Social Security to Undergo Major Change This Fall: As the leaves start turning this fall, Social Security will also undergo a major transformation that could affect millions of Americans. The changes set to take place are designed to modernize how Social Security benefits are delivered and make life easier for recipients. However, they also come with some important steps and adjustments that everyone needs to understand. In this article, we’ll break down everything you need to know about the changes happening to Social Security this fall. Whether you’re a recipient or a professional advising others on Social Security, this guide will help you navigate the new rules. From eliminating paper checks to understanding the impact of rising Medicare premiums, we’ve got it covered with easy-to-follow explanations, insights, and tips.

Social Security to Undergo Major Change This Fall

The changes to Social Security this fall represent a significant shift for recipients. From eliminating paper checks to adjusting taxes and increasing Medicare premiums, it’s crucial to stay informed about how these changes will affect you. By understanding these key updates, you can better prepare and make the most of your Social Security benefits. Whether it’s setting up electronic payments or budgeting for rising healthcare costs, taking action today can help you secure your financial future.

| Key Change | What It Means | Why It’s Important | Official Reference |

|---|---|---|---|

| End of Paper Checks | Paper checks for Social Security payments will be phased out by September 30, 2025. | Recipients must switch to direct deposit or a prepaid debit card. | Go Direct |

| Tax Relief for Seniors | Temporary $6,000 deduction for seniors, potentially eliminating taxes on Social Security. | Helps seniors keep more of their benefits but only applies through 2029. | Washington Post |

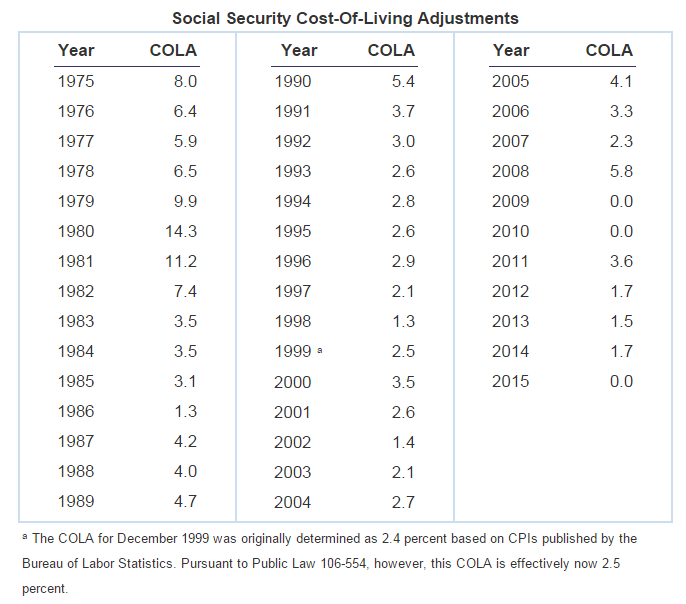

| Cost-of-Living Adjustment (COLA) | Social Security benefits will increase by 2.5% in 2025. | The increase helps recipients keep up with rising costs, but may be offset by Medicare premium hikes. | MarketWatch |

| Repeal of Windfall Elimination Provision (WEP) | Social Security Fairness Act repeals WEP, benefiting over 3 million retirees. | Retirees who had pensions from non-Social Security jobs will see an increase in benefits. | Kiplinger |

| Medicare Premiums | Medicare Part B premiums expected to rise in 2026. | May offset Social Security COLA increases for many, especially low-income retirees. | Barron’s |

End of Paper Checks: A Big Shift for Social Security Payments

The most significant change impacting Social Security recipients this fall is the end of paper checks. Starting in September 2025, the U.S. Treasury Department will stop sending paper checks for all federal payments, including Social Security benefits. This means recipients will need to switch to electronic payments, either through direct deposit into a bank account or through a Direct Express® card, which is a prepaid debit card specifically for federal payments.

Why This Change Is Happening?

The change is part of a nationwide push to eliminate the use of paper checks in favor of electronic payments. The U.S. government is looking to modernize its payment systems, cut down on fraud (which is 16 times higher with paper checks), and save money—around $750 million each year.

What Do You Need to Do?

- If you are still receiving paper checks, now’s the time to make the switch! The deadline is September 30, 2025.

- To get set up for direct deposit, you can use the official Go Direct website or contact your bank.

- Alternatively, you can sign up for the Direct Express® card if you don’t have a bank account.

If you face challenges setting up electronic payments, there are exceptions, and you may still qualify for a paper check, but this is for individuals who lack access to financial services or face extreme hardships.

Tax Relief for Seniors: A Temporary Break

In 2025, seniors will see a temporary tax relief measure that could make a significant difference in their income. The One Big Beautiful Bill Act, signed into law earlier this year, provides a $6,000 deduction for individuals aged 65 and older with certain incomes. This could potentially eliminate taxes on Social Security benefits for many seniors.

What Does This Mean?

For those who qualify, this relief could make a noticeable difference in how much of your Social Security benefits are taxable. However, there’s a catch: this relief measure is temporary, set to expire in 2029.

Who Will Benefit?

- Seniors with a taxable income under certain thresholds could see a reduction or complete elimination of taxes on their Social Security benefits.

- But not everyone will qualify. The deduction is based on income levels, and seniors who earn too much could still see a portion of their benefits taxed.

Practical Example

Let’s say you’re a senior receiving $1,500 a month in Social Security benefits. Under the current tax laws, a portion of your Social Security benefits could be taxed if your overall income exceeds certain limits. With this new tax break, seniors like you could potentially keep all of your Social Security benefits without facing taxation, depending on your income.

Cost-of-Living Adjustment (COLA): More Money, But Watch Out for Medicare Premiums

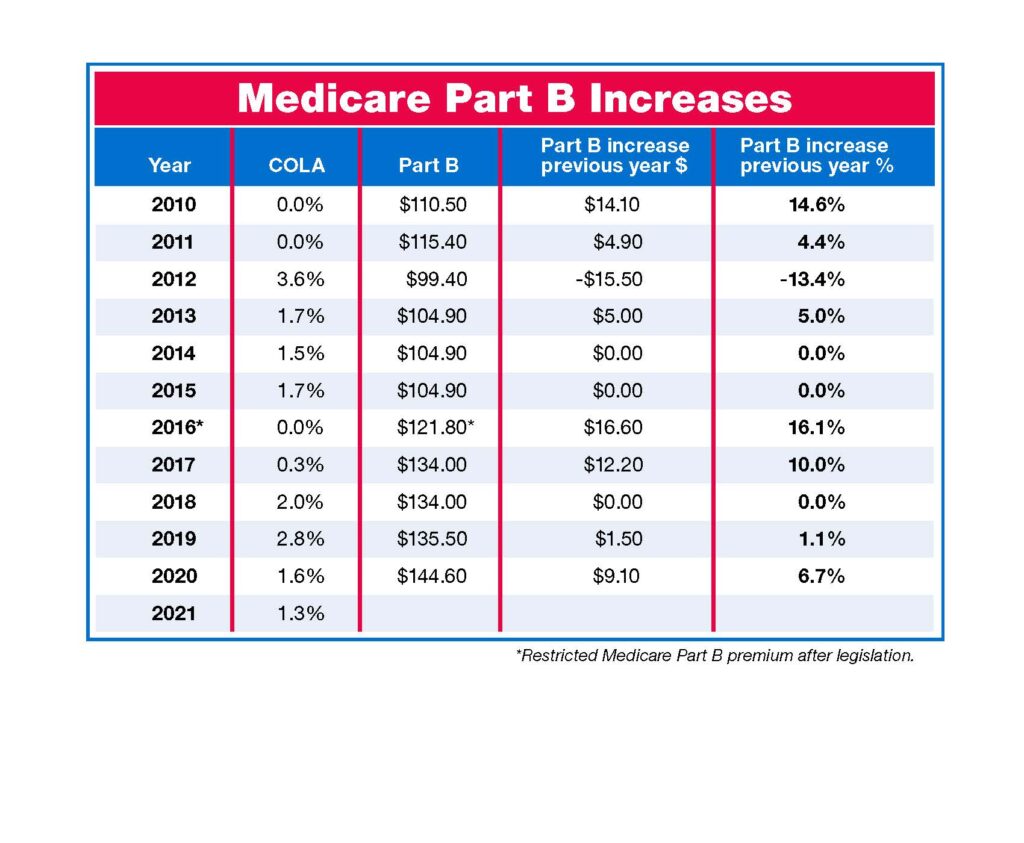

Every year, Social Security benefits are adjusted based on the cost of living (COLA), which takes into account inflation and the rising costs of goods and services. In 2025, Social Security recipients will see a 2.5% increase in their monthly benefits. This might sound great, but there’s a downside: the Medicare Part B premiums are also expected to rise.

How Much Will Your Benefits Increase?

- The average monthly Social Security retirement benefit will rise from $1,927 to $1,976.

- Married couples will see a boost, increasing their monthly benefit to $3,089 on average.

Medicare Premiums: A Catch

- While the COLA increase is helpful, Medicare premiums are projected to rise by $21.50 a month, which could eat up a large portion of the COLA increase.

- For example, if you’re receiving $800 a month in Social Security benefits, this increase in premiums might cancel out any COLA gain you would’ve received.

So, it’s important for recipients to plan ahead and factor in the rising cost of Medicare premiums when budgeting for the year.

Windfall Elimination Provision (WEP) Repeal: A Big Win for Retirees

If you have worked in a job where you didn’t pay into Social Security, you might be familiar with the Windfall Elimination Provision (WEP). This provision used to reduce Social Security benefits for people who also had pensions from jobs not covered by Social Security.

But in 2025, the Social Security Fairness Act repealed WEP, benefiting over 3 million retirees. This means more money in the pockets of people who were unfairly penalized by the WEP in the past.

What Does This Mean for You?

- If you were affected by the WEP, you will see an increase in your monthly Social Security benefits.

- Retroactive payments will be issued, so you may receive back pay for the benefits you were denied in the past.

Medicare Part B Premiums: What to Expect in 2026

While Medicare Part B premiums may rise in 2025, the increase in 2026 is expected to be even steeper. Projections show that premiums could jump by 11.5%, from $185 in 2025 to $206.20 in 2026. This will directly impact Social Security recipients, especially low-income individuals, as the premium increase could eat into their COLA adjustments.

How Will This Impact You?

- If you’re already living on a tight budget, you’ll want to keep a close eye on how these premiums affect your monthly income.

- If you qualify for low-income assistance programs, you may be able to offset the premium increase.

Impact on Younger Workers: What You Need to Know About Social Security to Undergo Major Change This Fall

Though most of the changes discussed here affect retirees and current recipients, younger workers should be paying attention as well. With the Social Security trust fund projected to run out by 2033, younger generations may need to make important financial decisions soon to ensure they are financially secure.

What Can You Do?

- Start saving early: Begin saving for retirement now to ensure you’re not dependent on Social Security alone when the time comes.

- Understand Social Security’s future: Stay informed about any upcoming changes to Social Security. If benefit cuts are enacted, it’s important to adjust your retirement plans.

Planning for the Future

It’s not just about collecting benefits when you retire; it’s about preparing today. Look into other retirement savings accounts, like 401(k)s and IRAs, to supplement any potential shortfall in Social Security benefits.

How Social Security May Evolve Under President Trump’s Proposed Changes

Republican Senator Lays Out Social Security Changes That Could Reshape Future Benefits

2026 Social Security COLA Forecast Updated — Here’s the Estimated Benefit Increase