Tweak the 4% Rule Like This: Retirement is a huge milestone in anyone’s life. After years of hard work, it’s time to enjoy the fruits of your labor. But, here’s the catch: if you don’t plan carefully, your retirement savings might not last as long as you’d hope. One of the most well-known strategies for managing retirement funds is the 4% rule. While this rule has been a trusted guide for many, experts now suggest tweaking it to help your nest egg last longer in today’s ever-changing economic landscape. In this article, we’ll break down the 4% rule, explain why it’s not a one-size-fits-all solution, and give you practical advice on how to adjust it to fit your personal situation. Whether you’re a retiree looking for ways to make your savings last longer, or someone still in the workforce trying to plan ahead, this guide will help you navigate the complex world of retirement savings.

Tweak the 4% Rule Like This

Planning for retirement isn’t as simple as following a one-size-fits-all rule. While the 4% rule has served retirees well in the past, today’s economic environment requires more flexibility and careful planning. Lowering your withdrawal rate, using dynamic strategies, and incorporating the bucket or guardrails methods are all effective ways to ensure your savings last longer. Retirement is supposed to be a time for relaxation and enjoyment, not stress. By taking a personalized approach to your withdrawals, you can help your nest egg weather the ups and downs of the market and make sure you’re not running out of money before you’re ready.

| Key Points | Details |

|---|---|

| 4% Rule Overview | The 4% rule is a guideline suggesting retirees can withdraw 4% of their savings each year for 30 years. |

| Why It Needs Tweaking | Economic factors, including market volatility and inflation, have prompted experts to revise the rule. |

| Adjusting Withdrawal Rates | Suggestions now range from 3.7% to 5.5%, based on factors like market conditions and portfolio structure. |

| Alternative Withdrawal Strategies | Dynamic strategies, bucket strategies, and guardrails can offer better ways to ensure long-term stability. |

| Expert Advice and Resources | Websites like SmartAsset, Investopedia, and MarketWatch offer insights and updates on retirement planning. |

| Real-life Example | William Bengen, creator of the 4% rule, now advocates for a higher withdrawal rate in certain conditions. |

| FAQs | Answering common questions about adjusting the 4% rule. |

What Is the 4% Rule?

Before we dive into how to tweak the 4% rule, let’s first take a look at what it actually is. The 4% rule was created by financial planner William Bengen in 1994. The idea behind it is simple: If you have a sizable nest egg—let’s say $1 million—during retirement, you can withdraw 4% of that amount each year, adjusted for inflation, and your money should last for about 30 years.

Here’s how that works in practical terms:

- $1 million × 4% = $40,000 per year

- This means you would withdraw $40,000 annually, adjusting the amount each year for inflation to maintain purchasing power.

The 4% rule gained popularity because it’s simple to understand and offers a straightforward plan for retirement withdrawals. However, in recent years, many financial experts have questioned whether this rule still holds up in today’s economic climate.

Why You Might Need to Tweak the 4% Rule Like This?

As much as the 4% rule has been a go-to for retirement planning, there’s growing concern about its viability in the current financial environment. Several factors contribute to why tweaking this rule could be beneficial:

1. Market Volatility

In the past, the market has been more favorable for long-term growth. But now, with stock prices rising, inflation rates climbing, and interest rates fluctuating, there’s less certainty about future returns. Simply withdrawing 4% of your savings could leave you vulnerable if your investments underperform or if market conditions turn negative.

2. Longevity

People are living longer, and retirement could last 30, 40, or even 50 years. The 4% rule was built on the assumption that people wouldn’t need to make withdrawals for more than 30 years, but today’s retirees are more likely to need their savings for much longer periods.

3. Low Interest Rates

In previous decades, bonds and other low-risk investments provided better returns. Today, with historically low interest rates, fixed-income investments are generating much lower returns, meaning retirees may have to adjust their withdrawal rates to ensure their savings last.

4. Inflation

As inflation rises, the value of your money decreases over time. The 4% rule doesn’t always take this into account, meaning that retirees could find themselves with less purchasing power than they originally anticipated.

5. Unforeseen Healthcare Expenses

Healthcare costs are another wild card for retirees. As medical technology advances and people live longer, the cost of healthcare continues to rise. Retirees may need to account for these rising expenses by adjusting their withdrawal strategies to accommodate potential health-related costs.

How to Adjust the 4% Rule to Make Your Nest Egg Last Longer?

While the 4% rule is a solid foundation, it’s important to personalize it to fit your individual circumstances. Here are some ways to make adjustments that could help stretch your retirement savings.

1. Lower the Withdrawal Rate

One of the most effective ways to make your money last longer is to reduce the percentage you withdraw each year. Many experts now recommend withdrawing closer to 3.5% or 3.7%. While this may seem like a small difference, it can significantly extend the life of your retirement savings, especially during economic downturns.

Let’s say you have $1 million saved up. At a 3.7% withdrawal rate, you would withdraw:

- $1 million × 3.7% = $37,000 per year

This means you’ll have a little less money each year, but your savings will likely last longer.

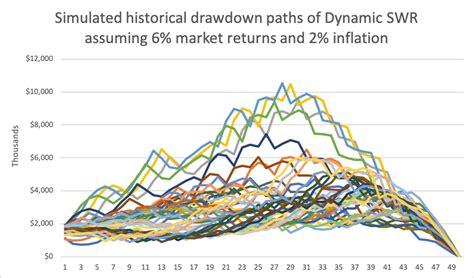

2. Use Dynamic Withdrawal Strategies

A more flexible approach to withdrawals is called the dynamic withdrawal strategy. This means you adjust the amount you withdraw based on how the market is performing. For example:

- If the market is doing well, you might take a higher withdrawal.

- If the market is down, you could reduce your withdrawals to avoid draining your savings when your investments are losing value.

This method provides flexibility, allowing you to adapt to the changing economic landscape.

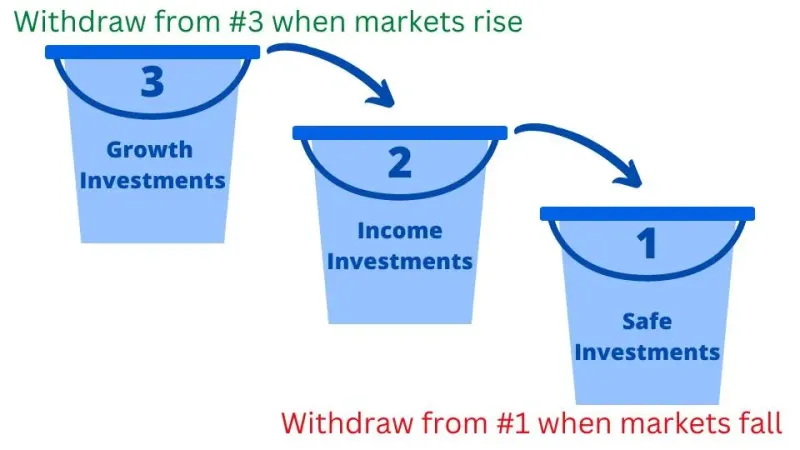

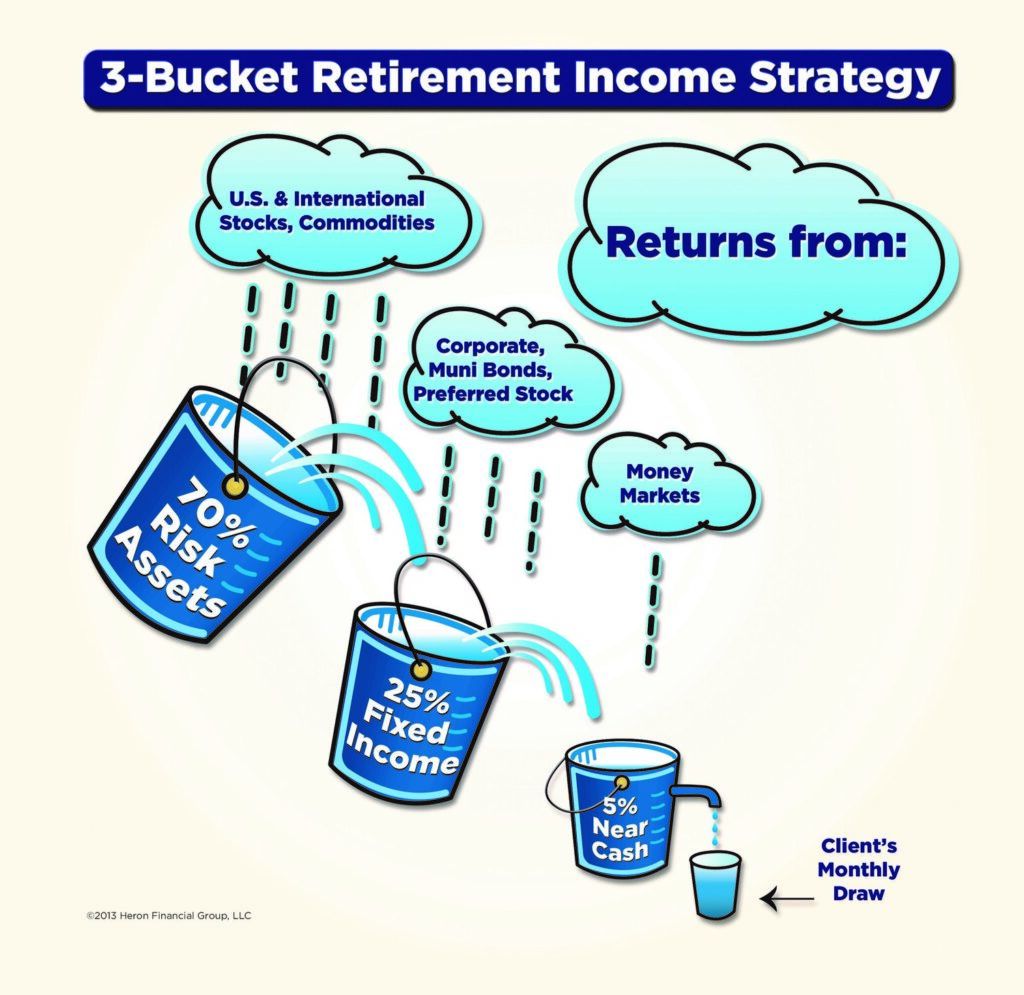

3. Consider the Bucket Strategy

The bucket strategy is a popular approach where you divide your retirement savings into different “buckets” based on when you plan to use them. Here’s how it works:

- Bucket 1: Cash or short-term investments (1-5 years) for immediate spending needs.

- Bucket 2: Intermediate-term investments (5-10 years) for upcoming needs.

- Bucket 3: Long-term growth investments (10+ years) that are expected to grow over time.

By having these buckets, you can ensure that you don’t need to sell stocks during a downturn. You can rely on your short-term investments for cash flow and leave your growth investments alone to rebound.

4. Set Up Guardrails for Flexibility

Another approach is the guardrails strategy, where you set upper and lower limits for your withdrawal rate. If your portfolio does well and grows beyond a certain threshold, you might increase your withdrawals. Conversely, if your portfolio shrinks below a certain point, you reduce your withdrawals to protect your savings.

5. Diversify Your Portfolio

Diversification is another key strategy to protect your savings in retirement. A well-diversified portfolio that includes a mix of stocks, bonds, real estate, and even alternative investments like gold or real estate can help reduce the risks posed by market volatility. By spreading your risk across different asset classes, you’ll have a better chance of weathering financial storms and continuing to grow your nest egg.

Expert Advice and Resources

It’s essential to stay updated with the latest retirement planning strategies. Some reliable sources to consider:

- SmartAsset: Offers tools to calculate how long your money will last using various withdrawal strategies.

- Investopedia: Provides in-depth articles on financial planning, investment options, and retirement.

- MarketWatch: Offers expert opinions and real-life examples of how to adjust retirement strategies.

- Bengen’s Research: William Bengen, the creator of the 4% rule, now suggests that retirees could safely withdraw higher amounts, depending on their portfolios and economic conditions.

Expert Offers Guidance for Couples Planning Retirement With Limited Savings

Retiring Soon? These 10 States Are the Best—and 10 Are the Worst

Waze Co-Founder Shares Candid Retirement Advice After Years of Entrepreneurship