Tapping 401(k) Private Assets Could Supercharge Wall Street: If you’re saving for retirement with a 401(k), get ready for a big shake-up. Wall Street firms are pushing to include private assets — like private equity, real estate, and private credit — into your retirement plan. While this could mean more investment options and higher returns, it also introduces new risks, higher fees, and potential headaches you may not be prepared for. This move has been years in the making. But now, it’s gaining serious momentum — and your future nest egg could be riding shotgun.

Tapping 401(k) Private Assets Could Supercharge Wall Street

Including private assets in 401(k)s could be revolutionary — or it could be a disaster. The truth is somewhere in between. If done right, with low-cost access, transparency, and clear communication, it might help diversify retirement savings. But for most everyday investors, keeping it simple and cheap still works best. A mix of index funds, regular contributions, and smart asset allocation remains the foundation of retirement success. Don’t get seduced by hype. Ask questions. Read the fine print. And don’t be afraid to say “no” if something feels too risky or too complicated.

| Topic | Details |

|---|---|

| What’s New | Private assets like private equity, real estate, and private credit may soon be included in 401(k)s. |

| Who’s Leading the Charge | Firms like BlackRock, Apollo, Goldman Sachs, and KKR are designing private market products for 401(k)s. |

| Market Size | Over $12.5 trillion is held in U.S. defined-contribution retirement plans like 401(k)s. |

| Rollout Timeline | Empower begins private investment options in Q3 2025; others follow later in 2025. |

| Potential Benefits | Higher returns, inflation protection, broader diversification. |

| Major Concerns | High fees, illiquidity, lack of transparency, legal risks for employers. |

| Official Guidance | Visit DOL.gov for details on 401(k) investment regulations. |

What Are Private Assets — and Why Should You Care?

Private assets are investments not traded on public stock exchanges. That means you can’t buy or sell them like you would with a regular stock or mutual fund.

They include:

- Private Equity: Ownership in companies that aren’t publicly traded.

- Private Credit: Direct lending arrangements, typically riskier than bonds.

- Commercial Real Estate: High-value properties that may generate rental income.

- Infrastructure Assets: Data centers, toll roads, energy plants.

- Alternative Funds: Hedge funds, venture capital, and even cryptocurrency.

Until recently, these assets were mostly reserved for institutional investors — pension funds, endowments, ultra-wealthy families. But that’s changing fast.

In June 2020, the U.S. Department of Labor (DOL) issued new guidance that allows these assets inside professionally managed 401(k) portfolios. That opened the door for financial firms to start building products aimed squarely at retirement savers.

Why Tapping 401(k) Private Assets Could Supercharge Wall Street?

401(k) accounts are the cornerstone of American retirement. And for financial firms, they represent a huge pot of gold:

- There’s more than $12.5 trillion in defined-contribution plans.

- Over 60 million Americans actively participate in 401(k)s.

- The vast majority of that money is sitting in low-cost index or target-date funds.

That’s billions of dollars in missed management fees for firms like BlackRock, KKR, and Apollo — and they want in. Offering access to private investments gives them a way to charge higher fees and make bigger profits, even if your returns don’t significantly improve.

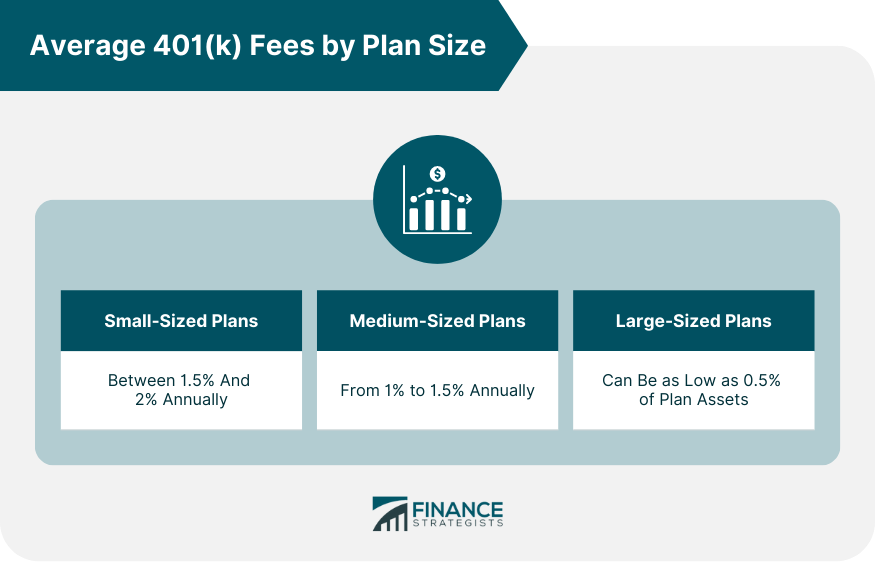

In fact, Goldman Sachs plans to launch a private credit collective investment trust (CIT) for 401(k) plans with fees of roughly 1%, well above the cost of traditional target-date funds, which average about 0.3% or less.

The Promise: Higher Returns, Better Diversification

Proponents say private markets provide long-term value by:

- Outperforming public stocks: McKinsey research suggests private equity outpaced public markets by 2–3% annually over 20 years.

- Smoothing volatility: Private investments aren’t priced daily, which can reduce short-term swings.

- Adding income and inflation protection: Real estate and private credit may offer stable, inflation-resistant cash flows.

They also argue that democratizing access to these investments gives everyday Americans the same tools as institutional investors.

And in theory, that’s not wrong.

The Perils: Big Costs, Low Liquidity, and Murky Pricing

But before you sign up, let’s talk about the red flags.

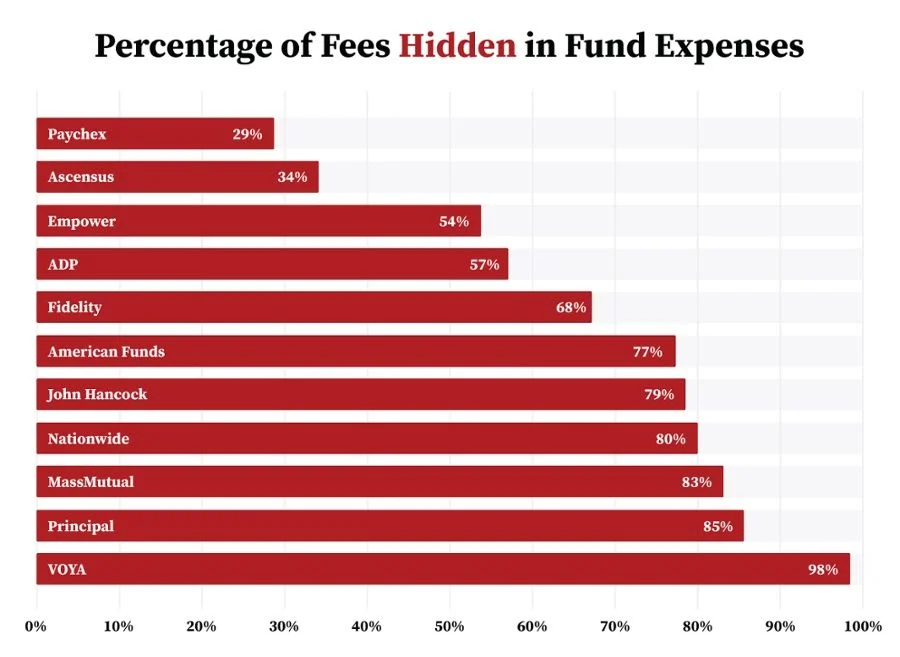

1. High Fees That Drag Down Returns

Private equity and private credit funds often come with multiple layers of fees:

- 1%–2% management fee

- 20% performance or “carried interest” fee

- Admin fees, setup fees, transaction costs

Compare that to a typical index fund, which charges 0.05%–0.15%, and you’re looking at fees that are 10 to 30 times higher.

These fees don’t just cost you money today — they compound over time, reducing your total nest egg in retirement by potentially hundreds of thousands of dollars.

2. Locked Up and Illiquid

Private assets are not easy to sell. Many come with lock-up periods of 3, 5, or even 10 years. That means if you need your money — for a house, emergency, or even retirement — you might not be able to access it without major penalties or delays.

3. Lack of Transparency

Unlike stocks and ETFs, private assets don’t have daily pricing. Their value is based on estimates — sometimes done by the fund managers themselves.

That creates major risk:

- You might not know the real value of your investment.

- Fraud or mismanagement could go undetected for years.

- Losses may not show up until it’s too late.

4. Fiduciary Risk for Employers

Employers are legally responsible for offering “prudent” investment options in 401(k) plans. With the complexity and risk of private assets, they could face lawsuits if employees lose money.

That’s why many plan sponsors are still wary — and why adoption will likely be slow unless strong protections are in place.

Real-Life Scenario: Linda’s 401(k) Gets a Private Makeover

Let’s break it down with a hypothetical.

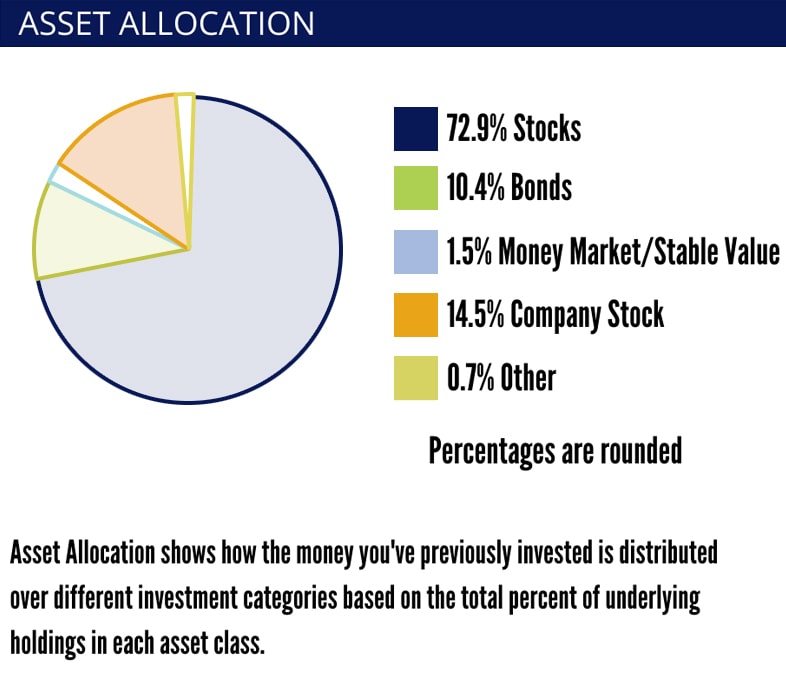

Linda is a 36-year-old teacher with $120,000 in her 401(k). Her employer switches the default investment option from a traditional target-date fund to a managed fund that includes:

- 20% private equity

- 15% private real estate

- 65% traditional stocks and bonds

Over 25 years:

- Her private equity portion grosses strong returns, but fees eat up much of the outperformance.

- Her real estate allocation loses value during a housing downturn — but she can’t sell.

- She misses a rebalancing opportunity during a recession because of liquidity lock-ups.

- Her final balance is slightly lower than if she had stayed in a low-cost index fund.

That’s not to say private assets are always a bad bet. But they’re complex, unpredictable, and often overhyped — especially for retail investors.

The Current Landscape: What’s Already Happening?

A few early movers are making noise:

- Empower, which manages $1.8 trillion in assets, is rolling out private market exposure in Q3 2025 via managed accounts.

- Goldman Sachs is launching a retirement-targeted private credit CIT later in 2025.

- BlackRock and State Street are building out platforms to integrate private investments into target-date funds.

Still, widespread adoption remains cautious, as employers wait to see how these investments perform in a real-world, retail retirement context.

How to Vet Private Assets in Your 401(k)?

If your plan starts offering exposure to private markets, here’s what to do:

- Ask About Fees: Get the total expense ratio, including all hidden or layered charges.

- Understand Lock-Up Terms: Know when and how you can access your money.

- Check Valuation Practices: Are assets valued by an independent third party? How often?

- Compare Performance: Ask how it stacks up vs. an S&P 500 or balanced benchmark.

- Talk to a Fiduciary Advisor: Not a broker — someone legally obligated to act in your best interest.

Pro vs. Con Table

| Pros | Cons |

|---|---|

| Higher potential long-term returns | Much higher fees (3x–10x more than index funds) |

| Greater portfolio diversification | Illiquid — may not access money when needed |

| Potential inflation hedge (real estate) | Poor transparency and valuation risks |

| Access to institutional-style strategies | Legal risk for employers and plan sponsors |

| New investment choices for savers | Complexity that most investors don’t fully understand |

Dave Ramsey Advises Caution and Planning on 401(k) Contributions Amid Economic Shifts

Thousands in Forgotten 401(k)s Waiting for Michiganders — See If You’re Owed Money

Millions of Americans Could See Their Social Security Checks Cut by 50 Percent