What Really Happens If You Breach the SASSA Income Threshold: The South African Social Security Agency (SASSA) plays a critical role in providing financial assistance to individuals in need. These grants help those facing difficult circumstances, such as old age, disability, or the responsibility of raising children. However, it’s important to be aware of the SASSA income threshold—the maximum income a person can earn to remain eligible for a grant. If you exceed this threshold, you risk losing your payments or facing other consequences. In this article, we’ll break down everything you need to know about SASSA’s income threshold, including what it means, why it exists, and what happens if you breach it. We’ll also offer practical advice and insights to help you avoid any issues and ensure your eligibility remains intact.

What Really Happens If You Breach the SASSA Income Threshold

Navigating the world of social grants can be challenging, but understanding the SASSA income threshold is vital to keeping your payments secure. By fully disclosing your income, attending reviews, and keeping your details updated, you can avoid the risk of suspension or cancellation. Remember, these guidelines are in place to ensure that grants are directed to those who need them most. Following the steps outlined in this article will help you stay in good standing with SASSA and continue receiving the support you need.

| Key Data | Details |

|---|---|

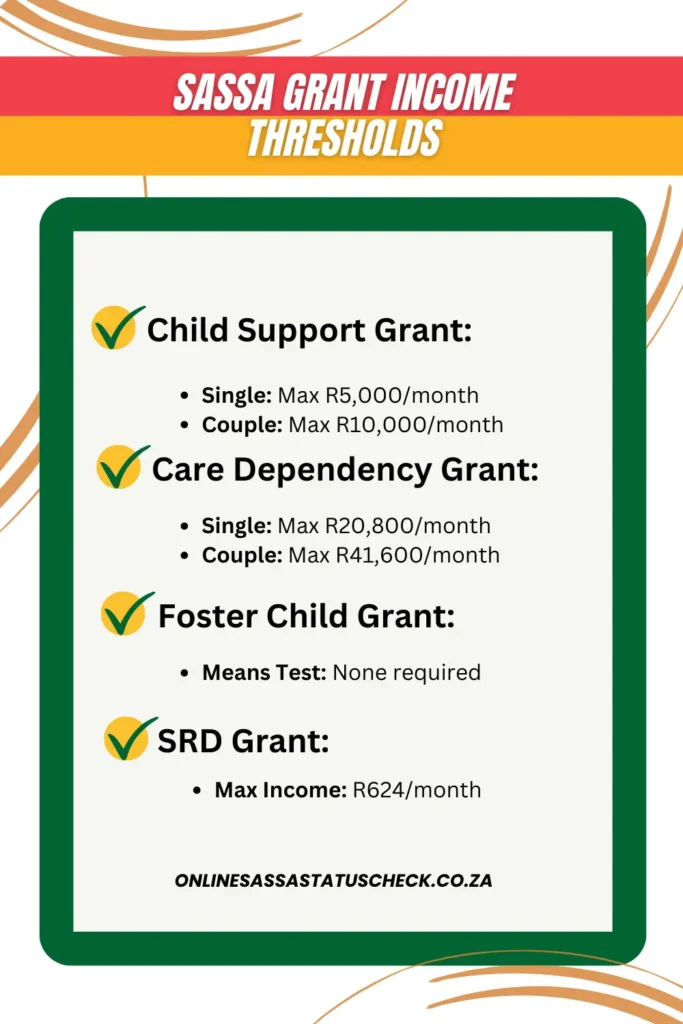

| Social Grant Types Affected | Child Support Grant, Disability Grant, Older Person’s Grant, Care Dependency Grant, and more. |

| Income Thresholds | R5,600 per month for single applicants (annual: R67,200); R11,200 per month for married applicants (annual: R134,400). |

| Repayment Requirement | Breaching the threshold may require repayment of excess funds, often in installments. |

| How to Avoid Suspension | Full disclosure of all income, timely response to SASSA reviews, and accurate updates to personal information. |

| Official Resources | SASSA Official Website for more details and assistance. |

What is the SASSA Income Threshold?

The SASSA income threshold refers to the maximum amount of income you are allowed to earn while still being eligible for a social grant. If your income exceeds this threshold, you may no longer be eligible to receive the grant, regardless of other circumstances. The threshold is designed to prioritize those who need financial assistance the most.

Why Does the Income Threshold Exist?

The income threshold exists to ensure that social grants are distributed to those who are genuinely in need. Without these limits, individuals with higher incomes could take advantage of the system, depriving those in real financial distress from receiving support. It helps the government allocate resources fairly and efficiently.

What Really Happens If You Breach the SASSA Income Threshold?

If you breach the income threshold, there can be several consequences. These depend on whether the breach was discovered by SASSA during a routine review or if you reported it yourself. Let’s dive into what could happen:

1. Suspension of Payments

One of the immediate consequences of breaching the income threshold is the suspension of your social grant payments. SASSA uses various methods to monitor recipients’ income and may flag accounts if they suspect that the threshold has been exceeded.

In 2025 alone, over 210,000 beneficiaries were flagged for having undeclared or excess income. These individuals had their payments delayed and were required to attend a review meeting within 30 days to confirm their eligibility.

2. Repayment of Overpaid Funds

If SASSA determines that you have been overpaid because of exceeding the income threshold, you may be required to repay the excess amount. This often happens when a beneficiary does not update SASSA about their increased income. For example, a Child Support Grant beneficiary had to repay R3,360 after SASSA found her income had exceeded the threshold.

3. Permanent Cancellation of the Grant

In severe cases, repeated breaches or failure to attend a review can lead to the permanent cancellation of your social grant. If SASSA finds that you have been deceitful or failed to comply with regulations, they may remove you from the grant system altogether.

4. Legal Action for Fraud

In extreme cases of deliberate fraud (such as knowingly providing false information about income), legal action could be taken. This could result in penalties or even jail time.

How to Avoid Breaching the Income Threshold?

Avoiding a breach of the income threshold is key to maintaining your eligibility for social grants. Here’s a guide on how to ensure your payments continue uninterrupted:

1. Disclose All Sources of Income

It’s essential that you report every source of income you receive, whether from a job, a side hustle, or financial assistance from family or friends. When you first apply for a grant, disclose all income sources, and make sure to update SASSA if your income changes.

For example, if you start a part-time job or receive a raise, inform SASSA immediately to avoid any surprises during the review process.

2. Respond to SASSA Reviews

SASSA conducts periodic reviews to ensure that grant recipients still meet the eligibility criteria. If you receive a letter or phone call asking for information or an interview, make sure to respond within the allotted timeframe.

Not attending these reviews or responding to SASSA’s requests can lead to the suspension or cancellation of your grant.

3. Keep Your Personal Information Updated

If there’s a significant change in your life, such as getting married or changing your address, make sure SASSA has your updated details. Your marital status affects the income threshold, so any changes could impact your eligibility. Keeping your information accurate will prevent confusion and ensure that you remain in good standing.

4. Review Your Income Regularly

It’s important to regularly review your income to ensure it remains below the threshold. If your circumstances change, such as a spouse getting a new job or you earning more income, check if this affects your eligibility. If necessary, update your details with SASSA to avoid any penalties.

Examples of How Breaching the Threshold Affects Recipients

Example 1: Child Support Grant Breach

Let’s say you receive the Child Support Grant as a single parent, but you recently started a small business on the side. If your total income from all sources exceeds R5,600 per month, you could be flagged by SASSA during a review. This could lead to the suspension of your grant payments until you’ve updated your information.

Example 2: Disability Grant Suspension

A person receiving a Disability Grant has been living on a fixed income but recently began receiving rent income from a property they own. If their rental income pushes their total monthly earnings above R5,600, they might no longer qualify for the disability grant and could face suspension of payments until the situation is resolved.

SASSA July 2025 Payments Updated—Will the Child Support Grant Date Change Too?