UK Pensions Shake-Up: The UK pensions system is getting a major overhaul, and it’s got folks on both sides of the pond asking: Will you have to retire later or pay in more? Whether you’re a Brit planning your golden years or an American keeping tabs on global financial trends, this shake-up could signal broader changes in how nations support aging populations. So, what’s really going down? The UK government is reviewing how pensions are funded, managed, and accessed—and some pretty big shifts are on the table. These changes could hit retirement age, contribution rates, and even how pension money is invested. If you think this won’t affect you, think again. From how long you’ll work to how much you’ll save, this shake-up might just change the game.

UK Pensions Shake-Up

The UK pensions shake-up is more than just policy talk—it’s a call to action. Whether you’re 25 or 55, it’s time to revisit your retirement plan. With the retirement age increasing, contributions likely rising, and new systems being introduced, staying passive is no longer an option. Start small, stay informed, and make smart choices. These changes may seem overwhelming now, but they’re designed to ensure that when you retire, you can do so with dignity, stability, and confidence.

| Key Point | Details |

|---|---|

| Retirement Age | Rising to 67 by 2028 and under review to increase further post-2030 |

| Contribution Rates | Expected to rise from 8% to around 12% (combined employer/employee) |

| Coverage Expansion | Auto-enrollment could expand to young workers, part-timers, and the self-employed |

| Megafund Investments | New large-scale pension schemes may yield £6,000–£29,000 more over a career |

| Triple Lock | Still in place but under review due to sustainability concerns |

| Minimum Pension Age | Increasing from 55 to 57 in April 2028 |

| NI Record | You need 35 years of National Insurance contributions for full pension |

| Official Resource | GOV.UK Pension Age Tool |

Context: Why This Matters Now

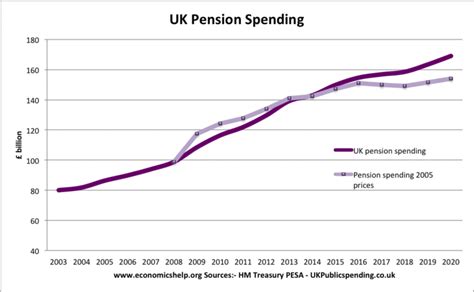

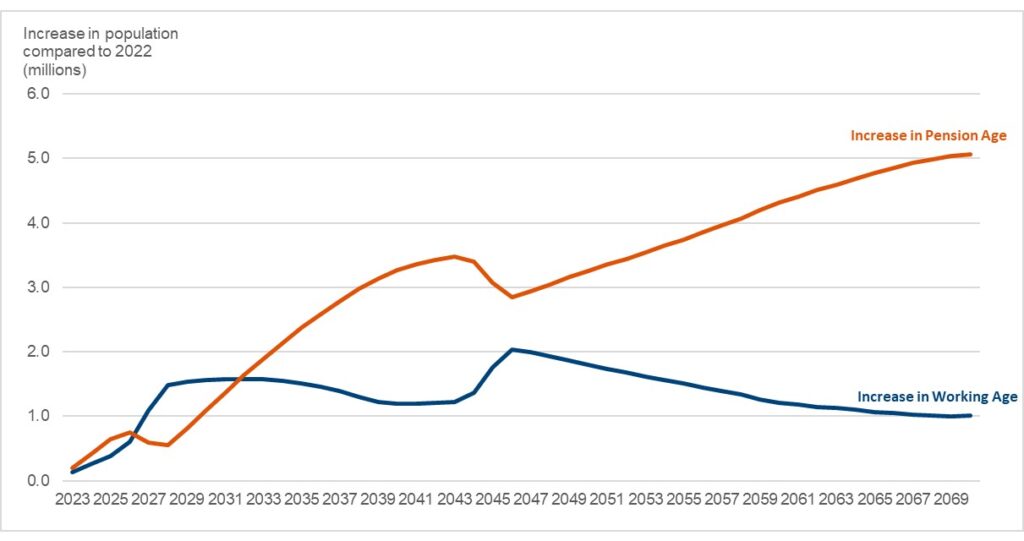

The UK, like many developed countries, is facing a demographic crunch. According to the Office for National Statistics, by 2045, around 25% of the UK population will be over 65. That’s a significant strain on public pensions and healthcare systems.

Meanwhile, inflation, stagnant wages, and rising living costs have made it difficult for people to save enough. The average defined contribution pension pot at retirement is just over £37,000, according to the Pensions Policy Institute—nowhere near enough for a comfortable retirement.

To keep the system sustainable and fair, major changes are underway.

What Is Changing and Why?

1. Retirement Age Is Going Up

The state pension age (SPA) is:

- 66 today

- Rising to 67 by April 2028

- Under review to increase to 68 or higher as early as the late 2030s

Why? People are living longer and drawing pensions for decades. A longer retirement means more money the government has to shell out. Adjusting the SPA helps balance the books.

Tip: If you’re under 40, plan for a retirement age closer to 70.

2. Higher Contribution Requirements

The current setup:

- Workers contribute 5%

- Employers chip in 3%

- Total = 8%

The issue? That’s just not enough. Experts like the Pensions and Lifetime Savings Association recommend saving 12% to 15% of your salary to maintain your lifestyle in retirement.

Expected reforms include:

- Increasing minimum contributions to 10–12%

- Possibly scaling based on age or income

- Encouraging voluntary top-ups

This might sound like a burden now, but it could save you from struggling later in life.

3. Expanded Auto-Enrolment

Auto-enrolment has brought millions into pension saving, but many are still left out. New proposals aim to:

- Lower the age threshold from 22 to 18

- Eliminate the £10,000 earnings floor

- Introduce auto-enrolment for the self-employed through HMRC tax returns

These changes could bring up to 9 million more people into workplace pensions.

4. Introduction of Megafunds

Instead of hundreds of small, inefficient pension schemes, the UK government is moving toward megafunds—large collective pension investments. These can:

- Reduce management fees

- Improve long-term returns

- Provide access to major infrastructure, tech, and green energy projects

Treasury estimates show that workers could earn £6,000 to £29,000 more in their lifetime from this reform alone.

Real-Life Example: Meet Sarah and James

Sarah, age 35, earns £30,000 and saves the minimum 8%. At this rate, she’s on track to retire at 68 with a pot of about £250,000.

James, also 35, increases his contributions to 12%. He’s projected to retire with £375,000. That’s an extra £125,000, just from upping his savings by a few hundred quid a year.

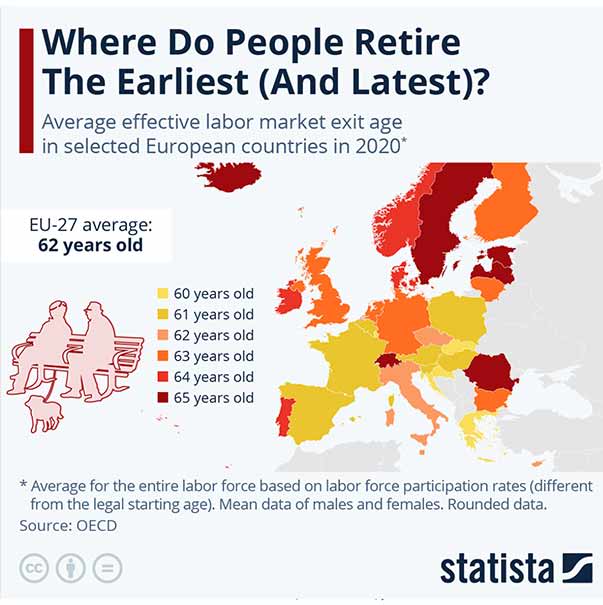

How Does the UK Compare Globally?

United States

In the U.S., Social Security is under pressure. The retirement age is 67, but rising healthcare costs and inflation are creating similar challenges. The SECURE Act 2.0 is pushing for automatic 401(k) enrollment and higher catch-up contributions—echoing what the UK is now proposing.

Australia

Australia uses a mandatory Superannuation system, where employers must contribute 11% of wages, rising to 12% by 2025. That’s higher than the UK’s current rate, and it shows in better retirement outcomes.

Lessons for the UK

- Make saving automatic and early

- Increase default contributions

- Simplify pension options

Who Will Be Most Affected?

- Young workers: Longer to retirement, more time to benefit—but higher contributions ahead

- Women: More likely to take career breaks and earn less, leading to smaller pots

- Gig and self-employed workers: Many currently outside the system, but likely to be included soon

- Low-income earners: Reforms may lower entry barriers, but they’ll need support to save enough

Financial Planning Tips for Navigating the UK Pensions Shake-Up

1. Use the Pension Calculator

Try the MoneyHelper calculator to see how much you need based on your age, income, and lifestyle.

2. Top Up Whenever You Can

Even a 1% increase in your contributions can add thousands to your pension pot over time. Many employers will match extra contributions—don’t leave free money on the table.

3. Fill Gaps in Your NI Record

You need 35 full years of National Insurance contributions for the full state pension.

4. Open a SIPP or ISA for Flexibility

If you want more control, consider opening a Self-Invested Personal Pension (SIPP) or a Stocks & Shares ISA. These can supplement your workplace pension.

5. Watch for Tax Changes

The government may tweak tax relief rules. Currently, most people get 20–40% tax relief on contributions. Keep an eye on budgets and announcements.

UK’s Retirement System Faces Pressure—Why the Government May Need to Raise the Pension Age Again?

UK Revives Pensions Commission Amid Savings Crisis — What It Means for Your Retirement

UK Set to Raise State Pension Age Beyond 67 as Life Expectancy Grows