Up to $5000 in Social Security Payments: “Social Security payments of up to $5,108 are coming this month!” Sound familiar? If you’ve read headlines promising thousands in Social Security checks, you’re not alone. The buzz is real—but it’s important to understand who actually qualifies for that maximum benefit and when these payments are scheduled to arrive. Whether you’re planning retirement, already receiving benefits, or just curious how this all works, this guide walks you through everything you need to know—from eligibility and payment dates to recent tax changes and overpayment policies. Let’s break it down.

Up to $5000 in Social Security Payments

While the headlines are attention-grabbing, only a small percentage of retirees will receive the full $5,108 per month. That said, everyone can make smarter choices to boost their Social Security income, especially by delaying benefits, working longer, and ensuring accurate records. New tax changes and stricter overpayment rules make it more important than ever to stay on top of your SSA account. Understanding your payment schedule, benefits estimate, and how to appeal overpayment notices can make a real difference in your retirement security. Take a moment today to log into your account, review your data, and build a strategy that helps you retire smarter—not just sooner.

| Highlight | Detail |

|---|---|

| Maximum Monthly Benefit (2025) | Up to $5,108 per month at age 70 with full earning history |

| Payment Dates (July 2025) | July 9 (birthdays 1–10), July 16 (birthdays 11–20), July 23 (birthdays 21–31) |

| SSI Payments | July 1 (SSI only), July 3 (SSI + SS or claims before May 1997) |

| New Tax Exemption | 90% of recipients now exempt from taxes up to $6,000 (individual) / $12,000 (joint) |

| Overpayment Recovery Policy | SSA can now deduct up to 50% of benefits |

| Official SSA Source | SSA.gov |

Understanding the $5,108 Monthly Benefit

Let’s clear the air: the $5,108 number isn’t just media hype—it’s accurate for a small subset of retirees. However, most people receive far less, and here’s why.

The maximum monthly benefit for retirees in 2025 is $5,108, but to qualify, you must:

- Delay collecting Social Security until age 70

- Earn the maximum taxable amount for 35 years (in 2025, that’s around $168,600 annually)

- Accumulate at least 40 work credits (equivalent to 10 years of covered employment)

Most Americans don’t meet all these conditions. According to the Social Security Administration, the average monthly benefit for retired workers in 2025 is approximately $1,907. However, by making strategic decisions—like delaying benefits and working longer—you can raise your personal payout significantly.

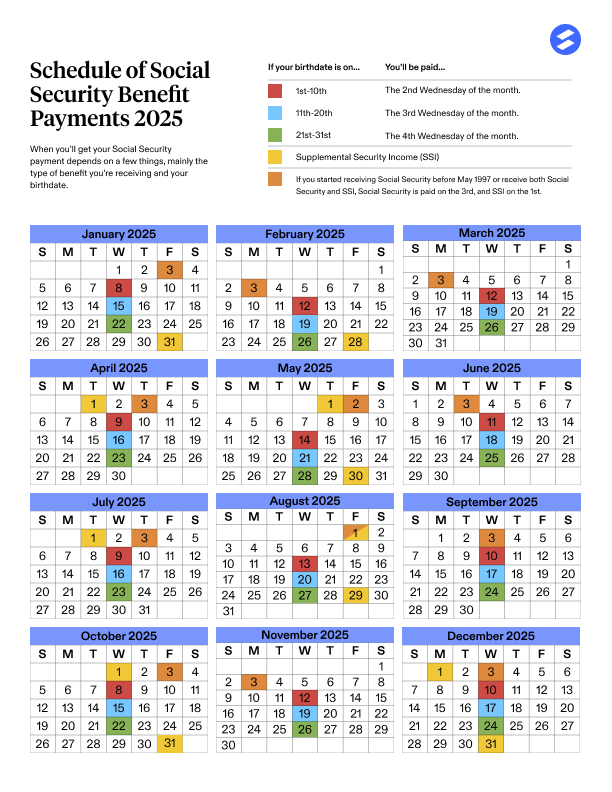

July 2025 Social Security Payment Schedule

Your payment date depends on your birthday and when you started receiving benefits. Social Security follows a structured payment calendar each month:

- If your birthday is between the 1st–10th → You’ll be paid Wednesday, July 9

- If your birthday is between the 11th–20th → You’ll be paid Wednesday, July 16

- If your birthday is between the 21st–31st → You’ll be paid Wednesday, July 23

For those who receive Supplemental Security Income (SSI) only, payments were issued on July 1.

If you receive both SSI and Social Security, or if you began receiving benefits before May 1997, your benefit was paid on July 3.

It’s worth noting that if your payment is delayed due to a weekend or holiday, SSA typically delivers it the business day before or after. If your payment is late, wait three business days before contacting the SSA.

Eligibility: Who Gets What and Why

Let’s take a closer look at who qualifies for the highest Social Security benefit and why.

Who Qualifies for $5,108?

To get the full amount in 2025, you must:

- Have reached full retirement age (FRA) or delayed benefits up to age 70

- Have worked 35 years at maximum taxable income

- Earned 40 work credits under Social Security guidelines

The maximum benefit increases each year due to cost-of-living adjustments (COLA) and adjustments in the taxable wage base. In 2024, the taxable maximum was $168,600. To qualify for the full $5,108 in 2025, your income needs to stay above that threshold for most of your working life.

Who Does Not Qualify?

Most Americans will not reach the maximum. You are likely ineligible for the full amount if you:

- Retired early (before full retirement age)

- Claimed Social Security at 62 or 63

- Have less than 35 years of earnings

- Had fluctuating or low-paying jobs not subject to Social Security tax

Even if you’re not maxing out your benefit, you can still optimize what you receive through timing, spousal benefits, and work history.

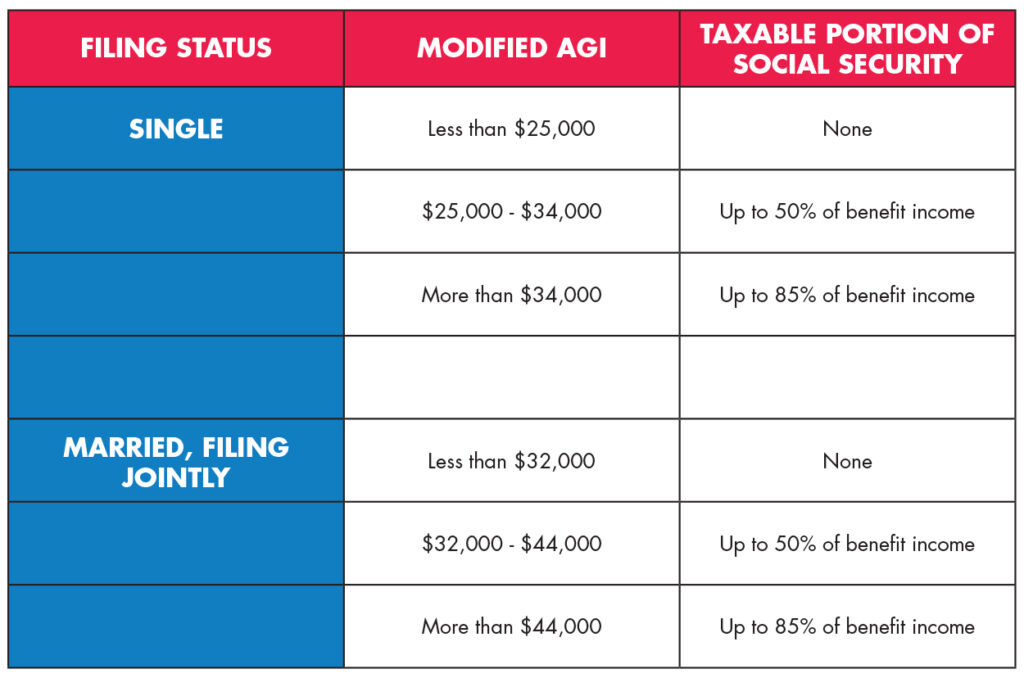

Recent Tax Changes: A Big Win for Retirees

On July 4, 2025, the government passed a bill increasing the federal tax exemption on Social Security benefits. The “One Big Beautiful Bill” now exempts most recipients from federal taxes on their benefits, offering significant savings.

Key Provisions

- Individual filers are now exempt from federal income taxes on Social Security benefits up to $6,000

- Married couples filing jointly are exempt up to $12,000

- The change impacts approximately 90% of all current Social Security beneficiaries

Previously, taxation on Social Security benefits kicked in once an individual made more than $25,000 annually. This new bill raises that limit, offering relief for low- to moderate-income retirees. It also includes inflation-adjusted thresholds to prevent future bracket creep.

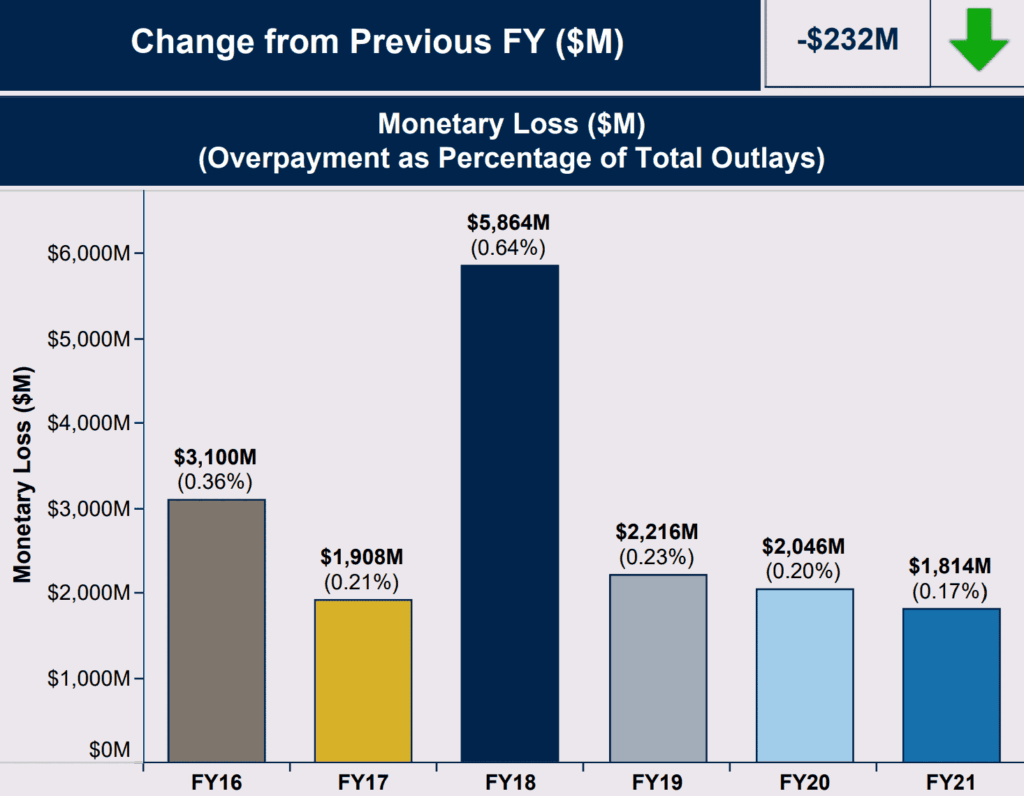

Overpayment Recoupment: New Rules Effective July 2025

If you’ve ever been overpaid by the SSA, the rules just got stricter. Effective late July 2025, SSA will:

- Recoup up to 50% of your monthly benefit for new overpayments issued after April 25, 2025

- Previously, the maximum monthly recovery was 10%, unless the recipient agreed to a higher rate

If this affects you, you have the right to:

- Request a waiver if the overpayment wasn’t your fault

- File an appeal within 60 days if you disagree with the decision

Common Scenarios and Examples

Let’s look at a few real-life examples that show how different choices affect monthly payments:

Example 1: The Maximum Earner

- Name: Robert

- Age: 70

- Work History: 40 years at max income

- Start Claiming: July 2025

- Monthly Benefit: $5,108

Example 2: The Early Retiree

- Name: Susan

- Age: 62

- Work History: 32 years, average income

- Start Claiming: July 2025

- Monthly Benefit: ~$1,700

Example 3: The Dual-Income Couple

- Names: Mary and James

- Ages: 67 and 65

- Strategy: James delays until 70, Mary claims spousal benefits

- Combined Monthly Benefit: ~$4,800

How to Get Up to $5000 in Social Security Payments: Step-by-Step Guide

Here’s a simple action plan to help you get the most from your benefits.

- Check Your Earnings Record

Log into your mySSA account and verify your earnings history is accurate. - Use the Retirement Estimator Tool

SSA’s Retirement Estimator shows your potential benefits at different claiming ages. - Work at Least 35 Years

Less than 35 years? SSA averages in zeros, which can lower your benefit. - Delay Benefits Until 70 (If You Can)

Delaying from FRA to age 70 adds about 8% per year to your monthly payment. - Avoid Earning Too Much While Receiving Early Benefits

If you claim before FRA and continue to work, your benefits may be temporarily reduced.

Trump’s ‘Big Beautiful Bill’ Sparks Debate Over Social Security and Benefits

Deadline Alert—July 2025 Social Security Cutoff Is Closer Than You Think

Millions of Americans Could See Their Social Security Checks Cut by 50 Percent