State Pension Payment Increase: If you’re living in the UK and rely on state pension payments or disability benefits, recent changes are set to improve your financial situation. From rising pension amounts to important adjustments in disability-related benefits, these changes are an essential step in addressing the financial needs of vulnerable populations.

Whether you’re a senior citizen, a disabled person, or a caregiver, understanding these increases can help you manage your finances and plan for the future. With rising costs and inflation, these updates are critical for providing financial security and stability. In this article, we’ll explore the recent increases in state pension payments and how they affect those receiving disability benefits in the UK, offering a detailed and practical guide on what it all means for you.

State Pension Payment Increase

In summary, the UK state pension and disability benefit increases are a welcome development for many people across the country. With the cost of living rising, these boosts will help ensure that those who need it most—seniors, disabled individuals, and those with health-related difficulties—will have more financial stability.

The state pension increases provide an essential cushion, while the disability benefits adjustments continue to support people facing long-term health challenges. Staying informed and planning effectively can help you make the most of these changes. Be sure to check with the official government website for ongoing updates and review your financial needs regularly. By understanding these changes, you can better navigate the future with confidence and take full advantage of the support available to you.

| Key Point | Details |

|---|---|

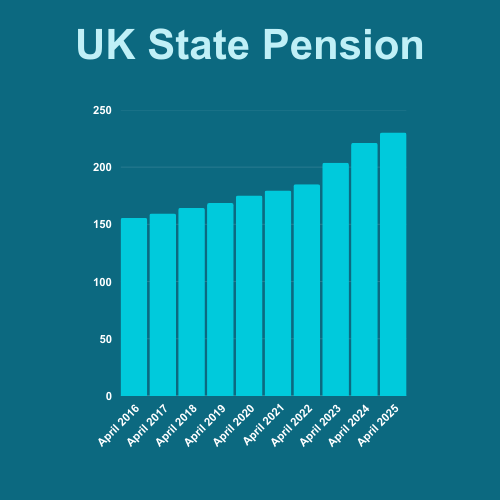

| State Pension Increase | The UK state pension has increased by up to £470 annually for new pensioners. |

| New State Pension | The new state pension increased from £221.20 to £230.25 per week. |

| Basic State Pension | The basic state pension now stands at £176.45 per week, an increase of £360 annually. |

| Disability Benefits | Disability benefits are affected by a freeze but will not decrease for current recipients. |

| Personal Independence Payment (PIP) | Payment levels for PIP remain unchanged, but future reforms are under review. |

| Impact on Vulnerable Groups | These increases provide financial relief for seniors and individuals with disabilities. |

What Is State Pension and Disability Benefits in the UK?

Before diving into the recent changes, let’s first understand state pension payments and disability benefits in the UK and how they help those in need.

State Pension in the UK

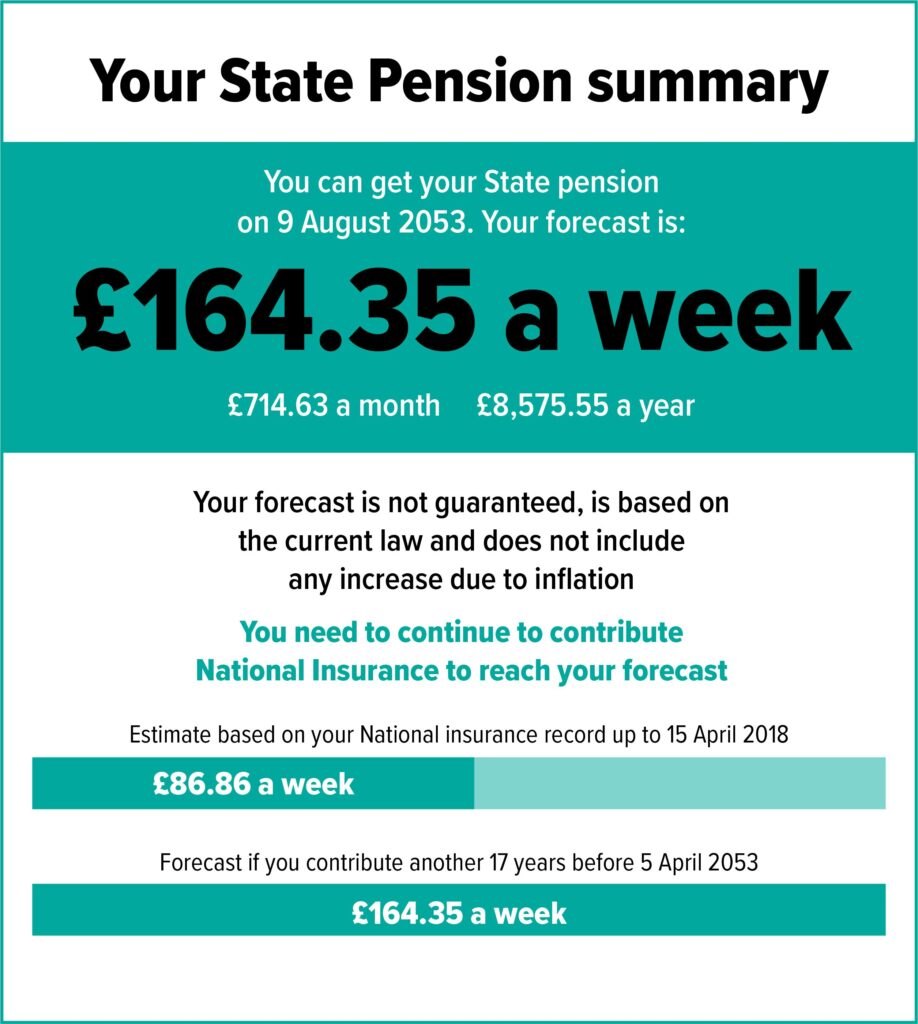

The state pension is a regular payment made to individuals who have reached state pension age, which is currently 66 for both men and women, and will increase to 67 by 2028. To qualify for state pension payments, you must have made enough National Insurance contributions during your working life. The amount you receive depends on your contributions.

For many, the state pension forms a critical part of their income after retirement. In recent years, the government has guaranteed annual increases in pension payments to ensure recipients keep up with rising costs. The most significant of these is the triple lock system, which ensures pensions rise by the highest of inflation, average earnings, or 2.5%.

Disability Benefits in the UK

Disability benefits in the UK provide financial assistance to people who are unable to work or require additional support due to a physical or mental disability. The most common disability benefits are:

- Personal Independence Payment (PIP): This benefit helps people with the extra costs caused by long-term disability or ill-health.

- Employment and Support Allowance (ESA): For those who cannot work due to illness or disability, ESA provides financial support and personalized help to get back to work if possible.

- Universal Credit (UC): This is a payment to help with living costs for people who are on a low income or out of work. It’s also available to individuals who are sick or disabled.

State Pension Payment Increase: How It Affects You

New State Pension: A Boost in Payments

From April 2025, the new state pension in the UK saw an increase, benefiting millions of pensioners. This increase is part of the government’s annual triple lock uprating. The new state pension has gone up from £221.20 to £230.25 per week. This translates to an annual increase of £470, which can make a significant difference in covering everyday expenses such as bills, groceries, and healthcare costs.

This is especially crucial in today’s financial environment, where inflation and rising living costs are a concern. For those who rely on the state pension as their primary source of income, this increase will help ease the pressure.

Basic State Pension Increase

The basic state pension, which applies to individuals who reached state pension age before April 2016, has also increased. The new rate is £176.45 per week, up from £169.50. This increase adds £360 annually, providing more financial security for older pensioners who may not have the same work history or contribution level as those who qualify for the new state pension.

These increases are a step in the right direction for helping individuals meet the rising costs of living.

Disability Benefits: What You Need to Know

The Impact on Disability Benefits

While the state pension increase is a major development, it’s equally important to understand the current state of disability benefits in the UK. In recent years, the government has made adjustments to disability benefits, including freezing the health element of Universal Credit for new claimants. However, current recipients will retain their existing levels, with no reductions.

Disability benefits like Personal Independence Payments (PIP) are expected to undergo some future reforms, but for now, they remain an essential source of support for many disabled individuals.

What Are the Upcoming Reforms for Disability Benefits?

The UK government has been looking into reforming the system for awarding disability benefits, specifically PIP. However, as of now, there are no drastic changes. These reforms could potentially alter the way individuals are assessed for benefits or change eligibility criteria, so it’s important to stay updated with any announcements.

In the meantime, if you’re already receiving disability benefits like PIP, your payments won’t be affected by these reforms, but it’s wise to be aware of any future changes that may come down the line.

Practical Advice for Managing Your Pension and Disability Benefits

Managing your state pension and disability benefits effectively can help you get the most out of these increases. Here are a few practical tips:

1. Review Your Financial Situation Regularly

With these increases, it’s a good time to review your budget and plan accordingly. While these extra funds can provide some relief, it’s important to stay mindful of any changes in your expenses.

2. Consider Extra Support Programs

In addition to your state pension or disability benefits, you might qualify for other support programs such as housing benefit, cold weather payments, or free prescriptions. Check with your local council or the UK government website to see if there are additional programs available to you.

3. Budget for Health and Care Costs

If you’re disabled or elderly, health and care costs can add up quickly. Make sure to allocate a portion of your pension or disability payments to cover medical expenses, including prescription costs, specialist appointments, and personal care.

4. Stay Updated on Future Changes

Since disability benefits, particularly PIP, are under review, it’s essential to stay informed about any future changes. You can regularly check the UK Government’s website for updates or subscribe to newsletters for the latest news.

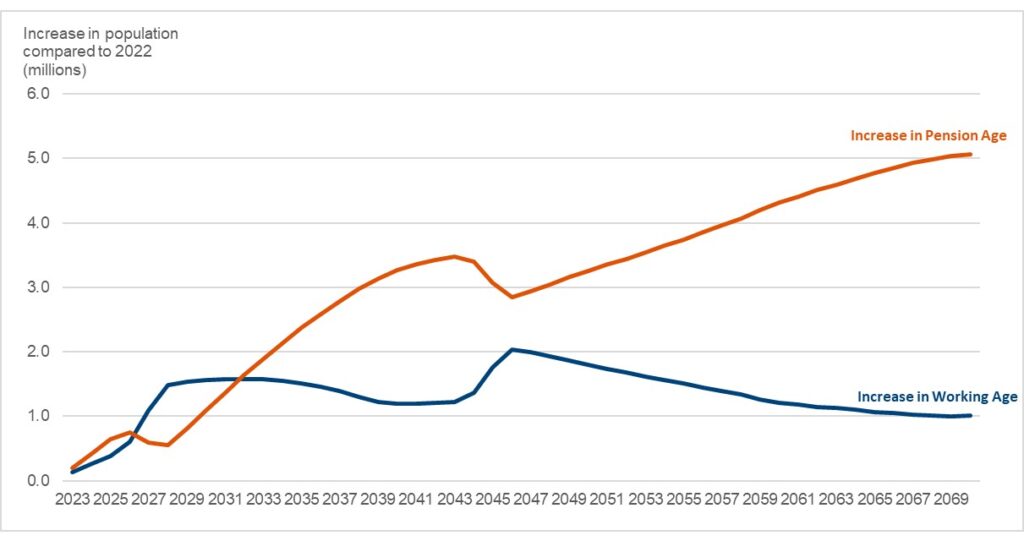

UK’s Retirement System Faces Pressure—Why the Government May Need to Raise the Pension Age Again?

You Could Get £333 a Month From DWP—Check If You’re Eligible

Millions of Pensioners Could Be Missing Out on Free Appliances From the DWP