Think Social Security Cuts Are Bad: If you’ve been keeping an eye on your retirement plans, you might’ve heard the buzz: Social Security cuts are coming. But here’s the kicker—the proposed fixes might sting even more. From hiking taxes to raising the retirement age, none of these solutions come without trade-offs. And while that might sound like just another political football, it could affect your wallet way sooner than you think. Let’s break it down in plain English, so everyone from grandma to your 10-year-old niece can understand exactly what’s going on—and what you can do to protect your future.

Think Social Security Cuts Are Bad

Yeah, Social Security’s got problems—but the fixes aren’t easy either. Whether it’s higher taxes, delayed retirement, or trimmed-down benefits, the road ahead is bumpy. The smartest move? Get informed, get involved, and start stacking up your own savings. Nobody likes talking about cuts, but pretending they won’t happen? That’s the real danger. Let’s be real, face the facts, and prepare like pros.

| Topic | Details |

|---|---|

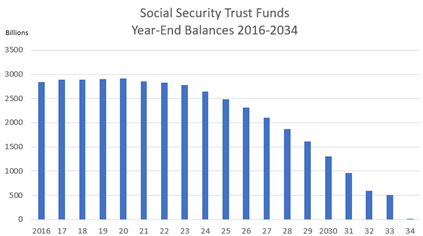

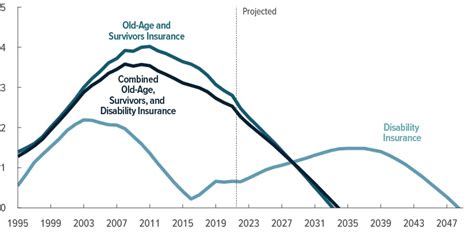

| Projected Insolvency Date | 2033 (SSA Official Site) |

| Benefit Cut Risk | Up to 23% across the board |

| Primary Causes | Aging population, tax policy changes, longer life expectancy |

| Fix Options | Tax increases, benefit cuts, raising retirement age |

| Most Balanced Plan | Bipartisan mix of gradual tax hikes + modest benefit adjustments |

How Did We Get Here? A Little History Lesson

Social Security was born in 1935, during the Great Depression, when Americans desperately needed a safety net. Originally, there were about 42 workers for every retiree. Fast forward to today, that number has dropped to less than 3 workers per retiree. Why? Simple: people are living longer, having fewer kids, and retiring in bigger numbers.

Back in 1983, lawmakers made a big move to rescue the system—raising the retirement age and increasing payroll taxes. It bought us time, but now we’re back at the edge of the cliff. And the options today are even tougher.

How Social Security Is Funded?

Here’s the quick version: Social Security is a pay-as-you-go program. That means today’s workers pay into the system through payroll taxes, and that money goes out almost immediately to pay current retirees.

- 12.4% total payroll tax (split 6.2% between employee and employer)

- Only income up to $168,600 (as of 2024) is taxed for Social Security

- The excess went into the trust fund—but that’s running out by 2033

Once that trust fund is gone, there won’t be enough coming in each year to cover full benefits. That’s why experts say action needs to happen now, not later.

Why Are Cuts on the Table?

Fewer workers = less payroll tax money coming in. More retirees = more money going out.

It’s basic math. But instead of solving it with one big decision, policymakers are floating a bunch of different fixes—most of which come with consequences that Americans may not be ready for.

The So-Called “Fixes” (And Why They Might Be Worse)

Raising Payroll Taxes

Right now, you and your employer each pay 6.2%. A popular fix is bumping that up gradually to 7.4%, or even higher. That would help fill about half the funding gap over the next 75 years.

But higher taxes mean smaller take-home pay for workers, and higher labor costs for businesses. Small businesses, in particular, could feel the pinch.

Cutting Benefits

Across-the-board benefit cuts of 17% to 23% are what would happen automatically if no reforms are passed by 2033. That’s the “do nothing” option, and it hits everyone.

Some also suggest means-testing: reducing benefits for wealthier retirees. While that might seem fair, it could discourage people from saving or working later in life.

Raising the Retirement Age

Pushing full retirement age to 70 is another fix. It may make sense on paper—after all, people are living longer. But in practice, not everyone can keep working that long, especially in physically demanding jobs.

According to the Congressional Budget Office, this fix could reduce the funding gap by up to 50%, but it would disproportionately hurt blue-collar workers and people with chronic health issues.

Switching to Flat Benefits

Another idea floated by the CBO is giving everyone the same monthly check, around $1,660. That simplifies the system, but it wipes out the link between what you earn and what you get back.

For high earners who’ve paid more into the system, this feels like a raw deal. And politically, it’s a hard sell.

The Most Balanced Path Forward

Most experts, including those at the Brookings Institution, GAO, and AARP, agree that a balanced solution is the only realistic one. That means:

- Gradually increasing the payroll tax

- Raising or removing the income cap on taxable wages

- Slowing the growth of future benefits (not cutting current ones)

- Increasing the full retirement age for higher-income workers

- Expanding coverage to include gig and freelance workers

This combo spreads the pain out more evenly, protects lower-income retirees, and keeps the system solvent for future generations.

What You Can Do Right Now If You Think Social Security Cuts Are Bad?

Don’t Panic—but Be Proactive

Social Security isn’t disappearing. But it might not be as generous when you retire. Start planning with the assumption that you’ll need to supplement your benefits.

Max Out Retirement Contributions

Take advantage of retirement savings options like 401(k)s, IRAs, and HSAs. Compound interest is your best friend.

Delay Claiming if You Can

If you wait until age 70 to start collecting Social Security, your monthly check could be over 30% larger than if you start at 62.

Diversify Your Income Streams

Consider rental properties, side hustles, or freelance work. The more sources of income you have, the less vulnerable you are to policy changes.

Stay Informed and Engaged

Policy debates will heat up as the 2033 deadline approaches. Staying informed will help you plan and advocate for the changes that make the most sense.

Real-World Example

Take John, a 45-year-old HVAC technician in Texas. He’s been paying into Social Security since he was 18. If cuts happen, his expected $2,200 monthly benefit might drop to around $1,700.

That’s a huge blow. But John’s been maxing out his Roth IRA, contributing to his company 401(k), and plans to work until at least 68. He’s got options—and that’s the key.

Trump’s New Tax Bill Could Reshape How Social Security Benefits Are Taxed

Social Security Sends Out Urgent Email Over Trump Tax Bill Confusion – Check Details!

How Social Security Taxes Could Be Impacting Your Retirement Income Today? Check Details!