Tariffs are coming: and they’re not just another D.C. headline or Wall Street memo. Whether you’re a parent shopping for back-to-school supplies, a small business managing shipping costs, or a professional navigating supply chains, these new U.S. tariffs are about to affect how much you spend, what you buy, and where you buy it—and that’s true even if fresh trade deals are signed.

In 2025, the U.S. is undergoing a massive overhaul of its trade policy. President Donald Trump’s administration has introduced a sweeping tariff regime, raising average import duties to levels unseen in more than a century. While some deals are softening the blow, prices for American consumers and businesses are still poised to rise sharply. Let’s unpack what’s really happening, how it affects your wallet and operations, and what you can do about it—in plain English, backed by real data and expert insights.

Tariffs Are Coming

Tariffs are here, and prices are rising—even if trade deals are signed. With average import taxes jumping to 15–50%, households and businesses will soon feel the pinch. Whether it’s your grocery bill, your next TV purchase, or your company’s packaging supplies, the cost of doing business and living in the U.S. is about to get higher. While some may benefit from a more protected domestic market, the majority of Americans will pay more in the short term. By understanding the details and acting now, you can minimize the impact and stay ahead of the curve. Stay informed. Ask questions. Make smart, long-term decisions.

| Topic | Details |

|---|---|

| Main Issue | U.S. tariffs rising significantly in 2025 |

| Average Tariff Rate | 15–20% baseline on most imports |

| High-Tariff Countries | Canada, Mexico, EU, China, India, Indonesia |

| Industries Affected | Consumer electronics, apparel, food, retail, automotive |

| Consumer Price Impact | 2–5% inflation increase in 2025 |

| Small Business Risk | Higher inventory, shipping, and procurement costs |

| Timeline for Effects | Fall through Winter 2025 |

| Resource for Official Updates | U.S. Trade Representative |

What Are Tariffs and Why Do They Matter?

A tariff is a tax the government imposes on goods imported from another country. It’s like a toll businesses must pay to bring in foreign products. Those businesses then pass the cost along—to you.

For example, if a U.S. store imports a $100 blender from Germany and a 30% tariff is applied, that blender suddenly costs $130 just to get it on the shelf. And you better believe that extra $30 shows up in the retail price.

The Trump administration’s new trade policy is rooted in “reciprocal” tariffs, meaning if another country charges the U.S. a 25% duty on American-made goods, the U.S. will now charge that country the same rate on imports sent here. The policy shift is designed to level the playing field—but even friendly allies like Canada, Japan, and the EU are being hit with these new rates.

What’s Changed in 2025?

Since January 2025, the U.S. has been rolling out tiered tariffs:

- 10% baseline tariff on all imported goods.

- Country-specific tariffs ranging from 15% to 50%, depending on trade relationships.

- Even countries with deals in place, such as Japan, have agreed to sustained 15% tariff floors.

Negotiations with the European Union are ongoing. If a deal isn’t reached by August 1, tariffs could spike to 30% or more on cars, electronics, and luxury goods.

Meanwhile, Canada and Mexico, long-time NAFTA partners, are facing a potential tariff reclassification of 30–35%, unless a revised agreement is reached soon.

This isn’t just a trade war—it’s a trade overhaul.

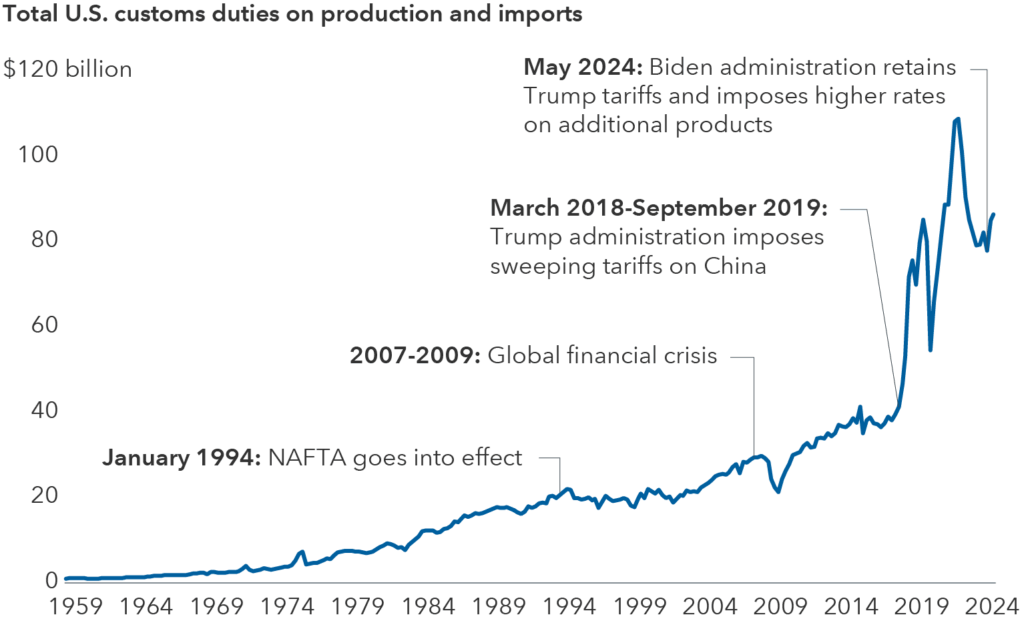

Historical Context: Tariffs in American Policy

To understand the current moment, it helps to look back. Tariffs have long played a role in U.S. economics:

| Year | Event |

|---|---|

| 1789 | First federal tariff enacted to raise government revenue |

| 1930 | Smoot-Hawley Tariff deepens the Great Depression |

| 1990s | Global trade agreements lower U.S. tariffs to 2.5% average |

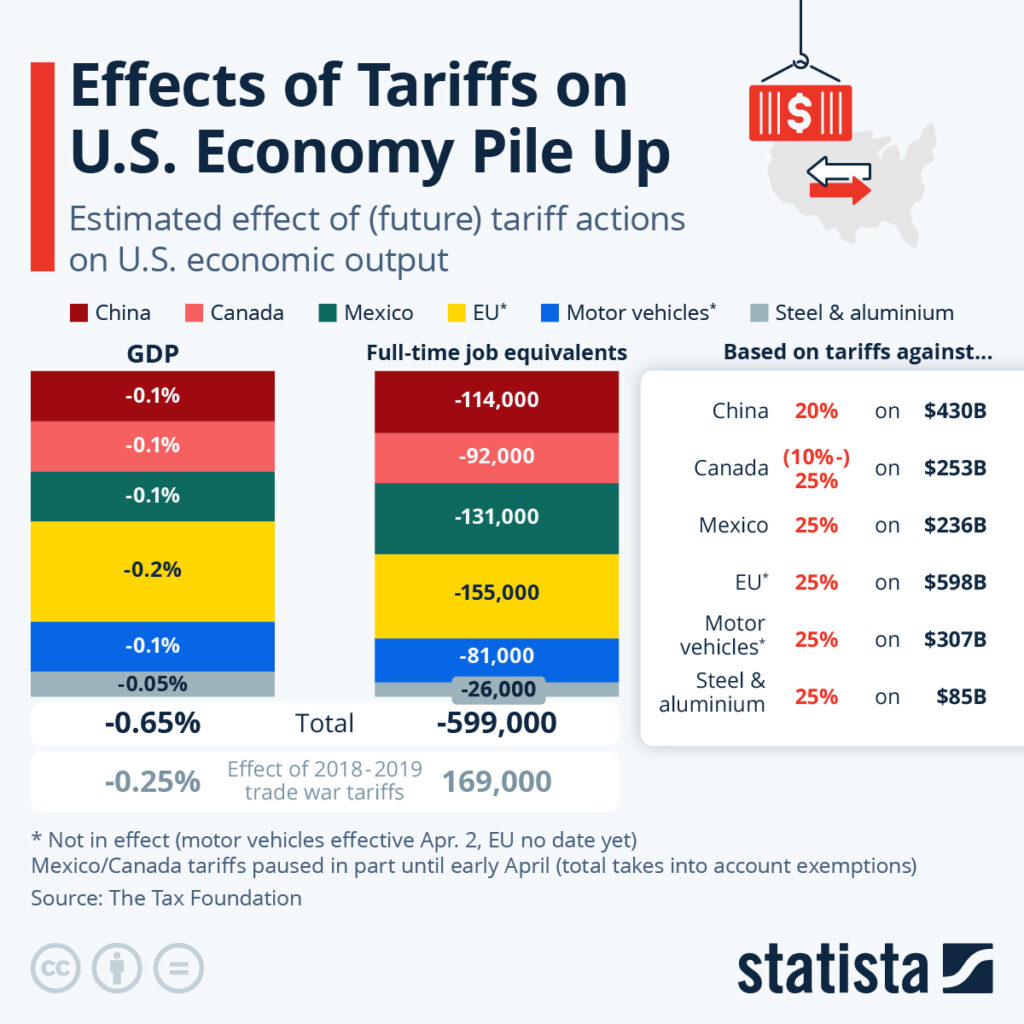

| 2018 | Trump initiates tariffs on China, steel, and aluminum |

| 2025 | Trump’s second term brings across-the-board tariff hikes |

Today’s moves mark a sharp reversal from decades of free-trade momentum. This is the highest sustained tariff environment the U.S. has seen since the 1920s.

How Much Will Prices Rise?

Let’s talk numbers.

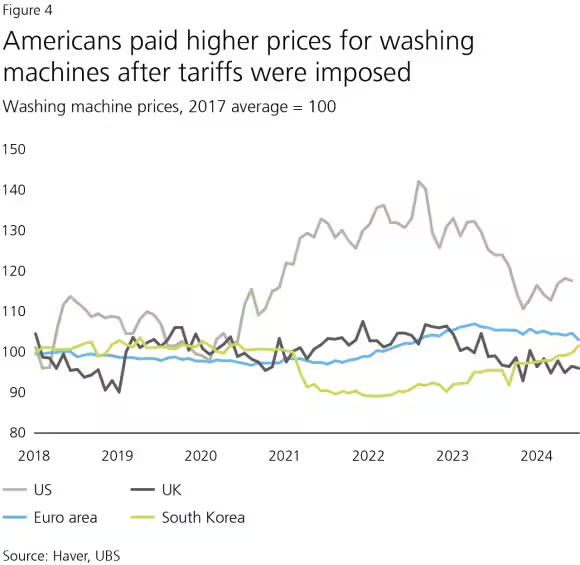

- Goldman Sachs estimates 65% of tariff costs will be passed directly to consumers.

- Capital Economics forecasts a 2–5% rise in consumer price inflation due to new tariffs.

- The Yale Budget Lab projects category-specific increases:

- Clothing and shoes: +35–40%

- Electronics: +20%

- Imported food: +10–15%

- The Peterson Institute for International Economics estimates the average U.S. household could spend $2,600 more annually under this regime.

This isn’t theoretical. It’s real money, and it hits hardest in sectors like apparel, groceries, electronics, and household goods.

Real-World Example: Your Weekly Spending

If you’re a typical U.S. consumer, here’s what those tariffs might mean by the holidays:

| Product | Pre-Tariff Price | Projected Price | Increase |

|---|---|---|---|

| Nike running shoes | $90 | $126 | +40% |

| Samsung TV | $600 | $720 | +20% |

| Bluetooth earbuds | $100 | $115 | +15% |

| Imported Parmesan | $7 | $8.40 | +20% |

| Leather handbag | $200 | $280 | +40% |

For families with kids, this means back-to-school shopping could get 25–30% more expensive. Even grocery trips might stretch your budget further.

Expert Commentary

Leading economists are sounding alarms:

Dr. Alicia Brown, Senior Policy Fellow at Brookings:

“Tariffs may bring short-term leverage at the negotiating table, but they come with a long-term cost to American families.”

Larry McKinney, former trade advisor to the Obama administration:

“It’s a political weapon that doubles as an economic hand grenade. The explosion hits consumers first.”

Impacts on Small Businesses

If you run a business, you’re likely already seeing the warning signs:

- Shipping costs are rising due to tariff-related rerouting.

- Inventory expenses are increasing for parts, packaging, and raw materials.

- Customers are price-sensitive, limiting how much you can pass on costs.

Case Study: Ava’s Outdoor Gear

Ava Rivera, owner of a U.S.-based hiking gear company, shared:

“We import zippers and nylon fabric from Southeast Asia. Tariffs bumped our costs by 18%. We had to adjust pricing and delay two product launches.”

What helped her weather the change?

- Switching to U.S.-based suppliers for key items.

- Launching transparent communication with loyal customers.

- Rethinking packaging to reduce overhead.

Strategic Advice As Tariffs Are Coming: What You Can Do Now

Whether you’re a consumer, business owner, or investor, here’s your action checklist:

For Consumers:

- Buy American-made products where possible.

- Look for alternatives from countries with lower tariff rates.

- Stock up now on long-lasting imported goods before Q4 2025.

For Businesses:

- Audit your supply chain and product sourcing.

- Negotiate contracts early to lock in lower rates.

- Communicate price changes transparently with customers.

For Investors:

- Monitor sectors that rely heavily on imports: retail, apparel, electronics.

- Explore U.S.-based or vertically integrated companies.

Countries Most Affected

| Country | Status |

|---|---|

| Japan | 15% tariff locked in through new deal |

| EU | Deal deadline Aug 1; up to 30% if talks fail |

| China | Tiered tariffs still apply (25–50%) |

| Canada | Facing 30–35% tariffs if NAFTA isn’t renewed |

| Mexico | At risk of 30% duties |

| Indonesia, India, Philippines | Under review for targeted tariffs |

Even friendly partners are not exempt. The message is clear: deal or no deal, baseline tariffs are here to stay.

4 Financial Mistakes Americans Keep Making That Wreck Their Budgets

Trump’s Tariffs on Canadian Goods May Catch Markets Off Guard, Warns CIBC

House Passes Explosive Crypto Bill After Right-Wing Rebellion — What’s Inside the GENIUS Act