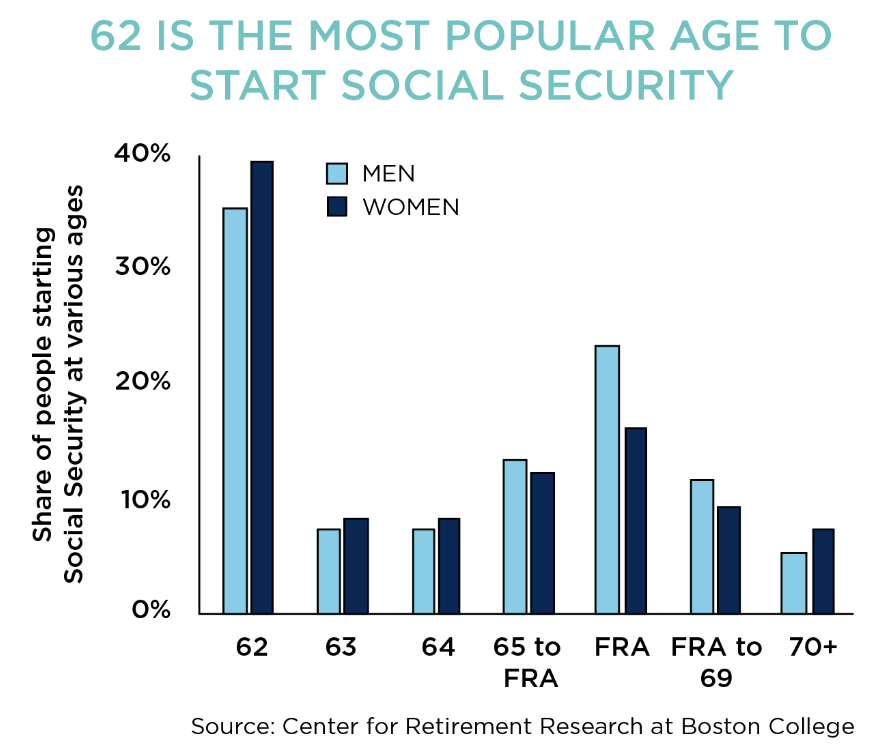

Social Security Bridge Strategy: Planning for retirement is a journey, not a destination. For many, Social Security becomes an essential part of that plan. However, the way you claim your Social Security benefits can make a huge difference in how much you’ll receive over your lifetime. One strategy that has gained traction in recent years is the Social Security Bridge Strategy. This approach can help you delay claiming Social Security until you’re 70, allowing you to maximize your monthly benefit. If you’re serious about planning for your retirement, understanding this strategy could make all the difference.In this article, we’ll dive deep into the Social Security Bridge Strategy. We’ll explain how it works, when to consider using it, and provide step-by-step guidance on how to implement it. Whether you’re just starting to think about retirement or you’re already well into the planning phase, this strategy can help you secure a more comfortable future.

Social Security Bridge Strategy

The Social Security Bridge Strategy can be a powerful tool for maximizing your retirement income, but it requires careful planning and consideration. By delaying Social Security until age 70, you can significantly increase your monthly payout, providing greater financial security for the future. However, make sure you have enough savings to cover living expenses during the delay, and consider your health and tax implications before deciding to use this strategy. If you’re unsure, it’s always a good idea to consult with a financial advisor to tailor the plan to your individual needs.

| Key Takeaways | Data & Stats | Resources & References |

|---|---|---|

| What is the Social Security Bridge Strategy? | Delay Social Security until age 70 to increase monthly payments. | Social Security Administration |

| How much can you increase your benefits? | Benefits increase by approximately 8% for each year you delay. | AARP – Social Security Delaying |

| When should you consider this strategy? | If you have sufficient savings to bridge the gap before age 70. | |

| Pros of the strategy | Boosts lifetime income and lowers the risk of outliving savings. | |

| Things to consider | Sufficient savings, tax implications, and health risks. |

What Is the Social Security Bridge Strategy?

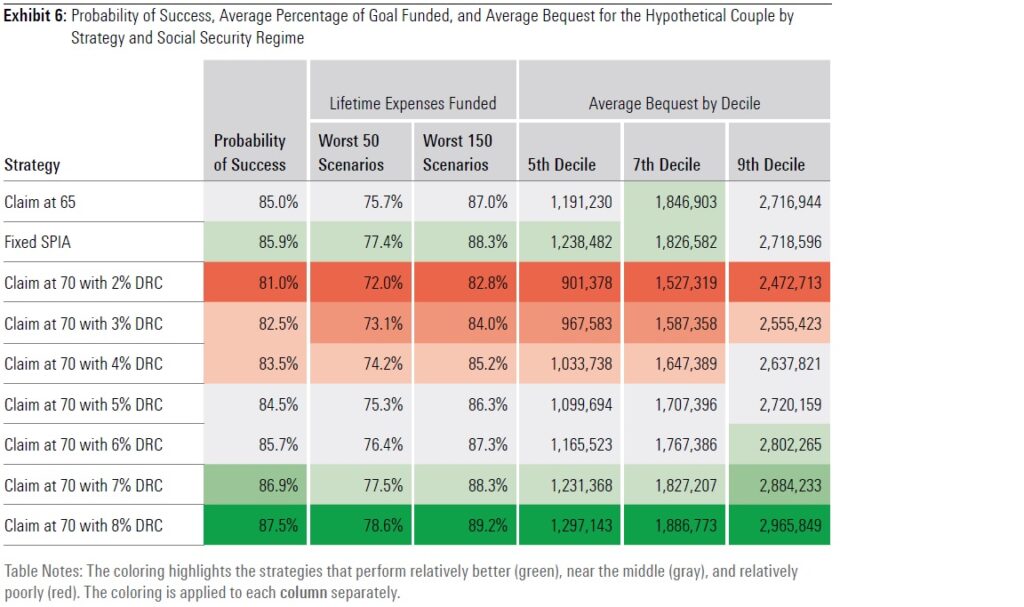

The Social Security Bridge Strategy is a financial technique designed to help you delay claiming Social Security benefits. Essentially, you can use your personal savings or retirement accounts (like a 401(k) or IRA) to cover living expenses until you turn 70. This allows your Social Security benefits to grow at an 8% annual rate (for each year you delay claiming), maximizing your monthly payout.

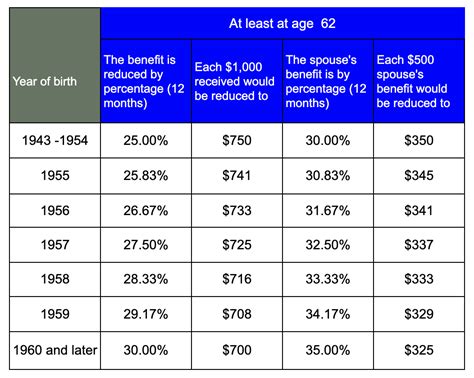

Now, if you’re wondering why it’s a good idea to wait until 70 to claim, here’s why: Social Security benefits grow significantly the longer you wait to claim them—up to age 70. The government increases your benefit by approximately 8% per year for each year after your Full Retirement Age (FRA) and until you reach 70.

Let’s break it down: Suppose your monthly Social Security benefit at your FRA (usually age 66 or 67) is $2,000. If you wait until 70 to claim, your monthly benefit would rise to $2,480—that’s $480 extra per month! And, this increase lasts for the rest of your life, plus it’s adjusted for inflation.

The Benefits of the Social Security Bridge Strategy

While waiting to claim Social Security can be tempting, it’s not always an easy choice. You’ll need enough savings to cover your living expenses in the meantime. However, if you can pull it off, here are some major benefits of the Social Security Bridge Strategy:

1. Increased Lifetime Benefits

One of the biggest advantages of delaying Social Security is the higher monthly payout you’ll receive once you start collecting benefits. That 8% increase per year is significant. Over time, those additional funds can make a huge difference in your quality of life, especially during your later years when expenses might increase, and healthcare needs become more prominent.

2. Tax Planning Opportunities

Strategic withdrawals from your retirement accounts can help you manage your taxes better. If you withdraw funds during years when your taxable income is lower, you could potentially reduce your overall tax burden. This makes it easier to delay Social Security while minimizing taxes on both your retirement accounts and the benefits you’ll eventually claim.

3. Financial Security for the Future

By delaying Social Security, you are securing a higher guaranteed income for the rest of your life. This approach is especially helpful if you live longer than expected, as the higher monthly benefit could be a financial lifesaver.

How Does the Social Security Bridge Strategy Work?

Let’s walk through an example of how the Social Security Bridge Strategy can work in practice.

Example: A Step-by-Step Breakdown

Suppose your Full Retirement Age is 66, and your expected monthly Social Security benefit at FRA is $2,000. Here’s what happens when you implement the Social Security Bridge Strategy:

- Step 1: Withdraw from your retirement savings

You decide to retire at 66 but don’t want to start Social Security yet. You have enough in your 401(k) or IRA to cover living expenses. So, you start drawing $2,000 per month from your retirement savings. This money is used to cover your living expenses until you’re ready to start claiming Social Security. - Step 2: Delay Social Security

By the time you turn 70, you’ve used $72,000 in total from your retirement accounts to cover the gap (4 years x $2,000/month). At age 70, you’re ready to claim Social Security. - Step 3: Enjoy a higher monthly payout

Now that you’re 70, your monthly Social Security benefit jumps to $2,480 (thanks to the 8% annual growth). That’s an extra $480 per month, and this benefit will continue for the rest of your life, adjusted for inflation.

By taking this approach, you’re ensuring a larger lifetime income while using your existing retirement savings to bridge the gap.

Considerations Before Implementing the Strategy

While the Social Security Bridge Strategy can be highly beneficial, it’s not for everyone. There are a few key factors to consider before jumping in.

1. Sufficient Savings

Do you have enough savings in your retirement accounts (such as a 401(k) or IRA) to cover your expenses for several years? This is the big question. If you don’t, it could be tough to delay Social Security. Without enough savings, you might have to start Social Security earlier than 70, which would reduce the potential benefits.

2. Health and Longevity

Your health and family history of longevity are crucial factors in determining whether delaying Social Security is right for you. If your health is already declining or your family tends to have shorter lifespans, you might want to reconsider waiting until 70 to claim benefits. On the flip side, if you’re in good health and expect to live a long life, delaying Social Security could be a good move.

3. Market Conditions

The performance of your investment accounts can impact how much you’ll need to withdraw to cover your expenses. If the stock market is down, your retirement savings might not stretch as far as you’d hoped. If this happens, you might need to adjust your strategy, either by reducing withdrawals or starting Social Security earlier than planned.

4. Tax Implications

Withdrawing from retirement accounts often means paying taxes. If you’re in a higher tax bracket, the withdrawals could be taxed at a higher rate. Make sure to account for these taxes when planning your withdrawals, as they could reduce the funds available to bridge the gap before Social Security kicks in.

Social Security Projected to Cut Benefits by 2033, Affecting Retired Workers

Trump’s ‘Big Beautiful Bill’ Sparks Debate Over Social Security and Benefits

$5,108 Social Security Checks Arrive in July—Here’s Who Qualifies