Trump’s Tariffs on Canadian Goods May Catch Markets Off Guard: Former U.S. President Donald Trump has announced a sweeping 35% tariff on a wide range of Canadian imports, a decision that is already shaking market confidence and trade stability. The tariffs, aimed at what Trump calls “unfair advantages from America’s northern neighbor,” are scheduled to take effect on August 1, 2025. According to the Canadian Imperial Bank of Commerce (CIBC), the markets were not expecting such a dramatic policy shift and are largely unprepared for its consequences. The bank warns of significant disruptions to trade flows, price volatility, and investor uncertainty across key sectors including automotive, agriculture, forestry, and industrial manufacturing.

Trump’s Tariffs on Canadian Goods May Catch Markets Off Guard

Trump’s decision to impose 35% tariffs on Canadian goods represents a major shift in U.S. trade policy with its closest economic partner. While the stated intent is to protect American industries, the real-world consequences could be far-reaching, affecting supply chains, consumer prices, corporate earnings, and even macroeconomic stability. CIBC’s warning is timely and clear: the market is not ready for this level of disruption. Businesses, investors, and policymakers must prepare for a volatile few months as the situation unfolds. The stakes are high, and the window for diplomatic resolution is quickly narrowing.

| Category | Details |

|---|---|

| Tariff Announcement | 35% tariff on select Canadian goods announced by Donald Trump |

| Effective Date | August 1, 2025 |

| Targeted Sectors | Automotive, agriculture, forestry, manufacturing, processed goods |

| Goods Affected | Non-USMCA-compliant goods (parts, lumber, fertilizer, beef, dairy, etc.) |

| Reason Cited | “Unfair trade practices” and protecting American jobs |

| CIBC Warning | Markets were unprepared; investor and economic risks underestimated |

| Market Impact | TSX fell 0.6%; CAD weakened; materials/agriculture stocks volatile |

| Canada’s Response | Negotiating exemptions; potential for retaliatory tariffs |

| Legal Mechanism | USMCA dispute panel process possible; legal challenge under review |

| Supply Chain Effects | Risk of delays and cost increases in auto and construction industries |

| Consumer Impact | Expected rise in prices of food, vehicles, and housing materials |

| Business Risk | Higher input costs; profit margin pressure; inventory disruptions |

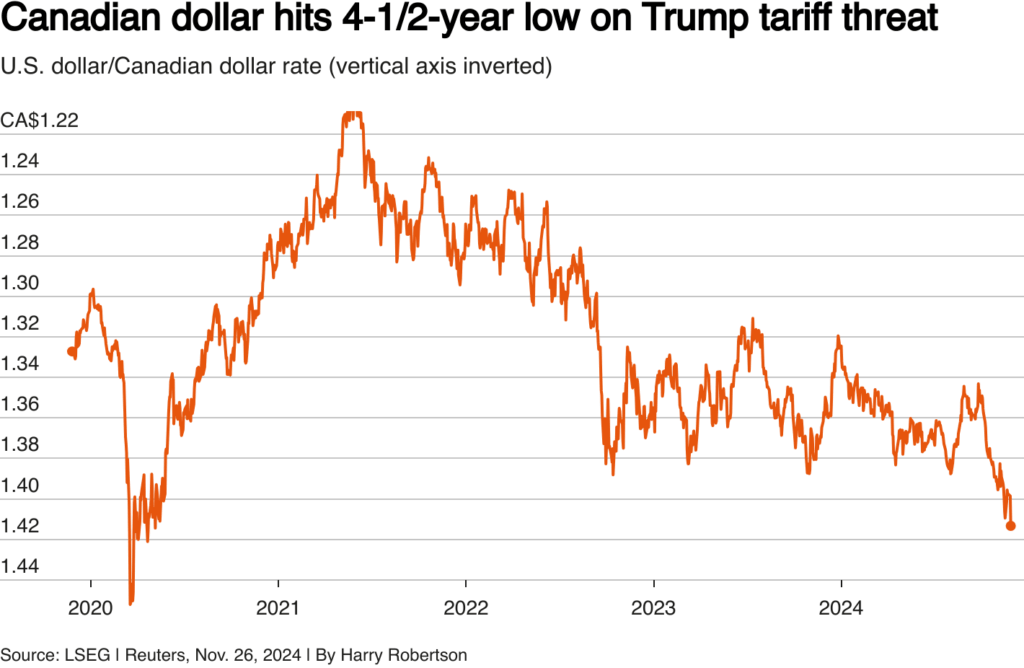

| Currency Impact | CAD dropped to a two-week low against USD |

| Economic Forecast | Potential slowdown in Q3–Q4 growth; possible inflation pressures |

| Investor Action | Rebalancing suggested; monitor currency and sector exposure closely |

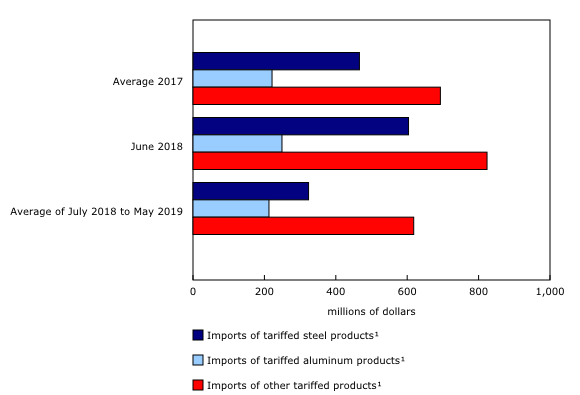

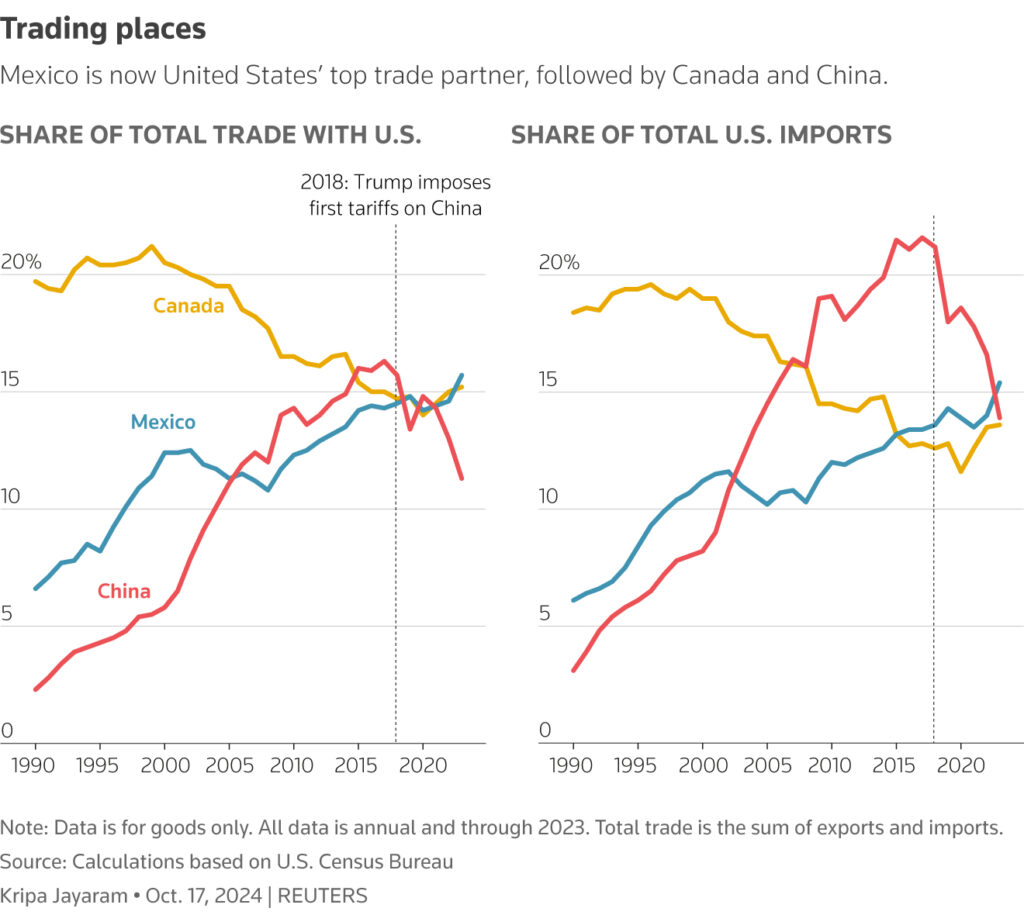

| Historical Context | Echoes Trump’s 2018–19 tariff strategy (China, Canada, EU) |

| U.S. Industry Concern | American automakers, builders, and retailers warn of higher input costs |

| Next Steps | Diplomacy ongoing; tariffs may proceed unless blocked or revised |

What Are the New Tariffs?

The new tariffs apply to Canadian goods that do not meet U.S.-Mexico-Canada Agreement (USMCA) rules of origin. These rules require a minimum percentage of content to be produced within North America to qualify for duty-free treatment. The targeted goods span multiple industries, such as:

- Automotive parts and vehicles

- Agricultural exports including grains, beef, and dairy

- Softwood lumber and forestry products

- Fertilizers and chemicals

- Processed food and beverages

- Industrial and construction materials

The 35% rate is higher than any currently in place under USMCA, marking a sharp policy turn. Trump’s team has stated the move is meant to “level the playing field” and reduce what he claims are systemic trade deficits with Canada.

CIBC’s Market Warning

CIBC released an analysis stating that the markets had not priced in the likelihood of such tariffs. The report indicated that:

- Stock indexes, particularly Canada’s TSX, are vulnerable to sector-specific drawdowns.

- The Canadian dollar fell to a two-week low after the announcement, showing signs of capital flight and foreign investor caution.

- Canadian exporters may suffer immediate earnings hits, especially in Q3 and Q4 of 2025.

- U.S. supply chains, which rely on Canadian intermediate goods, could see delays and cost overruns.

Their economists added that if retaliation from Canada follows, the uncertainty could weigh on North American economic growth forecasts.

Historical Context: Trump and Trade Policy

This isn’t Trump’s first use of tariffs as an economic tool. During his first term in office (2017–2021), Trump engaged in several high-profile trade conflicts:

- Imposed Section 232 tariffs on steel and aluminum from Canada, Mexico, and the EU

- Initiated a broad-based trade war with China that affected more than $360 billion worth of goods

- Withdrew from the Trans-Pacific Partnership (TPP)

- Renegotiated NAFTA into USMCA, emphasizing stricter rules of origin

In each case, tariffs were used as both negotiating tools and political messaging, aimed at reinforcing Trump’s “America First” platform. This latest action echoes that philosophy but targets a close ally with deeply integrated economic ties.

Reactions from Canada

Canada’s federal government has responded quickly. Deputy Prime Minister Chrystia Freeland called the move “a deeply regrettable step backwards in a relationship built on trust and mutual benefit.”

The Prime Minister’s Office confirmed that high-level communications are underway with U.S. trade representatives in an attempt to negotiate either an exemption or a delay.

Canadian industry stakeholders are equally alarmed:

- The Automotive Parts Manufacturers’ Association stated that the tariffs “could irreversibly damage the integrated auto supply chain built over decades.”

- The Canadian Chamber of Commerce warned that retaliatory measures would be considered, including counter-tariffs on U.S. products such as dairy, tech hardware, and pharmaceuticals.

- Forestry groups, already dealing with cyclical demand, said the new tariffs would crush profit margins and cost thousands of jobs if not reversed.

U.S. Business Concerns

American businesses are not immune to the repercussions. Many rely on Canadian raw materials, intermediate goods, and agricultural products.

- U.S. automakers source a significant portion of parts and assembly from Ontario-based plants. A tariff will raise production costs and delay inventory.

- Builders and construction firms warn of rising home costs due to higher prices for Canadian lumber.

- Grocery retailers expect a short-term spike in prices for goods such as beef, canola oil, and processed foods.

The U.S. Chamber of Commerce released a statement expressing concern, urging the administration to consider “the unintended economic harm that may result from this aggressive trade stance.”

Market Reactions

The initial response from financial markets has been cautious but negative. Here’s how key indicators moved following the announcement:

- The TSX Composite Index fell by 0.6%, with auto, agriculture, and forestry stocks leading the declines.

- The Canadian dollar (CAD) weakened to a two-week low against the U.S. dollar.

- U.S. stock sectors exposed to Canadian inputs—such as auto manufacturers and food processors—saw mild losses.

- Futures markets for lumber, wheat, and fertilizer saw a quick rise as traders anticipated supply disruptions.

Analysts note that further declines are possible depending on how Canada responds, and whether additional tariffs are introduced.

Expert Economic Analysis

Economists at multiple institutions agree the tariffs could be inflationary at a time when central banks are attempting to stabilize price growth.

- Inflation: Tariffs function as indirect taxes, raising the price of imported goods and adding upward pressure on consumer prices.

- Interest Rates: The Bank of Canada may need to reevaluate its interest rate trajectory if inflation rises while GDP growth slows.

- Trade Flows: Disruptions in just-in-time supply chains, especially in automotive and industrial goods, could drag on Q3 and Q4 GDP figures in both countries.

The broader fear is that these trade restrictions may reintroduce the kind of economic volatility seen during the 2018–2019 U.S.-China trade war.

Investor Checklist

Investors and business operators are encouraged to prepare accordingly. Below is a brief checklist of recommended actions:

- Reevaluate Exposure to Canadian Assets: Investors should review their holdings in Canadian ETFs, particularly those tied to industrials, materials, or agriculture.

- Monitor Currency Trends: Hedging may be advisable as CAD/USD volatility is likely to increase.

- Diversify Supply Chains: Businesses reliant on Canadian imports should explore domestic or alternative international suppliers.

- Prepare for Volatile Earnings Seasons: Sectors directly impacted by tariffs may post lower margins, requiring careful stock selection.

- Watch for Central Bank Announcements: Both the Federal Reserve and the Bank of Canada may respond to tariff-driven inflation or economic slowdown.

Legal and Trade Implications on Trump’s Tariffs on Canadian Goods May Catch Markets Off Guard

Canada may invoke the dispute resolution mechanisms under USMCA. These panels can take several months but may ultimately block or modify the tariff structure.

Legal experts point out that tariffs based on national security, like those previously imposed on aluminum and steel, have limited standing under USMCA without strong justification. If Canada proves the tariffs are punitive and not protective, it may gain legal leverage for reversal or compensation.

In the meantime, diplomatic negotiations remain the most viable path to de-escalation.

What Happens Next?

Here is a timeline of possible events:

- July 2025: U.S. and Canada continue negotiations; Canadian business groups lobby for exemptions.

- August 1, 2025: If no agreement is reached, the tariffs go into effect.

- August–October 2025: Canadian retaliation likely if U.S. does not reverse course. Markets may react strongly to a tit-for-tat trade dispute.

- Late 2025: USMCA dispute resolution processes may begin; legal action may also be filed in U.S. courts depending on business pressure.

Could This Become a Broader Trade War?

There is potential. If the U.S. imposes additional tariffs, and Canada responds in kind, other countries may adjust their trade relationships. Mexico, the EU, and China will all watch this closely.

International observers fear a rollback in the spirit of USMCA and other free trade agreements, leading to uncertainty across global markets. This comes at a sensitive time, as countries worldwide are working to stabilize post-COVID economies amid ongoing geopolitical stress.

Trump’s ‘Big Beautiful Bill’ Sparks Debate Over Social Security and Benefits

Trump’s Claim That His Bill Ends Social Security Taxes Debunked by Experts

Trump’s New Tax Bill Could Reshape How Social Security Benefits Are Taxed