UK Revives Pensions Commission Amid Savings Crisis: The UK government is reigniting the Pensions Commission to tackle an ongoing retirement savings crisis that could affect millions. With growing concerns about inadequate pension savings, especially among younger workers and underserved groups, the government hopes that the revived commission will propose reforms aimed at securing a more sustainable retirement future for everyone. This article explores what the revival means for your retirement and how you can prepare for the changes. In this article, we will break down the key aspects of the commission’s revival, the potential impact on pension savings, and what it means for your financial future. From new regulations to a shift in how pension contributions are managed, these changes are set to affect both individual savers and employers. We’ll also provide tips on how to adjust your retirement plan in response.

UK Revives Pensions Commission Amid Savings Crisis

The revival of the Pensions Commission marks an important shift toward addressing the UK’s growing retirement savings crisis. With a focus on higher contributions, underrepresented groups, and a review of the state pension age, these changes will have a significant impact on how people plan for retirement. While the road to a more secure retirement might require some adjustments, there are plenty of steps you can take to ensure you’re on the right track. Stay proactive in reviewing your pension contributions, consider additional savings options, and keep an eye on changes to the state pension age. By staying informed and making smart decisions now, you’ll be better prepared for a comfortable retirement in the future.

| Key Area | What You Need to Know | Data/Stats | Sources |

|---|---|---|---|

| Pensions Commission Revival | The UK government has revived the Pensions Commission to address a growing pension savings crisis. | 45% of working-age adults are saving nothing for retirement. | The Guardian, The Sun |

| Changes to Contributions | The minimum auto-enrolment contribution may rise from 8% to 12%. | Potential impact on employer payroll costs. | Pensions UK |

| Focus on Underrepresented Groups | Special attention will be given to women, the self-employed, and ethnic minorities. | Women may receive £5,000 less annually in private pension income compared to men. | The Sun |

| State Pension Age Review | The government is reviewing the state pension age, which is set to increase from 66 to 67 in 2026. | Current pension age is 66, moving to 67 in 2026. | Financial Times |

Understanding the Pensions Crisis

Before diving into the specifics of what the revived Pensions Commission means for you, it’s important to understand the background. For years, pension saving rates in the UK have been insufficient to secure a comfortable retirement for many. With the rise of the gig economy and an increasing number of people working as freelancers or self-employed, many individuals have found it difficult to save for retirement.

An alarming 45% of working-age adults in the UK are not saving anything for their future. This is a stark contrast to the ideal situation where everyone, regardless of their career or employment status, contributes a portion of their income into a pension plan.

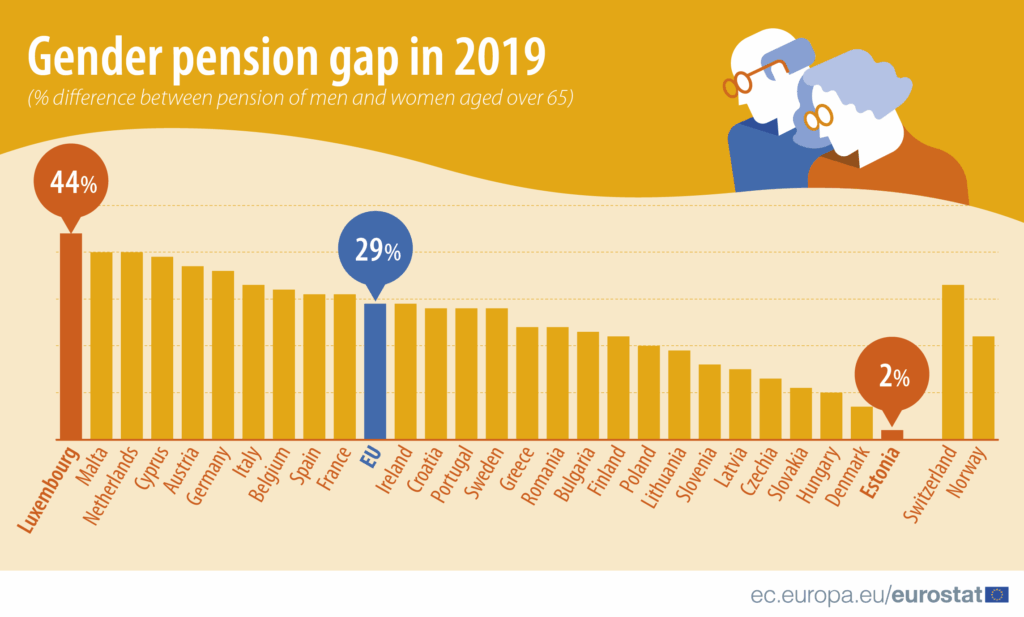

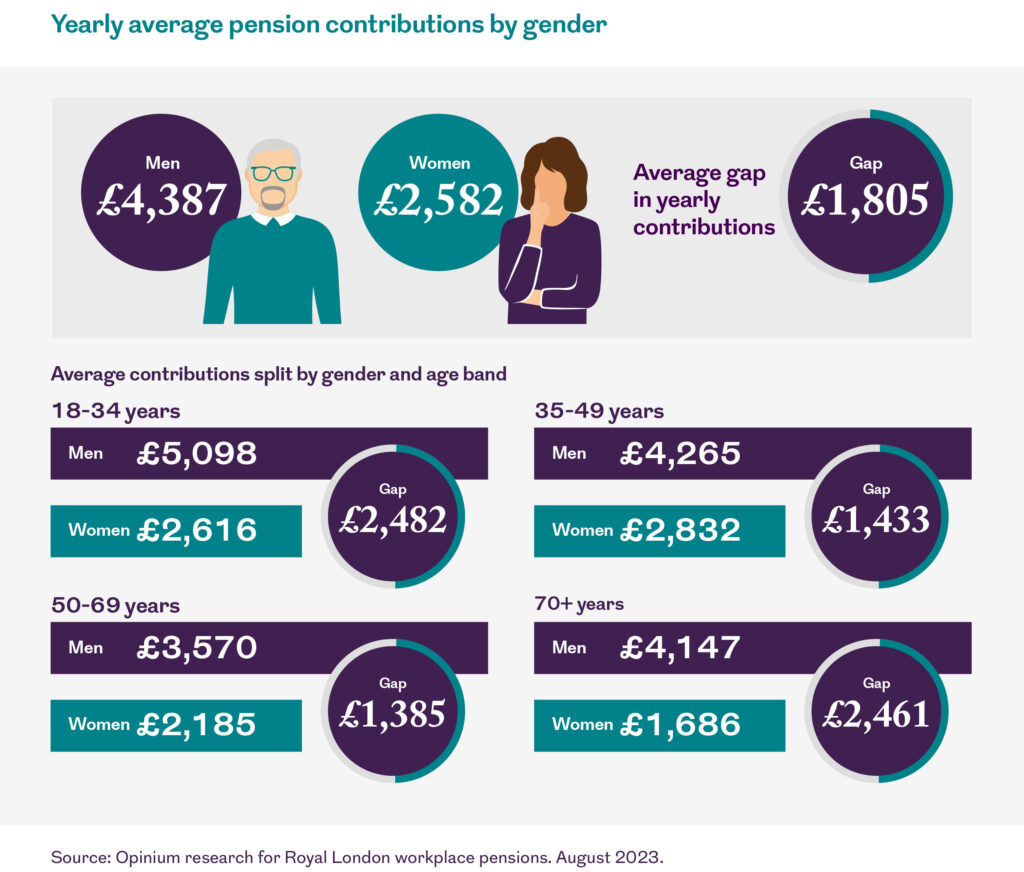

The situation is particularly dire for certain groups, like women, who are expected to receive £5,000 less per year than men in private pension income when they retire. The disparity in retirement savings is mainly attributed to lower lifetime earnings and career breaks due to caregiving responsibilities. These groups will likely benefit from the focus of the revived commission.

The Pensions Commission’s goal is to tackle these issues head-on and develop practical, sustainable solutions that can ensure a more equitable retirement landscape. But what exactly will change, and how will it impact you?

What the UK Revives Pensions Commission Amid Savings Crisis Means for Your Retirement?

The revival of the Pensions Commission brings with it a range of potential changes to how pensions are structured in the UK. Here are the key aspects you need to know.

1. Increased Contributions for Auto-Enrolment

The UK government is considering raising the minimum contribution rate for auto-enrolment pensions from 8% to 12%. This means that if you’re enrolled in an automatic pension plan through your employer, both you and your employer will need to contribute a larger percentage of your salary toward your pension.

Currently, the 8% contribution is split between the employer (3%) and the employee (5%), with the remaining 2% coming from tax relief. Under the new proposals, this split will likely increase, but it’s still unclear how the costs will be shared.

For many, this change will be a double-edged sword. On one hand, higher contributions mean more money for retirement. On the other hand, it could lead to higher payroll costs for employers, who may pass on some of the burden to employees in the form of lower wages or higher workplace costs.

2. Focus on Underrepresented Groups

The Pensions Commission has emphasized a commitment to addressing disparities in pension savings, particularly among underrepresented groups. Women, ethnic minorities, and the self-employed have all been identified as groups that struggle to save adequately for retirement. This is due to a variety of reasons, including gender pay gaps, fewer opportunities for self-employed individuals to contribute to pensions, and systemic barriers that prevent ethnic minorities from building wealth.

In particular, women often receive lower lifetime earnings due to career breaks, part-time work, and caregiving roles. The new commission aims to ensure that these groups are not left behind when it comes to retirement planning. One of the solutions might involve offering more tailored pension products or creating policies that incentivize these groups to save more for their future.

3. Review of the State Pension Age

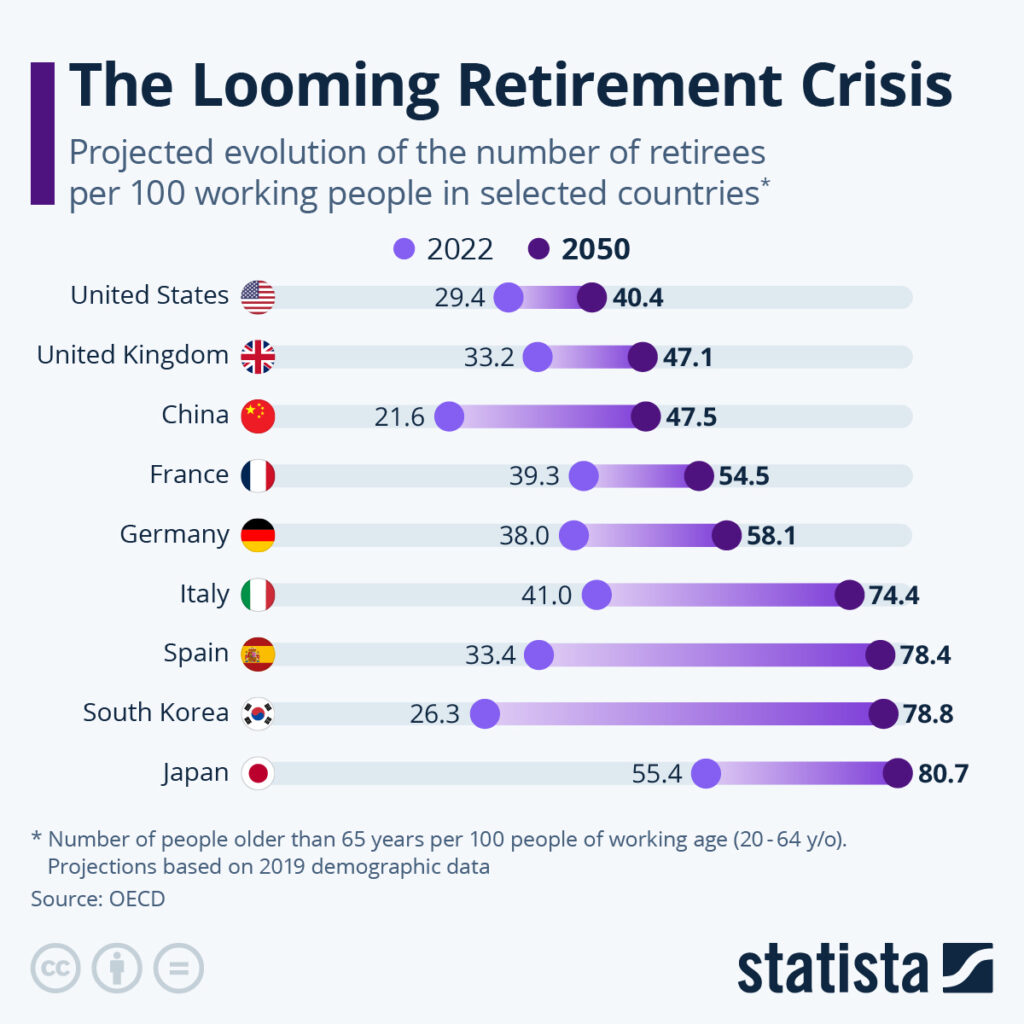

Currently, the state pension age in the UK is set to rise from 66 to 67 by 2026. However, with longer life expectancies and increasing financial pressures on the pension system, the government is considering whether this increase should happen as planned or if further adjustments are needed.

For individuals planning their retirement, the state pension age is a critical factor to consider. While many people expect to rely on state pensions as part of their income, the growing number of pensioners and longer life expectancies could put additional strain on the system.

How the Changes Will Affect Your Retirement Planning?

Now that we understand the main elements of the pension reforms, it’s time to figure out how these changes will affect you personally. Let’s break it down in practical terms.

1. Review Your Pension Contributions

If you’re currently enrolled in an auto-enrolment pension scheme, keep an eye out for any changes to contribution rates. If the rate increases, this might affect your take-home pay, so be prepared for a slightly smaller paycheck. However, the good news is that higher contributions will mean a more comfortable retirement when you reach it.

If you’re not already contributing to a pension, now might be a good time to start. The sooner you begin, the more you’ll benefit from the power of compound interest. Even small contributions can add up over time.

2. Consider Additional Savings Options

For those looking to supplement their pensions, consider opening a Lifetime ISA or personal pension plan. These accounts provide tax benefits that can help your savings grow faster. The key is to be proactive and put money aside as early as possible to take advantage of these opportunities.

3. Prepare for Changes in the State Pension Age

If you’re nearing retirement age, it’s important to plan for any changes to the state pension age. If you were expecting to retire at 66 but the state pension age increases, this could delay your retirement plans. Stay informed about the latest updates and adjust your retirement timeline accordingly.

International Comparison: How the UK Pension System Stacks Up

To put the UK pension reforms into perspective, it’s helpful to compare them to other countries. For example, in the United States, the Social Security system provides a basic safety net, but many Americans rely on employer-sponsored 401(k) plans and personal savings to cover their retirement needs. Like the UK, the US faces similar challenges in terms of low savings rates and income disparities.

In Canada, the Canada Pension Plan (CPP) offers a universal, publicly funded pension scheme that is akin to the UK’s state pension. However, Canadians are also encouraged to contribute to private pensions like RRSPs and TFSAs (Tax-Free Savings Accounts) to supplement their future retirement income.

By examining these international systems, it’s clear that many countries, including the UK, are rethinking how to make retirement more secure for all citizens. Understanding how different systems operate can offer valuable lessons on what works and what doesn’t.

Financial Implications for Employers

While the Pensions Commission reforms are primarily focused on individuals, employers also play a crucial role in the pensions landscape. As an employer, you’ll need to prepare for potential increases in pension contribution rates. This could have a significant impact on payroll budgets, especially for small and medium-sized enterprises (SMEs).

How Employers Can Prepare:

- Budget for higher costs: Factor in increased pension contributions when planning payroll and business expenses.

- Encourage participation: Educate employees about the benefits of contributing to pensions, particularly younger workers who may not fully understand the long-term value of saving.

- Review pension schemes: Make sure your pension offerings are competitive and help employees make the most of available contributions.

Integrated Pension Rules May Reduce State Pension for Some, Confirms DWP

State Pension Payment Increase for Those Receiving Disability Benefits- Check Details!

Thousands of Mothers at Risk of Missing Out on Full DWP State Pension