Trump’s New Tax Bill: Social Security benefits are the foundation of retirement income for millions of Americans. For nearly 9 in 10 retirees, those monthly checks are the difference between financial comfort and hardship. That’s why former President Donald Trump’s new tax bill—nicknamed the “One Big Beautiful Bill”—has become a hot topic. It promises major changes to how these benefits are taxed, and for many seniors, it could mean real relief.

But what does the bill actually do? And just as important—who wins, who doesn’t, and what are the long-term consequences? This guide breaks everything down in simple, everyday language. Whether you’re a retiree, working professional, financial advisor, or just someone planning ahead, you’ll find clear steps, helpful examples, and expert-backed insights to understand how this bill could impact your financial future.

Trump’s New Tax Bill

Trump’s new tax bill changes the game for millions of seniors. With the introduction of a $6,000–$12,000 “senior deduction,” many retirees will now avoid federal taxes on their Social Security income altogether. It’s not a full exemption, and it won’t help everyone—but it’s a meaningful shift for middle-income seniors. Still, the bill brings long-term challenges, especially around Social Security’s solvency. If you’re planning for retirement or advising someone who is, this deduction could play a big role in shaping tax strategy through 2028.

| Key Point | Details |

|---|---|

| New Tax Deduction | Seniors 65+ can deduct up to $6,000 ($12,000 for couples) |

| Income Eligibility | Individual income ≤ $75,000 / Couples ≤ $150,000 |

| Deduction Window | 2025 through 2028 |

| Tax Impact | Up to 88% of seniors will avoid federal taxes on their Social Security benefits |

| Not a Full Exemption | Social Security remains taxable—deduction just lowers taxable income |

| Trust Fund Revenue Impact | Estimated $30 billion/year in lost federal revenue |

| New Projected Insolvency Date | May move from 2033 to 2032 |

| Official Source | Social Security Administration |

What the New Tax Bill Does (and Doesn’t) Do?

Let’s get something straight: this new bill doesn’t eliminate taxes on Social Security benefits. What it does is create a new deduction specifically for seniors aged 65 and older. This deduction is designed to reduce taxable income so that fewer retirees hit the threshold where Social Security benefits become taxable.

Under this new law:

- Individuals aged 65+ earning $75,000 or less can deduct $6,000 from their taxable income.

- Married couples earning $150,000 or less can deduct $12,000 from their taxable income.

The deduction is added on top of the standard deduction and any other applicable deductions, meaning many seniors will no longer owe any federal income tax on their benefits—but only if their income falls under the new limits.

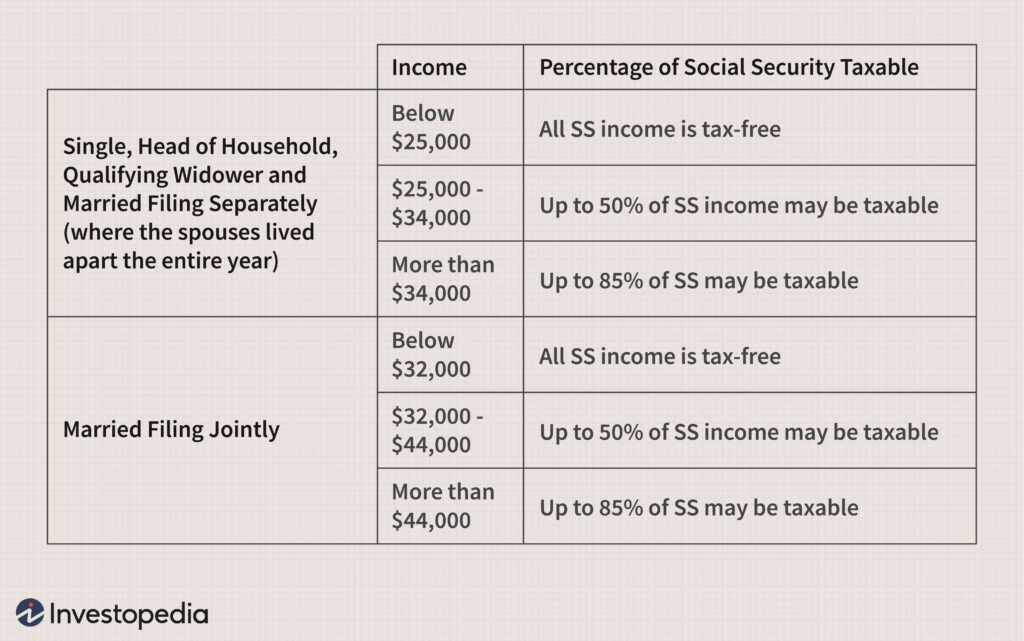

Historical Context: How Social Security Became Taxable

Social Security was originally tax-free. That changed in 1983, when President Ronald Reagan signed a reform package allowing up to 50% of Social Security benefits to be taxed for higher-income seniors. A second reform in 1993, under President Bill Clinton, increased that to 85% for even more beneficiaries.

Since then, the income thresholds that determine whether benefits are taxed have never been adjusted for inflation, dragging more and more retirees into the tax net every year. This new deduction under Trump’s bill is the first significant tax relief for Social Security recipients in over 30 years.

How Social Security Benefits Are Taxed (Old vs. New)?

Under previous rules, if your income exceeded certain thresholds, up to 85% of your Social Security benefits could be taxed:

- Single filers with income over $25,000

- Married couples filing jointly with income over $32,000

But Trump’s new deduction offsets taxable income, making it less likely that seniors hit those thresholds.

Comparison Table: Before vs. After the Tax Bill

| Scenario | Before the Bill | After the Bill |

|---|---|---|

| Single senior, $65K income | $2,800 taxable SS | $0 taxable SS |

| Married couple, $140K income | $4,600 taxable SS | $0 taxable SS |

| Single senior, $90K income | 85% of SS taxed | Partial deduction, some SS still taxed |

| Couple earning $170K | 85% of SS taxed | Deduction phases out, partial relief only |

Who Qualifies and Who Doesn’t?

Who Benefits Most

- Seniors aged 65 and older

- Middle-income retirees with modest pensions, small IRAs, or part-time income

- Married couples with combined income below $150,000

This group previously fell into a strange gap: too wealthy to avoid taxes but not wealthy enough to absorb them without pain. The new deduction offers them significant tax relief.

Who Doesn’t Benefit Much (or At All)

- Low-income seniors who were already tax-exempt

- High-income seniors earning over $175,000 (individual) or $250,000 (married), where the deduction phases out

- People under 65—this deduction doesn’t apply until the calendar year of your 65th birthday

Real-Life Examples

Case 1: Margaret, Age 68

- Social Security: $22,000

- Pension: $33,000

- Total Income: $55,000

- Filing Status: Single

Before the new bill, she paid tax on roughly 50% of her Social Security. Now, with the $6,000 deduction, she’s under the tax threshold and owes nothing on her benefits.

Case 2: Joe & Linda, Married Couple, Both 70

- Social Security: $44,000 combined

- 401(k) withdrawals: $100,000

- Total Income: $144,000

Before, they paid taxes on 85% of their benefits. With the $12,000 senior deduction, they now owe significantly less, and only part of their benefits are taxed.

Tax Strategy: How to Maximize Your Savings

If you’re close to the eligibility thresholds, some smart planning could help you benefit fully from the deduction:

- Delay large withdrawals from retirement accounts (IRAs, 401(k)s) to stay under income limits.

- Consider Roth conversions before turning 65 to reduce future taxable income.

- If you’re on the edge of the phase-out zone, talk to a CPA about strategic charitable contributions or itemized deductions to lower AGI.

- For younger folks planning retirement, consider how Roth vs. traditional IRA strategies might play out under laws like this one.

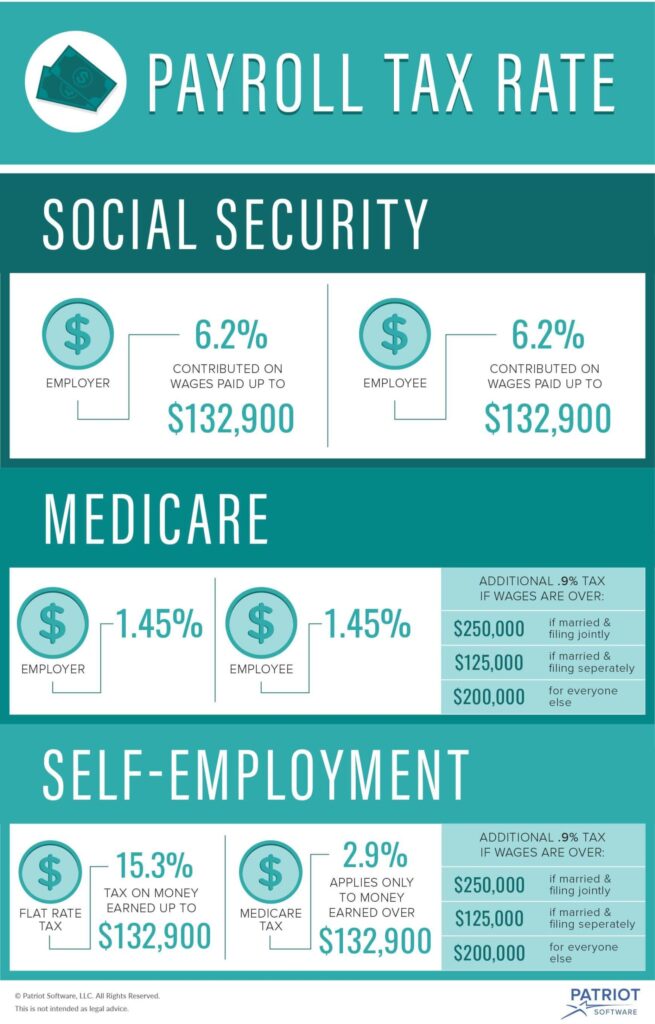

The Political and Economic Impact

Critics of the bill point to its potential consequences for the Social Security Trust Fund. Currently, taxes on benefits bring in roughly $30 billion per year to help pay for ongoing benefits.

By reducing or eliminating that income for many recipients, analysts at the Center on Budget and Policy Priorities warn that the trust fund’s depletion date could move from 2033 to as early as 2032.

AARP, while supportive of tax relief for seniors, has also voiced concern that the bill may be politically popular but fiscally shortsighted unless it’s paired with broader reforms to preserve the trust fund’s solvency.

Expert Opinions

“This deduction provides much-needed relief for retirees living on a fixed income, but it doesn’t address the elephant in the room—Social Security’s long-term sustainability.”

— Teresa Ghilarducci, Professor of Economics, The New School

“We need tax reform that’s fair and forward-thinking. This is a step forward, but we need a plan that supports both beneficiaries and the trust fund.”

— David Certner, Legislative Counsel, AARP

Future Outlook: Will This Deduction Last?

This tax deduction is set to expire in 2028, unless Congress extends or amends it. The upcoming elections in 2026 and 2028 will likely shape whether this policy becomes permanent, is expanded, or disappears entirely.

Both Democrats and Republicans are aware of the political power retirees hold, and Social Security will remain a high-priority issue in every campaign.