Trump’s Claim That His Bill Ends Social Security Taxes: Former President Donald Trump recently announced that his latest legislation would completely eliminate taxes on Social Security benefits. In his words: “We’re ending Social Security taxes — totally gone, just like I promised.” At first glance, this statement fired up supporters and left many older Americans excited about saving more in retirement. But here’s the deal — it’s not true. Not entirely.

The truth is that Trump’s bill introduces a temporary tax deduction for seniors, which helps some — but doesn’t repeal Social Security taxes for everyone. According to multiple independent experts, policy analysts, and fact-checkers, the claim is misleading at best and factually incorrect at worst. Let’s break down what the bill really does, who benefits, who doesn’t, and how it affects your wallet, your taxes, and your future.

Trump’s Claim That His Bill Ends Social Security Taxes

Trump’s new bill might offer some seniors a helpful tax break — but the truth is far from the political spin. It doesn’t eliminate Social Security taxes. It doesn’t help everyone. And it doesn’t last forever. Whether you’re nearing retirement or advising someone who is, now is the time to review your income, adjust your plan, and stay informed. Knowing the truth behind the headlines can save you real money — and real headaches — down the road.

| What’s In the Bill? | Temporary tax deduction for seniors age 65+ |

|---|---|

| Effective Years | 2025 through 2028 (expires after four years) |

| Deduction Amount | $6,000 per individual / $12,000 per couple |

| Income Phase-Out | Begins at $75,000 (single) and $150,000 (joint) |

| Who Still Pays Taxes? | Millions of higher-income seniors, disabled recipients, and early retirees |

| Payroll Tax Impact | No change – 6.2% still taken from paychecks |

| Source | Congress.gov – Tax Relief for Seniors Act |

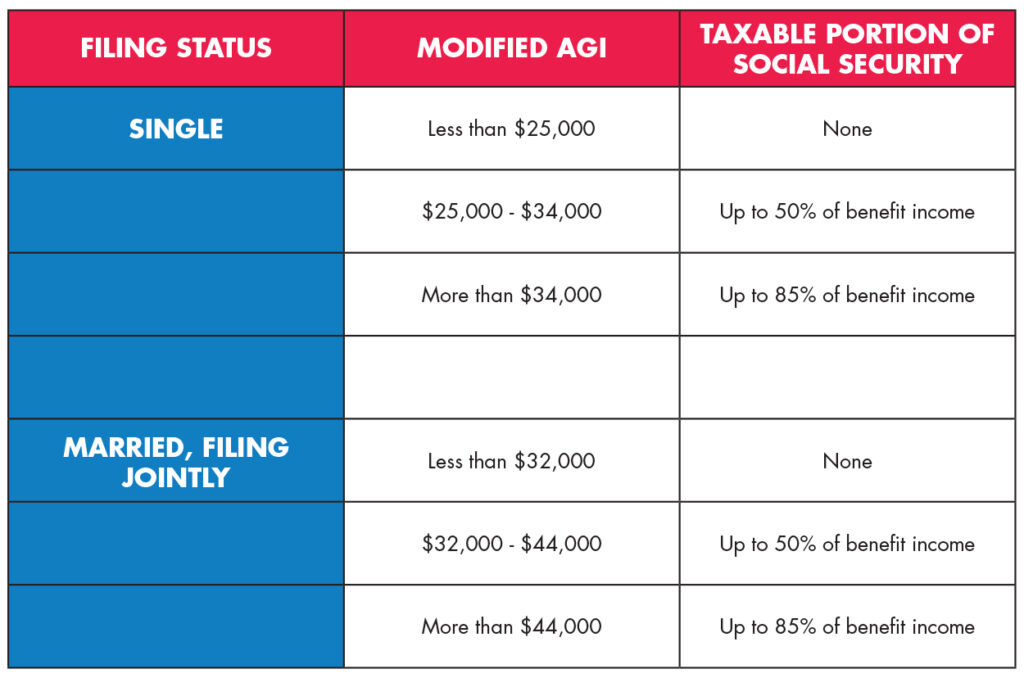

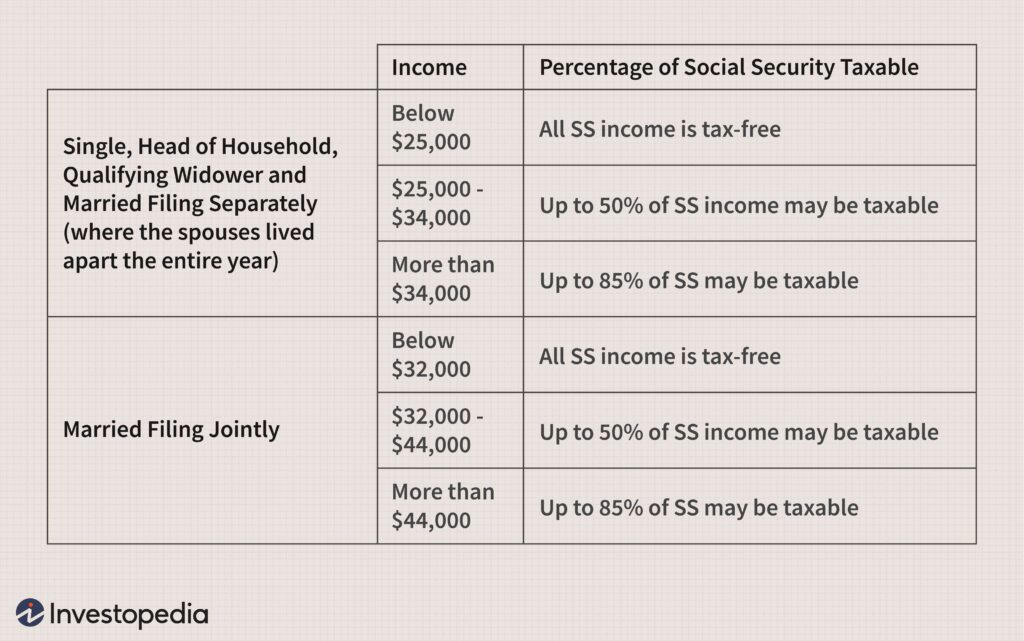

How Social Security Benefits Are Currently Taxed?

To understand the new bill, it helps to first understand how Social Security is taxed today — because a lot of Americans still don’t know the details.

Social Security taxes come in two forms:

- Payroll Taxes

- Workers pay 6.2% of their wages into Social Security.

- Employers also pay 6.2% on your behalf.

- Self-employed people pay the full 12.4%.

- Taxes on Benefits

- Once you retire, your benefits themselves can be taxed — depending on your total income.

- The formula uses something called provisional income, which includes:

- Adjusted Gross Income (AGI)

- Tax-exempt interest

- 50% of your Social Security benefits

If your provisional income exceeds certain thresholds, up to 85% of your Social Security benefits can be taxable. These income thresholds have not been adjusted for inflation since 1993, so more and more seniors are being taxed over time.

Will His Bill Ends Social Security Taxes?

Let’s set the record straight. Trump’s bill does not eliminate Social Security taxes — it simply introduces a new standard deduction for older Americans that can reduce their taxable income and, in some cases, make Social Security benefits tax-free.

Here are the details:

- If you’re 65 or older, you may qualify for an additional deduction on top of the standard one.

- The deduction is $6,000 for individuals and $12,000 for married couples filing jointly.

- It only applies for four years: 2025 to 2028.

- Once your income hits $75,000 (single) or $150,000 (joint), the deduction begins to phase out and eventually disappears.

This deduction will help some seniors pay less tax — but millions will still be taxed.

Who Qualifies for the Deduction?

The deduction is designed for low- to moderate-income seniors, age 65 and older. Here’s a breakdown of common scenarios:

Example 1: Retired Couple Living on Social Security and Small Pension

- Ages: 68 and 70

- Income: $44,000 total (including $30,000 Social Security + $14,000 pension)

- Result: Their taxable income drops after applying the deduction. Likely owe no tax on their benefits.

Example 2: Retired Engineer with Investment Income

- Age: 67

- Income: $110,000 (Social Security + dividends + capital gains)

- Result: Deduction phases out due to income. Social Security remains partially taxable.

Example 3: Disabled Veteran, Age 62

- Income: $26,000

- Result: Not eligible for the deduction due to not being 65 yet.

What the Experts Say?

Almost every major nonpartisan expert has weighed in on this bill — and they’re all saying the same thing.

PolitiFact rated Trump’s statement “Mostly False,” stating that while the bill gives relief, it doesn’t repeal Social Security taxation.

The Associated Press explained that the claim “oversells the benefit” and that millions of seniors will still pay tax even under the new law.

The Tax Foundation, a conservative-leaning think tank, called the bill “modest” and warned that it could jeopardize long-term funding for Social Security.

Janet Holtzblatt, a senior fellow at the Urban-Brookings Tax Policy Center, said:

“This deduction is helpful, but it doesn’t fundamentally change the taxation of Social Security. It’s temporary, limited, and income-tested.”

The Bigger Picture: What Happens After 2028?

Because this deduction is not permanent, seniors must prepare now for what’s coming later:

- In 2029, unless extended, the deduction disappears.

- Taxable income will go back up for those who previously benefited.

- Social Security benefits may once again be taxable at the same rate as before.

That means it’s smart to adjust your retirement plan now.

Here’s what you can do:

- Use the deduction window (2025–2028) to withdraw from pre-tax accounts like 401(k)s or traditional IRAs at a lower tax rate.

- Consider Roth conversions while your tax liability is temporarily reduced.

- If you’re nearing retirement, work with a tax professional to model scenarios for both with and without the deduction.

- Visit the IRS Tax Withholding Estimator to update your tax plan.

- Don’t bank on this deduction being extended — plan conservatively.

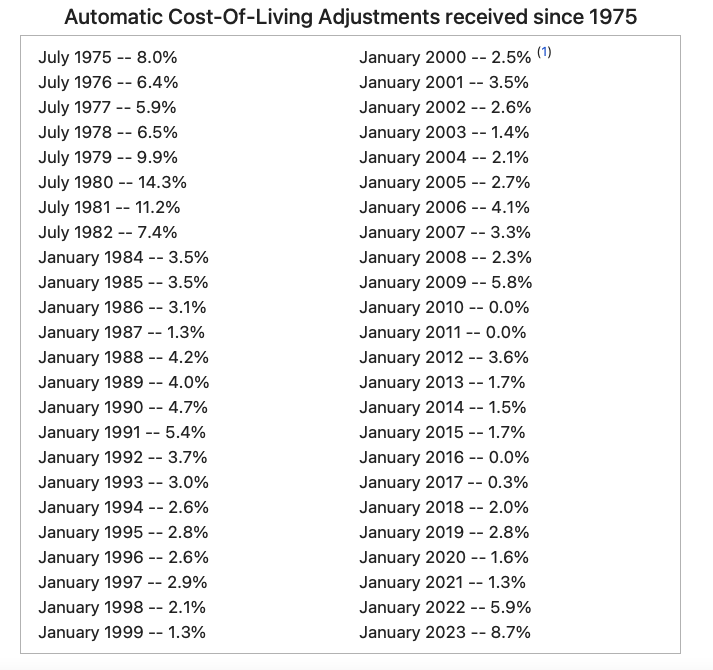

How This Impacts Social Security’s Long-Term Solvency?

Here’s the elephant in the room: every tax cut has a cost.

The Congressional Budget Office estimates the deduction will reduce revenue by at least $60 billion over 4 years. That’s real money, especially considering Social Security’s trust fund is expected to run dry by 2033.

If more tax revenue is lost, that date could move up to 2032 — or sooner.

While the deduction offers short-term savings, experts warn it could accelerate the depletion of the Social Security fund, which supports retirement, disability, and survivors’ benefits for over 70 million Americans.

How This Compares to Other Tax Relief Proposals?

Trump’s deduction is not the first time lawmakers have tried to ease the tax burden on retirees.

- In 2000, President George W. Bush proposed eliminating the tax on Social Security entirely — it never passed.

- In 2016, then-candidate Trump made similar promises — but didn’t push related legislation during his term.

- In 2024, some House Republicans proposed a bill to fully repeal Social Security taxation — but it was dropped due to its $1.5 trillion price tag.

This latest move, while less expensive, still doesn’t touch the underlying tax rules and isn’t permanent.