To Qualify for the $5,108 Maximum Social Security Benefit: If you’re aiming for the top-dollar Social Security benefit of $5,108 per month in 2025, you’re not alone. It’s a figure that grabs attention, especially for professionals and diligent workers who’ve paid into the system for decades. But what exactly does it take to qualify for that maximum monthly check? Whether you’re planning your retirement years down the road or you’re getting ready to apply in a few years, this guide breaks down exactly what it takes to hit that figure — with clear steps, practical tips, and no-nonsense financial facts.

By the end of this article, you’ll know:

- How Social Security benefits are calculated

- What income level you need each year

- How long you need to earn at that level

- When you should start claiming benefits

- Common mistakes that reduce your benefit

- Strategic moves that could raise your future check

To Qualify for the $5,108 Maximum Social Security Benefit

Reaching the $5,108 monthly Social Security benefit isn’t easy — but it’s not impossible either. If you’re early in your career or in your prime earning years, you have time to plan and push toward it. Even if you don’t hit the exact max, getting close can mean a more secure and stable retirement. Start by tracking your earnings, maximizing your taxable income, and being strategic about when you claim. And most of all, remember: it’s never too late to start planning smarter.

| Topic | Details |

|---|---|

| Maximum Monthly Benefit (2025) | $5,108 |

| Required Annual Income | $176,100 for 35 years |

| Required Claiming Age | 70 |

| Full Retirement Age (FRA) | 67 (for those born 1960 or later) |

| Average Monthly Benefit (2025) | $1,976 |

| Number of People Receiving Max | Less than 5% of retirees |

| Source | SSA.gov |

What Is the Maximum Social Security Benefit?

The maximum Social Security benefit is the highest possible monthly payment a retiree can receive. This number is calculated by the Social Security Administration (SSA) based on your earnings history and the age at which you start collecting benefits.

In 2025, that maximum benefit is $5,108 per month — a hefty check that totals over $61,000 per year. But not everyone gets there. In fact, most retirees collect far less.

The average monthly Social Security check as of January 2025 is approximately $1,976, according to the SSA. That means the maximum benefit is more than 2.5 times the average payout — making it a highly desirable, yet difficult, milestone to reach.

How Social Security Benefits Are Calculated?

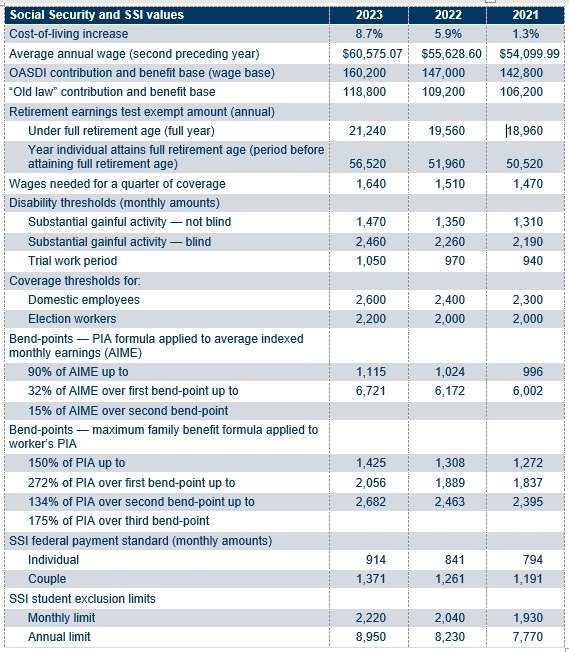

Social Security benefits are based on your Average Indexed Monthly Earnings (AIME). Here’s how it works:

- SSA looks at your 35 highest-earning years (adjusted for inflation).

- It calculates your AIME — the monthly average of those years.

- It applies a formula to determine your Primary Insurance Amount (PIA).

- Your PIA becomes your monthly benefit if you claim at Full Retirement Age (FRA).

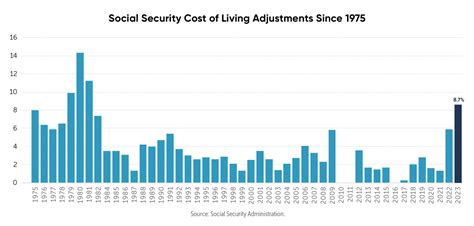

But if you claim earlier, your benefit is permanently reduced. If you wait until age 70, you receive a delayed retirement bonus, which increases your check by up to 32%.

The Income You Need to Qualify: $176,100 in 2025

The magic number for 2025 is $176,100. That’s the Social Security wage base limit — the maximum amount of income subject to Social Security tax. Only income up to that cap counts toward your future benefit.

So, to qualify for the maximum payout, you need to:

- Earn at least the wage base limit each year

- Do that for 35 years

- Delay collecting benefits until age 70

Here’s a look at how the wage base has grown:

| Year | Wage Base Limit |

|---|---|

| 2023 | $160,200 |

| 2024 | $168,600 |

| 2025 | $176,100 |

This limit changes annually based on inflation and wage growth, so if you’re years from retirement, expect it to continue rising.

Why You Need 35 High-Earning Years?

Social Security is not based on your average lifetime income, but rather your 35 best years. If you only worked for 30 years or had several years of low income, those missing or low-income years are filled in as zeroes — which drags down your average.

For example:

- 30 years of high income + 5 years of zero income = lower AIME

- 35 years of high income = maximum AIME and maximum benefit

That’s why many near-retirees choose to work a few extra years, especially if they’re replacing earlier years of low earnings or gaps due to job changes, caregiving, or education.

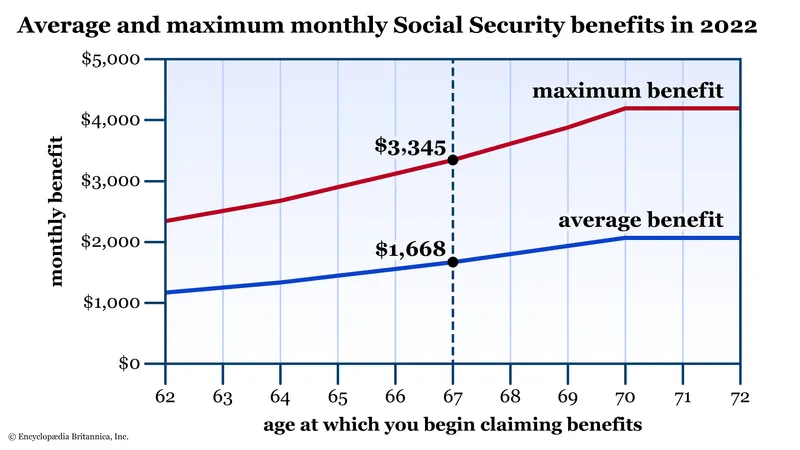

The Age You Claim Makes or Breaks It

Let’s talk strategy. Even if you earn the wage cap every year for 35 years, you will not receive the maximum benefit unless you wait until age 70 to claim.

Here’s the breakdown for 2025:

| Age You Claim | Maximum Monthly Benefit |

|---|---|

| 62 (earliest possible) | $2,831 |

| 67 (FRA) | $4,018 |

| 70 (maximum payout) | $5,108 |

Waiting past your full retirement age earns you delayed retirement credits — about 8% per year. That’s a 24%+ increase from age 67 to 70 alone.

Can You Still Qualify for the $5,108 Maximum Social Security Benefit If You Don’t Max Out Every Year?

Yes — sort of. You may still get a very high benefit, even if you don’t hit the wage cap for all 35 years.

For instance:

- If you hit the wage base for 25 years, and had 10 solid middle-income years, your benefit could still exceed $4,000/month at age 70.

- If you only earn the max for 15 years, your benefit could be around $3,500 to $3,800/month.

Every high-income year helps replace lower-earning years in your 35-year average. So while you might not hit the top, you can get close, and that’s worth striving for.

A Look at Real-Life Scenarios

Example 1: High-Earning Executive

- 40 years in corporate roles

- Always earned above the wage cap

- Delays claiming until 70

Result: Receives $5,108/month

Example 2: Small Business Owner

- Earns above $176,100, but only for 20 of 35 years

- Claims benefits at 67

Result: Receives around $4,200/month

Example 3: Teacher with Modest Income

- Earns $65,000/year for 35 years

- Claims at 62

Result: Receives approximately $1,800/month

Common Mistakes That Lower Your Social Security Check

Many retirees inadvertently reduce their benefits by:

- Claiming too early: Reduces your benefit by up to 30%.

- Working fewer than 35 years: Missing years count as zero.

- Failing to check SSA earnings record: Errors can lower your benefit.

- Not understanding spousal benefits: Married individuals may qualify for higher combined income using spousal strategies.

Taxes and Social Security: What to Know

While Social Security is not taxed at the federal level for low-income retirees, it can be taxed if your income exceeds certain thresholds.

For example:

- If your combined income (Social Security + other sources) is over $34,000 for individuals or $44,000 for couples, up to 85% of your benefits may be taxable.

How to Estimate Your Future Benefit?

Want to know where you stand?

Create a My Social Security account at SSA.gov to:

- Review your earnings history

- Get personalized benefit estimates

- Forecast different retirement scenarios

This tool is critical for planning. Errors on your earnings record could cost you thousands over time, so checking early and often is a smart move.

Final Checklist: Qualify for the Maximum Social Security Benefit

| Task | Completed? |

|---|---|

| Earned at least the wage base limit for 35 years | ⬜ |

| Created a MySSA.gov account and verified income | ⬜ |

| Waited until age 70 to claim | ⬜ |

| Avoided early filing penalties | ⬜ |

| Explored spousal benefits (if applicable) | ⬜ |

| Consulted a financial advisor for timing | ⬜ |

Recent Adjustment to Social Security Benefits Raises Questions- Check Details!

Social Security Projected to Cut Benefits by 2033, Affecting Retired Workers

Trump’s ‘Big Beautiful Bill’ Sparks Debate Over Social Security and Benefits