Trump’s ‘Big Beautiful Bill’ Could Mean Thousands in Savings: In a bold and sweeping move, President Donald Trump’s administration introduced the One Big Beautiful Bill (OBBB), promising major tax cuts and financial relief to American families, workers, and businesses. Signed into law on July 4, 2025, the OBBB is designed to reshape the U.S. economy by slashing taxes, offering savings incentives, and encouraging more people to enter the workforce. It’s a massive overhaul that impacts everything from homeownership and savings to tax-free tips and senior relief. While the bill may be seen as a lifeline for some, it has sparked heated debates across the country. Supporters argue it could mean significant financial relief, while critics worry about the bill’s long-term fiscal impact. Let’s break down what’s inside the bill, what it means for you, and how it could affect your wallet.

Trump’s ‘Big Beautiful Bill’ Could Mean Thousands in Savings

President Trump’s One Big Beautiful Bill is a game-changer for many Americans, promising major financial relief and a boost to the economy. With tax cuts, savings incentives, and help for seniors, families stand to benefit. However, the bill’s cuts to social programs and its potential impact on the national debt could have far-reaching consequences. As the debate rages on, it’s essential to stay informed about how these changes will affect your pocketbook.

| Topic | Details | Official Reference |

|---|---|---|

| Projected Savings for Families | $7,600 to $10,900 additional take-home pay, $4,000 to $7,200 in higher wages, and tax-free tips | White House OBBB Savings by State |

| Seniors’ Tax Relief | $6,000 deduction for seniors, with 88% of Social Security recipients paying no tax on benefits | White House Press Release |

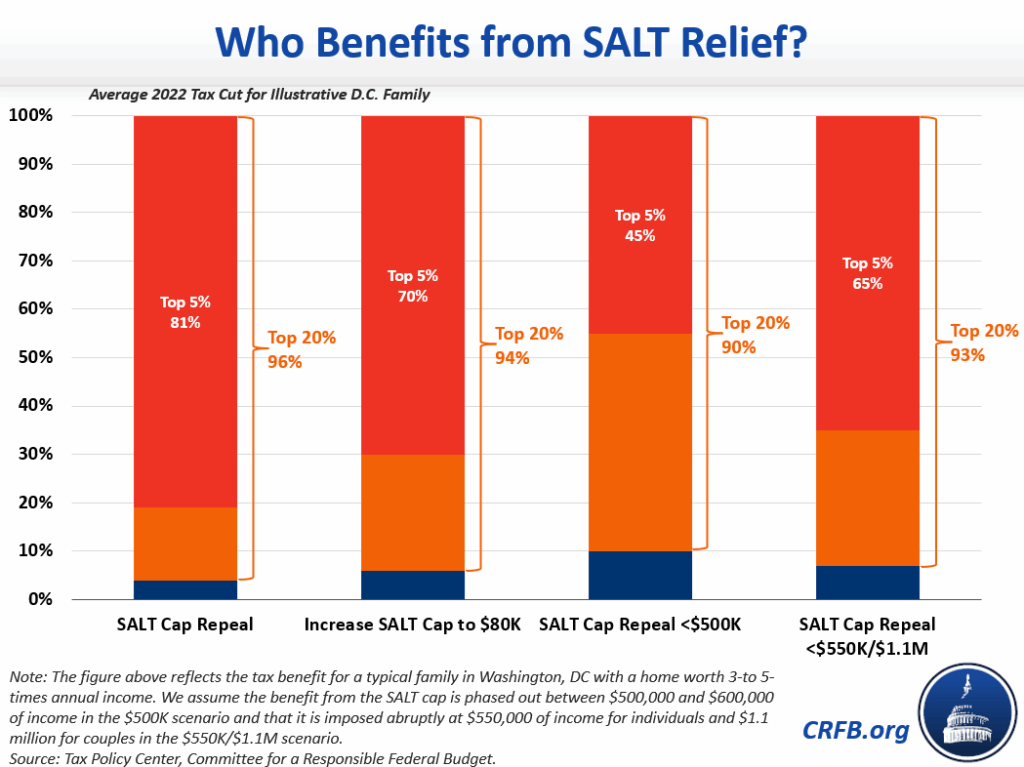

| State and Local Tax (SALT) Changes | SALT deduction cap raised to $40,000 for five years, benefiting taxpayers in high-tax states | Tax Foundation Analysis |

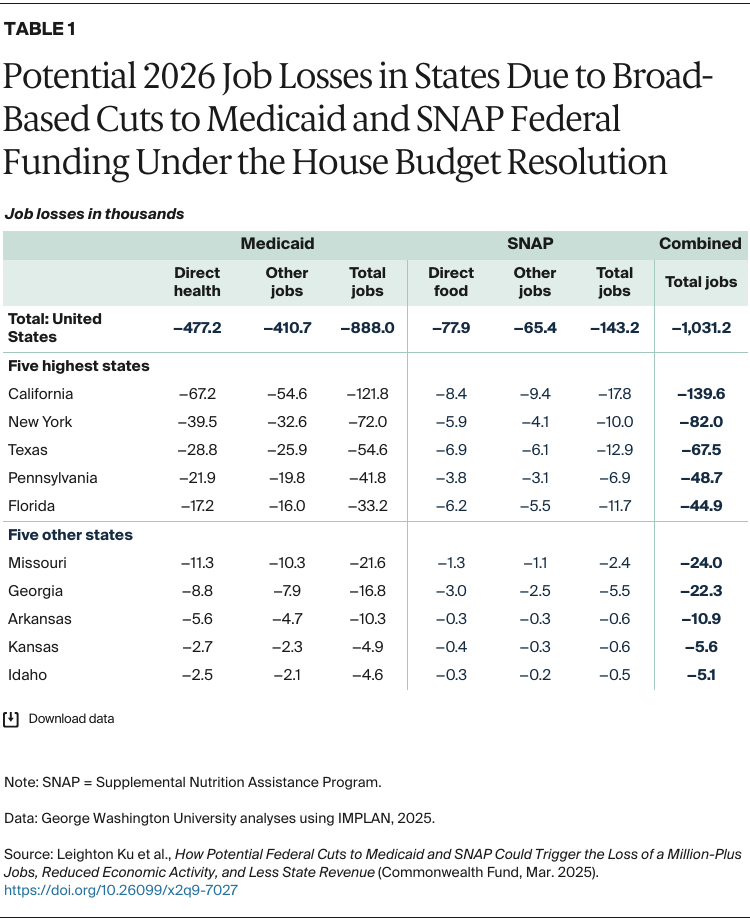

| Medicaid and SNAP Cuts | $1.2 trillion in cuts, with new work requirements and co-payments | Washington Post |

| National Debt Increase | The bill will add $2.8 trillion to the national debt by 2034 | Wikipedia Overview |

What Is the ‘One Big Beautiful Bill’?

The OBBB, a cornerstone of President Trump’s legislative agenda, aims to provide widespread financial relief to U.S. families, reduce the tax burden on the middle class, and incentivize economic growth through job creation. As part of the bill, there are income tax cuts, deductions for homeowners, and savings programs designed to help Americans keep more of their hard-earned cash.

Supporters of the bill argue that the tax relief will boost the economy by enabling consumers to spend more, thus driving economic growth. But the bill has not come without controversy, particularly over its long-term effects on social programs like Medicaid and SNAP, the country’s primary nutrition assistance program.

Breaking Down the Trump’s ‘Big Beautiful Bill’ Could Mean Thousands in Savings: What Does It Mean for You?

1. Tax Relief for Families

One of the standout features of the OBBB is the promise of direct savings for families. For a family of four, the bill is expected to provide substantial financial relief in the form of:

- Higher wages: Americans could see an average wage increase of $4,000 to $7,200 annually.

- Lower tax burdens: Additional tax credits could lead to $7,600 to $10,900 more in take-home pay each year.

- Tax-free overtime and tips: With no federal income tax on overtime and tips, workers in industries like hospitality and service could see an additional $1,400 per year.

These savings are designed to encourage spending and investment, creating a more robust economy and offering a helping hand to hardworking families.

Example: How Could This Affect You?

Let’s say you work in a restaurant where you earn a base salary of $30,000 per year. With the OBBB, you could see an additional $1,400 in your pocket each year from tax-free overtime and tips. Combine that with a $5,000 wage increase, and your overall income could grow by nearly $6,400 per year — a significant bump for most families.

2. Relief for Seniors

Seniors stand to benefit from the OBBB too. For those living on Social Security benefits, the bill introduces:

- A $6,000 additional tax deduction for seniors.

- 88% of Social Security recipients would no longer pay federal taxes on their benefits.

This change is especially beneficial for those living on fixed incomes and struggling to make ends meet. With fewer taxes coming out of their checks, seniors have more room to spend on essential needs like food, healthcare, and housing.

3. Homeownership and Savings Incentives

The OBBB offers tax breaks for homeowners and savers:

- Mortgage interest deduction: This is made permanent, which means homeowners can continue to deduct mortgage interest from their taxable income.

- State and Local Tax (SALT) deduction cap: This cap is raised to $40,000 for five years, which is great news for taxpayers in high-tax states like California and New York.

- Trump accounts: A new savings vehicle allows parents to start a savings fund for children born between 2025 and 2028, offering tax-free growth for educational or homeownership purposes.

These incentives could make it easier for families to buy homes and save for their children’s future.

4. Medicaid and SNAP Cuts

On the flip side, the OBBB has faced criticism for its proposed cuts to Medicaid and SNAP. Over $1.2 trillion is slashed from these programs, with new work requirements and co-payments for participants.

Critics argue that these changes could lead to millions losing coverage, especially among vulnerable populations, including the elderly, children, and people with disabilities.

Example: Potential Impact on Families

Imagine a family that relies on Medicaid for healthcare and SNAP for food assistance. With these cuts in place, they could face higher costs for medical services and groceries. This could lead to hardship for many families, especially in states with already limited access to social services.

5. Long-Term Economic Concerns

While the OBBB promises immediate financial relief, critics warn that the bill could have long-term consequences:

- National debt increase: The bill is projected to add $2.8 trillion to the national debt by 2034, which could strain the economy down the road.

- Disproportionate benefits: Critics argue that the bill disproportionately benefits wealthier Americans, while low-income families may not see the same level of relief.

The question remains: Can the U.S. afford this bill in the long run? Only time will tell if the economic growth spurred by the bill can offset the rising national debt.

Economic Experts’ Opinions

Experts like Dr. John Williams, an economist at the National Bureau of Economic Research, suggest that while the OBBB offers immediate economic stimulation, the long-term fiscal sustainability is questionable. He points out, “The cuts to Medicaid and SNAP could lead to higher healthcare and food insecurity costs, especially in the short term. The debt increase could become a burden on future generations.”

Moreover, many economists are wary of the job creation aspect of the bill. Sally Thompson, a former senior economist at the Federal Reserve, warns that “While businesses may see tax relief, it’s not clear that this will translate into significantly more jobs.”

State-by-State Breakdown

To give you a better idea of what this could mean for you, let’s take a look at some key states:

California

- SALT Deductions: With California’s high taxes, the $40,000 cap on SALT deductions will provide major relief to residents.

- Wage Increase: Families in California could see an average of $7,000 in additional income.

Texas

- Lower Tax Burden: With fewer state taxes, Texas residents will benefit primarily from wage increases and tax-free tips in industries like hospitality.

- Homeownership Incentives: Texas families will likely take advantage of the Trump accounts and SALT cap increase for future homeownership.

Trump’s ‘Big Beautiful Bill’ Sparks Debate Over Social Security and Benefits

Trump’s ‘Big Beautiful Bill’ Could Reshape Social Security for Millions of Americans

Inside Trump’s ‘Big Beautiful Bill’ and Its Impact on Your Social Security