what he called the “One Big Beautiful Bill” into law—a sweeping tax and policy package that is already transforming how millions of Americans handle taxes, healthcare, and Social Security. While headlines have focused on how the bill eliminates federal taxes on Social Security for most seniors, there’s a lot more under the hood—including massive spending cuts, rising deficits, and new benefits for workers and families. In this guide, we’ll walk through everything you need to know. Whether you’re a retiree, a financial advisor, a small business owner, or just someone trying to understand what Washington just did—this article will break it down step-by-step.

What’s Inside the New “Big, Beautiful Bill”

The “Big, Beautiful Bill” lives up to its name in size and scale. It gives a meaningful short-term boost to millions of seniors, small businesses, and working families. But the cost is significant—both in terms of lost safety net protections and a mounting national debt that could haunt future generations. For now, seniors are seeing relief. But everyone—from Medicaid users to financial planners—should stay alert. As we head toward 2028, many of these benefits will sunset unless Congress takes action. The best move? Plan ahead and stay informed.

| Feature | What It Means | Why It Matters |

|---|---|---|

| Social Security Tax Break | Additional $6,000 (individual) / $12,000 (married) standard deduction for seniors over 65 | Makes Social Security federally income-tax-free for ~90% of seniors through 2028 |

| Income Thresholds | Applies up to $75,000 (single) / $150,000 (married) MAGI | Seniors earning above this may still owe tax |

| Tax Extensions | Renews 2017 Trump tax cuts: SALT deduction, pass-throughs, small business perks | Provides extended tax relief—especially for high earners |

| New Benefits | MAGA Baby Bonds, tip and auto loan deductions, child savings incentives | Adds new ways for families and workers to build savings |

| Medicaid & SNAP Cuts | Over $1 trillion in cuts, plus work requirements | As many as 12 million people could lose health or food benefits |

| Federal Deficit | Estimated to grow by $2.8–3.3 trillion by 2034 | May impact long-term funding for Social Security and Medicare |

How the Big, Beautiful Bill Affects Social Security?

Let’s start with what’s been grabbing the headlines: the elimination of federal taxes on Social Security income for most seniors. Technically, the bill doesn’t repeal the taxation rules—it instead adds an extra standard deduction specifically for Americans aged 65 and older.

This deduction is $6,000 for single filers and $12,000 for married couples, on top of the standard deduction that all taxpayers receive. For many seniors, that’s enough to reduce their taxable income so low that their Social Security benefits become tax-free—at least at the federal level.

To qualify, your Modified Adjusted Gross Income (MAGI) must be below:

- $75,000 for individuals

- $150,000 for couples

According to the Social Security Administration, roughly 89% of current recipients fall below these thresholds. For these folks, the new deduction essentially wipes out the federal tax burden on Social Security income. That’s real money—especially for those on fixed incomes.

But there’s a catch: this benefit expires after 2028, unless Congress renews it.

Who benefits most?

- Retirees aged 65+ living on fixed income

- Seniors with modest savings or small pensions

- Widows and widowers whose income is now below the new thresholds

Who doesn’t benefit?

- Younger retirees under 65

- Seniors with high MAGI (from rental properties, capital gains, large pensions)

- Anyone already receiving non-taxed Social Security due to low income (many of the poorest retirees)

Extending Trump-Era Tax Cuts

The bill also makes many of the 2017 Tax Cuts and Jobs Act provisions permanent, including:

- Lowered individual tax brackets

- Expanded SALT deduction: capped at $30,000–$40,000 through 2030

- Continued bonus depreciation for businesses

- Increased pass-through deduction for small business owners

- Enhanced deductions for tips, overtime pay, and auto loan interest (up to $10,000 on U.S.-made vehicles)

These provisions disproportionately benefit:

- High earners

- Self-employed professionals

- Restaurant and service industry workers

MAGA Baby Bonds and Family Savings Incentives

To help families build generational wealth, the bill introduces a new savings program for children:

- Every newborn receives a one-time $1,000 government deposit into a new MAGA Savings Account

- Families can contribute up to $5,000 per year, tax-deferred

- Funds can be used for college, home purchases, or retirement after age 30

This is similar to previous “baby bond” proposals but adds a conservative spin, incentivizing family savings and reducing reliance on federal student loan programs.

There are also new deductions for:

- Tips and overtime, especially for workers earning under $150,000

- Auto loan interest for cars manufactured in the USA

These perks help hourly workers and gig workers—often overlooked in traditional tax policy.

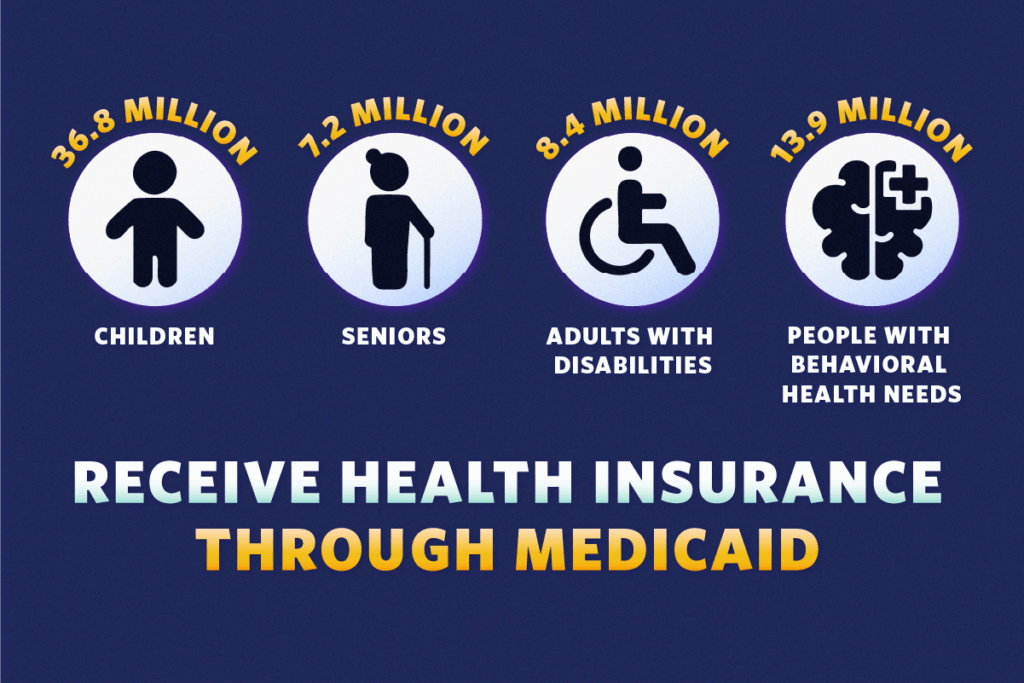

Deep Cuts to Medicaid and SNAP

To pay for the tax cuts and deductions, the bill slashes spending in other areas—particularly Medicaid and Supplemental Nutrition Assistance Program (SNAP), also known as food stamps.

- Medicaid: The bill introduces work requirements, caps funding growth, and eliminates certain subsidies. The CBO estimates that up to 12 million people could lose coverage by 2034.

- SNAP: Tightened eligibility rules could push 2–3 million Americans off the food assistance rolls, many of whom are low-income seniors, single parents, and disabled adults.

States will now be responsible for verifying employment, citizenship, and family status more frequently—an administrative burden that could result in eligible families being dropped due to paperwork or delays.

Public health experts from organizations like the Commonwealth Fund and Kaiser Family Foundation warn that these changes could lead to:

- Increased uninsured rates

- Worsening health outcomes, especially for low-income families

- Job losses in healthcare and social service sectors

Federal Deficit and Long-Term Risk

The tax cuts and new programs don’t come cheap. The Congressional Budget Office (CBO) projects that the bill will add:

- $2.8 to $3.3 trillion to the federal deficit over 10 years

- Push total U.S. debt-to-GDP ratio beyond 130% by 2034

Critics argue this added debt could force future cuts to Social Security and Medicare if the trust funds run out earlier than expected. Indeed, the Social Security Board of Trustees recently updated their estimate: the Social Security Trust Fund may become insolvent by 2032–33, one year sooner than previously projected.

Financial planners are already advising clients to prepare for:

- Reduced benefits in future

- Higher payroll taxes for younger workers

- A need to rely more heavily on personal savings and investments

Who Wins and Who Loses?

Winners:

- Seniors aged 65+ with low to moderate income

- Small business owners and freelancers

- Families saving for kids’ futures

- Wealthier Americans, due to extended Trump tax cuts

Losers:

- Low-income Americans relying on Medicaid and food stamps

- Middle-income retirees under age 65

- Future generations, who may face higher debt and fewer benefits

What to Do Next: Action Steps

If you’re a senior (65+):

- Meet with your tax advisor to adjust your 2025 withholding

- Review your MAGI to stay under thresholds

- Consider Roth conversions to manage future tax liability

If you’re a working family:

- Open a MAGA savings account if you have a newborn

- Take advantage of new deductions for tips, overtime, and car interest

If you’re a Medicaid or SNAP recipient:

- Watch for notices from your state agency

- Prepare for new paperwork or work verification

- Look into marketplace health plans if you lose coverage

If you’re a financial professional:

- Recalculate retirement projections post-2028

- Monitor legislative updates—this deduction could be extended or reversed

- Consider more aggressive savings strategies for younger clients