Thousands Could Be Owed £5,000 After Major DWP Payment Error: If you’ve ever applied for disability benefits or a state pension in the UK, you could be owed up to £5,000—or even more—by the Department for Work and Pensions (DWP) due to a major miscalculation in how payments were processed. And here’s the kicker: you don’t need to be a financial expert to find out if you’re affected.

In fact, this DWP blunder could mean over 600,000 people across the country are due back pay averaging £5,285, with some even pocketing £12,000 or more. Sounds wild, right? Well, it’s real—and if you’re one of the folks impacted, this might be the best news you’ve heard all year. Let’s break it all down so it makes sense, no matter if you’re just starting your benefits journey or you’re a seasoned social services pro.

Thousands Could Be Owed £5,000 After Major DWP Payment Error

If you’ve ever felt that something didn’t add up with your benefits—or you know someone who might fit into one of these categories—now’s the time to act. For many, this isn’t just about extra cash. It’s about justice, respect, and getting the support they were promised. Check your records. Ask questions. Get help if you need it. Because at the end of the day, you’ve earned it.

| Topic | Details |

|---|---|

| Who’s affected? | PIP claimants, legacy benefit claimants moved to Universal Credit, and State Pensioners with gaps in Home Responsibilities Protection (HRP) |

| Average payout | £5,285 (some as high as £12,000) |

| Error discovery date | Supreme Court ruling in 2019 (MM Judgment) and DWP reviews began in 2021 |

| Cases reviewed | Over 527,700 PIP cases reviewed; 105,600+ under review (as of July 2025) |

| Total estimated owed | £3 billion+ |

| Next steps | Contact DWP or check online eligibility tools |

| Official resource | DWP Gov.uk Official Website |

What’s the DWP Payment Error All About?

This isn’t just one mistake—it’s a combination of three major slip-ups, affecting hundreds of thousands of people. Each of these errors touches a different segment of the population, but the common thread is this: the government didn’t deliver on what people were legally entitled to.

1. Personal Independence Payment (PIP) Misjudgments

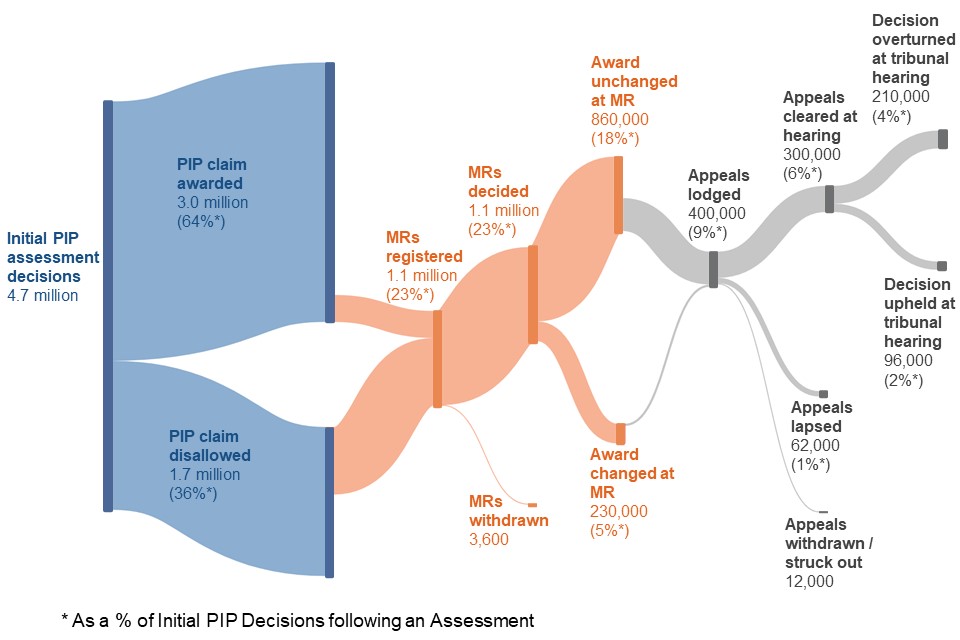

A major flaw was uncovered in how the DWP interpreted what counts as needing “social support.” This issue came to light following the MM Supreme Court ruling in 2019, which clarified that people with mental health conditions who required support when engaging socially or making decisions were being under-scored during their PIP assessments.

This meant many people received lower PIP awards or were outright rejected when they should have qualified for higher or full daily living components.

2. State Pension Underpayments: HRP Credit Gaps

From 1978 to 2010, parents who stayed home to care for children under age 12 were supposed to get Home Responsibilities Protection (HRP) added to their National Insurance (NI) records to protect their future pension.

The problem? For many claimants—mostly women—this wasn’t applied properly, especially when NI records weren’t automatically updated from child benefit data. According to government estimates, up to 200,000 people may be owed an average of £5,000 to £7,000.

3. Universal Credit Migration Gaps

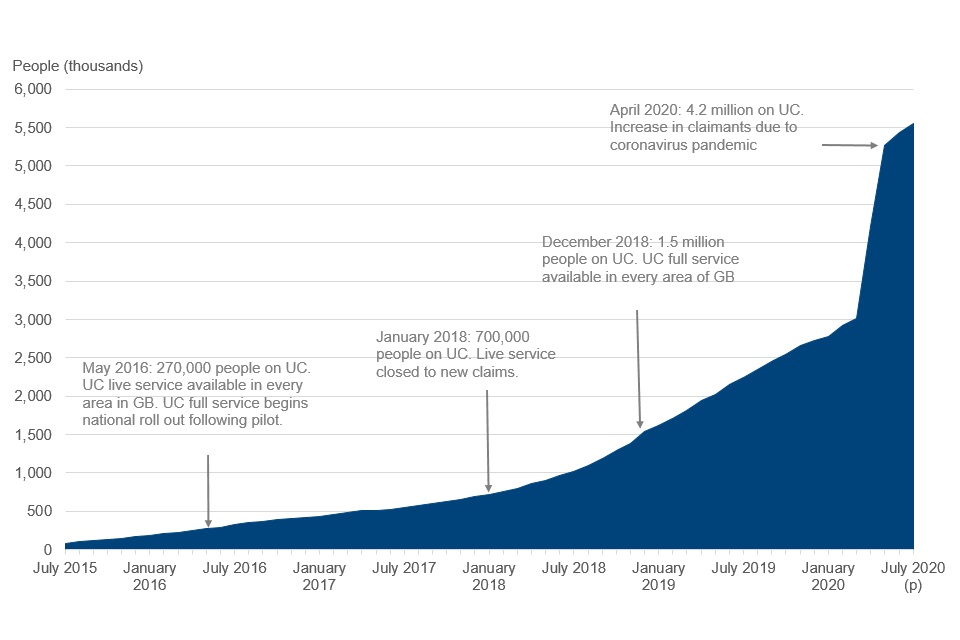

Before the DWP introduced “transitional protection” in 2019, thousands of people who moved from legacy benefits (such as Income Support, Disability Living Allowance, or Employment and Support Allowance) to Universal Credit lost vital components like the Severe Disability Premium (SDP).

Those who transitioned early—particularly in 2017 and 2018—missed out on support designed to help them manage their health and independence. Legal challenges forced the DWP to begin issuing back payments, and some claimants have received compensation exceeding £5,000.

Why This Matters — And Why It’s a Big Deal

This isn’t just about money. It’s about vulnerable people—those with disabilities, elderly pensioners, and low-income households—not getting what they’re legally entitled to. Many of them have been struggling for years while the DWP error quietly ate into their financial security.

Let’s break down the impact:

- Over 105,000 PIP cases are still under review

- Around 200,000 pensioners were underpaid due to HRP failures

- Roughly 15,000+ early UC migrants lost out on disability premiums

- Estimated repayments: £3 billion and rising

In other words, this isn’t a small glitch. It’s a systemic problem that’s affected one in every 100 UK citizens—and the fix is still ongoing.

How to Check If You’re One of the Thousands Could Be Owed £5,000 After Major DWP Payment Error — A Step-by-Step Guide

Step 1: Figure Out Which Category You Belong To

Ask yourself:

- Did you apply for PIP between 2016 and 2021?

- Did you care for children between 1978 and 2010 and now receive a State Pension?

- Were you moved to Universal Credit before January 2019?

If you answer “yes” to any of these, you might be eligible for a back payment.

Step 2: Use Official Resources

- For PIP Errors: Call the PIP helpline at 0800 121 4433 or use the mandatory reconsideration tool.

- For State Pension HRP Gaps: Use the NI record checker and compare with your pension estimate.

- For Universal Credit Disability Premium Losses: Contact Citizens Advice or visit DWP UC protection pages.

Step 3: Request a Mandatory Reconsideration or Appeal

If you believe you were affected:

- Send a written request for a mandatory reconsideration of your claim.

- If denied or delayed, escalate to a First-tier Tribunal. You don’t need a lawyer, and win rates are high—especially for PIP-related errors.

Step 4: Get Support From Professionals

You’re not alone. National and local organizations are ready to help:

- Turn2Us

- Age UK

- Scope

- MoneyHelper

These organizations can help you draft letters, understand what documents to submit, and stay on top of deadlines.

Real-Life Examples That Prove It’s Real

Example 1: Janine’s Missing HRP Credits

Janine, a retired nurse from Leeds, found out that she was shorted over £6,000 in her state pension. She had taken 12 years off work to raise her kids in the 80s and 90s—but her HRP credits weren’t recorded because her Child Benefit was under her husband’s name.

After calling HMRC and requesting a correction, her weekly pension went up by £38, and she received a lump sum worth years of underpaid entitlements.

Example 2: Marcus’s PIP Misjudgment

Marcus, 34, from Bristol, has been living with anxiety and PTSD since his late teens. When he applied for PIP in 2018, he was denied the daily living component because the assessor didn’t recognize his need for social support in public situations.

In 2022, he received a letter from DWP saying they were reviewing his claim. A few months later, he received £8,300 in back payments.

Tips for Professionals Supporting Affected Individuals

If you’re a caseworker, benefits advisor, or legal representative, here’s how you can help:

- Run data checks for older PIP claims (2016–2021)

- Educate clients on NI credit gaps if they raised children before 2010

- Track clients who lost premiums when migrating to Universal Credit before 2019

- Use Rightsnet or Benefits and Work for current case law and decision guides

Consider organizing:

- Local benefits audit drop-ins

- Free NI record workshops

- Info sessions at community centers and libraries

Government Response and Future Updates

The DWP has acknowledged the errors and allocated additional resources to deal with the backlog. Here are their main actions so far:

- Launched a PIP correction exercise in 2021, still ongoing in 2025

- Introduced automated NI correction tools in 2023 for HRP errors

- Offered one-off compensation and transitional protection for early UC migrants

They expect most cases to be reviewed or resolved by March 2027.

But watchdog groups and charities are pushing for independent oversight, arguing that the DWP has been too slow and opaque.

UK’s Retirement System Faces Pressure—Why the Government May Need to Raise the Pension Age Again?

DWP Lowers Estimated Reimbursements for Unpaid UK State Pensions in New Forecast

UK Revives Pensions Commission Amid Savings Crisis — What It Means for Your Retirement