These 5 Money Mistakes Could Delay Your Retirement by Years: Let’s get real for a second: retirement isn’t just about kicking back and sipping lemonade on a beach. It’s about having the freedom to choose how you want to spend your golden years — without stressing about bills, healthcare, or running out of money. But here’s the kicker: a lot of folks in the U.S. are unknowingly making money mistakes that could delay retirement by years. And we’re not just talking one or two years — we’re talking five, ten, or even more. Whether you’re just starting your career or you’re in your 50s and feeling the heat, this article will break it down in plain, clear language. We’ll look at the biggest retirement planning blunders, the data, and most importantly, how to fix them. Stick around — this could save you thousands and bring you years closer to the retirement lifestyle you want.

These 5 Money Mistakes Could Delay Your Retirement by Years

There’s no shame in making mistakes — but letting them slide can cost you precious retirement years. The good news? You don’t have to be a financial genius to course-correct. Whether it’s starting too late, claiming Social Security early, ignoring taxes, or underestimating healthcare, every mistake on this list has a solution. The key is awareness, action, and consistency. You’ve worked hard — you deserve to retire on your terms, with freedom and peace of mind. Start now, and your future self will thank you.

| Topic | Details |

|---|---|

| Main Focus | 5 major money mistakes delaying retirement |

| Average Retirement Age in the U.S. | 64 years (U.S. Census Bureau, 2023) |

| Ideal Retirement Savings | 10x your annual salary by age 67 (Fidelity Investments) |

| Top Mistake | Starting savings too late |

| Healthcare Costs in Retirement | $315,000 for the average couple (Fidelity, 2023) |

| Helpful Tool | SSA Retirement Estimator |

| Official Guidance | U.S. Department of Labor Retirement Toolkit |

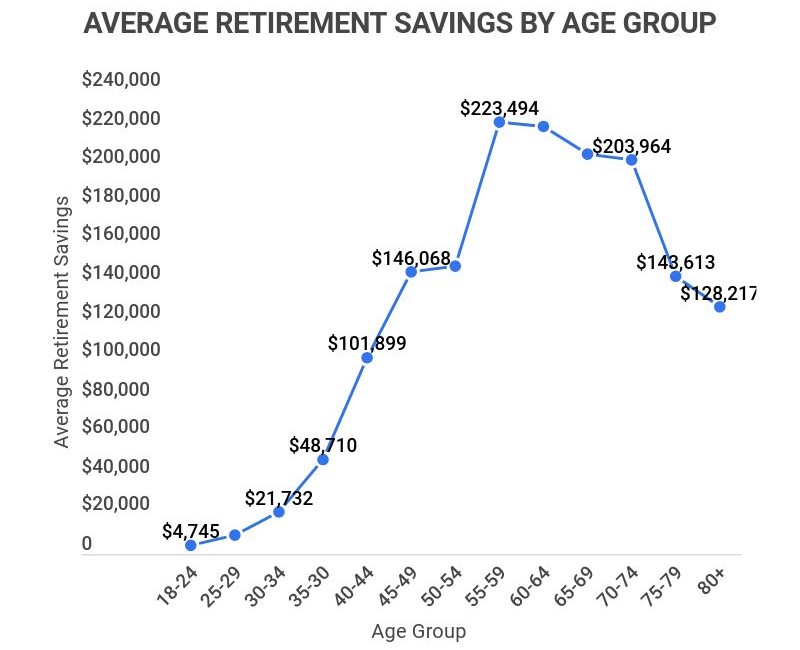

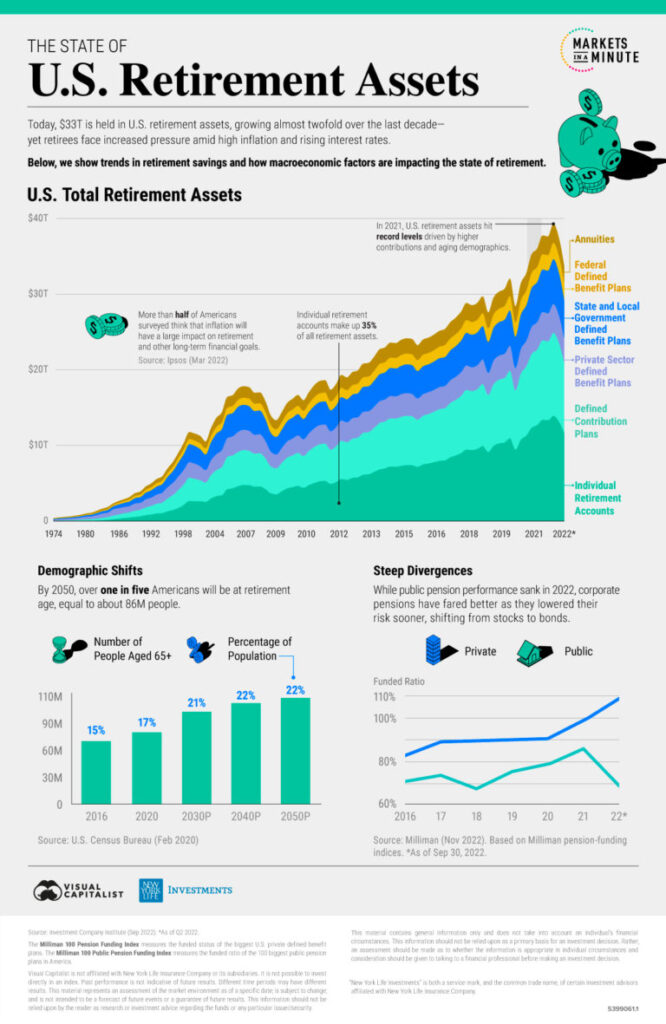

Mistake #1 – Waiting Too Long to Start Saving

The biggest and most common mistake is putting off retirement saving. Life gets expensive fast — student loans, housing, kids — and many Americans believe they’ll have time to “catch up” later. Unfortunately, that approach often backfires.

Example:

If you start saving $200/month at age 25 with a 7% annual return, you’ll have over $500,000 by 65. Wait until 40 to start the same contribution? You might have only $150,000.

The power of compound interest means that the earlier you start, the more your money grows on its own.

Additional Insight:

A 2023 GoBankingRates survey found that 42% of Americans have less than $10,000 saved for retirement. That’s a scary number, considering how long retirement can last — often 25 to 30 years or more.

Action Tip: Automate your savings. Start with 1% of your income and increase it every year. Use employer-sponsored plans like 401(k)s, especially if they offer matching contributions — that’s free money.

Mistake #2 – Claiming Social Security Too Early

Many people claim Social Security at the first chance — age 62 — but doing so could permanently reduce your monthly benefit by up to 30% compared to waiting until your full retirement age (usually 66 or 67). And if you wait until age 70, your benefits increase by 8% annually.

Example Breakdown:

- Claim at 62: $1,200/month

- Claim at 67: $1,800/month

- Claim at 70: $2,376/month

That’s a $1,176/month difference — for life.

Waiting until age 70 may not work for everyone, especially if health or financial need is a factor. But for those who can wait, it significantly improves long-term income stability.

Action Tip: Use the Social Security Administration Retirement Estimator to compare your options and optimize your benefit timing.

Mistake #3 – Playing It Too Safe or Too Risky

Finding the right balance in your investment strategy is tricky. Some folks stash all their money in savings accounts or CDs, which barely beat inflation. Others go all-in on risky stocks and hope for the best.

The right strategy lies somewhere in the middle and evolves with age. Young investors can handle more risk. Older adults need to focus more on preservation and income.

Suggested Asset Allocation:

- 20s–30s: 80% stocks / 20% bonds

- 40s–50s: 70% stocks / 30% bonds

- 60s+: 50% stocks / 50% bonds or more conservative

Action Tip: Rebalance your portfolio once a year. Consider target-date funds or use tools from trusted providers like Vanguard, Schwab, or Fidelity to align your investments with your timeline.

Mistake #4 – Ignoring Taxes and Required Minimum Distributions (RMDs)

Many pre-retirees forget to factor in taxes on retirement income. Distributions from 401(k)s and traditional IRAs are taxed as ordinary income. When you turn 73 (as of 2023), you must begin taking Required Minimum Distributions (RMDs) — and if you miss them, the penalty is steep: up to 25% of the amount you failed to withdraw.

Example:

If your RMD is $10,000 and you forget to take it, you could owe a $2,500 penalty, on top of income taxes.

Action Tip: Consider Roth conversions during low-income years. Work with a CPA or financial planner to minimize your lifetime tax burden.

Mistake #5 – Underestimating Health and Long-Term Care Costs

Healthcare is one of the most overlooked (and expensive) aspects of retirement. A 2023 Fidelity report estimates that the average 65-year-old couple will need $315,000 just for medical expenses over their retirement — and that doesn’t include long-term care, which can easily cost $100,000 or more annually.

What Medicare Doesn’t Cover:

- Dental

- Vision

- Hearing aids

- Long-term custodial care

Action Tip: Start an HSA (Health Savings Account) if eligible. The money grows tax-free and can be used for medical expenses. Also, consider long-term care insurance or hybrid life/long-term care policies.

Bonus Mistake #6 – Not Having a Written Retirement Plan

You wouldn’t build a house without a blueprint. So why retire without a detailed plan?

Many people guess their expenses or use overly optimistic assumptions about returns and lifespan. A written retirement plan helps you anticipate shortfalls, track progress, and make course corrections.

Components of a Retirement Plan:

- Projected expenses by category

- Expected income sources (Social Security, pensions, savings)

- Investment strategy and timeline

- Healthcare planning

- Withdrawal strategy

Action Tip: Sit down with a Certified Financial Planner (CFP) and review your plan at least once a year or after major life changes.

Step-by-Step Guide to Avoid These 5 Money Mistakes Could Delay Your Retirement by Years

- Calculate Your Retirement Number

Use tools like the SmartAsset Retirement Calculator to estimate how much you need based on lifestyle and location. - Audit Your Current Budget

Track expenses for a month. Identify needs vs. wants and redirect some discretionary spending toward retirement. - Increase Contributions Gradually

Boost your 401(k) or IRA contributions by 1% each year. Use catch-up contributions after age 50. - Diversify Income Sources

Don’t rely solely on Social Security. Consider rental income, part-time work, dividends, or annuities. - Plan for Taxes

Work with a tax pro to determine how to pull money from taxable, tax-deferred, and tax-free accounts efficiently. - Build a Healthcare Safety Net

Estimate Medicare premiums, supplemental insurance, and out-of-pocket expenses. Budget accordingly. - Review and Update Annually

Retirement planning isn’t a one-and-done task. Schedule a yearly financial checkup with a professional.

Expert Offers Guidance for Couples Planning Retirement With Limited Savings

Waze Co-Founder Shares Candid Retirement Advice After Years of Entrepreneurship

Millennial Who Achieved Early Retirement Reveals Harsh Truth About FIRE Lifestyle