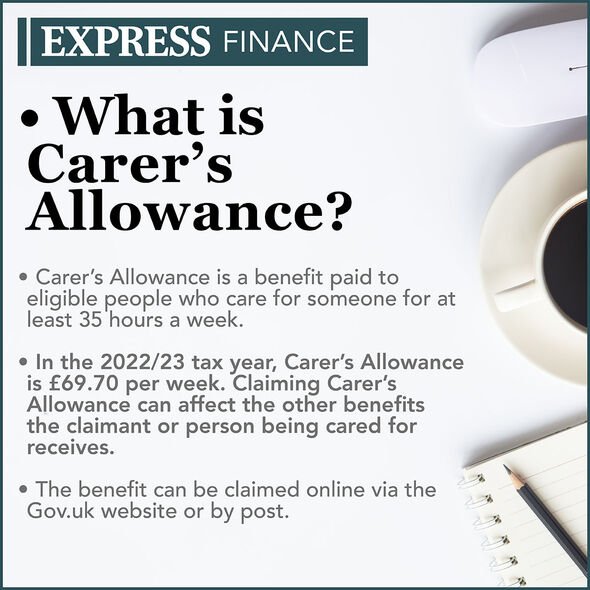

UK Households Can Get £333 a Week: If you’re a carer in the UK, you might be eligible for Carer’s Allowance—a benefit designed to help those who care for people with long-term illnesses or disabilities. This allowance provides £333 a month, but there’s a catch: you need to meet specific requirements, including caring for at least 35 hours a week. Let’s break down how it works, who qualifies, and how to apply for this helpful benefit.

UK Households Can Get £333 a Week

In summary, Carer’s Allowance provides up to £333 a month to help carers who dedicate 35 hours or more per week to providing essential care to someone with a long-term illness or disability. If you meet the eligibility criteria, this allowance can provide significant financial relief. Remember to gather all necessary documentation, apply through the official GOV.UK website, and check how it might impact your other benefits. Being a carer can be demanding, but with the right support, including financial assistance like Carer’s Allowance, you can focus on what truly matters—taking care of your loved ones.

| Key Information | Details |

|---|---|

| Allowance Amount | £333/month (approx. £83.30 per week) |

| Eligibility Requirements | 35 hours of care per week, earning £196 or less per week, aged 16+ and under State Pension age |

| Who Can Receive | Carers providing regular care to someone receiving certain disability benefits (PIP, Attendance Allowance) |

| Earnings Limit | £196 per week after taxes, National Insurance, and expenses |

| How to Apply | Apply through the official GOV.UK website |

What is Carer’s Allowance?

Carer’s Allowance is a benefit from the Department for Work and Pensions (DWP), aimed at providing financial support to individuals who are caring for someone with a disability or long-term illness. Whether you’re looking after a spouse, parent, child, or friend, if you’re putting in the hours, you might be eligible to receive £333 a month to help cover costs.

This amount doesn’t sound too shabby, right? It works out to about £83.30 per week, which can make a big difference when you’re juggling caregiving responsibilities with your daily life. The allowance can be particularly useful for those who aren’t able to work full-time due to their caregiving role.

Moreover, receiving Carer’s Allowance may also qualify you for other benefits, and there are financial and social protections in place to ensure that the support is sustainable.

Why is There a 35-Hour Requirement?

You might be wondering, why 35 hours? Well, the idea behind this requirement is to ensure that the benefit is given to those who are truly dedicating substantial time and effort to caregiving. It’s not just about helping out every now and then—it’s about providing consistent, hands-on care.

For perspective, 35 hours per week is essentially a full-time job. Think about it like this: If you’re providing care for 35 hours, it’s like you’re clocking in for work. The government wants to make sure that the people who are receiving Carer’s Allowance are genuinely dedicating the necessary time to support someone in need.

This requirement aims to ensure that those who are not able to work full-time due to caregiving responsibilities aren’t left behind. If you’re in this role, you’re entitled to receive support to help maintain your wellbeing, financial stability, and quality of life.

Who Can Qualify for Carer’s Allowance?

Now that we understand the 35-hour rule, let’s talk about who can actually qualify. Here are the key eligibility criteria:

- Caring for at least 35 hours a week: If you are helping someone with a disability or long-term illness and providing 35 hours of care each week, you’re eligible. The care can include assistance with personal care, medication management, household tasks, and emotional support.

- Care recipient eligibility: The person you’re caring for must be receiving certain disability-related benefits, such as Personal Independence Payment (PIP), Attendance Allowance, or Disability Living Allowance (DLA).

- Age Requirements: Y

- ou must be at least 16 years old and under the State Pension age.

- Income Limit: You can’t earn more than £196 per week after taxes, National Insurance, and allowable expenses. This limit was increased from £151 to £196 per week in April 2025, which helps those who want to work part-time without losing the benefit.

- Not being in full-time education: You can’t be in full-time education (more than 21 hours per week) if you want to qualify for Carer’s Allowance.

- Cannot receive Carer’s Allowance for more than one person: This rule is important—if you’re already receiving Carer’s Allowance for one person, you can’t receive it for another, even if you’re caring for multiple people.

How to Apply for UK Households Can Get £333 a Week?

If you meet all the eligibility requirements, applying for Carer’s Allowance is relatively straightforward. Follow these steps:

- Check Your Eligibility: Double-check that you meet all the criteria, especially the 35-hour caregiving requirement and the income limits.

- Gather Documents: You’ll need to provide information about the person you care for, including their disability benefits, as well as your National Insurance number and details of your earnings.

- Apply Online: The application process is simple and can be done online via the official GOV.UK website. The form should take about 15-20 minutes to complete.

- Wait for a Decision: After submitting the application, you should receive a decision from the DWP within 6 to 8 weeks. If approved, your payments will be backdated to the date you started caring for someone.

Other Financial Help for Carers

While Carer’s Allowance is a valuable benefit, it’s not the only financial support available. If you’re a carer, here are some additional forms of assistance you may qualify for:

- Universal Credit: If you’re on a low income or unable to work full-time due to caregiving, you may be eligible for Universal Credit. Keep in mind that receiving Carer’s Allowance might affect the amount you can claim, so it’s essential to check.

- Carer’s Premium: If you’re eligible for means-tested benefits like Universal Credit, you may also qualify for a Carer’s Premium, which is a financial boost for carers.

- Help with Household Costs: Some local authorities or charities offer additional support for carers, such as discounts on utilities, counseling services, or respite care options.

- National Insurance Credits: If you’re earning below the National Insurance threshold, Carer’s Allowance provides National Insurance credits, ensuring that your contributions toward your State Pension aren’t negatively impacted.

How Does Carer’s Allowance Impact Other Benefits?

If you’re already receiving other benefits like Housing Benefit or Jobseeker’s Allowance, it’s important to understand how Carer’s Allowance might affect them. While Carer’s Allowance doesn’t reduce these benefits directly, it may reduce the amount of means-tested benefits you receive, like Universal Credit. It’s always a good idea to check with the DWP or your local benefits office before applying.

What if I Earn More Than £196 a Week?

One of the most common concerns people have is whether they can qualify for Carer’s Allowance if they’re working part-time or freelance. The good news is that you can work part-time, but you mustn’t earn more than £196 per week (after taxes and allowable expenses). If you earn more than this, you won’t qualify for the allowance.

If your income fluctuates, it’s essential to keep track of your earnings to ensure you stay within the limit. For instance, if you’re working as a freelancer or have a variable income, you should review your earnings weekly to make sure you’re still eligible.

DWP Lowers Estimated Reimbursements for Unpaid UK State Pensions in New Forecast

UK Set to Raise State Pension Age Beyond 67 as Life Expectancy Grows

UK’s Retirement System Faces Pressure—Why the Government May Need to Raise the Pension Age Again?