Want to Retire in the Top 10%? Retiring in the top 10% isn’t just about hitting a magic number—it’s about making smart, consistent financial choices throughout your life. If you’re thinking, “I want to retire in the top 10%, but where do I even start?” you’re already ahead of most. This guide walks you through exactly what it takes to build long-term wealth and secure a retirement that gives you freedom, security, and peace of mind. Whether you’re 25 or 55, the steps to reaching the top 10% are surprisingly practical—and easier to implement than you might think.

Want to Retire in the Top 10%?

Retiring in the top 10% isn’t a fantasy—it’s a financial possibility. It takes hustle, discipline, and smart money decisions made over time. The sooner you start, the easier it becomes. But even if you’re starting later, the roadmap is the same: save aggressively, invest wisely, earn intentionally, and plan purposefully. With a strong plan, the right tools, and a steady hand, you’ll not only retire comfortably—you’ll retire confidently, with options and freedom.

| Topic | Details |

|---|---|

| Top 10% Net Worth (U.S.) | Average: ~$7.8M |

| Retirement Account Avg (Top 10%) | ~$970,000 |

| Savings Rate Recommended | 15% to 25% of income |

| Primary Investment Tools | 401(k), Roth IRA, Index Funds, Brokerage Accounts |

| Official Planning Resources | SSA Retirement Estimator |

Why Aim for the Top 10% in Retirement?

Imagine waking up at 65 with zero financial stress. No more commuting, no worrying about monthly bills, and the freedom to spend your time however you want. That’s what being in the top 10% gets you.

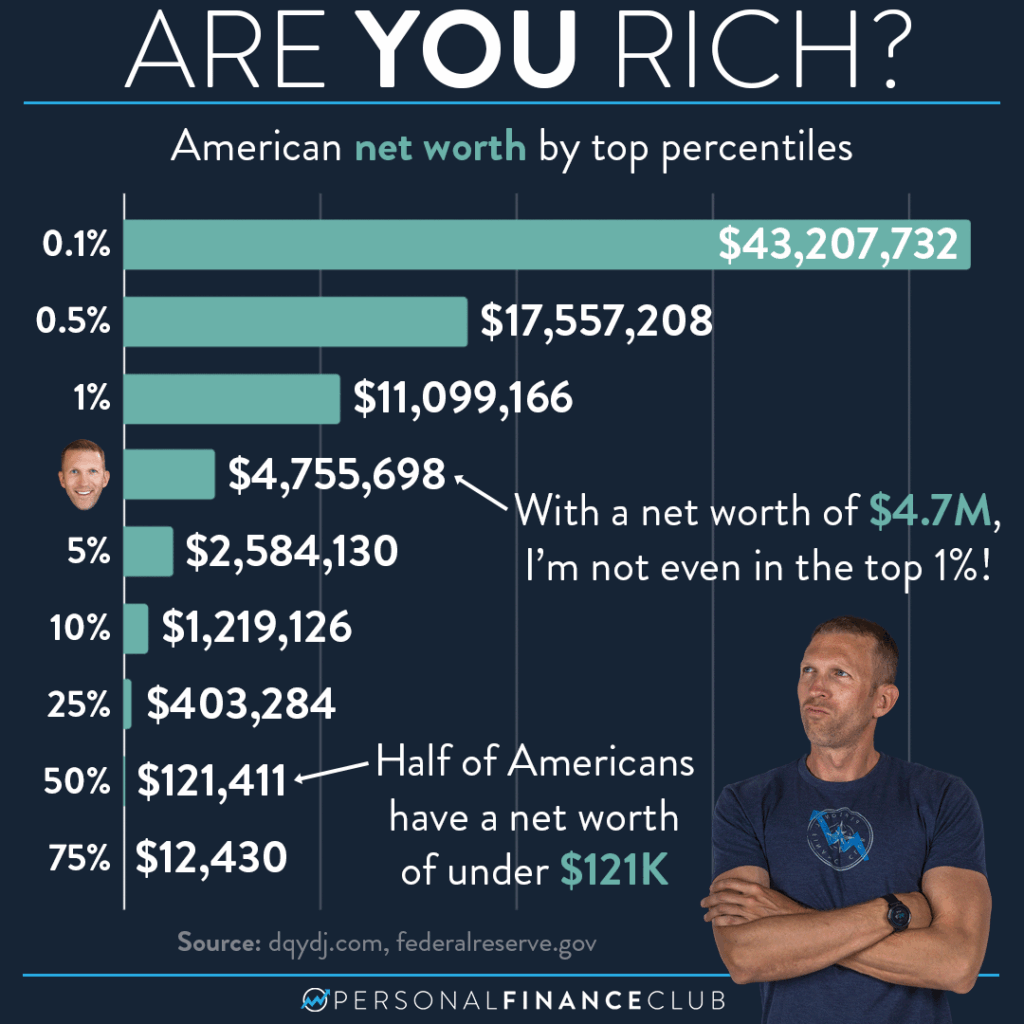

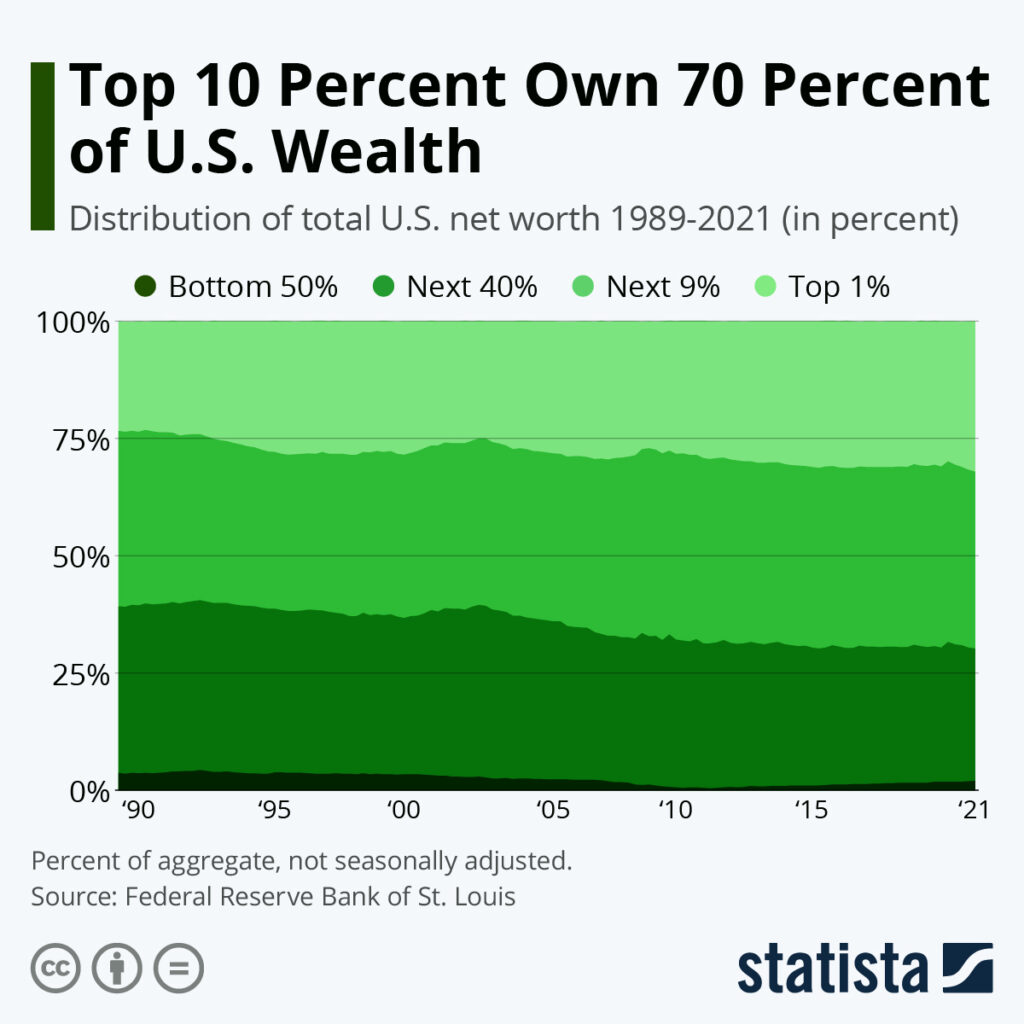

With the cost of healthcare rising and people living longer, you need more than just a few hundred thousand dollars. According to the Federal Reserve’s Survey of Consumer Finances, the average retiree in the top 10% has several million dollars saved—and they live comfortably.

Reaching this elite status isn’t about winning the lottery or inheriting money. It’s about discipline, strategy, and consistency.

Step-by-Step: How to Retire in the Top 10%?

1. Know Your Number

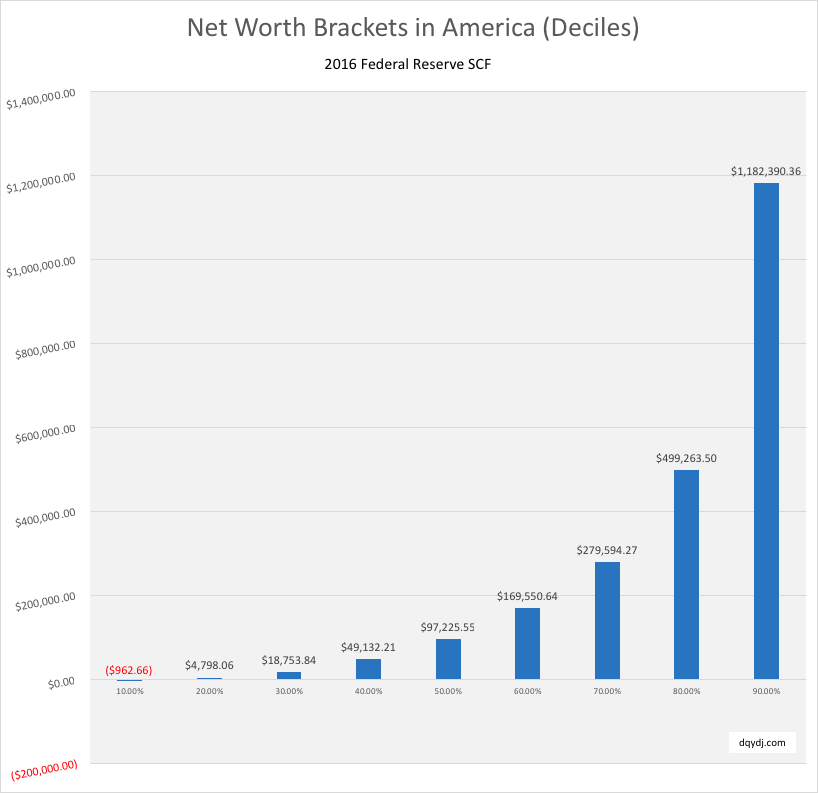

Before you start, figure out where you stand. Calculate your net worth: everything you own (home equity, retirement accounts, cash, investments, vehicles) minus what you owe (mortgages, student loans, credit card debt).

Top 10% retirees typically have $3.8M–$7.8M in net worth. That may sound like a lot now, but with compounding, it’s more achievable than you’d think.

2. Play Offense with Income

Want to save more? You’ll need to earn more. Whether you’re working a 9–5, freelancing, or growing a business, income growth is critical.

Ways to grow income:

- Negotiate better pay every 1–2 years.

- Switch jobs strategically—job hopping can yield 10–20% salary jumps.

- Start a side hustle: Freelance writing, e-commerce, Uber, YouTube—it adds up.

- Upskill through certifications or online learning.

According to Pew Research, the top 10% of earners bring in around $173,000+ annually. You don’t have to earn that today, but growing toward it helps fuel serious savings.

3. Save Aggressively—15% to 25% is the Sweet Spot

To retire in the top 10%, saving 15–25% of your gross income isn’t optional—it’s essential.

Where to put savings:

- 401(k): Contribute enough to get your employer match.

- Roth IRA or Traditional IRA.

- Brokerage accounts for taxable investing.

- High-yield savings for emergency funds.

Every raise? Boost your savings rate before upgrading your lifestyle.

Use the formula from The Millionaire Next Door:

Age × Income ÷ 10 = Target Net Worth

Example: 40 years old × $150,000 ÷ 10 = $600,000

4. Invest for Long-Term Wealth

You don’t need to day trade or bet on crypto to build wealth. You just need a smart, long-term plan.

Key investment options:

- 401(k) and 403(b) plans: Often offer company match.

- Roth IRA: Grows tax-free.

- Brokerage Accounts: For flexible, non-retirement investing.

- Real Estate: Rental properties can generate passive income and grow equity.

Best strategies:

- Index funds like VTSAX (Vanguard Total Stock Market) or SPY (S&P 500).

- Dollar-cost averaging: Invest the same amount regularly, regardless of market conditions.

- Diversify: Stocks, bonds, REITs, and international exposure.

Don’t chase fads. Stick with proven investments and let compounding do the heavy lifting.

5. Budget with Purpose

The top 10% don’t nickel-and-dime everything—but they spend intentionally.

Tips:

- Avoid lifestyle inflation: Just because you earn more doesn’t mean you need a new car every year.

- Use the 50/30/20 rule:

- 50% needs (housing, food, bills)

- 30% wants (travel, entertainment)

- 20% savings/investing

6. Pay Attention to Taxes

Taxes are one of the biggest threats to your retirement money. The wealthy use every legal strategy to keep more of what they earn.

Smart tax strategies:

- Roth Conversions in low-income years.

- Tax-loss harvesting in taxable accounts.

- Max out HSAs—the only triple tax-advantaged account.

- 529 plans for college savings with tax-free growth.

- Donor-Advised Funds (DAFs) for charitable giving with deductions.

Meet with a fiduciary financial advisor or CPA every year to update your tax strategy.

7. Plan Your Retirement Exit and Legacy

Getting rich is one thing. Staying rich in retirement is another.

Here’s how to avoid outliving your money:

- Use the 4% rule: Withdraw 4% of your portfolio yearly, adjusted for inflation.

- Delay Social Security until age 70 for max benefit.

- Plan for long-term care and medical costs.

- Set up an estate plan: wills, power of attorney, living trusts.

You can also explore:

- Annuities: Provide guaranteed income, but come with trade-offs.

- Reverse mortgages: Tap home equity in retirement, though they aren’t for everyone.

8. Teach the Next Generation

Part of leaving a legacy is educating your kids and grandkids. The earlier they learn about money, the better off they’ll be.

Ways to teach:

- Open a custodial Roth IRA if your teen has earned income.

- Talk about compound interest at dinner.

- Involve them in budgeting or tracking spending.

- Gift them books like Rich Dad Poor Dad for Teens or The Simple Path to Wealth.

By modeling good financial behavior, you’re passing on something far more valuable than money: financial wisdom.

The Wealth Mindset: What Top 10% Retirees Do Differently

It’s not just about how much you earn or save—it’s how you think about money. One of the most powerful secrets to joining the top 10% isn’t a new investment trick or high-paying job. It’s developing the mindset of long-term wealth builders.

1. They Think Long-Term

People who retire in the top 10% didn’t get rich overnight. They planned decades in advance. They think in terms of decades, not days.

- They ask, “How will this choice affect me 20 years from now?”

- They choose delayed gratification over short-term thrills.

- They visualize the lifestyle they want in retirement—and reverse-engineer how to get there.

2. They Automate Good Decisions

Instead of relying on willpower, top savers automate:

- Investments (via 401(k)s, IRAs, auto-transfers)

- Bill payments (to avoid fees or credit damage)

- Budgeting tools that send alerts and track spending

They make one good decision—and let the system carry it forward.

3. They Avoid Emotional Spending

They don’t let emotions drive financial decisions. Whether it’s a market crash or a luxury sale, they stay calm and stick to the plan.

- They understand that markets fluctuate.

- They resist the temptation of impulse spending by following value-based budgeting.

- They build emergency funds so unexpected costs don’t derail them.

4. They Keep Learning

Top 10% retirees are lifelong learners. They regularly consume:

- Finance books and podcasts

- Retirement calculators and projections

- News on taxes, investment trends, and Social Security changes

Recommended reads:

- The Psychology of Money by Morgan Housel

- Your Money or Your Life by Vicki Robin

- The Millionaire Next Door by Thomas J. Stanley

5. They Talk About Money Openly

Unlike many Americans who keep finances taboo, wealthy families talk about:

- Budgets and income

- Credit and debt

- Investing and taxes

- Goals and legacy planning

By talking about money openly—with spouses, kids, or advisors—they make smarter decisions and avoid common pitfalls.

Expert Offers Guidance for Couples Planning Retirement With Limited Savings

Waze Co-Founder Shares Candid Retirement Advice After Years of Entrepreneurship

Millennial Who Achieved Early Retirement Reveals Harsh Truth About FIRE Lifestyle