Some Social Security Recipients Could See Payments Slashed in Half: If you’re receiving Social Security benefits, there’s an important change you need to know about. Starting July 24, 2025, millions of Americans may see their monthly Social Security checks cut by up to 50%. That’s right — some recipients could have half their payments withheld, even if they’ve done nothing wrong.

Sound extreme? It is. But this move is part of a broader effort by the Social Security Administration (SSA) to recover billions of dollars in overpayments — money that was given out by mistake. In this in-depth guide, we’ll break down everything you need to know: who’s affected, what to do, and how to protect your benefits. Whether you’re a retiree, a caregiver, a financial advisor, or someone helping out a loved one, this article is your roadmap.

Some Social Security Recipients Could See Payments Slashed in Half

The SSA’s new overpayment policy could severely impact millions of Americans. If you receive a notice, don’t ignore it. You have the right to appeal, request relief, or negotiate a fair payment plan. But you must act quickly. This policy may feel overwhelming, especially for seniors and those with disabilities. That’s why education, support, and timely action are so important. Talk to a trusted advisor, legal aid provider, or SSA representative — and protect the income you’ve earned.

| Topic | Details |

|---|---|

| Who’s affected? | Anyone receiving an SSA overpayment notice dated April 25, 2025, or later |

| New Policy | SSA may withhold up to 50% of monthly benefits to recover overpaid funds |

| Effective Date | July 24, 2025 |

| Response Timeframe | You must respond within 90 days to stop garnishment |

| Programs Affected | Social Security Retirement, SSDI, and survivors’ benefits — not SSI-only recipients |

| Where to respond | Visit ssa.gov for forms and info |

What’s Going On With Social Security Overpayments?

Over the past few years, the SSA has mistakenly overpaid billions of dollars to millions of recipients. This isn’t about fraud or criminal activity. In most cases, it’s just life happening — a retiree picks up a part-time job and forgets to report it, someone’s income changes, or the SSA simply makes a clerical error.

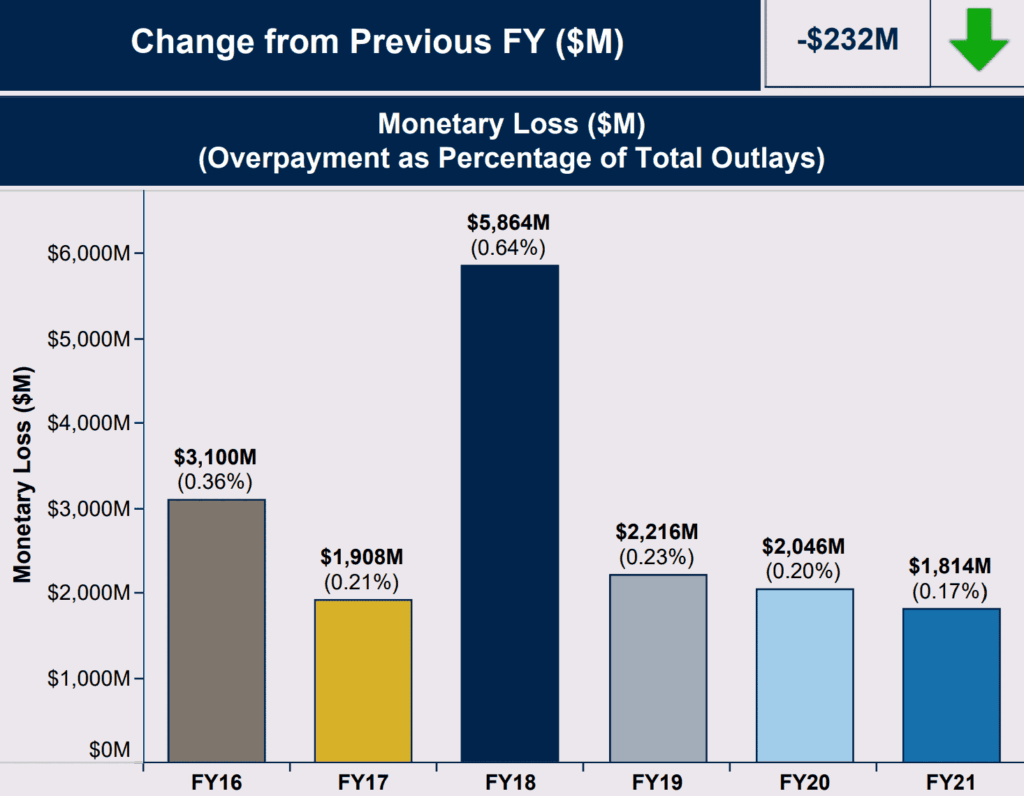

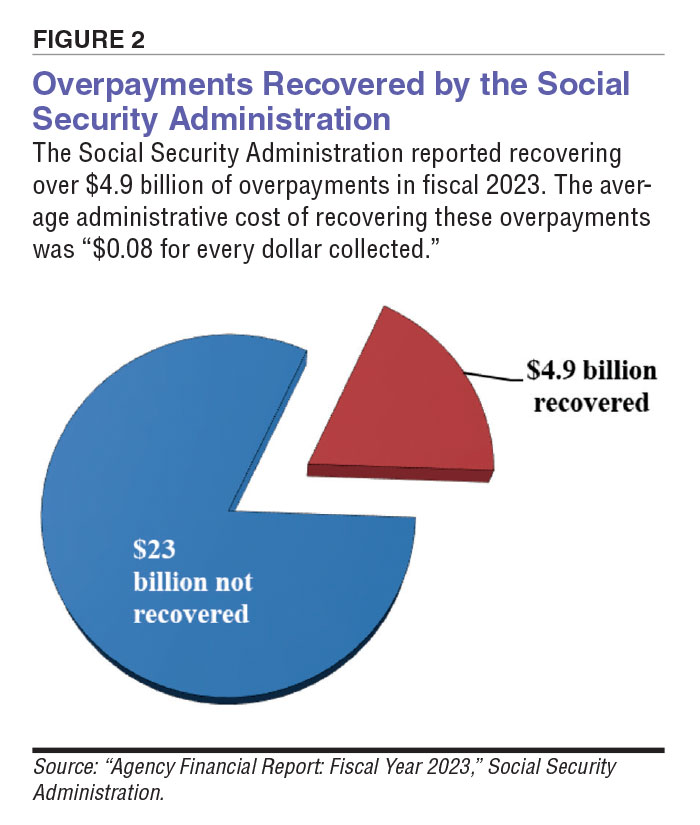

According to a 2023 report from the Office of Inspector General, the SSA issued more than $21.6 billion in overpayments between 2020 and 2023. Even more staggering: over the longer period from 2015 to 2022, the agency sent out an estimated $72 billion in improper payments. So now, the SSA is taking action to recover those funds — and fast. Previously, if you were overpaid, the SSA would deduct just 10% of your benefit each month until the debt was paid back. But now, they can take up to 50% — and it starts with new overpayment notices dated April 25, 2025, or later.

Why Some Social Security Recipients Could See Payments Slashed in Half Is Happening Now?

The new rules stem from a public controversy in late 2023 and 2024, when it was revealed that some Social Security recipients were having 100% of their monthly checks withheld due to overpayment collections. This left some seniors and disabled Americans with no income at all, leading to evictions, food insecurity, and widespread backlash.

To address this, the SSA proposed changes. Initially, they considered taking everything owed in one shot — but public and congressional pressure forced a pivot. The compromise? A 50% withholding cap. It’s better than losing everything, but still a big financial blow for anyone living paycheck to paycheck.

Who Is at Risk?

If you receive any of the following benefits, and you’re sent an overpayment notice after April 25, 2025, you may be affected:

- Social Security Retirement Benefits

- Social Security Disability Insurance (SSDI)

- Survivors’ Benefits

The new 50% rule does NOT apply to SSI-only recipients (those on Supplemental Security Income). They remain under the old rule, where only 10% of their benefit can be withheld each month.

Also, if your overpayment was dated before April 25, 2025, you’ll stay under the previous rules.

Real-Life Example: A Common Scenario

Let’s say “John,” a 68-year-old retiree, began collecting benefits in 2022. In 2024, he took a part-time job earning $1,200/month to supplement his income. Unfortunately, he didn’t report this income change to SSA, and by the time they caught it in early 2025, he’d been overpaid $6,000.

On May 5, 2025, John receives an overpayment notice. According to the new rules, if he doesn’t respond within 90 days, SSA can withhold $800/month from his $1,600 benefit until the overpayment is cleared.

That’s a huge hit — especially for someone already living on a fixed income.

What Counts as an Overpayment?

Overpayments occur when someone receives more benefits than they’re legally entitled to. Common causes include:

- Unreported income (like a part-time job or rental property)

- Changes in living arrangements (such as moving in with someone else)

- Marital status updates not communicated to SSA

- Returning to work after disability

- SSA system errors or processing delays

How to Avoid the 50% Garnishment: Step-by-Step Guide

If you receive an overpayment notice, it’s essential that you act quickly. You have 90 days to respond before SSA starts withholding money from your check.

Here’s what you can do:

Step 1: Carefully Read the Notice

Look at the:

- Date of the notice (April 25 or later triggers the new rule)

- Reason for the overpayment

- Amount owed

- Deadline to respond

Step 2: Consider Your Options

You have three main options:

1. Request a Reconsideration

Think the SSA got it wrong? You can dispute the overpayment by filing Form SSA-561. This is called a Request for Reconsideration.

2. Request a Waiver

If the overpayment wasn’t your fault, and repaying it would cause financial hardship, ask SSA to forgive the debt by submitting Form SSA-632. You’ll need to show evidence like:

- Rent/mortgage statements

- Utility bills

- Medical expenses

- Bank statements

3. Set Up a Payment Plan

If you agree that you were overpaid but can’t afford to lose half your check, you can propose a reasonable monthly repayment plan. SSA often accepts smaller monthly amounts if you demonstrate need.

Step 3: Keep Records

Document everything:

- Keep copies of all forms

- Write down names and dates of anyone you speak with at SSA

- Send mail certified with a return receipt

What Happens If You Do Nothing?

If you ignore the notice, the SSA will begin withholding 50% of your monthly benefit after 90 days. They don’t need your permission. It’s automatic.

Also, if you owe a significant amount and don’t respond at all, the SSA may eventually refer your case to the Treasury Department for collection. This can result in:

- Garnishment of federal tax refunds

- Garnishment of wages (if you’re still working)

- Reduction of future benefits

Legal and Financial Support

If you’re struggling to understand the process or feel overwhelmed, you’re not alone. Here are some trusted resources:

- SSA Overpayment Info — Official guidance on how overpayments work

- Form SSA-632 — Request for Waiver of Overpayment

- Form SSA-561 — Request for Reconsideration

- Legal Services Corporation — Find free or low-cost legal aid

- AARP — Advocacy and education for retirees

Policy Reaction and Expert Opinions

Many advocacy groups, lawmakers, and watchdogs have voiced concerns about the new rule.

According to the National Council on Aging, this policy “targets vulnerable older adults who are often unaware they were overpaid in the first place.”

Even former SSA officials have said that the agency needs better internal controls, not harsher recovery measures.

Congressional hearings in 2024 showed bipartisan support for overpayment reform — but so far, legislative action has lagged behind SSA’s policy implementation.

Trump’s New Tax Bill Could Reshape How Social Security Benefits Are Taxed

Why Some Social Security Recipients Might See Their Payments Slashed by 50%

Millions of Americans Could See Their Social Security Checks Cut by 50 Percent