These 7 Retirement Moves Could Save You Thousands: If you’re in your 40s, you’re standing at a financial crossroads. Retirement might seem like a distant finish line, but trust me—what you do right now matters more than ever. This is the decade when your earnings are likely at their peak, your expenses are juggling between family and lifestyle, and your window for compound growth is still open—but just barely. You might be thinking, “Isn’t it too late to make a big dent?” Not at all. Your 40s are the prime time to clean up your money game, invest smarter, and dodge future regrets. With just a few sharp moves, you could save yourself thousands—if not hundreds of thousands—come retirement.

These 7 Retirement Moves Could Save You Thousands

Your 40s are your financial power decade. You’ve got experience, earning potential, and time—but not enough to waste. By making smart, strategic moves now, you can build a retirement that isn’t just about surviving—but thriving. Even if you feel behind, there’s time to catch up. Small changes lead to big outcomes when you stay consistent.

| Strategy | What It Does | Key Data | Source/Link |

|---|---|---|---|

| Max Out 401(k) & Roth IRAs | Builds tax-advantaged retirement savings | $23,500 401(k) limit for 2025 | IRS.gov |

| Project Future Expenses | Sets accurate savings targets | Retirees typically need 80-90% of pre-retirement income | Fidelity |

| Use Roth Conversions or Backdoor Roth | Enables tax-free growth for high earners | Roth IRA phase-out starts at $144,000 income | Investopedia |

| Invest Tax-Efficiently | Minimizes taxable investment income | ETFs, municipal bonds, and tax-managed funds recommended | Morningstar |

| Prioritize Health Spending | Helps avoid massive retirement health expenses | $315,000+ is the average healthcare cost for a retired couple | Fidelity |

| Lock Down an Estate Plan | Protects assets and ensures your wishes are followed | Only 33% of Americans have an estate plan | Caring.com |

| Define Retirement Vision | Clarifies goals, guiding investment and savings | Goal-aligned savers have higher success and satisfaction in retirement | Vanguard |

Why Your 40s Are Critical for Retirement Planning?

By the time you hit your 40s, life feels real. You’re likely juggling career advancements, mortgage payments, child-rearing, or even caring for aging parents. Retirement may not seem urgent when your to-do list is stacked with more immediate responsibilities.

But here’s the hard truth: the choices you make in your 40s have a disproportionate impact on your retirement outcomes. According to the U.S. Department of Labor, the average American retires with less than $200,000 in savings. Yet experts estimate that most people need at least $1.5 to $2 million to retire comfortably.

You’ve still got a runway, but it’s time to take off.

These 7 Retirement Moves Could Save You Thousands

1. Max Out Your Retirement Accounts

If your job offers a 401(k), 403(b), or TSP, make it your financial priority. In 2025, the contribution limit is $23,500, not including employer matching.

If you’re self-employed, open a Solo 401(k) or SEP IRA to dramatically boost your savings. Have a Roth IRA? Great—but remember, if your modified AGI exceeds $144,000, you can’t contribute directly. That’s where the backdoor Roth strategy comes in: contribute to a traditional IRA, then convert it to Roth.

Saving 20% of your income toward retirement in your 40s can have a massive impact over the next two decades. Let’s break it down:

- Saving $1,500/month from age 42 to 62 = $565,000 (with 7% annual return)

- Add employer match and Roth growth = Over $800,000 potential by retirement

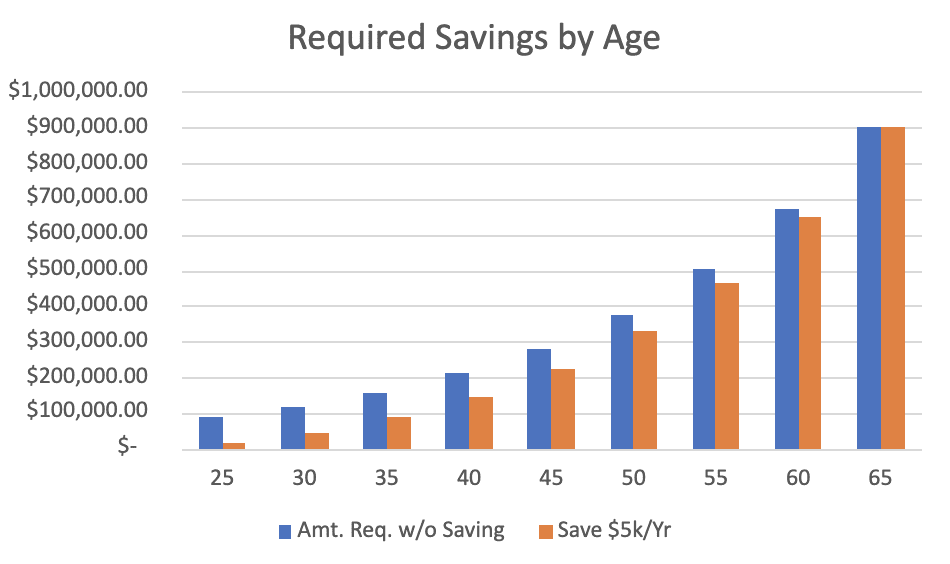

2. Estimate Your Future Needs—Realistically

A common mistake? Underestimating how much you’ll spend in retirement. Most financial planners recommend replacing 80% to 90% of your current income.

Use a retirement calculator (like Fidelity’s or NerdWallet’s) and plug in:

- Your current savings

- Annual contributions

- Expected Social Security benefits

- Planned retirement age

Also account for:

- Inflation (3-4% annually)

- Healthcare

- Travel, hobbies, and unexpected costs

Build a retirement budget based on lifestyle—not just survival. Think “how I want to live,” not “what I need to scrape by.”

3. Use Roth Conversions to Reduce Taxes Later

Here’s a tax-saving move few people think about: Roth conversions.

In your 40s, especially if you have a low-income year or you’re between jobs, consider converting traditional IRA or 401(k) funds into a Roth IRA. You’ll pay taxes now—but future growth and withdrawals are 100% tax-free.

This is a solid hedge against:

- Future tax rate increases

- Required Minimum Distributions (RMDs) starting at age 73

- Losing tax flexibility in retirement

Pro tip: Work with a CPA or financial advisor to avoid getting pushed into a higher tax bracket when converting.

4. Invest With Tax Efficiency in Mind

Many people focus only on “how much to invest” but ignore “where and how” they invest.

Here’s how to do it smart:

- Place bonds and REITs in tax-deferred accounts (like IRAs)

- Place index funds, ETFs, and muni bonds in taxable accounts

- Use tax-loss harvesting to offset capital gains

- Avoid active mutual funds in taxable accounts—they’re tax-inefficient

Platforms like Empower, Wealthfront, or Betterment can automate tax optimization for you.

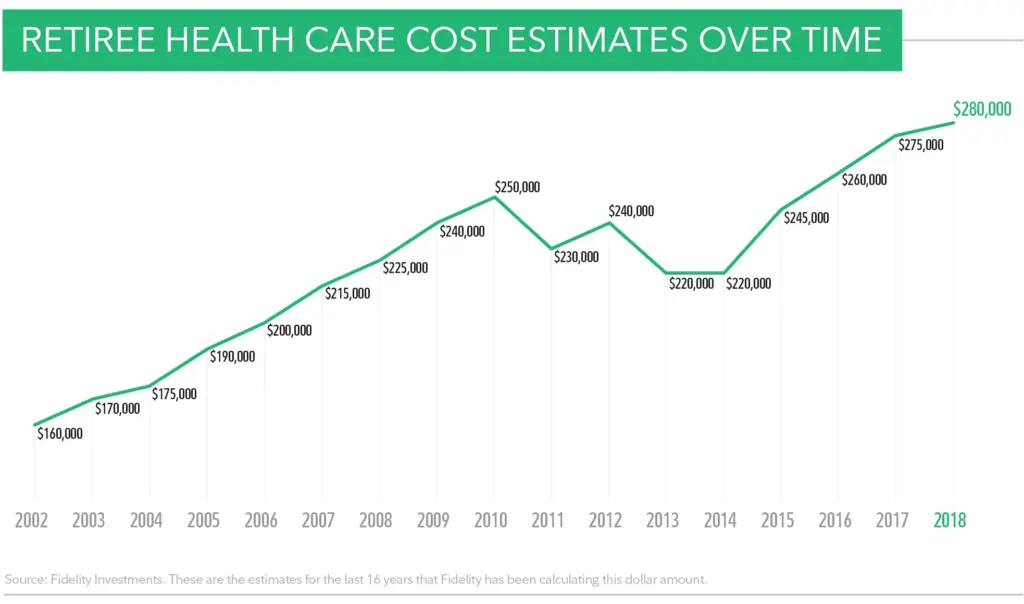

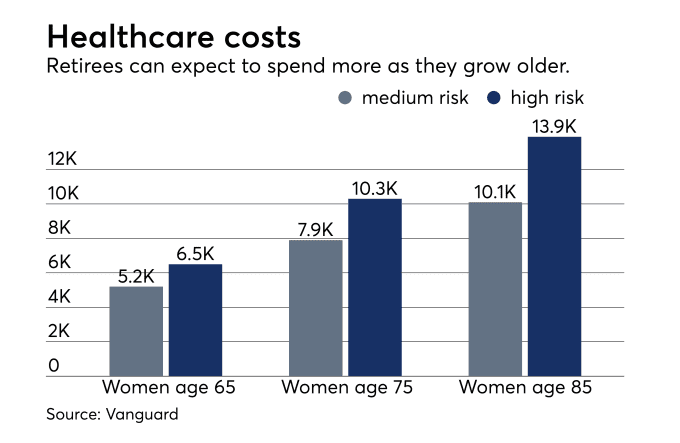

5. Prioritize Health and Open an HSA

Healthcare will likely be your biggest retirement expense. A Fidelity study estimates a 65-year-old couple today will need $315,000 just for healthcare.

Start preparing now by:

- Opening a Health Savings Account (HSA) if you’re enrolled in a high-deductible health plan

- Max contribution (2025): $4,300 individual / $8,600 family

- Invest your HSA like a retirement account (tax-free growth AND withdrawals for qualified expenses)

Also focus on lifestyle health changes—maintaining a healthy weight, exercising, and avoiding chronic conditions can literally save you six figures in retirement.

6. Solidify Your Estate Plan

In your 40s, it’s no longer just about you. You may have kids, assets, and real responsibilities. That’s why you need a basic estate plan, even if you’re not “rich.”

Must-haves:

- Will

- Durable Power of Attorney

- Healthcare Directive

- Beneficiary Designations (on retirement accounts and life insurance)

Without a plan, your loved ones may end up in probate or facing avoidable taxes. Consider creating a living trust if your estate exceeds $1 million or involves multiple properties.

Digital platforms like Trust & Will or LegalZoom offer easy, affordable estate plans.

7. Clarify Your Retirement Vision

Not all retirements are the same. Some folks want to golf in Florida. Others want to live in a van and tour national parks. Your dream impacts how much you need to save.

Questions to ask yourself:

- Will you move or downsize?

- Do you plan to work part-time or freelance?

- What hobbies, travel, or bucket-list items are must-dos?

Write down your answers. This isn’t fluff—it gives clarity to your saving and investing goals.

Real-Life Case Study: “Jason & Dana Turn It Around at 46”

Jason and Dana, both 46, had only $95,000 saved across a 401(k) and Roth IRA. With two teens, debt, and limited savings, they thought they’d never retire comfortably.

But after working with a financial advisor, they:

- Paid off $15,000 in credit cards

- Upped their retirement savings to 20% of income

- Switched to low-fee index funds

- Opened an HSA and invested it

Six years later, they’ve crossed $420,000 in retirement savings and are on track to retire by 65.

Common Mistakes to Avoid in Your 40s

- Waiting too long to start: You’re not too late, but you’re not early either.

- Not reviewing your investment mix: Too conservative = slow growth. Too aggressive = risky.

- Lifestyle creep: More income doesn’t mean more spending.

- Neglecting insurance: Life, disability, and umbrella insurance are essential for risk management.

Tools and Resources to Help You

| Tool | Purpose |

|---|---|

| Empower (formerly Personal Capital) | Net worth and retirement tracking |

| YNAB (You Need A Budget) | Budgeting & cash flow management |

| Vanguard / Fidelity / Schwab | Low-fee investing |

| Trust & Will | Online estate planning |

| NerdWallet / SmartAsset Calculators | Planning & tax calculators |

Gen Z Is Saving for Retirement Early, But Employers May Be Falling Behind

New Report Reveals Britons May Need £300k in Retirement Savings to Match State Pension

Waze Co-Founder Shares Candid Retirement Advice After Years of Entrepreneurship

Retirement Checklist for Your 40s

- Max out 401(k) and IRAs

- Open and invest in HSA

- Review estate planning documents

- Rebalance investment portfolio annually

- Check life and disability insurance

- Define your retirement lifestyle

- Project future expenses

- Explore Roth conversions

- Automate monthly contributions