Eight-Year Rule That Could Maximize Your Social Security Benefits: isn’t just another retirement buzzword. It’s a powerful strategy rooted in Social Security’s structure—and if you play your cards right, it can add hundreds of thousands of dollars to your lifetime retirement income. Whether you’re just starting to plan for retirement or are already knocking on Social Security’s door, the eight-year window between age 62 and 70 is where your financial decisions carry the most weight. This article breaks it all down with real-life examples, expert advice, and steps you can act on today.

Eight-Year Rule That Could Maximize Your Social Security Benefits

The Eight-Year Rule is more than a number game—it’s about designing a retirement strategy that works for your lifestyle, income needs, and health outlook. Whether you claim early at 62, wait until 70, or find a middle ground, understanding your options can protect your future income and help you sleep better at night. The smartest move? Don’t default to the earliest age or the latest just because you can. Run your numbers. Know your break-even point. Coordinate with your spouse. And talk to a financial advisor if you’re unsure. With the right plan, your Social Security benefits can do more than cover the basics—they can help you enjoy the retirement you’ve worked so hard for.

| Feature | Details |

|---|---|

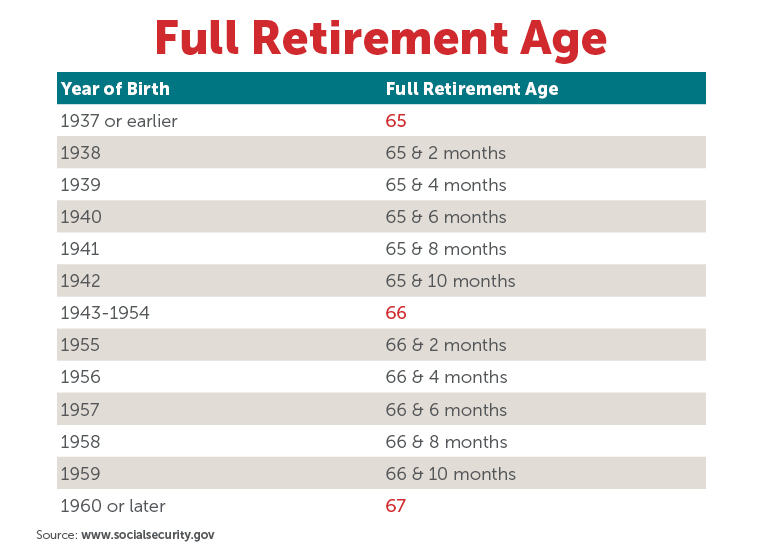

| Claiming Ages | You can start at 62, but your full benefit (FRA) comes between 66 and 67, and you max out at 70. |

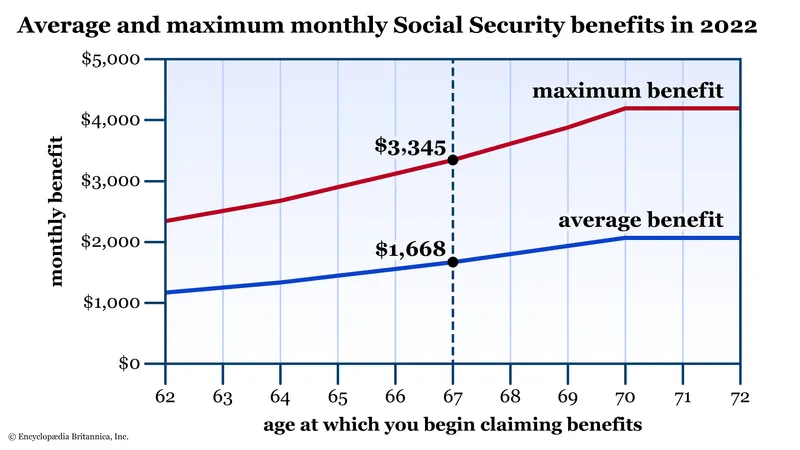

| Monthly Benefit Impact | Claim at 62 = ~30% reduction. Wait until 70 = up to 32% increase over FRA. |

| Break-Even Age | Usually around age 78–80, depending on life expectancy and benefit size. |

| Couples Strategy | One spouse files early for income, the other delays for max survivor benefits. |

| Income Test | If you work before FRA, earning more than $22,320 (2024) could reduce your benefit. |

| Delayed Credit | Waiting earns about 8% more per year from FRA to 70. |

| Taxes | Up to 85% of benefits could be taxable; delay may reduce tax burden in early years. |

| Official Site | Visit ssa.gov for calculators and personalized guidance. |

Why the Eight-Year Rule Is So Critical?

Social Security was created in 1935 during the Great Depression as a safety net for aging Americans. Back then, life expectancy was under 65, so the system didn’t anticipate people living 20 to 30 years in retirement.

Fast forward to today: people live longer, retire earlier, and rely more heavily on their Social Security benefits. That’s where the Eight-Year Rule becomes so important. It provides a strategic choice—take benefits early and get more years of smaller checks, or wait to increase your monthly income permanently.

This isn’t just about age—it’s about lifetime income. If you live past your early 80s, delaying benefits could put tens of thousands more in your pocket.

Real-World Example: Comparing Joe and Susan

Let’s say Joe and Susan both have an FRA of 67 and are eligible for $2,000/month.

- Joe claims at 62. He gets $1,400/month (a 30% reduction) for the rest of his life.

- Susan waits until 70. Her check becomes $2,480/month due to delayed retirement credits.

If they both live to age 85, Susan will collect significantly more—around $80,000 more over her lifetime, not including inflation adjustments. And if one of them passes away, the surviving spouse will continue receiving the higher of the two benefits.

This example highlights how timing can make or break retirement income longevity.

Who Should Delay? And Who Shouldn’t?

Delaying Social Security isn’t always the best choice. It depends on your health, finances, work situation, and family circumstances.

People Who Might Benefit from Delaying:

- Healthy individuals with long life expectancy

- People with strong retirement savings who don’t need SS early

- The higher earner in a couple (to maximize survivor benefit)

- Widows/widowers eligible for survivor benefits

- People who retire early but want to avoid taxable income spikes

People Who Might Claim Early:

- Those with health concerns or shorter life expectancy

- Individuals needing immediate income

- Workers laid off or retiring before 65 without other income sources

- Divorced spouses who want to claim off an ex-spouse’s record while delaying their own

The Math: Understanding the Break-Even Point

This is where it gets interesting. If you claim early, you receive more checks over your lifetime—but smaller ones. Delaying means fewer checks, but they’re much larger.

The break-even age is the point at which both approaches (early vs. delayed) pay out the same total amount.

- For most people, the break-even age is around 78 to 80.

- If you live past that, delaying results in more lifetime income.

- If your family has a history of longevity, the math favors waiting.

Strategy for Couples: How to Optimize Together

Married couples have even more options. You can stagger your claiming strategy to balance early income needs with long-term benefit maximization.

Here’s a proven plan:

- Lower earner claims early to bring in cash.

- Higher earner delays to age 70 for maximum benefit and increased survivor protection.

When one spouse passes, the surviving partner receives the higher of the two benefits—so delaying for the higher earner boosts both spouses’ income long term.

This is one of the most effective ways to use the Eight-Year Rule to protect your household.

What If You’re Divorced?

You might be eligible to claim benefits based on your ex-spouse’s record if:

- You were married for at least 10 years

- You’re currently unmarried

- Your ex is at least 62 years old

- Your own benefit is lower than your ex-spouse’s

You can file based on their record and later switch to your own higher benefit if it surpasses your ex’s, especially if you delay to age 70.

This can be a hidden goldmine for divorced individuals—many don’t realize they qualify.

Taxes and Medicare: Two Hidden Pitfalls

Social Security is not always tax-free. Up to 85% of your benefits could be taxable if your combined income exceeds certain thresholds:

- $25,000 for single filers

- $32,000 for married couples filing jointly

Plus, delaying benefits can reduce required minimum distributions (RMDs) from IRAs and reduce Medicare IRMAA surcharges in early retirement.

Delaying Social Security could give you space to make strategic Roth IRA conversions or reduce taxable income, minimizing long-term taxes.

Still Working? Know the Earnings Test

If you claim benefits before your FRA and keep working, your benefits could be temporarily reduced:

- In 2024, if you earn more than $22,320, Social Security will withhold $1 for every $2 over that limit.

- In the year you reach FRA, they’ll withhold $1 for every $3 over $59,520 (2024).

Once you hit FRA, they recalculate your benefit to “pay you back” over time—but you need to plan for that cash flow gap.

The Future of Social Security: Should You Be Worried?

You’ve probably heard the headlines: “Social Security is going broke.” But here’s what the data says:

- As of 2024, the Social Security Trust Fund is projected to run short by 2033.

- If Congress doesn’t act, benefits could be reduced by roughly 23%.

That sounds scary, but remember:

- Delaying still increases your benefit amount, even if there are future reductions.

- Congress is expected to act, as 65 million Americans rely on these payments.

- Likely changes will affect younger workers, not near-retirees.

So no, the system isn’t going away—but you still need a plan.

5-Step Game Plan to Use the Eight-Year Rule That Could Maximize Your Social Security Benefits

- Find your Full Retirement Age (FRA)

Use SSA’s FRA chart. - Use the SSA Retirement Estimator

Visit ssa.gov to project your benefits. - Run your break-even analysis

Try tools from SmartAsset or your financial planner. - Create a bridge plan

Budget for income from savings, part-time work, or spousal benefits if delaying SS. - Coordinate with your partner

Maximize household and survivor benefits through timing.

Trump’s New Tax Bill Could Reshape How Social Security Benefits Are Taxed

Social Security Projected to Cut Benefits by 2033, Affecting Retired Workers

Trump’s ‘Big Beautiful Bill’ Sparks Debate Over Social Security and Benefits