Trump’s ‘Big Beautiful Bill’ Sparks Debate: Trump’s “Big Beautiful Bill”—officially titled the One Big Beautiful Bill Act (OBBB)—has entered the legislative arena with major fanfare and a mountain of controversy. Promoted as a sweeping tax overhaul aimed at helping working Americans and retirees, the bill is generating buzz, confusion, and a heated debate.

At its heart, the bill proposes changes to how seniors are taxed on their Social Security benefits, among other provisions affecting healthcare, food assistance, and federal safety net programs. But is it truly a benefit for everyday Americans—or a strategic political move during an election cycle? Let’s break it all down in plain English, with all the facts, context, and tools you need to understand how this bill may—or may not—impact you or your loved ones.

Trump’s ‘Big Beautiful Bill’ Sparks Debate

Trump’s “Big Beautiful Bill” offers immediate tax savings for many retirees, particularly middle-income seniors who have been burdened by Social Security taxation for decades. However, it leaves behind those who need help most—low-income seniors—and those who are wealthier, while potentially threatening the future of Social Security funding. As always, the key is to stay informed, speak with professionals, and make strategic decisions based on your personal financial situation. Whether you’re collecting benefits or planning for retirement down the line, now is the time to act.

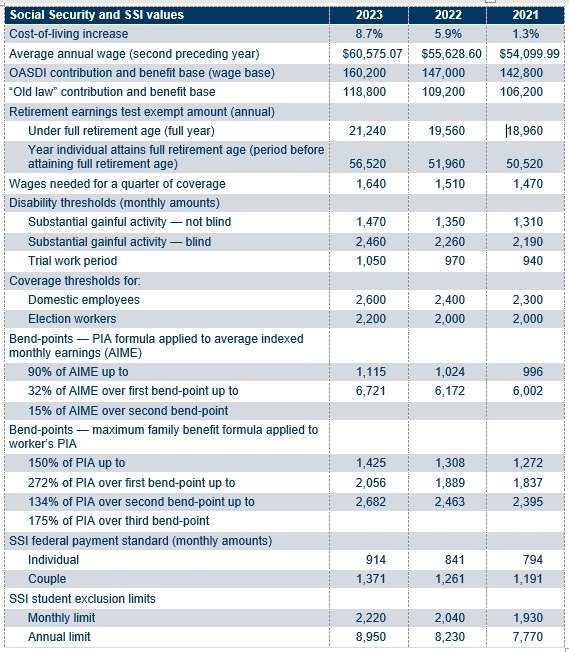

| Aspect | Details |

|---|---|

| Bill Name | One Big Beautiful Bill Act (OBBB) |

| Key Change | Temporary standard deduction for seniors: $6,000 (individuals), $12,000 (married couples) |

| Applies To | Seniors age 65 and older |

| Deduction Phase-out | Begins at $75,000 (single) and $150,000 (married), ends at $175,000/$250,000 |

| Tax Year Effective | 2024 (filed in 2025) |

| Expires | 2028 |

| Social Security Impact | Reduces federal tax liability on Social Security income for qualifying seniors |

| Trust Fund Risk | May accelerate insolvency by one year |

| Official Source | SSA.gov |

Historical Context: How Social Security Became Taxable

Originally, Social Security benefits were not taxed when the program was established in 1935. That changed in 1983, when a bipartisan agreement introduced income thresholds above which benefits would become partially taxable. In 1993, a second reform raised the portion of benefits subject to taxation from 50% to 85%.

These thresholds—$25,000 for single filers and $32,000 for couples—have never been adjusted for inflation. As a result, more and more seniors each year have found themselves paying taxes on their Social Security, even if their purchasing power hasn’t changed.

That’s what makes Trump’s proposed deduction significant: it’s the first major structural change to Social Security taxation in decades.

What the “Big Beautiful Bill” Actually Does?

Contrary to some promotional messaging and emails from Social Security officials, the bill does not eliminate taxes on Social Security benefits outright. Instead, it creates a new standard deduction exclusively for taxpayers age 65 and older:

- $6,000 for single filers

- $12,000 for married couples filing jointly

This deduction is in addition to the existing standard deduction and applies before calculating taxable income, which can help reduce the amount of Social Security subject to taxation.

However, there are income caps:

- Deduction starts to phase out at $75,000 AGI for singles and $150,000 for married couples

- Fully phased out by $175,000/$250,000

So while many middle-income seniors will see real tax relief, low-income seniors who already pay no tax, and high-income retirees whose incomes exceed the threshold, won’t benefit.

Real-Life Examples: Who Benefits?

Example 1: James and Linda, Age 68 and 70, Retired, Joint AGI $90,000

- Combined Social Security income: $45,000

- Other income (IRA distributions, pensions): $45,000

- Under current law, 85% of SS benefits are taxed

- With OBBB, the $12,000 deduction lowers taxable income to $78,000

- Savings: Approximately $1,500 to $2,000 in reduced taxes

Example 2: Karen, Age 67, Single, Income $180,000

- Mostly from investments and part-time consulting

- Deduction fully phased out

- Pays same taxes on 85% of Social Security benefits

Example 3: Martha, Age 70, Income $24,000 (Mostly SS)

- Already under threshold where benefits are taxable

- No change to her tax bill under OBBB

Professional Opinions: Experts Weigh In

Tax experts and policy analysts are split on the bill’s long-term impact.

Dr. Olivia Herrera, an economist at the Brookings Institution, notes:

“This legislation offers temporary relief for some, but does not address the underlying structural challenges with Social Security funding. It’s a political fix, not a fiscal one.”

CPA and retirement planner James Evans adds:

“For middle-income retirees, the deduction could be a game-changer. But the bill misses the opportunity to reform the outdated income thresholds that trigger benefit taxation.”

Meanwhile, critics warn that reducing tax revenue without a funding offset could worsen future shortfalls.

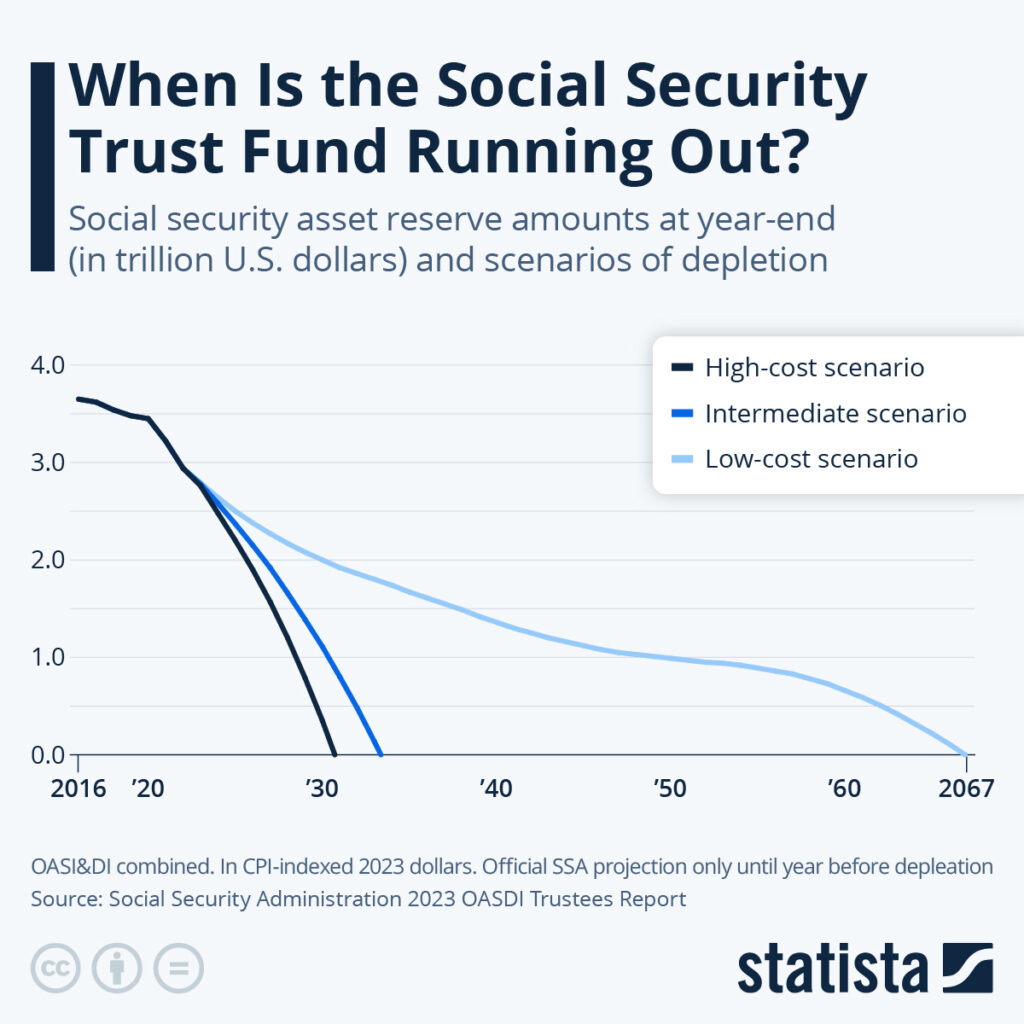

Will This Hurt the Social Security Trust Fund?

Yes, potentially. The Social Security Administration and the Congressional Budget Office estimate the deduction could reduce federal tax revenue by over $750 billion over 10 years.

Because some of those taxes feed back into Social Security trust accounts, the fund’s insolvency timeline could shift from 2033 to 2032, unless Congress finds new revenue or reduces benefits.

This makes younger generations especially vulnerable, as they may face reduced benefits, higher retirement age, or higher payroll taxes to sustain the system.

Beyond Social Security: What Else Is in the Bill?

The bill isn’t just about seniors. It includes broad changes, including:

- Tax breaks for businesses and tip income exclusions for service workers

- Expanded child tax credits for families

- Elimination of student loan interest deductions

- $1.5 trillion in Medicaid cuts

- $300 billion in SNAP (food stamps) reductions

- Rollback of ACA subsidies and clean energy credits

Many advocacy groups, including the Center on Budget and Policy Priorities, argue these cuts will disproportionately affect low-income families, rural communities, and Native American populations who rely more heavily on federal assistance.

How to Prepare for Trump’s ‘Big Beautiful Bill’ Sparks Debate: A Step-by-Step Guide

Step 1: Check Your Adjusted Gross Income (AGI)

Look at your latest tax return or use the IRS AGI calculator to see where you fall.

Step 2: Determine Eligibility

If you’re 65+ and your AGI is under the threshold, you’ll likely qualify for the deduction.

Step 3: Use the IRS Withholding Estimator

Update your tax withholding or estimated payments based on your new deduction.

Step 4: Speak with a Tax Advisor

Especially if you’re near the income thresholds or rely on multiple income sources.

Step 5: Watch the Clock

The deduction sunsets in 2028, so plan ahead while it lasts.

What About State Taxes?

Even if you qualify for the new federal deduction, 13 states still tax Social Security income in some form. These include:

- Colorado

- Connecticut

- Kansas

- Minnesota

- Missouri

- Montana

- Nebraska

- New Mexico

- North Dakota

- Rhode Island

- Utah

- Vermont

- West Virginia

Some states offer exemptions or income thresholds, so it’s important to consult your state tax agency or advisor for details.

Younger Americans: What Does This Mean for You?

If you’re under 50, you may not see immediate benefits from the OBBB, but the long-term implications are significant:

- Accelerated depletion of the Trust Fund could lead to benefit cuts or age increases

- Potential changes to Medicare, Medicaid, and ACA subsidies may increase your healthcare costs

- Less federal revenue may translate to higher taxes in the future

Now is the time to prioritize diversified retirement planning: IRAs, 401(k)s, HSAs, and taxable investment accounts will likely play a larger role in your retirement strategy.

Deadline Alert—July 2025 Social Security Cutoff Is Closer Than You Think

Some Social Security Recipients Could See Payments Slashed in Half— Check Why!

$5,108 Social Security Checks Arrive in July—Here’s Who Qualifies