Trump’s Executive Order Could Revolutionize 401(k) Plans: In a bold move aimed at shaking up retirement savings in the United States, former President Donald Trump signed an executive order that could dramatically change how American workers invest for retirement. The order opens the door for 401(k) plans to include private market investments, including options like private equity, cryptocurrency, and infrastructure funds. This change promises to offer new opportunities for retirement savers but also introduces new risks. In this article, we will break down what this means for 401(k) plans, how it could impact you, and what you should consider when making decisions about your retirement savings.

Trump’s Executive Order Could Revolutionize 401(k) Plans

Trump’s executive order marks a major shift in how Americans can invest for retirement, opening up new opportunities for higher returns and greater diversification. However, with these opportunities come new risks, such as liquidity challenges, high fees, and the need for regulatory safeguards. Before jumping into private market investments, it’s important to weigh the pros and cons carefully. Make sure your retirement strategy remains balanced, and don’t hesitate to seek professional advice. In summary, the addition of private market investments to 401(k) plans could be a game-changer for retirement savers. If done correctly, it could offer significant advantages. But like any investment, it’s crucial to approach these options with caution and a clear strategy. Your future self will thank you for taking the time to understand these changes and plan accordingly.

| Key Point | Details |

|---|---|

| New Investment Options | 401(k) plans could soon include private equity, cryptocurrency, gold, and infrastructure funds. |

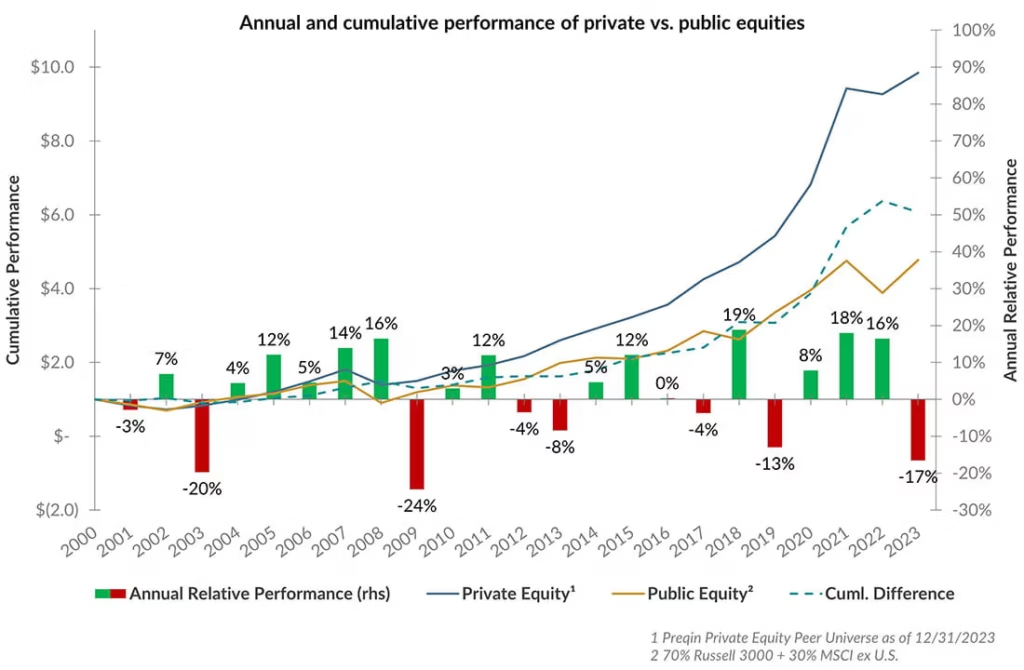

| Potential Returns | Private equity has outperformed public markets with 14.3% net returns over the past 20 years. |

| Diversification | The move allows for better diversification of retirement portfolios, reducing risk over time. |

| Risks | Liquidity issues, high fees, and valuation challenges are key concerns. |

| Regulatory Oversight | The SEC and Department of Labor will implement safeguards to protect individual investors. |

For those unfamiliar with the world of 401(k) plans, these retirement accounts are typically offered by employers to help workers save for their future. The plans allow workers to set aside a portion of their salary into an investment account, with tax advantages that encourage long-term saving. Traditionally, these accounts have been limited to relatively conservative investment options like stocks and bonds, but that is all about to change.

What is a 401(k)?

A 401(k) is an employer-sponsored retirement plan that allows employees to contribute a percentage of their income to an investment account. Employers often match contributions to encourage employees to save for retirement. These contributions are tax-deferred, meaning workers don’t pay taxes on the money they put in until they withdraw it during retirement.

The Big Change: Private Market Investments in 401(k)s

Until now, most 401(k) plans only allowed investments in stocks, bonds, and mutual funds. These traditional options are known for being relatively stable, but they also offer modest returns. In contrast, private market investments—like private equity, real estate, or cryptocurrencies—have historically offered higher returns but come with greater risks.

Trump’s executive order paves the way for 401(k) plans to include these non-traditional investment options. Here’s a closer look at some of the key investments that could soon be available through your 401(k):

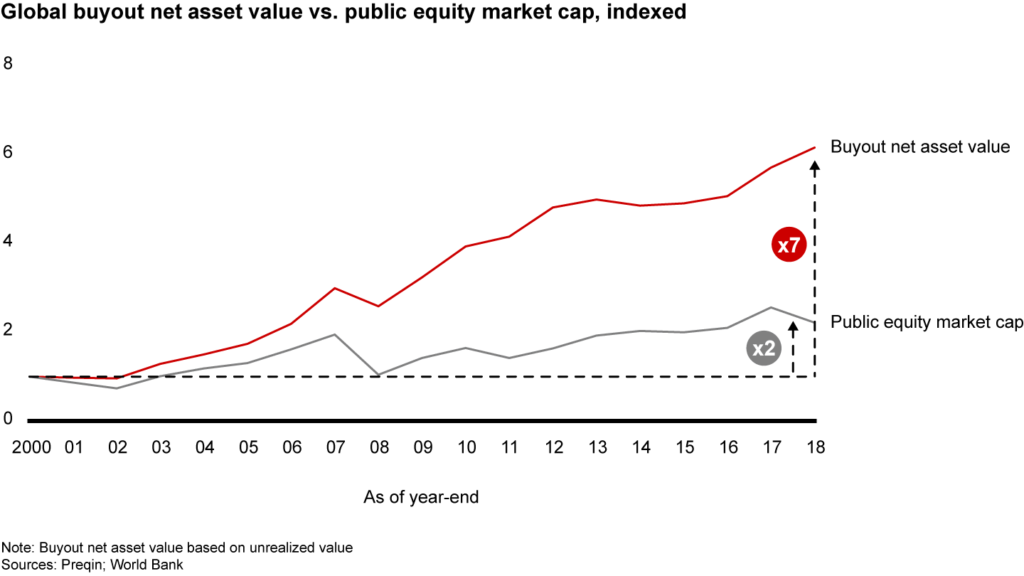

- Private Equity: This refers to investments in private companies, often through venture capital or buyouts. Historically, private equity has outperformed public markets, providing higher returns than the stock market. Over the past 20 years, private equity has delivered net returns of 14.3%, compared to just 8.1% for the MSCI World Index .

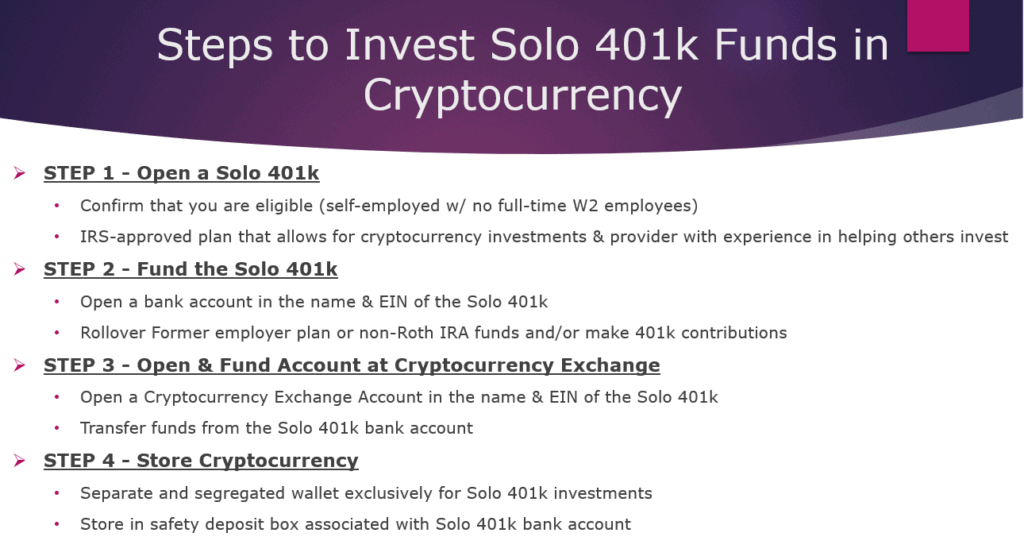

- Cryptocurrency: While still a volatile investment, cryptocurrencies like Bitcoin and Ethereum have gained popularity as an alternative investment option. The order could open the door for 401(k) plans to offer cryptocurrency as an option for those looking to take on more risk.

- Gold and Commodities: Another potential option is gold, which can act as a hedge against inflation and market volatility. Historically, precious metals like gold have been considered safe-haven assets in uncertain economic times.

These options are often limited to wealthy investors or large institutional funds, but the executive order could democratize access to these types of investments for everyday Americans.

The Benefits of Expanding 401(k) Investment Options

- Higher Returns: As mentioned earlier, private equity has historically outperformed traditional public markets. By including private market investments in your 401(k), you may have the opportunity to earn higher returns, especially if the stock market is underperforming.

- Diversification: Adding alternative assets like real estate, private equity, and cryptocurrency to your 401(k) can diversify your portfolio. Diversification helps reduce the overall risk of your investments by spreading them across different types of assets. For example, the performance of private equity is often less correlated with the stock market, which means it may not be affected by the same economic factors that impact public markets .

- Exclusive Investment Opportunities: Many private market investments, such as venture capital or private real estate deals, have been reserved for institutional investors or high-net-worth individuals. With this change, everyday workers could have access to opportunities once out of reach.

- Greater Access to Global Markets: Many private market options are not just limited to the United States; they offer access to global markets and emerging economies. For example, some private equity funds invest in international startups or real estate projects, allowing you to tap into a wider range of opportunities.

- Potential Tax Benefits: Some private market investments may offer additional tax benefits, such as depreciation from real estate investments. These tax advantages could provide extra savings in your 401(k) account.

The Risks of Expanding 401(k) Investment Options

While the potential rewards are exciting, there are several risks associated with investing in private markets:

- Liquidity Issues: One of the biggest challenges with private market investments is their lack of liquidity. Unlike stocks, which can be bought or sold on the open market in an instant, private investments are harder to sell quickly. This could pose a problem for workers who need to access their funds before retirement.

- High Fees: Alternative investments often come with higher management fees compared to traditional stocks and bonds. Over time, these fees could eat into your returns, making the investment less profitable than expected. For example, private equity funds typically charge management fees that range from 1% to 2% of assets, plus additional performance fees.

- Valuation Challenges: Unlike publicly traded stocks, which have clear market prices, private investments don’t have an easy way to determine their value. This can make it difficult for investors to know how much their investments are worth at any given time, leading to potential transparency issues.

- Legal and Fiduciary Risks: If these private market investments are added to 401(k) plans, plan sponsors could face additional legal risks. Fiduciaries (the people who manage retirement plans) will need to ensure that these investments are suitable for workers, adding complexity to the management of 401(k) plans.

Regulatory Oversight and Safeguards

To mitigate these risks, federal regulators are stepping in. The U.S. Securities and Exchange Commission (SEC) and the Department of Labor will be working together to establish “guardrails” for these new investment options, ensuring that workers are protected from excessive risks and fees. This oversight will help ensure that 401(k) plans remain a safe and reliable option for retirement savings, even as new investment opportunities are added.

How You Can Take Advantage of This Trump’s Executive Order Could Revolutionize 401(k) Plans?

If your employer adopts private market investment options for your 401(k), it’s essential to carefully consider your options. Here’s how you can make informed decisions:

- Diversify Your Portfolio: While it’s tempting to jump into high-return options like private equity, it’s crucial to maintain a balanced portfolio. Diversify across different asset classes, including stocks, bonds, and alternatives like private equity or cryptocurrency.

- Understand the Fees: Be sure to check the fees associated with any new investment options in your 401(k). Make sure you understand how much you’ll be charged for management fees, performance fees, and other costs.

- Consult a Financial Advisor: Before making any big changes to your retirement plan, it’s a good idea to consult with a financial advisor. They can help you navigate the complexities of private market investments and create a strategy that aligns with your retirement goals.

- Stay Informed: Keep an eye on the regulatory landscape and the fine print of any new offerings. The rules surrounding private market investments may evolve as the market for these options grows.

- Evaluate Your Risk Tolerance: These new investments come with different risk profiles than traditional options. Consider your personal risk tolerance and how these investments fit into your broader retirement strategy.

Dave Ramsey Advises Caution and Planning on 401(k) Contributions Amid Economic Shifts

Thousands in Forgotten 401(k)s Waiting for Michiganders — See If You’re Owed Money

Say Goodbye to Social Security as We Know It: 2026 Brings Big, Unexpected Changes