Trump’s ‘Big Beautiful Bill’ Could Reshape Social Security: Trump’s ‘Big Beautiful Bill’ has become a headline magnet, especially among America’s retirees. With millions of Social Security recipients receiving emails from the Social Security Administration (SSA) claiming that their benefits may no longer be taxed, many are wondering—is this the big break seniors have been waiting for? If you’re 65 or older and receiving Social Security, this could mean real tax relief. But is the hype backed by substance? Or is this just another political headline? In this article, we’ll walk through exactly what’s in the bill, how it affects Social Security recipients, and what smart steps you should take while the window is open.

Trump’s ‘Big Beautiful Bill’ Could Reshape Social Security

| Topic | Details |

|---|---|

| Law Name | One Big Beautiful Bill Act (2025) |

| Signed By | President Donald J. Trump |

| Main Claim | Ends federal income taxes on Social Security benefits |

| Actual Impact | Adds a temporary deduction for seniors aged 65+ earning under $75,000 (single) or $150,000 (married) |

| Tax Relief Offered | Up to $6,000 per person in added standard deduction |

| Expiration Date | December 31, 2028 |

| Who Benefits Most | Middle-income seniors who pay taxes on Social Security now |

| Official Resource | Social Security Administration |

Understanding the Headlines: What the Bill Actually Does

Let’s get one thing clear: the Big Beautiful Bill does not permanently repeal taxes on Social Security benefits.

Instead, it adds a temporary increase to the standard deduction for qualifying seniors. This deduction lowers taxable income enough that many seniors will no longer owe federal income tax on their Social Security benefits—but only if their income is within the limits.

For individuals over age 65 earning under $75,000, and married couples earning under $150,000, the bill provides an extra $6,000 per person in standard deduction—on top of the existing deduction.

So, yes—this bill can eliminate taxes on Social Security benefits, but it does so indirectly and temporarily, through a standard deduction boost.

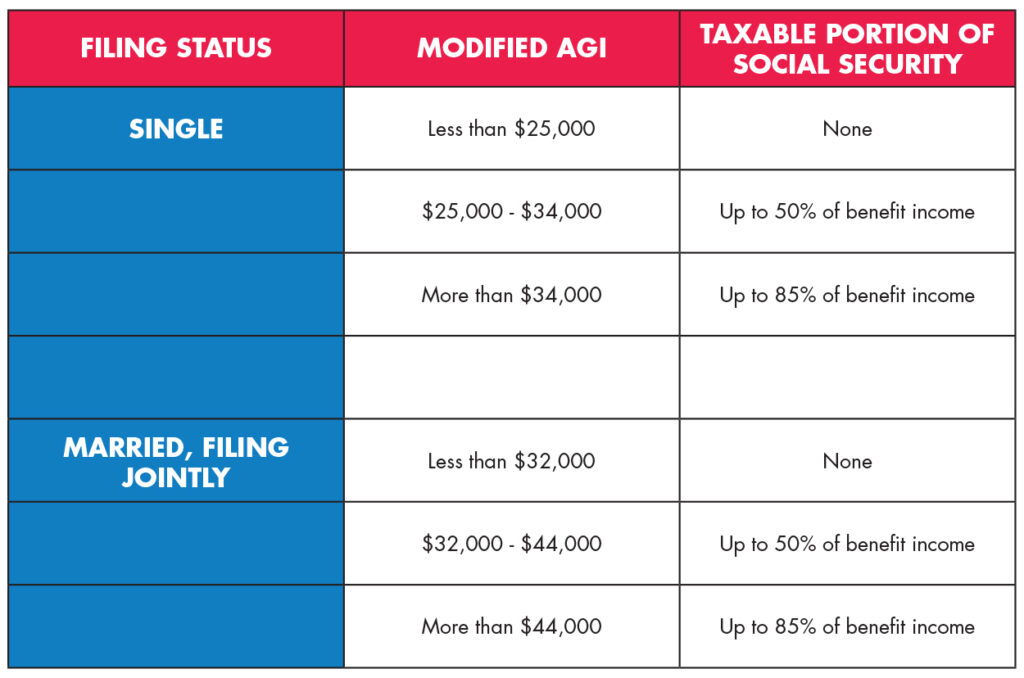

A Brief History: How Did Social Security Get Taxed?

Originally, Social Security benefits were completely tax-free. That changed with a 1983 bipartisan reform signed by President Ronald Reagan. Under that law, up to 50% of Social Security benefits became taxable for retirees with certain income levels. Later, under President Clinton in 1993, the threshold was expanded to allow up to 85% of Social Security benefits to be taxed for higher-income earners.

As of 2025:

- Individuals earning over $25,000 and couples earning over $32,000 may pay taxes on their Social Security income.

- Depending on income and filing status, up to 85% of your benefits can be subject to federal tax.

The Big Beautiful Bill is the first major change to this system in over 30 years.

Tax Savings by the Numbers

If you qualify, here’s what this deduction could look like:

- Single seniors (65+): An additional $6,000 off taxable income.

- Married seniors (both 65+): An additional $12,000 deduction combined.

This could translate to hundreds to thousands of dollars saved annually depending on how much of your benefits were previously taxed.

According to the Congressional Budget Office (CBO) and White House estimates, this deduction will allow 88% of Social Security recipients to avoid paying any federal tax on their benefits through 2028.

That’s millions of seniors who now keep more of their checks.

Who Benefits the Most From Trump’s ‘Big Beautiful Bill’ Could Reshape Social Security?

Let’s break it down:

Winners:

- Seniors aged 65+ earning below the income limits.

- Retirees whose income was just above previous taxation thresholds.

- Taxpayers using Roth IRA conversions or withdrawing strategically.

Not-so-lucky:

- Seniors under 65 (they don’t qualify for the enhanced deduction).

- Retirees with income above the $75K/$150K limit (deduction phases out).

- Low-income retirees already paying zero tax (this won’t affect them).

Also, keep in mind that this is a temporary benefit. It ends after tax year 2028, unless extended by Congress.

Real-Life Example: Before and After the Bill

Before the Bill:

- Barbara, age 68, receives $22,000/year from Social Security and earns another $30,000 from part-time work and retirement funds.

- She may have owed tax on up to 85% of her Social Security benefits.

After the Bill:

- Barbara qualifies for the enhanced $6,000 deduction.

- Her taxable income drops enough to push her below the tax threshold.

- Result: Barbara pays zero federal income tax on her Social Security income.

For millions of seniors like Barbara, this bill brings real, usable relief.

Tax Planning Tips: What You Should Do Now

1. Know Your Income Limits

Use your Adjusted Gross Income (AGI) from your tax return. Make sure it’s under:

- $75,000 (individual)

- $150,000 (married couple)

2. Confirm Your Age

You must be 65 or older by the end of the tax year to claim the deduction.

3. Optimize Withdrawals

If you’re near the income cap, consider adjusting how and when you draw retirement income to stay under the threshold.

4. Convert Strategically

Use this window to convert traditional IRA funds to a Roth IRA while paying lower taxes, if any.

5. Get Professional Help

Speak with a tax advisor to build a personalized strategy. Don’t leave potential savings on the table.

Political Reactions: Campaign Strategy or Meaningful Reform?

The bill has stirred up more than just tax software updates.

Supporters call it a bold move to protect seniors and reward hard work in retirement.

Critics say it’s a temporary fix dressed up as a game-changer. Democrats have criticized the SSA for sending a “misleading” email that lacked full context, and watchdog groups have accused the messaging of being politically motivated.

Furthermore, the Hatch Act—which bars federal employees from engaging in partisan activity—is being cited in multiple ethics complaints related to the SSA’s promotion of the bill.

With the 2026 midterms approaching, expect to hear more campaign ads referencing this bill.

Comparing: Before and After

| Scenario | Before the Bill | After the Bill |

|---|---|---|

| Standard Deduction (65+, single) | $15,700 | $21,700 |

| Social Security Taxable? | Yes, up to 85% | Often not |

| Average Tax Paid | $1,000–$2,000/year | $0–$300 |

| Affects | ~40% of seniors | Only 12% (while it lasts) |

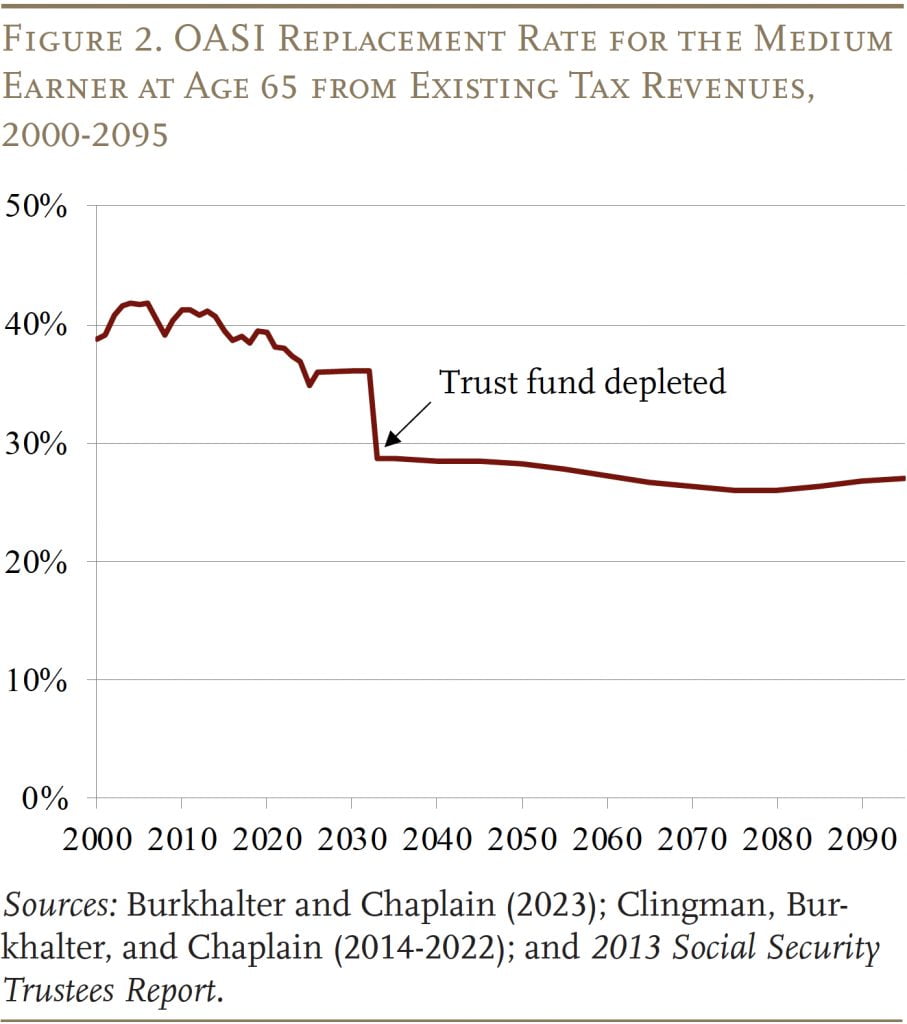

Why Some Social Security Recipients Might See Their Payments Slashed by 50%

Millions of Americans Could See Their Social Security Checks Cut by 50 Percent

Long-Term Concerns: Is This Sustainable?

One concern raised by critics is cost. Estimates suggest the bill could cost the government over $300 billion in lost tax revenue by 2028. That raises two key issues:

- Deficit impact: With the federal deficit growing, some argue this bill is fiscally irresponsible.

- Social Security Trust Fund: While the deduction doesn’t pull money directly from Social Security, lost revenue may lead to more pressure on the system over time.

Others argue that seniors—many living on fixed incomes—deserve relief, especially with inflation driving up costs.