U.S. Retirement Age Set to Rise Again: The U.S. retirement age is set to rise again as the nation faces an urgent challenge: Social Security is running out of money. If you’re planning for retirement, helping someone who is, or simply trying to make sense of what this means for your future—you’re not alone. In this guide, we’ll unpack what’s happening, why it matters, and how to prepare—whether you’re 25, 45, or nearing retirement. We’ll keep it simple, but grounded in real facts, expert data, and practical advice.

U.S. Retirement Age Set to Rise Again

The rising U.S. retirement age and the Social Security funding crisis are real, but you still have time to act. Whether you’re five years from retirement or just starting out in your career, the decisions you make today can help secure a better future. Understand your Full Retirement Age, delay benefits if possible, build diverse income sources, and stay on top of policy changes. Social Security may change—but with good planning, your financial future doesn’t have to suffer.

| Topic | Key Stats / Facts | Why It Matters | Source |

|---|---|---|---|

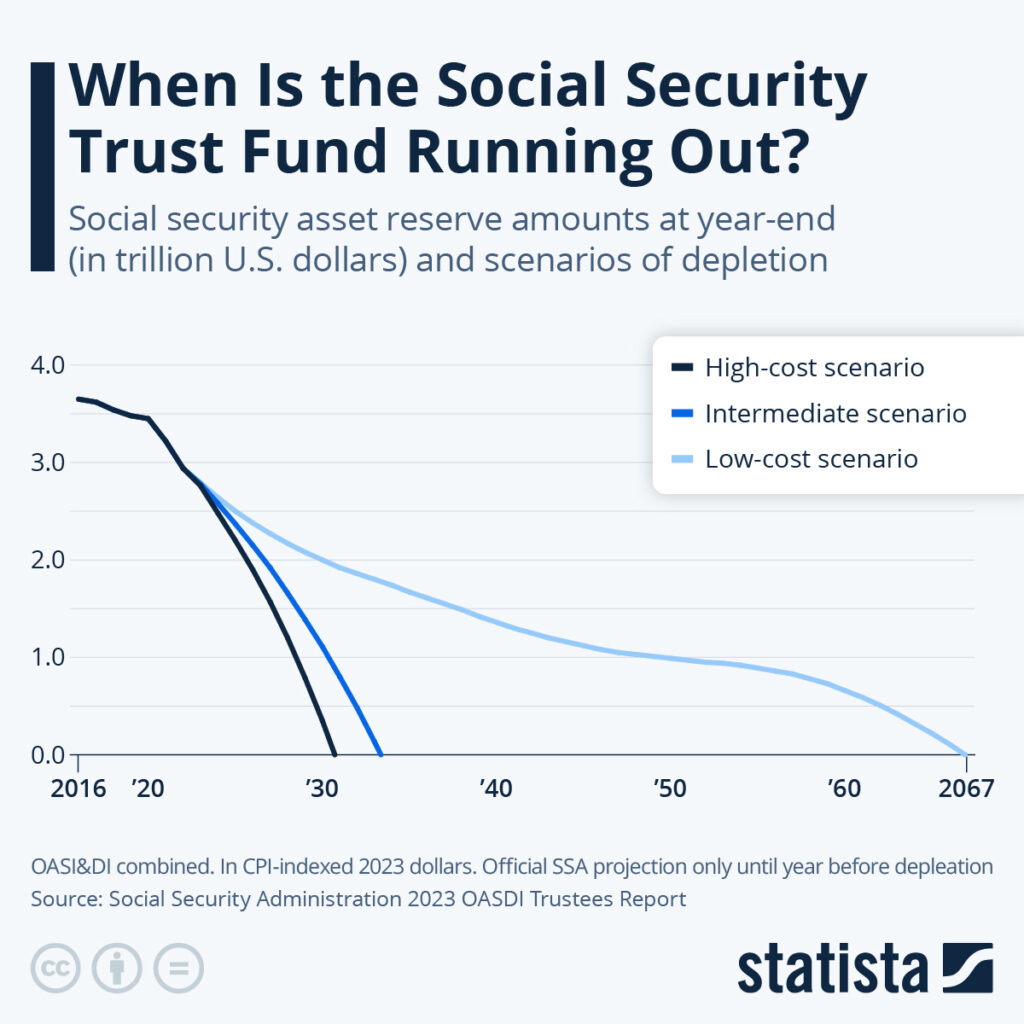

| Social Security Insolvency | Trust fund runs out by 2034 | Could trigger 23% cut in benefits | SSA.gov |

| Full Retirement Age (FRA) | Currently 67 for people born in 1960+ | May rise to 69 or higher | |

| Early Filing Penalty | Claiming at 62 reduces benefits by ~30% | Encourages workers to delay retirement | |

| Proposed Reforms | Raise FRA, increase taxes, invest trust funds | Multiple bills under review | Congress.gov |

The Social Security Crisis: What’s the Big Deal?

Let’s break it down: Social Security is the U.S. government’s main retirement program. It’s funded through payroll taxes and has helped retirees, disabled workers, and survivors for decades. But today, the program faces a major imbalance.

According to the 2024 Social Security Trustees Report, the Old-Age and Survivors Insurance (OASI) Trust Fund—which pays benefits to retirees—is projected to be depleted by 2034. Once that happens, only payroll tax revenues will support the system, covering just 77% of scheduled benefits.

So, unless Congress acts soon, retirees could see benefit cuts of up to 23%.

Why Is This Happening?

- More retirees: Baby Boomers are retiring fast. Over 10,000 Americans turn 65 each day.

- Fewer workers: In 1960, there were 5.1 workers per retiree. In 2024, it’s about 2.7—and falling.

- People live longer: The average life expectancy today is over 79. That’s a lot of monthly checks.

- Costs outpace income: Rising healthcare and living expenses mean retirees need more, while fewer workers are paying in.

The math doesn’t lie: without change, something’s got to give.

What Is the Full Retirement Age (FRA) and Why Is It Changing?

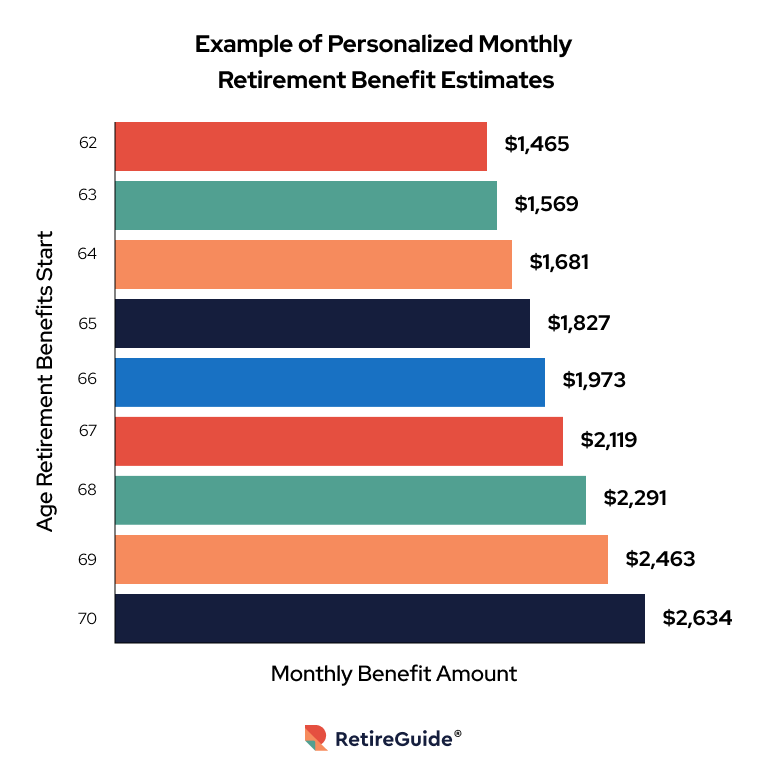

Full Retirement Age (FRA) is the age when you’re eligible for 100% of your Social Security benefits. If you take benefits earlier (starting at 62), you get less. If you delay beyond FRA (up to 70), you get more.

- Current FRA is 67 for people born in 1960 or later.

- Proposed FRA changes could raise it to 68 or 69 in the 2030s.

What Happens if FRA Increases?

If the FRA becomes 69, claiming at 62 would slash monthly benefits by up to 35–40%. Workers would either need to:

- Delay retirement until almost 70, or

- Save more privately to bridge the gap

This impacts low-income workers, people in physically demanding jobs, and those in poor health more than white-collar workers who can afford to wait.

How Would This Affect Real People?

Let’s look at a couple of realistic scenarios.

Case Study: Nicole, 52, Retail Manager

Nicole earns $45,000/year. She’s hoping to retire early at 62. If the FRA rises to 69, her monthly Social Security check could drop from an expected $1,500 to about $975/month—a big difference.

Unless she boosts her savings or delays retiring, she may have to work part-time in retirement.

Case Study: James, 68, Software Engineer

James earns $120,000/year and has a solid 401(k). He delays claiming benefits until 70. Thanks to delayed retirement credits (8% per year), his benefit jumps from $2,400/month to about $2,980/month. That adds up to over $70,000 more in lifetime benefits if he lives into his 80s.

What Are the Proposed Solutions?

Policymakers and experts have suggested multiple ways to fix Social Security. Let’s explore the most talked-about options.

1. Raising the Full Retirement Age

- Proposal: Increase FRA gradually to 68 or 69

- Reduces long-term payouts

- Phased over time to avoid hurting current retirees

Pros: Saves the system money

Cons: Hurts low-income and physically worn-out workers

2. Raising Payroll Taxes

- Current payroll tax: 12.4% (split between employer and employee)

- Proposal: Raise total tax rate to 16%

- Or apply the tax to income above the current cap (~$168,600 in 2024)

Pros: Increases system revenue

Cons: More expensive for workers and businesses

3. Investing the Trust Fund

- Current funds are invested in U.S. Treasury bonds

- Proposal: Create a diversified trust to invest in stocks and index funds

Pros: Higher returns, like private pensions

Cons: Market volatility, political concerns

4. Means-Testing Benefits

- Wealthier retirees would receive reduced or no benefits

- Focuses limited funds on lower-income recipients

Pros: Targets support where it’s most needed

Cons: Politically controversial, breaks the “everyone gets something” tradition

5. Combine Multiple Solutions

Most experts agree: no single fix will work alone. The final solution will likely include:

- A gradual FRA increase

- A modest payroll tax hike

- Investments with long-term strategy

- Potential benefit restructuring for high earners

How to Prepare Right Now For U.S. Retirement Age Set to Rise Again

Here’s how you can take control of your retirement planning, no matter your age.

1. Know Your Numbers

- Create a free account at SSA.gov

- Review your earnings record and estimate future benefits

2. Understand Your FRA

- Born in 1960 or later? Your FRA is 67

- Be aware of future legislative changes

3. Delay Claiming, If You Can

- Claiming at 62 = smaller check forever

- Waiting until 70 = 24%+ higher monthly payout

- Talk to a retirement advisor to calculate the best age for you

4. Build Other Income Streams

- Max out 401(k)s, IRAs, and Roth accounts

- Invest wisely: index funds, real estate, side hustles

- Consider Health Savings Accounts (HSAs) to manage medical costs in retirement

5. Stay Informed

- Bookmark SSA.gov, Brookings, Kiplinger, and Pew Research

- Follow changes via Congress.gov and trusted financial media

What Employers and Policymakers Should Know

The shift in retirement age and Social Security solvency isn’t just a personal issue—it’s also a workforce and economic issue.

- Older workers may delay retirement, leading to slower workforce turnover

- Pension liabilities and healthcare costs may increase for employers

- Low-income workers and communities may need additional support

Employers can:

- Offer financial wellness programs

- Provide access to retirement advisors

- Consider flexible work options for older employees

Deadline Alert—July 2025 Social Security Cutoff Is Closer Than You Think

$5,108 Social Security Checks Arrive in July—Here’s Who Qualifies

Trump’s New Tax Bill Could Reshape How Social Security Benefits Are Taxed