SSA Announces No More Taxes for This Group: In a major announcement, the Social Security Administration (SSA) has revealed that a select group of Americans is now exempt from paying federal taxes on their Social Security benefits. While this might sound like great news for everyone, the reality is a bit more nuanced. Let’s explore who will benefit, who won’t, and what it all means for your finances moving forward.

SSA Announces No More Taxes for This Group

The new Social Security tax exemption brings welcome relief to many seniors, but it’s important to understand that it’s not a permanent fix. While middle-income seniors aged 65 and older can enjoy a temporary tax deduction, high earners and younger seniors won’t benefit. Stay informed, adjust your tax planning, and take advantage of this opportunity while it lasts.

| Key Takeaways | Details |

|---|---|

| What is this about? | The SSA has announced a temporary tax exemption for Social Security benefits for many seniors. |

| Who benefits? | Seniors aged 65+ with certain income thresholds. |

| Eligibility | Based on income levels, deductions are available for single filers earning up to $75,000 and married couples earning up to $150,000. |

| What’s the catch? | The new law is a temporary tax break that phases out at higher incomes, set to expire by 2028. |

| Who’s not included? | People under 65, low-income seniors who already don’t pay taxes, and high-income seniors. |

| Criticism | Some experts say the announcement was misleading, as this isn’t a permanent tax elimination. |

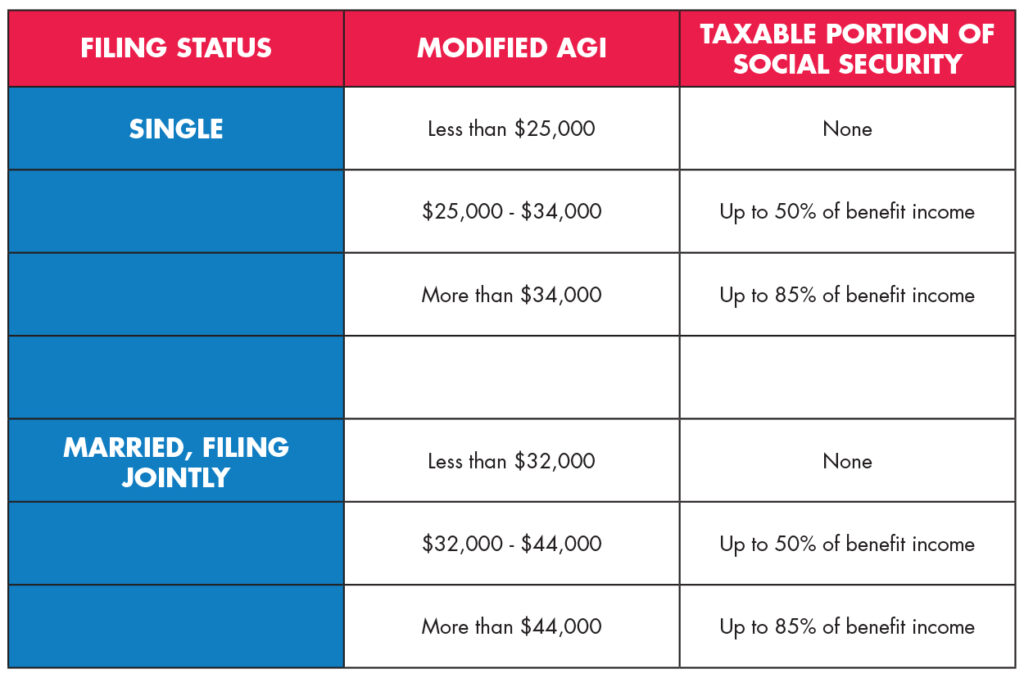

For many, Social Security benefits are a vital source of income, especially for retirees who rely on them after they stop working. However, Social Security benefits have long been subject to federal income taxes, and that’s where things get tricky. Fortunately, the new tax break announced by the SSA offers some relief for a specific group of Americans—though not everyone will benefit.

What Exactly Did the SSA Announce?

The new announcement by the SSA reveals a temporary tax exemption for many Social Security beneficiaries. This tax exemption applies to seniors aged 65 and older with incomes below a certain threshold. Here’s what you need to know:

- Single Filers: Seniors earning less than $75,000 will be eligible for a $6,000 deduction.

- Married Couples: Couples earning less than $150,000 will receive a $12,000 deduction.

This move is part of the One Big Beautiful Bill, a piece of legislation aimed at easing the tax burden on middle-income seniors.

The Historical Context: Why Are Social Security Benefits Taxed?

Before diving into who benefits from this tax break, it’s important to understand why Social Security benefits have been subject to taxation. The story begins in 1983 when the U.S. Congress decided to tax a portion of Social Security benefits for higher-income beneficiaries. The reasoning behind this decision was simple: as the number of Social Security recipients grew, the cost of benefits increased, and taxes were one way to help offset this rising expense.

Initially, Social Security benefits were not taxed, but over time, as more people began receiving benefits and the economy changed, taxing Social Security income became a reality for higher earners. This new tax break is an effort to alleviate some of that burden for seniors with moderate incomes.

Who Will Benefit from the SSA Announces No More Taxes for This Group?

The new tax law provides relief primarily to seniors aged 65 and older who earn a moderate income. If you fall within the income range set by the new law, you may qualify for a tax deduction on your Social Security benefits.

Single Filers

- If you earn up to $75,000, you will receive a $6,000 deduction from your taxable income.

- The deduction gradually phases out between $75,000 and $175,000 of income.

Married Couples

- If your joint income is up to $150,000, you will receive a $12,000 deduction.

- Couples earning more than $250,000 will no longer be eligible for this benefit.

This is an exciting change for middle-income seniors who may not have qualified for other forms of relief in the past.

What’s the Catch? Why Isn’t This a Total Tax Elimination?

While this change offers significant relief to many, it’s important to keep in mind that this is temporary and not a permanent tax break. Here’s what that means for you:

- Expiration Date: The tax deduction will expire in 2028. After that, the old system will likely resume unless Congress passes new legislation.

- Phase-Out for Higher Incomes: Seniors earning above a certain income threshold will not qualify for the tax break.

So while it’s great news for many, it’s not a complete fix to the problem of taxes on Social Security benefits. The law is temporary and benefits only those with moderate incomes.

Who Won’t Benefit?

If you fall into any of the following categories, this tax break is not for you:

- Seniors under age 65 – The tax break only applies to those aged 65 and older.

- Low-income seniors – If you already don’t pay taxes on your Social Security benefits, you won’t see any new relief.

- High-income seniors – Those with income above $175,000 for individuals or $250,000 for couples are excluded from the benefit.

Case Studies: How Will This Affect You?

Let’s take a look at how this tax break could affect different types of seniors:

- Jane, a 68-year-old widow, has an annual income of $70,000 from Social Security and a small pension. Under the new law, she qualifies for the $6,000 deduction, which will lower her taxable income and potentially reduce the amount of taxes she pays.

- The Johnsons, a married couple both aged 70, earn $200,000 combined, mostly from investments and Social Security. They qualify for the $12,000 deduction because their income is below the $250,000 threshold.

These examples show how the new tax break can help seniors lower their tax burden, providing some financial relief.

Impact on State Taxes

While the new federal tax break is a welcome relief for many seniors, it’s essential to remember that state taxes may still apply to Social Security benefits. Many states also tax Social Security income, and the new federal tax exemption won’t affect state tax laws. You should check with your state’s tax office to determine whether Social Security benefits are taxable in your state.

Action Steps for Beneficiaries

If you’re eligible for this tax break, here’s what you should do:

- Check Your Income: Make sure you meet the eligibility requirements based on your income.

- Consult a Tax Professional: They can help you adjust your withholding or tax planning to take full advantage of the deduction.

- Keep Track of Changes: Since this deduction is temporary, stay informed about future updates and the expiration of the benefit in 2028.

- Prepare for Tax Season: Gather all necessary documents and make sure your tax filings reflect the new changes.

Why Your Social Security Retirement Checks Might Shrink Sooner Than Expected- Check Details

Inside Trump’s ‘Big Beautiful Bill’ and Its Impact on Your Social Security

Social Security Retirement Age Adjusted to 67 Under New Guidelines- Check Official Details!