Trump’s New Law Will End Electric Car Incentives: In a significant shift, the federal electric vehicle (EV) incentives are set to expire in just three months. This change is coming as part of a broader piece of legislation signed into law by former President Donald Trump. The expiration of the incentives is expected to make electric cars less affordable for many buyers. If you’ve been thinking about jumping on the electric car bandwagon, it’s time to act quickly. In this article, we’ll explore what the law means, how it will affect you as a potential buyer, and what steps you should take before the clock runs out.

Trump’s New Law Will End Electric Car Incentives

The clock is ticking for potential electric vehicle buyers. With federal tax credits set to expire on September 30, 2025, anyone considering an electric car purchase should act quickly to take advantage of these incentives. While the end of the credits will make EVs more expensive for many buyers, the long-term benefits of owning an electric car—such as lower maintenance costs and no gas—can still make them a smart choice. Be sure to explore all available incentives, talk to your dealer, and weigh the total cost of ownership before making your decision. Time is of the essence!

| Key Points | Details |

|---|---|

| Law Signed | Former President Donald Trump signed the “One Big Beautiful Bill Act,” which will end EV tax credits. |

| Expiration Date | Federal EV tax credits for new and used electric cars will expire on September 30, 2025. |

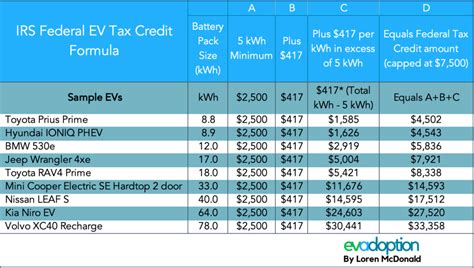

| Current EV Incentives | Buyers can still claim up to $7,500 for new EVs and $4,000 for used EVs. |

| Impact on Buyers | Expect higher prices for electric cars post-September 2025. Proactive purchases are recommended. |

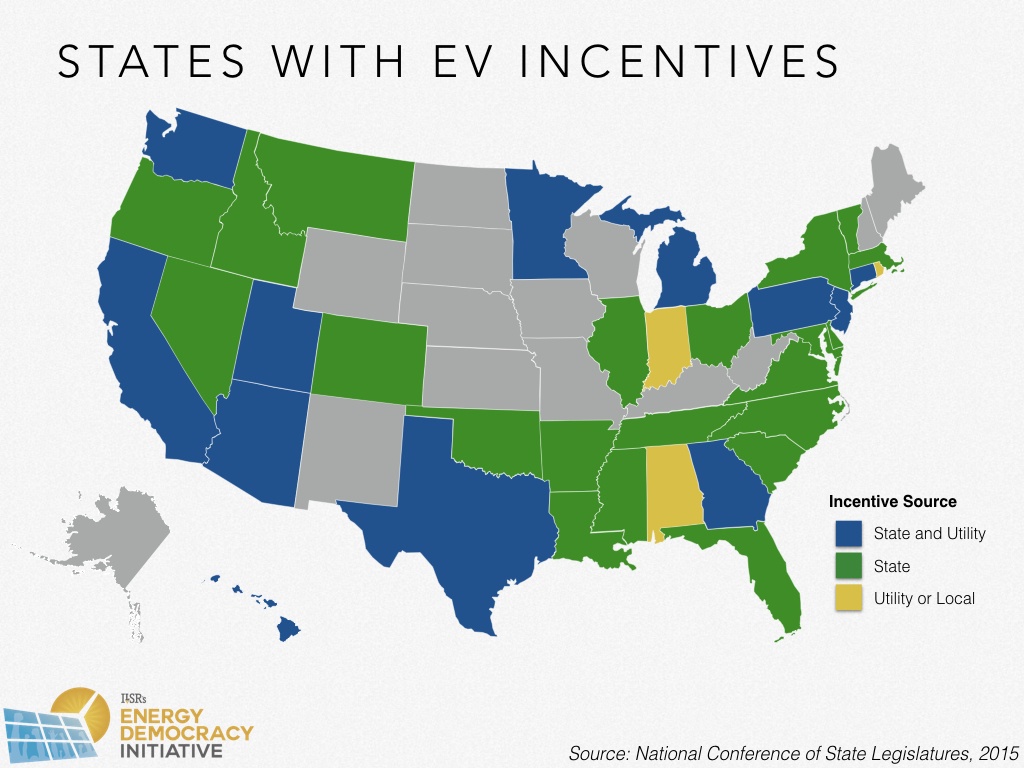

| State and Local Incentives | Some states and local governments may still offer incentives after federal credits are gone. |

| Manufacturer Deals | Automakers may offer their own promotions, but federal credits won’t be available. |

| Additional Legislation Impact | A new potential tax deduction for domestic car buyers could partially offset the loss of EV credits. |

| What Buyers Should Do | Act fast and purchase before September 30, 2025, to take advantage of the remaining federal incentives. |

For those who are unfamiliar with how the federal tax credit system for electric vehicles works, it’s pretty straightforward. Buyers of new electric vehicles (EVs) have been able to claim a $7,500 tax credit, and those purchasing used EVs could receive $4,000. These Electric Car Incentives have been a game-changer in making EVs more affordable and accessible to a wider range of people. However, the new law has decided to phase these benefits out by September 30, 2025, meaning that time is ticking for anyone hoping to take advantage of these tax credits.

Why Is This Happening?

The “One Big Beautiful Bill Act” is part of Trump’s broader effort to adjust federal spending and tax policies. The goal of the new law is to shift the focus from incentivizing consumers to purchase electric vehicles toward promoting the broader American-made vehicle market. According to proponents of the law, ending the electric car incentives will free up resources to fund other initiatives, like tax breaks for the manufacturing sector and domestic industries. This could, in theory, stimulate more local job growth and boost the overall economy.

However, not everyone agrees with this approach. Critics argue that removing EV incentives at a time when the nation is still trying to reduce emissions could set the country back on its green energy goals. They believe that the tax credits were an essential motivator for many buyers to choose electric cars over traditional gasoline-powered vehicles. In a world where climate change remains a pressing concern, this decision has raised eyebrows among environmentalists and advocates for sustainable energy.

Expert Insight:

According to Dr. Emily Greenfield, a professor of environmental economics at Stanford University, “The federal tax credit has been one of the main driving factors behind electric vehicle adoption in the U.S. A sudden removal of these credits could create a significant barrier for middle-class families who are already dealing with inflation and rising costs. This law, in essence, could slow down the transition to green energy.”

What Does Trump’s New Law Will End Electric Car Incentives Mean for Buyers?

For consumers looking to buy an electric vehicle, this shift in policy could mean a big change in price. The $7,500 credit for new electric vehicles has already been a crucial factor for many buyers when deciding whether or not to make the switch to EVs. Once the credits expire, buyers will no longer receive this significant financial incentive, making electric vehicles less affordable for many.

Think of it like this: If you’ve been considering buying a Tesla, a Nissan Leaf, or a Chevy Bolt, you’re likely to save thousands of dollars right now thanks to these credits. However, if you wait until after September 30, 2025, you might find yourself paying an extra $7,500 (or more) for the same car.

What Should Buyers Do?

If you’re currently in the market for an electric car and want to maximize savings, here are some steps to consider:

- Act Fast: The biggest piece of advice is simple – act fast. If you can purchase before the credits expire, you can still take advantage of the $7,500 federal tax credit for new electric cars or the $4,000 credit for used electric cars.

- Check Your State and Local Incentives: Some states and localities may continue to offer their own incentives to EV buyers, even after federal credits expire. For example, California and New York have robust Electric Car Incentive programs that could offset some of the loss in federal incentives. Be sure to research available programs in your area.

- Talk to Your Dealer: Automakers and car dealers are aware of the changing landscape, and they may offer special deals to encourage buyers to purchase before the tax credit disappears. Some brands, like Tesla and Ford, have been offering discounts, extended warranties, and even free charging kits in anticipation of the end of the credits.

- Consider Total Cost of Ownership: Even without the tax credits, electric vehicles can still be a great investment due to their lower operating costs. With no gas to buy and fewer moving parts to maintain, electric vehicles can save you money in the long term, even if the initial price tag is higher. Consider the long-term savings on maintenance and fuel when deciding whether to buy.

- Explore Financing Options: If the upfront cost is a concern, there are numerous financing options available for electric vehicle purchases. Many banks and credit unions offer loans specifically for EVs, and some automakers also provide financing with attractive terms.

- Plan for Charging Infrastructure: One important factor to consider before buying an EV is charging infrastructure. While most people can charge their vehicles at home, if you live in an apartment or somewhere without easy access to a home charging station, you might need to think about nearby charging stations. Many cities are building out their EV charging infrastructure, so research the availability of chargers in your area.

Alternatives to Federal EV Tax Credits

If you’re looking to offset the cost of an electric vehicle after the tax credits expire, here are a few alternatives to consider:

- State Rebates: States like California, Colorado, and Washington offer EV buyers rebates, tax credits, or even reduced registration fees. Check your state’s energy department or local government website to find out more.

- Manufacturer Incentives: Even after the federal credits are gone, automakers may still offer their own discounts, cashback deals, or financing promotions. Be sure to keep an eye on manufacturer promotions for potential savings.

- Environmental Programs: Some organizations may offer financial incentives or perks for purchasing eco-friendly vehicles. Check with local environmental groups or federal programs that might help cover part of the cost.

The Bigger Picture: The Future of EV Incentives

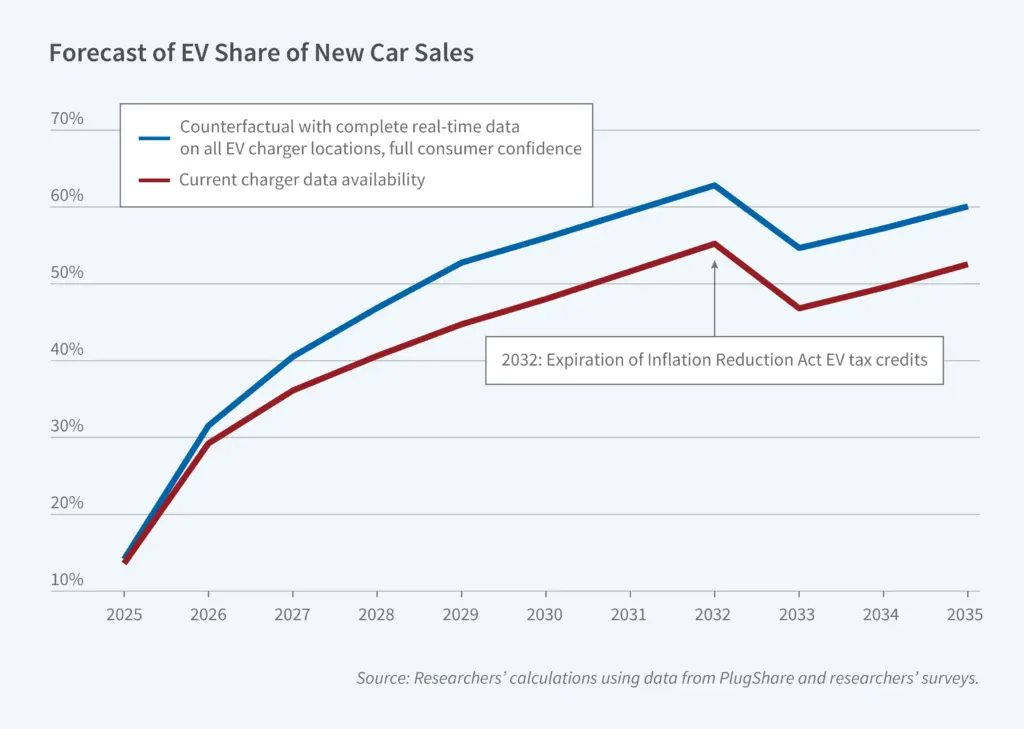

Looking beyond September 2025, it’s crucial to think about how these changes might affect the broader EV market. As the price of electric vehicles rises with the loss of federal incentives, it’s possible that automaker innovation will play a key role in keeping EVs affordable. Car manufacturers are already working on more cost-effective battery technologies, which could lower prices in the future. Additionally, as global demand for electric vehicles continues to rise, economies of scale may drive down the costs of production.

Industry Trend:

With the rise of cheaper EVs, some companies are even targeting the entry-level market with vehicles priced under $20,000, which could be a game-changer for buyers in lower-income brackets. Keep an eye on upcoming EV models that promise affordability while maintaining high performance and range.

Trump’s ‘Big Beautiful Bill’ Sparks Debate Over Social Security and Benefits

4 Financial Mistakes Americans Keep Making That Wreck Their Budgets

Up to $5000 in Social Security Payments Scheduled for This Date- Are You Eligible to Get it?