Thousands Missing Out on Extra DWP Support: Thousands of UK citizens are missing out on extra DWP support each year—often without realizing it. Whether you’re retired, disabled, a carer, or working on a low income, there may be financial help waiting for you. In this expanded guide, we’ll outline the available support, explain why so many miss out, and walk you through how to claim what’s rightfully yours—starting today. Lately, official figures show about £4.2 billion was underpaid over the past year—because eligible individuals didn’t apply or DWP errors delayed payments—including £870 million in underpaid PIP and £750 million in underpaid DLA. And another £22.7 billion in benefits was simply unclaimed—that’s life-changing support left unused.

Thousands Missing Out on Extra DWP Support

Here’s the bottom line: £4.2 billion in underpayments and £22.7 billion in unclaimed support are slipping through the cracks every year. But it doesn’t have to stay lost. With these six clear steps—check, apply, backdate, update, unlock extras, and get help—you can claim what’s yours and keep it smartly.

These aren’t just bits of money—they represent heating for your home, groceries for your household, travel for appointments, safety and dignity. If any part of the process feels overwhelming, remember: support is out there. You’ve already taken the first step by reading this.

| Topic | What’s Missed | Why It Matters |

|---|---|---|

| Unfulfilled eligibility | £22.7 billion in unclaimed support (Financial Year End 2024) | Extra income for struggling individuals and families |

| Pension Credit | £2.1 billion unclaimed; ~880k families missing out | Around £2,200 per year per family omitted |

| Underpayments (PIP/DLA) | £870 million (PIP), £750 million (DLA) | Vital living and mobility support delayed |

| PIP recipients (Apr ’25) | 3.7 million; 37% on highest rate; 2% increase since Jan 2025 | Demand is rising—awareness needs to follow |

| UC & Carer’s Support | £23 billion unclaimed across means-tested and social tariffs | Includes £8 billion Universal Credit, £2.3 billion Carer’s Allowance |

Why This Matters—and Why It’s Happening

Lack of Awareness and Stigma

Many people simply don’t know what they can claim. Even if you own a home or have a small private pension, you might still qualify for Guarantee Credit. Others fear applying—worried it’s too complicated or they might be judged.

Changes in Life Mean Changes in Benefits

Getting married, moving in with someone, changes in health or income—all these affect what you’re owed. If changes aren’t reported, support gets frozen or cut, leaving people worse off.

System Errors and Backlogs

The DWP has dealt with technical glitches and staffing shortages, slowing down PIP and DLA decisions. In 2023, only about 52% of PIP applications were processed within the standard 75 days. Errors alone caused an £870 million underpayment in PIP and £750 million in DLA.

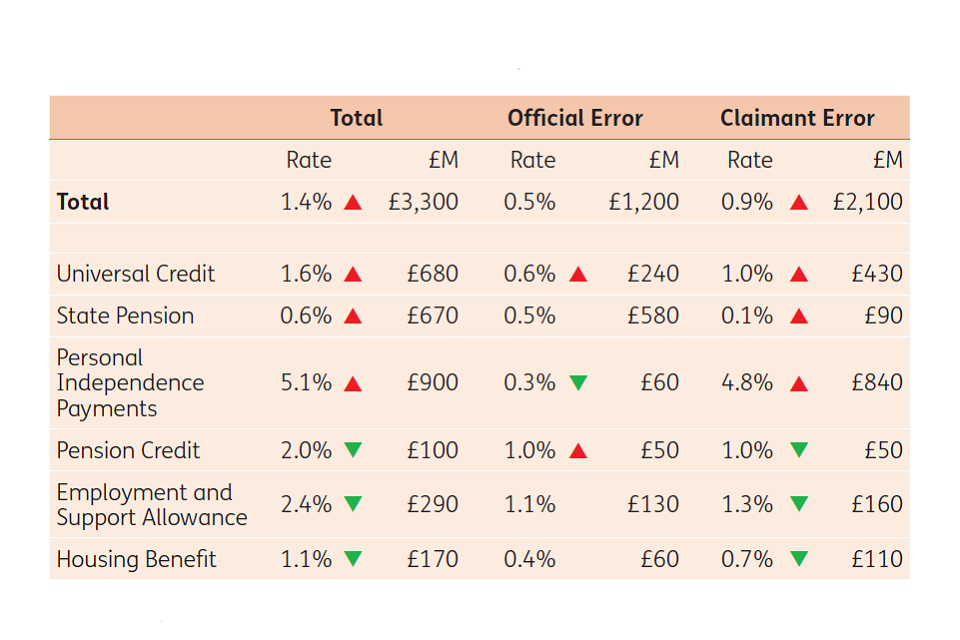

Fraud, Error, and Unintended Consequences

According to the National Audit Office, overpayments (fraud and error) totalled about £9.7 billion across DWP benefits in 2023–24—£6.5 billion from Universal Credit alone. But underpayments—money not given when due—are equally serious and totalled around £4.2 billion, especially affecting PIP and DLA claimants.

Step‑by‑Step Guide—Claim What Thousands Missing Out on Extra DWP Support

1. Discover What You Could Qualify For

- Are you above State Pension age? → Pension Credit, Pension Housing Benefit

- Do you have a disability or long-term health condition? → PIP, DLA, Employment and Support Allowance (ESA)

- Do you have a low income or dependent children? → Universal Credit, Child Benefit, Child Tax Credit

- Are you caring for someone else? → Carer’s Allowance and supplemental Universal Credit help

Use official GOV.UK benefit calculators for quick, accurate checks.

2. Check Eligibility—Even If You Doubt It

- Pension Credit doesn’t disqualify you based on owning a home or having savings. You may still get Guarantee Credit or Savings Credit.

- PIP acceptance rates are around 52%. If your condition impacts mobility or daily activities, don’t dismiss your chances.

3. Apply With Confidence

- Pension Credit: Apply online, by phone (0800 99 1234), or by post—just a 15-minute form.

- PIP/DLA/Universal Credit/Carer’s Allowance: Fill in DWP’s online forms or call their helplines.

- Always request backdating—claims can be backdated up to 3 months, or in some cases, longer.

4. Keep Your Details Updated

Any change in income, housing, health, or household should be reported immediately. This avoids the risk of losing benefits or facing recovery of overpayments.

5. Unlock Additional Support

Claiming one benefit often unlocks others:

- Warm Home Discount & Winter Fuel Payment

- Council Tax Reduction and Housing Support

- TV Licence Exemption for those on Pension Credit

- NHS Cost Help—free or reduced prescriptions, dental, eyesight

- Disability Equipment Grants and travel support

6. Get Expert Help

Local organizations—including Citizens Advice, Age UK, and Policy in Practice—specialize in helping people access benefits. They can guide you step-by-step through applications, appeals, and appeals for backdated adjustments.

Real-Life Success Stories

Linda’s Rescue from Fuel Insecurity

Linda, 79, lived alone in a modest home. She thought owning her house would disqualify her from Pension Credit. With help from Age UK, she discovered eligibility for the Guarantee Credit route, claiming an extra £4,500 a year. She also now receives Winter Fuel payments, freeing up her budget for food and bills.

Linda’s Testimony

“I never knew you could still qualify for help even if your home isn’t mortgaged,” she said. “That extra money meant I could actually heat my home this winter.”

James’s Small But Meaningful Boost

James, 48, recently diagnosed with multiple sclerosis, didn’t consider applying for PIP. After updating his DWP online journal, he was awarded support—enough to help pay for monthly travel and part-time care, adding around £180 each month to his budget.

Maria’s Family Top-Up

Maria, a single mum of two, worked part-time but still struggled with rent. A Universal Credit update she applied herself ended up securing an extra £250 monthly—enough to stabilize her finances and put some savings away.

UK’s Retirement System Faces Pressure—Why the Government May Need to Raise the Pension Age Again?

DWP Confirms Payment Update for 24 July— Check Who Could Be Affected

DWP’s Benefits U-Turn Shakes Up Expectations – Here’s Who’s Impacted Most

What Else You Can Do

- Stay informed: Keep an eye on GOV.UK updates related to eligibility, policy changes, and new benefit offerings.

- Encourage peer-to-peer help: Share what you learn with family, friends, and neighbours. Many applications happen because someone overheard the info.

- Follow local council outreach: Some councils now run targeted campaigns via GP surgeries or community centres to help people claim.

- Monitor errors closely: Underpayments happen often. If you spot anomalies in your statements, report them.