What Seniors Really Want From Social Security’s 2026 COLA: is more than a headline—it’s a growing concern for over 70 million Americans who depend on their Social Security checks to keep up with life’s rising costs. As inflation continues to hit hard, many seniors are questioning whether their annual Cost-of-Living Adjustment (COLA) is enough to cover necessities like food, housing, and healthcare. This year, retirees and advocacy groups are calling for a fairer system—one that better reflects the actual inflation older adults face. Let’s break down what’s being asked for, what’s realistically on the table, and what you can do to prepare for 2026.

What Seniors Really Want From Social Security’s 2026 COLA

Seniors are asking for something simple: a fair, realistic COLA that matches the real costs of aging in America. But in 2026, the most likely outcome is a modest 2.5%–2.7% increase, potentially wiped out by rising healthcare premiums. Now more than ever, retirees must stay informed, plan ahead, and use every available resource—from government aid to political advocacy—to ensure Social Security remains a reliable source of support.

| Topic | Details | Source / Link |

|---|---|---|

| Projected 2026 COLA | Estimated between 2.5% and 2.7%, according to current CPI-W data | The Senior Citizens League |

| Preferred COLA Formula | Seniors advocate for COLA based on CPI-E or CPI-BEST instead of CPI-W | Bureau of Labor Statistics |

| Medicare Part B Premiums | Expected increase of 11% to 12%, offsetting any benefit gains from COLA | Medicare.gov |

| COLA Impact Over Time | Seniors have lost up to 36% of purchasing power since 2000 due to inadequate COLAs | The Senior Citizens League |

| Next COLA Announcement Date | October 2025, based on Q3 2025 CPI-W data | SSA.gov |

Understanding the COLA System

Each year, the Social Security Administration adjusts benefit payments based on inflation, calculated using the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). This is known as the Cost-of-Living Adjustment (COLA).

The goal of COLA is simple: ensure beneficiaries maintain their purchasing power. But over time, critics argue that CPI-W fails to represent the reality of seniors’ spending habits.

CPI-W is based on the expenses of younger, urban workers—not retirees. That means it heavily weights costs like transportation and less on items that actually impact seniors the most, such as:

- Healthcare

- Prescription drugs

- Housing

- Long-term care

- Groceries

In contrast, the CPI-E (Consumer Price Index for the Elderly) and proposed CPI-BEST better reflect the spending patterns of people aged 62 and older. CPI-E gives more weight to medical expenses and less to things like education or childcare.

What Seniors Really Want From Social Security’s 2026 COLA?

A More Accurate Inflation Metric

A growing number of seniors want COLA tied to CPI-E, which better tracks costs affecting retirees. Advocacy groups like The Senior Citizens League have also proposed CPI-BEST, a model that uses either CPI-W or CPI-E—whichever is higher each year.

This shift could result in higher annual benefit increases, especially in years where medical inflation runs high.

A Minimum 3%+ Raise

Surveys conducted in 2025 show that seniors overwhelmingly feel that a minimum 3% COLA is needed just to break even. Even modest increases in food, energy, and rent prices can wipe out small COLAs.

In 2023 and 2024, COLAs were 8.7% and 3.2% respectively, which offered temporary relief. But inflation’s ongoing presence—especially in housing and healthcare—means many retirees feel they’re falling behind again.

Protection from Medicare Premium Spikes

For many retirees, Medicare premiums offset most—if not all—of their COLA increases. In fact, for low-income retirees, higher Part B and Part D premiums mean that COLA raises can be completely neutralized. Seniors want to see stronger “hold harmless” provisions and legislative caps on Medicare hikes.

2026 Projections: What Retirees Might Actually Get

Estimated COLA: 2.5%–2.7%

According to projections from The Senior Citizens League as of mid-2025:

- The most likely COLA for 2026 is around 2.6%

- This would amount to an average benefit increase of $45–$48/month

- However, Medicare Part B premiums are expected to increase by $21 or more, and drug plans may add another $10–$15/month

This means that for millions of retirees, the real-world benefit increase may be as little as $10 or less, or even zero.

Data Collection Changes Could Skew Results

The Bureau of Labor Statistics (BLS) has reduced the number of price collection areas in recent years. Cities like Buffalo, NY and Provo, UT have been removed from the inflation tracking system, potentially resulting in less accurate CPI-W data.

This could suppress COLA calculations even further, sparking criticism that the system needs reform to match real consumer experiences.

How Does COLA Really Affect Retirees?

Let’s look at a real-world example.

Mary, age 70, receives $1,800/month in Social Security. If the 2026 COLA is 2.6%, she would receive an extra $46.80/month. But if:

- Medicare Part B goes up by $21/month

- Medicare Part D goes up by $12/month

- Her prescription co-pays increase by $8/month

Then her net COLA is actually $5.80/month—hardly enough to cover rising grocery or utility bills.

Now multiply that situation by 40 million retired beneficiaries, and you see why there’s growing frustration about the COLA system.

Step-by-Step Guide: How to Prepare for 2026

1. Track Your Spending

List your fixed and variable monthly costs—housing, medical bills, food, and transportation. This gives you a clearer picture of whether your income adjustments are meeting your needs.

2. Understand Medicare Costs

Visit Medicare.gov regularly for updates on premium increases. Consider reviewing your Medicare Advantage or drug plan options each open enrollment period to ensure you’re getting the best value.

3. Advocate for Reform

Contact your lawmakers and support legislation that moves COLA calculation to CPI-E or CPI-BEST.

4. Explore State and Local Assistance

Depending on your income, you may qualify for:

- Supplemental Nutrition Assistance Program (SNAP)

- Low-Income Home Energy Assistance Program (LIHEAP)

- Senior rental or property tax assistance

- Utility payment relief programs

These can add meaningful support, especially when COLA falls short.

5. Consider Supplemental Income Streams

While not ideal for everyone, even occasional part-time or freelance work can provide flexibility and an extra $100–$200 per month. Options include remote jobs, pet sitting, or tutoring.

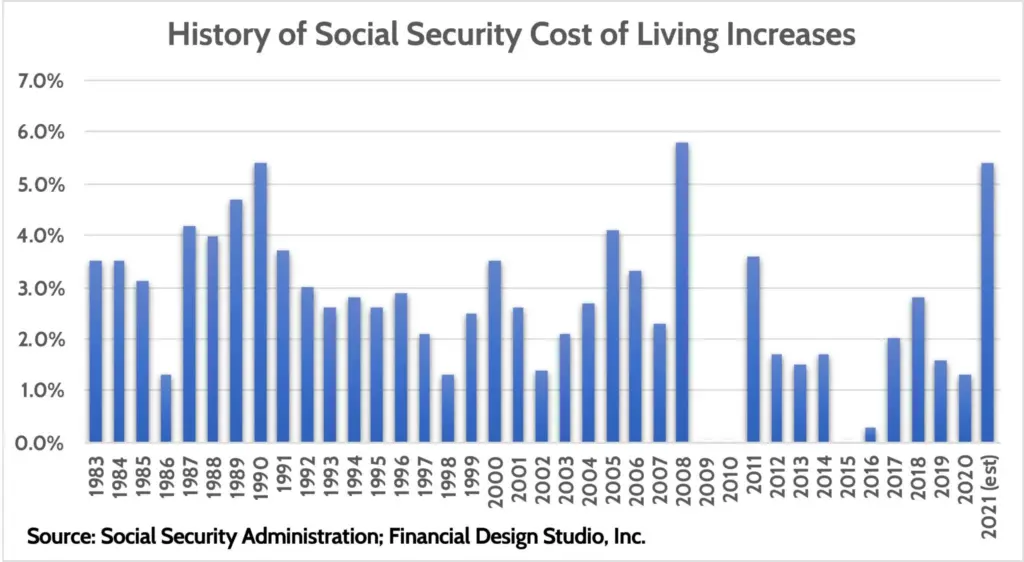

Historical Trends: How COLA Has Performed

Let’s look at the past 10 years of COLA data:

| Year | COLA % | Notable Trends |

|---|---|---|

| 2015 | 1.7% | Modest inflation |

| 2016 | 0.0% | No COLA increase |

| 2017 | 0.3% | Inflation lagging |

| 2018 | 2.0% | Gradual rebound |

| 2019 | 2.8% | Stronger wage growth |

| 2020 | 1.6% | Pre-pandemic dip |

| 2021 | 1.3% | Still lagging behind inflation |

| 2022 | 5.9% | First big jump in over a decade |

| 2023 | 8.7% | Largest COLA since 1981 due to post-COVID surge |

| 2024 | 3.2% | Correction year after inflation spike |

As you can see, COLA swings dramatically. Without structural reform, seniors remain vulnerable to under-adjustments during high-cost years.

2026 Social Security COLA Forecast Updated — Here’s the Estimated Benefit Increase

2026 COLA Estimate Is In—Here’s How Much Social Security Could Increase

Social Security Is Running Out of Cash — Here’s the Shocking Timeline