Teachers and Firefighters Get Surprise July Social Security Boost: If you’re a teacher, firefighter, police officer, or any other kind of public servant, July 2025 might feel a little like Christmas in the middle of summer. Thanks to the Social Security Fairness Act, signed into law by President Biden in early 2025, millions of public workers are now seeing unexpected boosts to their Social Security benefits—some even getting retroactive lump-sum payments worth thousands of dollars. This landmark legislation is reshaping how retirement looks for America’s public workforce. Whether you’re retired, nearing retirement, or supporting someone who is, understanding the implications of this act is essential. Even if you’ve never followed Social Security updates before, this one’s worth your time—it could put real money in your pocket.

Teachers and Firefighters Get Surprise July Social Security Boost

The Social Security Fairness Act represents a long-overdue fix to a broken system. For decades, public servants—who educated our children, protected our communities, and ran our cities—were penalized in retirement due to outdated rules. Now, they’re finally seeing justice in the form of higher monthly checks and retroactive payments. If you or someone you love is a current or former public-sector worker, check your status today. Don’t leave money you earned on the table.

| Topic | Details |

|---|---|

| Law Passed | Social Security Fairness Act (January 2025) |

| Key Changes | Repeal of Windfall Elimination Provision (WEP) and Government Pension Offset (GPO) |

| Who Benefits | Public sector workers like teachers, firefighters, police, and surviving spouses |

| Retroactive Payments | Started in February 2025 — average ~$6,700 per person |

| Monthly Benefit Increase | Rolled out April 2025 — average ~$360/month |

| How to Check Eligibility | SSA Website: ssa.gov |

| Contact SSA | 1-800-772-1213 or visit your local office |

What Is the Social Security Fairness Act?

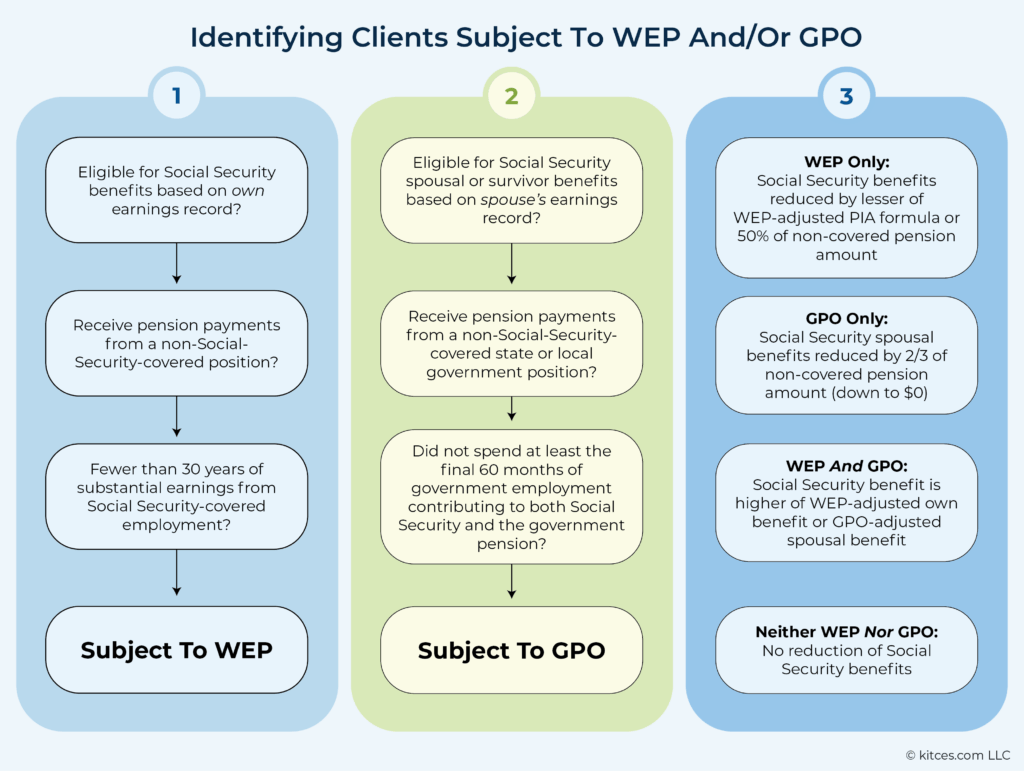

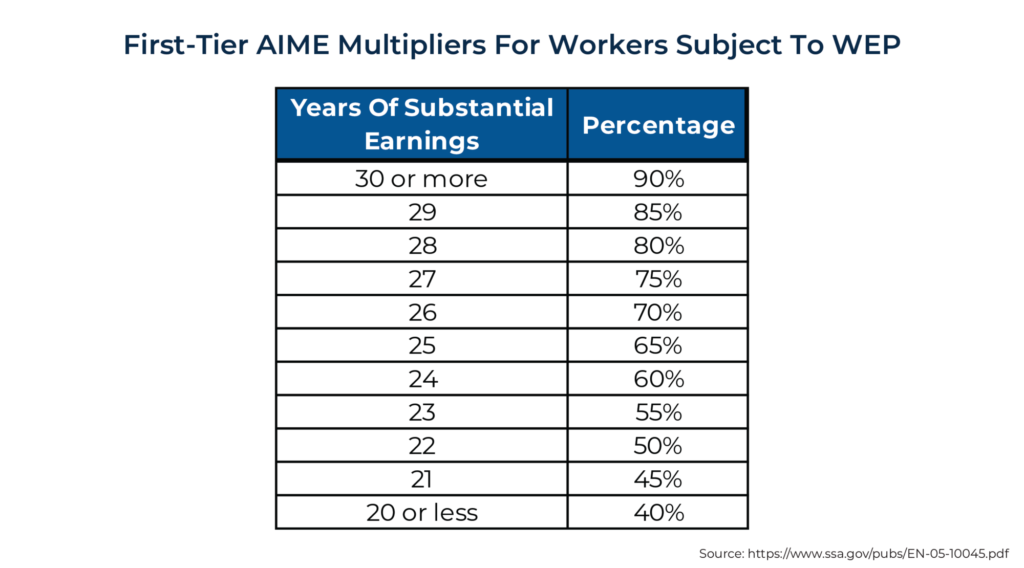

The Social Security Fairness Act addresses two controversial rules that affected millions of public workers: the Windfall Elimination Provision (WEP) and the Government Pension Offset (GPO).

These rules were originally created to prevent so-called “double dipping”—where someone might collect both a pension from a government job (that didn’t pay into Social Security) and a full Social Security benefit from another job. However, the reality was much harsher for honest, hardworking Americans.

People who spent their careers teaching or protecting communities were often penalized in retirement, even if they also paid into the Social Security system during other parts of their careers.

The Social Security Fairness Act fully repeals WEP and GPO, ensuring that public employees and their families receive fair and full benefits.

Who’s Affected by WEP and GPO?

For decades, the WEP reduced Social Security retirement or disability benefits for workers who also received pensions from non-covered employment (jobs not subject to Social Security taxes). Even if someone paid into Social Security for 10 or more years elsewhere, their benefits were still slashed.

The GPO, meanwhile, reduced or eliminated Social Security spousal or survivor benefits for people who received pensions from government jobs. In extreme cases, widows or widowers saw their survivor benefits reduced to zero.

These provisions hit hardest among:

- Public school teachers

- Police officers and firefighters

- State and local government employees

- Federal workers under the Civil Service Retirement System (CSRS)

- Spouses and widows of public-sector employees

Now, with the Fairness Act, all of that has changed.

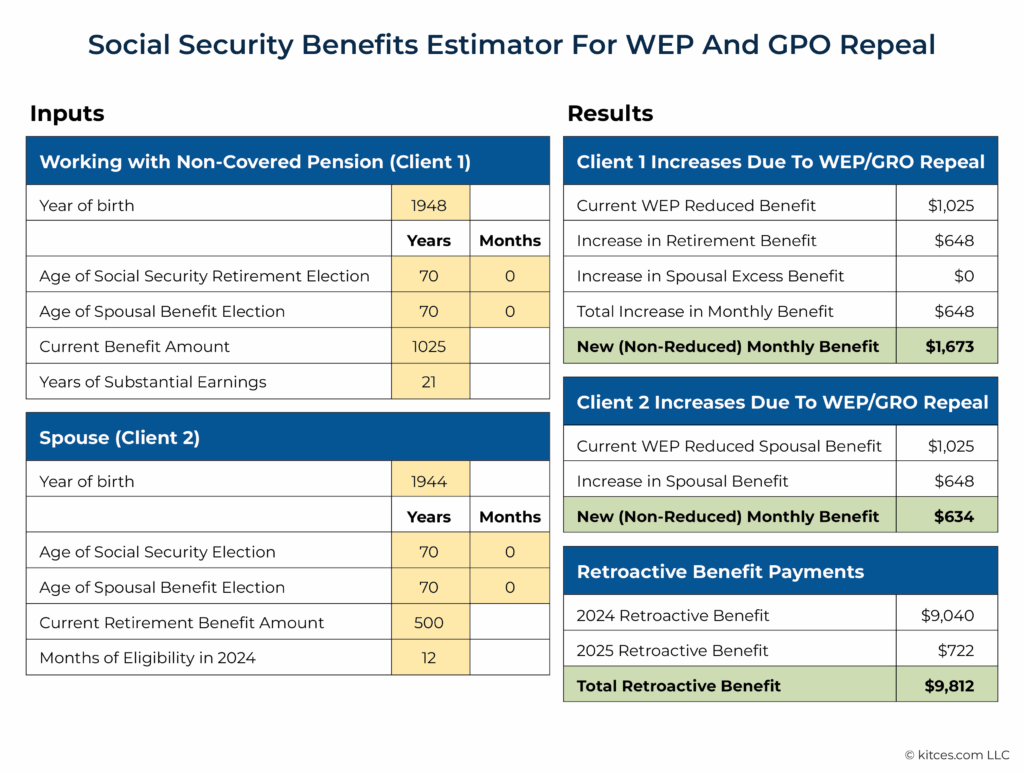

How Much More Will People Get?

Here’s where it gets interesting—and potentially life-changing.

Retroactive Lump-Sum Payments

The Social Security Administration (SSA) began issuing retroactive payments in February 2025, covering benefits that were underpaid from January 2024 through early 2025.

- Average payment: $6,700

- Some received up to $12,000, especially if they were impacted by both WEP and GPO

- By June 2025, over 2.5 million Americans had received these back payments

Increased Monthly Benefits

Starting in April 2025, retirees saw higher monthly checks, with the SSA adjusting benefit amounts to reflect the WEP/GPO repeal:

- Average increase: $360/month

- Some saw increases of $1,000 or more per month, especially surviving spouses

- Benefits are being adjusted automatically—no separate application required

These changes are permanent, not a one-time bump.

Real-Life Examples

Let’s make this personal, because that’s what retirement benefits are really about—people.

Sharon, a retired Texas teacher, spent 22 years in a state pension system and 10 years in private employment where she paid into Social Security. Before the law passed, her monthly Social Security check was $480. Now, thanks to the repeal of WEP, it jumped to $930. She also received a lump sum of $5,400 in March 2025.

James, a retired firefighter in Ohio, received a pension from his fire service and was also entitled to survivor benefits from his late spouse, who had worked in the private sector. Because of GPO, he was receiving nothing from Social Security. In July 2025, he began receiving $1,190/month in survivor benefits and got $14,280 in back pay.

Step-by-Step Guide to Check Teachers and Firefighters Get Surprise July Social Security Boost Eligibility and Payments

Step 1: Create or Log in to Your SSA Account

Visit www.ssa.gov/myaccount and check your benefits.

- You’ll see any recent changes to your monthly payment

- If you’ve received a retroactive deposit, it will be listed

Step 2: Check Your Mail

SSA is sending two letters:

- One confirms removal of WEP/GPO

- The second provides your new monthly benefit breakdown

If you haven’t received these yet, but believe you qualify, keep reading.

Step 3: Review Your Work History

Ask yourself:

- Did you receive a government pension from work where you didn’t pay Social Security taxes?

- Did you also work in jobs where you did pay into Social Security?

- Are you (or were you) married to someone who qualified for Social Security?

If yes, you’re likely eligible.

Step 4: Contact the SSA If Needed

Still not seeing anything?

- Call SSA at 1‑800‑772‑1213

- Or visit your local SSA office

Be prepared with your Social Security number, retirement or pension documents, and work history.

Financial Planning Tips: Making the Most of Your Boost

1. Pay Down High-Interest Debt

Use your lump-sum payment to wipe out credit card or personal loan debt. This gives you breathing room and saves on interest.

2. Boost Your Emergency Fund

You should aim for 3 to 6 months’ worth of expenses in a liquid savings account. If you don’t have this yet, now’s a great time to build it.

3. Consider Health and Long-Term Care

Now’s the time to invest in your health:

- Dental work

- Hearing aids

- Prescription glasses

- Long-term care insurance

Medicare doesn’t cover everything—this extra cash can.

4. Contribute to Retirement Accounts

Still working? You might be eligible to contribute to:

- Roth IRA

- Traditional IRA

- Health Savings Account (HSA)

5. Get Tax Advice

Retroactive payments could push you into a higher income bracket this year. A qualified tax professional can help you plan and possibly avoid surprises come tax season.

How Social Security May Evolve Under President Trump’s Proposed Changes

To Qualify for the $5,108 Maximum Social Security Benefit, Here’s the Income You Need

Here’s When the Next Round of Social Security Payments Is Expected to Arrive