Social Security’s Future Faces Uncertainty: Social Security has long been a cornerstone of retirement security for millions of Americans. But in recent years, the future of Social Security has been shrouded in uncertainty. With the trust fund facing depletion, many are wondering whether they can count on these benefits in the future and how to adapt their savings strategy accordingly. If you’re concerned about what might happen to your Social Security benefits down the road, you’re not alone. It’s time to take control of your future. While we can’t control the future of Social Security, we can control how we prepare for it. By boosting your savings, making strategic investment choices, and planning carefully, you can ensure that you’re ready for whatever the future holds. In this article, we’ll explore six smart ways you can start saving more now — to create a more secure financial future for yourself.

Social Security’s Future Faces Uncertainty

In a world where the future of Social Security is uncertain, it’s essential to take control of your financial future. By starting early, diversifying your investments, and taking advantage of employer-sponsored plans, you can build a strong foundation for your retirement. Delaying Social Security and creating a detailed financial plan will help you navigate the uncertainties ahead. With these smart strategies, you’ll be better prepared for whatever the future brings.

| Key Insight | Data/Fact | Resource Reference |

|---|---|---|

| Social Security Future Uncertainty | Trust fund depletion predicted by 2034 if no changes made. | Social Security Administration |

| Maximizing 401(k) Contributions | The average 401(k) balance for workers in their 60s: $228,000. | Investopedia |

| Delaying Social Security Benefits | Benefits increase by 8% each year you delay after 62. | AARP |

| Diversification Importance | Investors with diversified portfolios average better returns. | NerdWallet |

| Average Retirement Savings | The average American retirement savings: $65,000 (as of 2023). | Bankrate |

| Side Hustles and Income Streams | 36% of Americans have a side job for extra retirement funds. | Investopedia |

Why Social Security’s Future is in Jeopardy?

Social Security has been a safety net for retirees, the disabled, and their families since its inception in 1935. The program is funded through payroll taxes that workers and their employers contribute to, with benefits paid out based on a worker’s earnings history.

But as the Baby Boomer generation ages and life expectancy increases, the number of beneficiaries has skyrocketed. Meanwhile, the number of workers paying into the system has been stagnating. According to the Social Security Administration (SSA), the program’s trust fund is projected to run dry by 2034. If that happens, Social Security’s income would only cover about 78% of the promised benefits.

This looming shortfall makes it all the more important for individuals to think beyond Social Security as their sole source of retirement income. While Social Security will still provide some level of financial support, it’s clear that relying solely on these benefits is not a sustainable long-term plan.

Six Smart Ways to Save More Now As Social Security’s Future Faces Uncertainty

The good news is that there are several strategies you can adopt now to ensure you’re better prepared for your retirement, regardless of what happens to Social Security in the future. Let’s break down six smart ways to save more and build a secure financial foundation for your golden years.

1. Start Saving Early and Automate Contributions

The earlier you begin saving, the more time your money has to grow. Even small contributions to a retirement account can snowball into a substantial sum over time, thanks to the magic of compound interest.

A great way to ensure you’re consistently saving is to automate your contributions. Whether it’s through your employer’s 401(k) plan or an Individual Retirement Account (IRA), setting up automatic deductions means you’ll never have to worry about forgetting to contribute.

For example, if you start contributing just $100 a month at age 25, assuming an average annual return of 7%, by the time you’re 65, you’ll have around $234,000. Start earlier, and you could be sitting on a small fortune by the time you retire.

2. Maximize Your Employer-Sponsored Retirement Plans

If your employer offers a 401(k) plan, take full advantage of it. Many employers match your contributions up to a certain percentage — essentially offering you “free money.” If you’re not contributing enough to get the full match, you’re leaving money on the table.

As of 2023, the maximum annual contribution to a 401(k) is $22,500 for individuals under 50, with an additional $7,500 in “catch-up” contributions allowed for those 50 and older. Maxing out your contributions can significantly boost your retirement savings.

Let’s say you earn $60,000 a year and your employer offers a 5% match. That means you could receive up to $3,000 in additional contributions — for doing nothing extra on your part. Over time, that’s a game-changer for your retirement fund.

3. Diversify Your Investment Portfolio

It’s easy to get caught up in the idea of betting big on a single stock or investment, but the smartest approach is diversification. By spreading your investments across various asset classes, such as stocks, bonds, real estate, and even alternative investments like cryptocurrency or commodities, you reduce your overall risk.

Consider your age and time horizon. If you’re young and have decades before retirement, you might lean more heavily on stocks for growth. As you near retirement, it’s wise to adjust your portfolio to include more conservative investments that focus on income and stability.

Diversification can help ensure that a downturn in one area of the market doesn’t derail your entire retirement plan. It’s like spreading your eggs across several baskets — if one basket falls, you still have others to rely on.

4. Consider Delaying Social Security Benefits

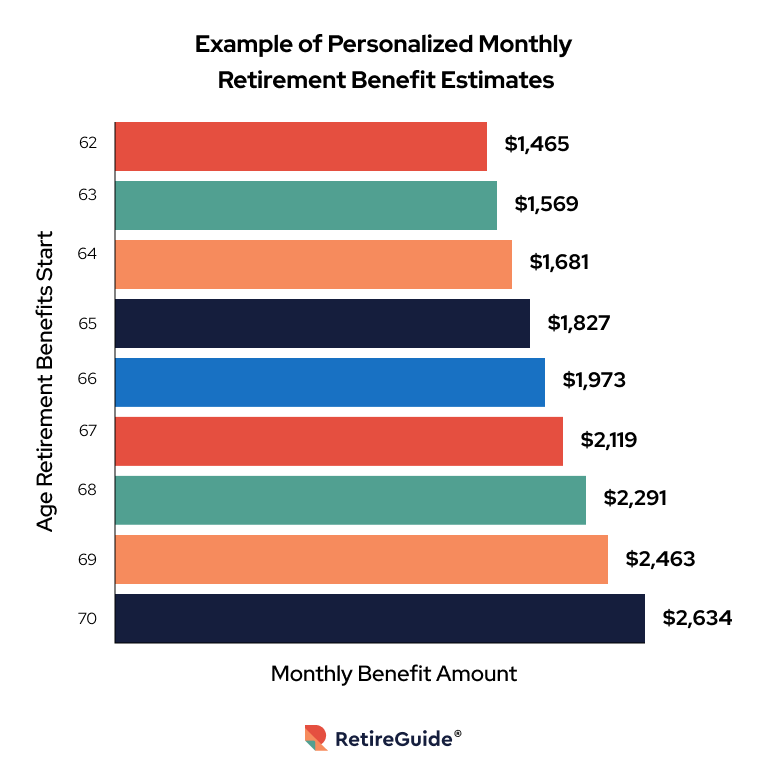

One of the best-kept secrets to maximizing your Social Security benefits is to delay your claim. While you can start receiving benefits as early as age 62, waiting until you reach your full retirement age (FRA), or even age 70, can significantly increase your monthly payout.

For every year you delay starting Social Security past your FRA, your benefits increase by 8% per year. For someone born in 1960 or later, full retirement age is 67. If you delay until 70, your monthly check could be 24% higher than if you started at 67.

This strategy works best if you expect to live into your 80s or beyond, as it provides a higher payout for a longer time. If you don’t need the funds right away, delaying can make a huge difference in the long run.

5. Create a Comprehensive Financial Plan

A solid financial plan is the foundation of any successful retirement strategy. It’s important to factor in things like healthcare costs, inflation, and possible changes to Social Security benefits. With the right plan in place, you can ensure that your savings and investments are aligned with your long-term goals.

If you don’t know where to start, consider seeking advice from a certified financial planner. They can help you determine how much you need to save each month, how to allocate your investments, and whether you’re on track to meet your retirement goals.

A good financial plan will also help you weather economic downturns, and make adjustments as needed, whether that’s increasing savings during a boom or cutting back when necessary.

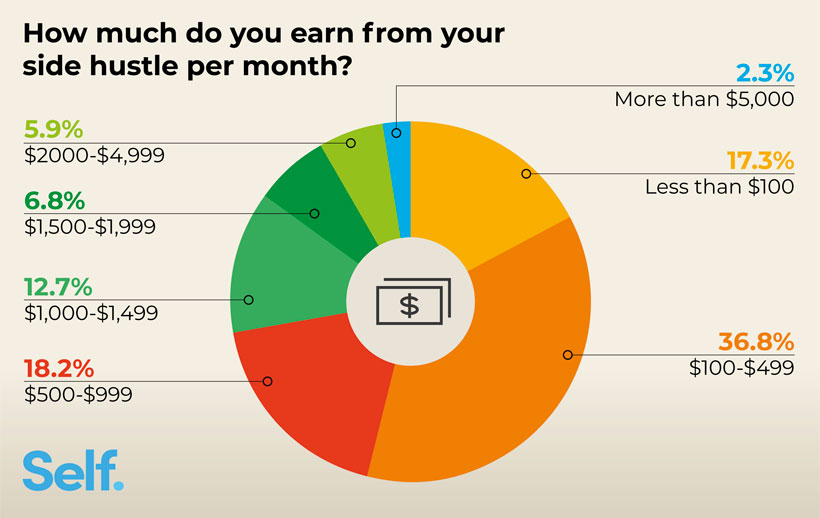

6. Explore Additional Income Streams

In today’s gig economy, many people are turning to side hustles to supplement their income. Whether it’s freelance writing, driving for a rideshare service, or starting an online business, side jobs can provide a much-needed boost to your retirement savings.

In fact, according to Investopedia, about 36% of Americans have a side hustle that helps fund their retirement. While it may seem like extra work, these income streams can accelerate your savings and offer additional financial flexibility in the future.

If you’re looking for a way to increase your savings without significantly changing your lifestyle, consider finding a side hustle that matches your skills or interests. The extra cash can go straight into your retirement account. You could even consider selling items you no longer need, or rent out unused spaces in your home for additional income.

Additional Strategies for Long-Term Financial Success

While the six strategies mentioned above are key to securing your retirement, you can also look at a few additional tips that can boost your financial success.

- Consider Tax-Advantaged Accounts

Tax-advantaged accounts, like Roth IRAs and Health Savings Accounts (HSAs), allow you to grow your money tax-free or tax-deferred, depending on the account type. This can give your savings a significant boost over the long run by reducing your overall tax burden. - Refinance Debt to Free Up Cash

High-interest debt can prevent you from saving enough for retirement. By refinancing or consolidating debt, you may be able to lower your interest rates and free up extra cash to put toward savings. - Plan for Healthcare Costs

Healthcare is one of the largest expenses in retirement. Consider adding a Health Savings Account (HSA) to your retirement plan. If used for medical expenses, HSAs grow tax-free and are a great way to save specifically for healthcare costs in retirement.

The Social Security Bridge Strategy That May Help You Delay Retirement Withdrawals

Social Security Retirement Age Adjusted to 67 Under New Guidelines- Check Official Details!

Why Your Social Security Retirement Checks Might Shrink Sooner Than Expected- Check Details