What Expenses Can Be Claimed as Tax Deductions in Canada for 2025? Tax season can be a real headache, especially when you’re trying to figure out what you can and cannot claim. If you’re living in Canada, the good news is that there are quite a few expenses you can claim to reduce your tax bill, and some of them might even surprise you. Whether you’re a small business owner, a remote worker, or just looking to save some cash, knowing which expenses are deductible can make a huge difference. In this article, we’ll break down the tax deductions you can claim in Canada for 2025, explain how to claim them, and give you some tips on how to make sure you’re not leaving money on the table. Plus, we’ll answer some of the most common questions folks have when it comes to tax deductions in Canada.

What Expenses Can Be Claimed as Tax Deductions in Canada for 2025?

| Expense Type | Key Deductible Expenses | Claim Limits | Important Notes | Official Link |

|---|---|---|---|---|

| Home Office Expenses | Rent, utilities, office supplies, internet fees | Home office expenses are based on the percentage of your space used | You need a signed T2200S form from your employer if applicable | Canada Revenue Agency |

| Medical Expenses | Prescription drugs, dental work, medical treatments | Deductible if total exceeds 3% of your net income or $2,759 | Can include expenses for dependents, but only out-of-pocket costs | Canada Revenue Agency |

| Child Care Expenses | Daycare, after-school programs, care for children with disabilities | $8,000 for children under 7, $5,000 for older children | Must be required to earn income or attend school | MyDoh |

| Automobile Expenses | Gas, maintenance, insurance, lease payments | $1,100 per month for leased vehicles | Must track business-related mileage | Ryan |

| Education-Related Expenses | Tuition, textbooks, student loan interest | Varies based on tuition fees and your program | Deductible under specific conditions, can include interest on loans | QuickBooks |

| Other Deductions | Pension contributions, alimony, moving expenses | Specific limits on each, varies based on the expense | Various eligibility rules apply | Canada Revenue Agency |

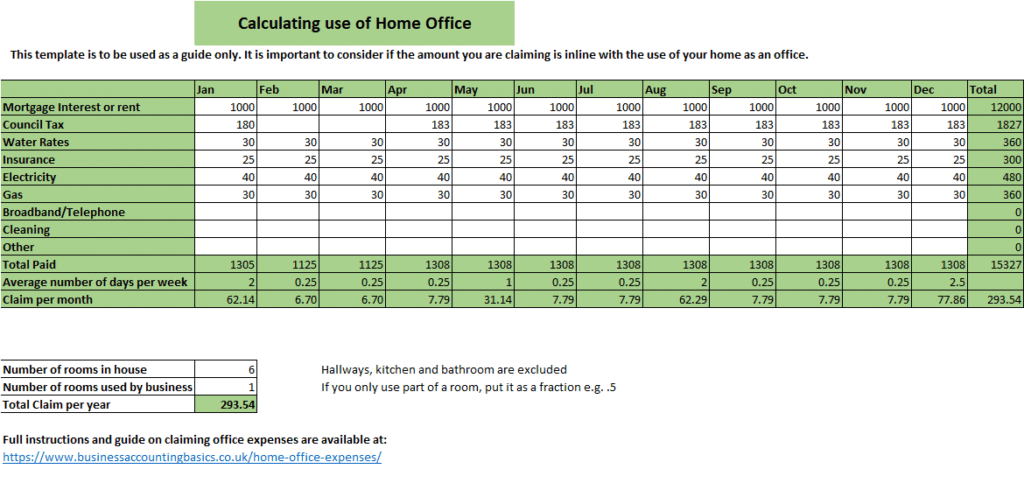

Home Office Expenses: These Expenses Can Be Claimed as Tax Deductions in Canada for 2025

With more people working remotely than ever before, claiming home office expenses has become an essential deduction. In 2025, if you’re working from home (and especially if you’ve been doing it for a while), you can claim several expenses that are directly related to your workspace.

What Can You Claim?

- Rent: If you’re renting your home or a portion of it, you can claim a portion of the rent corresponding to the size of your home office.

- Utilities: Electricity, heating, water, and internet access are eligible for claims.

- Office Supplies: Pens, paper, printers, and other necessary office supplies can be deducted.

How Does It Work?

You’ll need to fill out a T2200S form (if you’re employed) or a T2200 form (if you’re self-employed). This form should be signed by your employer and will confirm the number of hours you worked from home.

Example: If your home office takes up 20% of your apartment, you can claim 20% of your eligible home office expenses like rent and utilities. But remember, mortgage payments, property taxes, and home improvements (like renovating the kitchen) are not deductible.

Medical Expenses: Take Care of Your Health, Take Care of Your Taxes

When it comes to medical expenses, Canada is pretty generous. If you’ve had to pay out-of-pocket for things like medications, treatments, or dental work, you may be able to claim those costs on your taxes.

What Counts as Medical Expenses?

- Prescription Drugs: Medications that you have to buy from a pharmacy.

- Dental Services: Fees for dental procedures, including cleanings and fillings.

- Hospital Services: This includes services provided during hospitalization.

- Health-Related Travel: If you had to travel to get medical treatment, such as driving long distances to see a specialist, these costs are also deductible.

How Much Can You Claim?

You can deduct the amount of your medical expenses that exceeds 3% of your net income or $2,759, whichever is less. So, if you have a high medical expense that doesn’t reach this threshold, you won’t be able to claim it.

Example: If you spent $5,000 on medical expenses in a year and your net income is $50,000, you could potentially claim $2,241 as a deduction (because 3% of $50,000 is $1,500, and you subtract that from your total expenses).

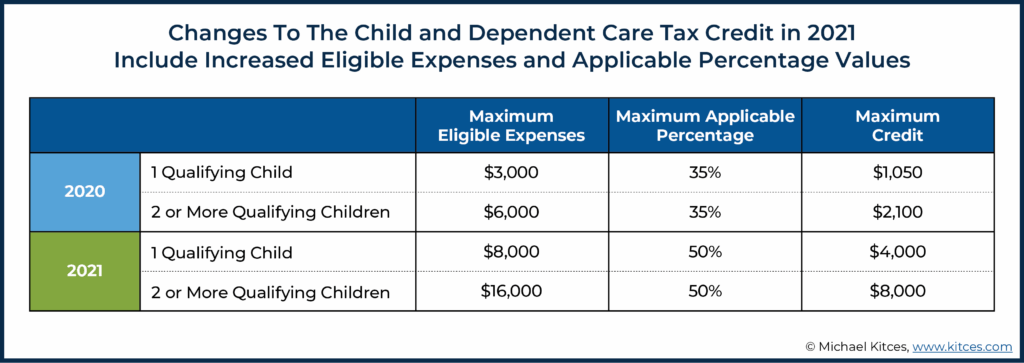

Child Care Expenses: Deduct the Costs of Raising Kids

Whether you’re working or studying, child care expenses can be a significant burden. Luckily, you can claim many child care costs on your tax return to ease the financial strain.

What Expenses Qualify?

- Daycare Fees: The costs of daycare, after-school programs, or even babysitting services.

- Special Needs Care: If your child has a disability, you can also claim the costs of care for them, regardless of their age.

How Much Can You Claim?

You can claim up to $8,000 per year for each child under 7, and $5,000 for children between 7 and 15. If your child is 15 or older and has a disability, you can also claim up to $5,000.

Example: If you spent $7,000 on daycare for your 5-year-old, you can deduct the full amount. But if your child is 10, you could claim up to $5,000.

Automobile Expenses: Track Your Business Mileage

Do you use your car for work? If you’re driving for business purposes—whether it’s meeting clients, picking up supplies, or delivering goods—you can deduct the associated automobile expenses. However, the key here is to track your business mileage and ensure it’s documented accurately.

What Can You Claim?

- Fuel: The cost of gas you used for business purposes.

- Maintenance: Repairs, oil changes, and tire purchases related to your business use.

- Insurance and Lease Payments: If you’re leasing or insuring a vehicle for business use, you can claim those payments based on the percentage of business use.

What’s the Limit?

For leased vehicles, you can claim up to $1,100 per month in 2025 (this amount includes taxes).

Example: If you drove 10,000 kilometers for work and your car’s total annual mileage was 20,000 kilometers, you can claim 50% of your vehicle-related expenses.

Education Expenses: Learn and Earn

Students, this one’s for you. Education-related expenses are another area where you can save money come tax time. Whether you’re pursuing post-secondary education, doing professional development, or even paying off student loans, you may be eligible for tax deductions.

What Can You Deduct?

- Tuition Fees: If you paid tuition fees for a recognized institution, you can claim them.

- Textbooks: The cost of textbooks required for your courses.

- Student Loan Interest: If you have a student loan, the interest you pay can be deducted.

Example: If you paid $5,000 in tuition fees and $500 in textbook costs, you can claim both amounts on your tax return. Additionally, the interest on your student loan can be deducted, saving you more money.

GST/HST Payments in Canada Start This Week—Check If You Qualify for the July 2025 Deposit

Canada Updates CRA Benefit Schedules for July 2025—Here’s What’s Coming Your Way

Canada Is Sending Out Larger GST Cheques—Here’s Who Gets the Bigger Payout