US Online Spending Jumps by $24.1 Billion: US online spending surged by $24.1 billion during the July 8–11, 2025 period, driven by unprecedented digital discounts, Amazon’s extended Prime Day, and a broader consumer shift toward mobile-first shopping. This mid-summer spike isn’t just a seasonal blip—it reflects powerful trends shaping the future of eCommerce and how Americans shop. Whether you’re running a small online store or managing your family’s monthly budget, understanding why this boom happened—and what it means—can help you make smarter choices next time the big sales roll around.

US Online Spending Jumps by $24.1 Billion

The $24.1 billion in July 2025 online spending tells us more than just “people love deals”—it shows that digital-first retail is dominating the future. With expanded shopping events, sharper discount strategies, and mobile commerce leading the way, we’re witnessing a shift in how—and when—Americans shop. Whether you’re a consumer trying to stretch your dollar or a retailer trying to catch the wave, there’s one thing clear: July is now one of the most important months on the retail calendar.

| Metric | Details |

|---|---|

| Total U.S. Online Spending (July 8–11, 2025) | $24.1 Billion |

| Year-over-Year Growth | 30.3% Increase |

| Most Discounted Categories | Apparel (24%), Electronics (23%), Toys (20%) |

| Mobile Shopping Share | 53.2% of total sales |

| Average Discount Range | 11%–24% |

| Top Retailers Participating | Amazon, Walmart, Target, Best Buy |

| Most Popular Payment Methods | Credit cards, Buy Now Pay Later (BNPL), digital wallets |

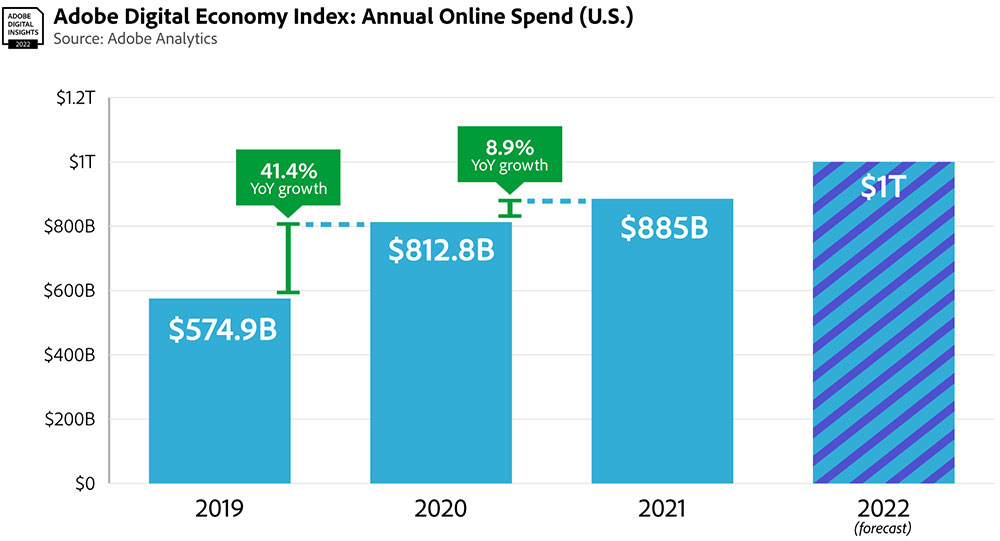

| Source | Adobe Digital Economy Index |

Why Did US Online Spending Jumps by $24.1 Billion?

Amazon Prime Day Expanded – and Dominated

Amazon turned Prime Day into a four-day shopping marathon, offering steep discounts on electronics, home goods, apparel, and Amazon-branded products. Originally launched in 2015 to celebrate Amazon’s 20th anniversary, Prime Day has since evolved into a global mid-year shopping event, now rivaling Black Friday in influence.

In 2025, Amazon pushed Prime Day out to 96 hours—double the typical 48-hour window—and paired it with exclusive early-access sales for Prime members. Adobe Analytics reported over $12 billion in Prime Day-related U.S. spending alone.

Other major retailers followed suit, offering their own flash sales to stay competitive. Walmart hosted “Rollbacks Week,” Target rolled out “Deal Days,” and Best Buy unleashed record-low prices on laptops and smart TVs.

Discounts Were Historically Deep

Retailers knew that shoppers were price-conscious due to inflation, student loan repayments, and rising utility costs. So they offered some of the best deals seen outside of Cyber Monday.

Here are the average discount depths by category:

- Apparel: Up to 24% off

- Electronics: Around 23% off

- Toys: 20% off

- Home goods: 18% off

- Sporting equipment: 15% off

These markdowns helped trigger higher-value purchases, as consumers took the opportunity to upgrade to better brands or buy in bulk.

The Rise of Mobile Shopping

More than 53% of all online purchases were made via mobile devices, according to Adobe’s July 2025 report. That’s the highest share ever recorded in a U.S. shopping event of this scale.

Mobile performance and app optimization became crucial for brands. Companies with fast-loading, easy-to-navigate mobile sites saw better conversions, while those lagging behind lost traffic and revenue.

Retailers also used mobile push notifications and limited-time offers to create a sense of urgency, nudging users to complete their purchases quickly.

Consumer Sentiment: Smart Spending in a Cautious Economy

Even with the strong numbers, shoppers were more cautious and selective than in previous years.

According to a National Retail Federation (NRF) survey in July:

- 67% of respondents said they were “budget-first” shoppers.

- 58% said they postponed some non-urgent purchases in Q2 2025 to wait for Prime Day or similar sales.

- 41% used tools like CamelCamelCamel, Honey, or Capital One Shopping to track and verify prices before buying.

Many shoppers also used Buy Now, Pay Later (BNPL) services like Klarna and Afterpay to split larger purchases into installments without interest. This payment method saw a 20% increase in usage compared to July 2024.

How Retailers Capitalized on the Moment?

To manage rising expectations and ensure seamless service, major retailers deployed a combination of technology, strategy, and partnerships.

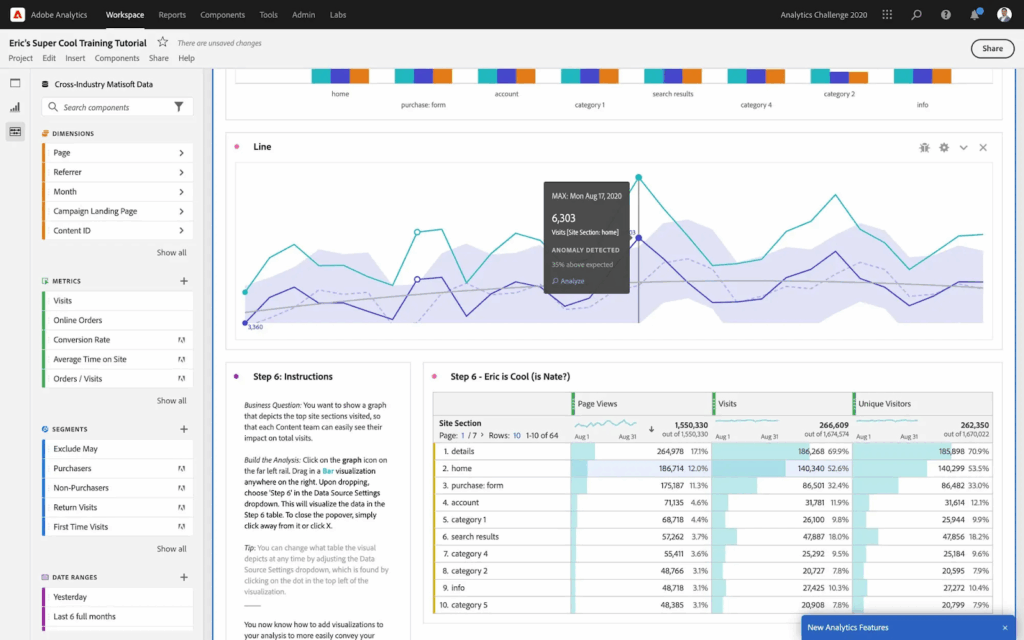

1. Advanced AI for Personalization

Using real-time analytics, many eCommerce platforms delivered hyper-personalized product recommendations, tailored coupons, and email alerts based on shopper behavior. This not only improved conversion rates but also increased the average order value.

Retailers like Nordstrom and Best Buy used AI to segment their audience, offering different levels of discounts or bundles based on past purchases and browsing history.

2. Fulfillment & Logistics

Retailers invested heavily in logistics and last-mile delivery. Amazon expanded its regional fulfillment centers to allow same-day delivery in select metro areas. Target leaned on its “Drive Up” pickup service to cater to mobile shoppers who wanted fast, contactless handoffs.

3. Social Commerce

This year saw a rise in influencer-led sales campaigns on TikTok, Instagram Reels, and YouTube Shorts. Brands launched limited-edition drops and discount codes through influencer partnerships, adding authenticity and urgency to promotions.

Gen Z, in particular, turned to creators for purchase recommendations, reinforcing the role of social media in modern retail.

What Consumers Bought the Most?

Certain product categories stood out in Adobe’s July 2025 report. Here’s a breakdown of top-selling items:

- Electronics: Tablets, smartwatches, wireless earbuds

- Home & Kitchen: Air fryers, robot vacuums, mattresses

- Back-to-School Gear: Laptops, backpacks, headphones

- Clothing & Accessories: Activewear, sneakers, designer handbags

- Toys & Games: Lego kits, board games, gaming consoles

Interestingly, eco-friendly and sustainable products also saw a rise in purchases, especially among younger consumers. Reusable kitchenware, organic cotton clothing, and solar-powered tech accessories gained popularity.

What US Online Spending Jumps by $24.1 Billion Means for the Rest of 2025?

This $24.1 billion moment signals a few key takeaways for the rest of the year.

1. Back-to-School Spending Has Shifted Forward:

Consumers are no longer waiting until August. July is now part of the new back-to-school season. Retailers should plan their campaigns accordingly.

2. Holiday 2025 Will Be More Competitive Than Ever:

Adobe predicts U.S. online holiday sales will surpass $300 billion this year, with Black Friday and Cyber Monday facing stiff competition from October and early November campaigns.

3. AI and Mobile Will Be Table Stakes:

Brands that ignore personalization or don’t optimize for mobile risk falling behind. Consumers expect a frictionless, tailored experience—anything less and they’ll bounce.

Actionable Guide: How to Prepare for Future Mega Sales

Whether you’re a shopper or a seller, here’s how to stay ahead:

For Shoppers:

- Make a Wishlist in Advance: Track your wants vs. needs using tools like Notion or Google Keep.

- Set Price Alerts: Use sites like CamelCamelCamel or browser extensions like Honey and Rakuten.

- Join Loyalty Programs: Get early access to deals and exclusive offers.

- Use Cashback & Rewards Apps: Stack savings using digital wallets or apps like Capital One Shopping.

- Verify the Deal: Use historical price checkers to avoid fake discounts.

For Businesses:

- Build Your Sales Calendar Early: Prep July sales like you prep for Black Friday.

- Invest in Mobile Speed: Faster sites convert better. Period.

- Leverage AI for Product Recommendations: Tailored emails and popups lead to higher AOV.

- Partner With Influencers: Especially micro-influencers with highly engaged niche audiences.

- Offer Flexible Payments: BNPL is now an expectation for big-ticket items.

4 Financial Mistakes Americans Keep Making That Wreck Their Budgets

How to Finally Stop Overspending—Practical Tips That Actually Work