Social Security to Send $2,000 on Average in 4 Days: isn’t just a flashy headline—it’s a significant moment for millions of Americans who rely on monthly benefits to stay afloat, plan their futures, or help support loved ones. Whether you’re a retiree checking your direct deposit or a young planner helping family manage benefits, this guide lays it out clearly.

Thanks to the 2.5% Cost-of-Living Adjustment (COLA) approved for 2025, the average monthly Social Security payment has climbed above the $2,000 threshold for many recipients. That’s more than just a bump in the check—it’s a reflection of growing inflation, policy shifts, and the continued importance of Social Security as a financial safety net.

Social Security to Send $2,000 on Average in 4 Days

The Social Security Administration’s decision to raise the average benefit above $2,000 in 2025 is a welcome financial relief for millions of Americans. From the updated payment schedule to overpayment policy changes and repeal of offset penalties, there’s a lot shifting in how benefits are delivered and calculated.

Make sure you:

- Know your payment schedule

- Monitor your benefit details

- Stay up-to-date on policy changes

- Use official resources to manage your benefits

Whether you’re a retiree, caregiver, financial advisor, or concerned relative, understanding how Social Security works puts you in the driver’s seat.

| Highlight | Details |

|---|---|

| Average Benefit | ~$1,976 as of January 2025; ~$2,002 by mid-year for many |

| COLA Increase | 2.5% approved for 2025, effective January |

| July 2025 Payment Dates | July 1, 3, 9, 16, 23, based on birthdate and claim status |

| Maximum Benefit | $5,108/month for those who claim at age 70 |

| WEP/GPO Changes | Windfall Elimination and Government Pension Offsets repealed April 2025 |

| Overpayment Rules | New recoupment policy: SSA can withhold up to 50% of future benefits |

| Eligibility | Must be receiving retirement, disability, or survivor benefits |

| Source | SSA.gov |

Why This Payment Matters in 2025?

Social Security, administered by the Social Security Administration (SSA), provides monthly income to over 72 million people in the U.S.—retirees, individuals with disabilities, survivors of deceased workers, and low-income seniors through SSI (Supplemental Security Income).

In January 2025, the SSA applied a 2.5% COLA, a yearly adjustment tied to the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). This increase nudged the average benefit for retired workers to around $1,976, and by mid-year, the average benefit exceeded $2,000 for many due to compounding and deferred claiming strategies.

It may not sound huge, but in today’s economy, every extra dollar counts—especially when groceries, rent, and medical costs keep rising.

July 2025 Payment Dates: What to Know

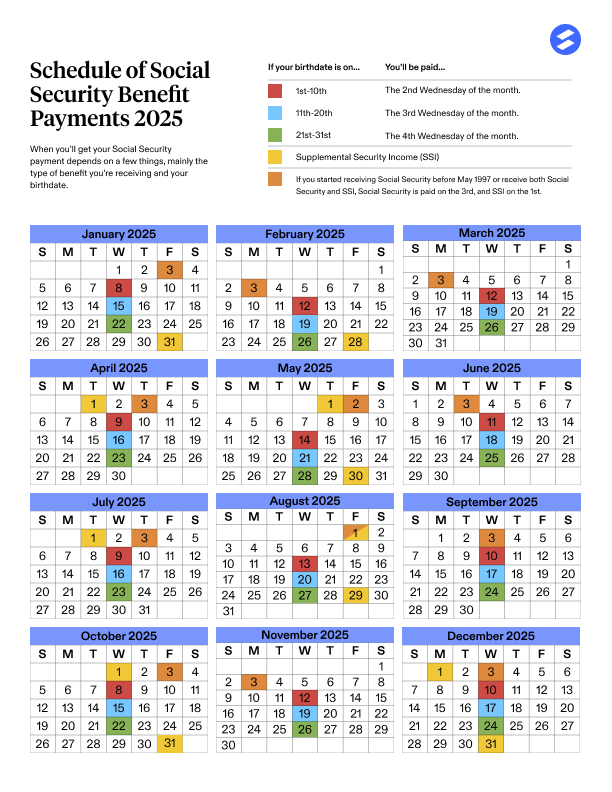

The day you get paid depends on two factors:

- Your birthday

- When you started receiving benefits

Here’s how it works:

- July 1 – SSI recipients (low-income seniors and disabled adults)

- July 3 – Those who began receiving SSA benefits before May 1997

- July 9 – Post-May 1997 claimants born 1st–10th

- July 16 – Post-May 1997 claimants born 11th–20th

- July 23 – Post-May 1997 claimants born 21st–31st

If your birthday is July 8 and you started receiving Social Security benefits in 2010, your check is scheduled to land on July 9.

Who Qualifies for the $2,000 Average?

Getting the average Social Security benefit of $2,000 or more depends on several factors. Here’s who is most likely to qualify:

- You’re receiving retirement, disability, or survivor benefits

- You began claiming benefits after May 1997

- Your birthday falls between the 1st and 10th of the month

- You had a moderate-to-high income during your working years

- You claimed benefits at or after full retirement age (FRA)

Keep in mind, if you retired early (before age 67 for most), your benefit is reduced. If you delayed past full retirement age, your benefit increases up to age 70.

Maximum Benefit and Claiming Age Strategy

While $2,002 is the average, some folks earn a whole lot more. The maximum monthly Social Security benefit in 2025 is $5,108—but to get there, you need to:

- Work for at least 35 years,

- Consistently earn at or above the SSA’s taxable maximum ($168,600 in 2024),

- And delay claiming until age 70.

Claiming at 62 (the earliest possible age) reduces your benefit by up to 30%. Delaying can increase your benefit by 8% per year after full retirement age.

Recent Policy Changes You Should Know

1. COLA Adjustment:

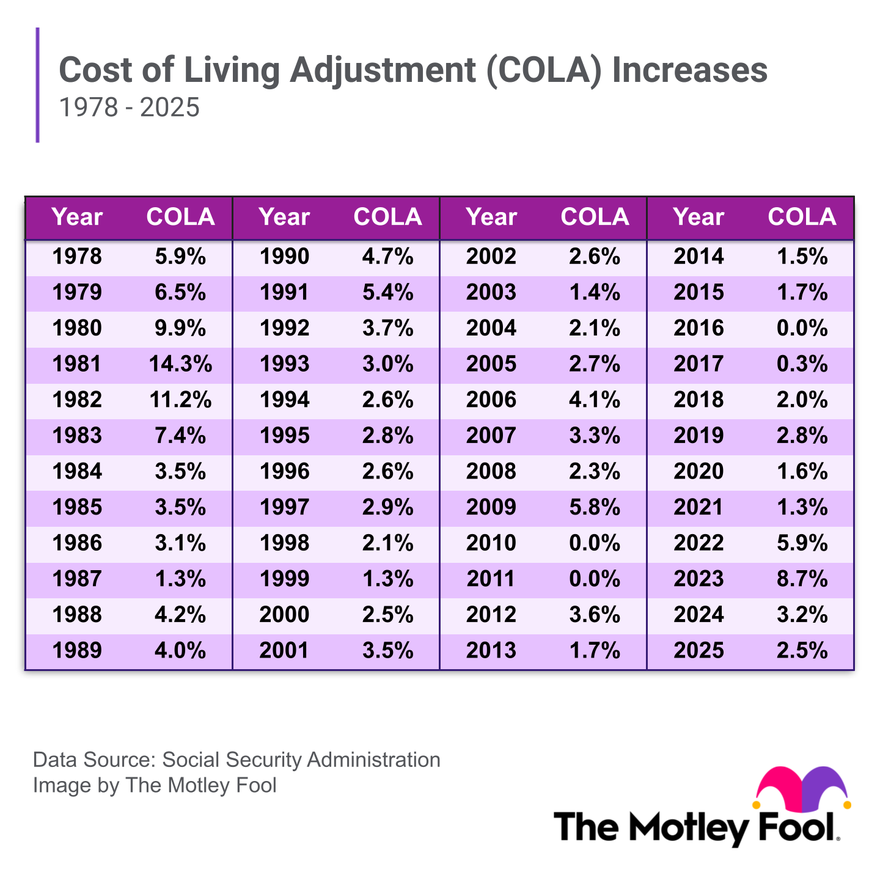

COLA is triggered annually based on inflation, as measured by the CPI-W. In 2025, the 2.5% increase helped cushion the blow of rising prices.

2. Overpayment Recoupment Rule (April 2025):

SSA can now withhold up to 50% of future benefits to recover overpayments. Previously, this was 10%. Recipients can request waivers or appeals if repayment creates undue hardship.

3. WEP and GPO Repeal:

The controversial Windfall Elimination Provision (WEP) and Government Pension Offset (GPO) were repealed in April 2025. This change significantly boosts benefits for public employees (like teachers and municipal workers) who were previously penalized for receiving a non-covered pension.

SSI vs. SSDI vs. Retirement Benefits

It’s important to distinguish between the types of Social Security benefits:

Retirement Benefits:

Available starting at age 62, based on work credits earned over your career. Full benefits come at FRA (66–67), and maximums come at 70.

SSDI (Disability Insurance):

For workers under 67 who become disabled. Based on prior work history and earnings.

SSI (Supplemental Security Income):

A needs-based program for elderly, blind, or disabled people with limited income and resources. Funded by general tax revenues, not Social Security taxes.

Survivor Benefits:

Paid to widows, widowers, and children of deceased workers. May be 75%–100% of the deceased’s benefit depending on age and family role.

Tax Implications: Yes, Your Benefits Might Be Taxed

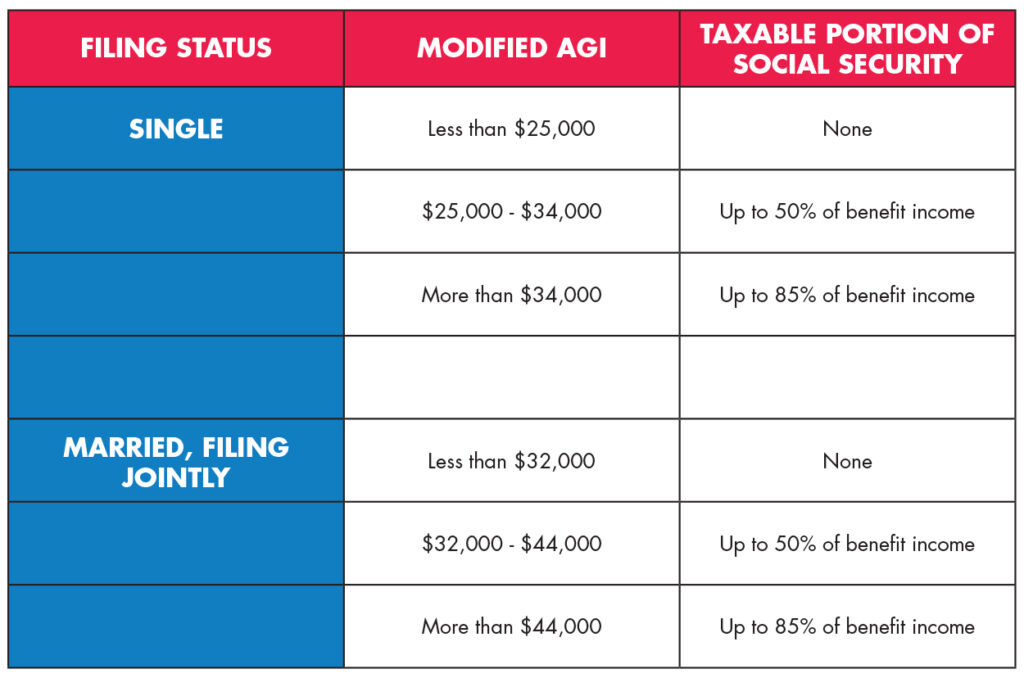

Many people are surprised to learn that Social Security benefits can be taxed, depending on your income:

- If you file as an individual and make over $25,000, or jointly over $32,000, up to 85% of your benefits may be taxable.

- These thresholds haven’t been adjusted in years, meaning more seniors are now facing benefit taxes due to inflation and COLAs.

Pro tip: Consider consulting a tax professional or using IRS Form SSA-1099 to see where you stand.

What If You Don’t Receive Social Security to Send $2,000 on Average in 4 Days?

First, don’t panic. SSA recommends waiting 3 business days past your expected payment date before contacting them.

Here’s what to do:

- Check your direct deposit details

- Log into your My Social Security account to verify payment date and amount

- Call SSA at 1-800-772-1213 if payment is still missing

Avoid calling on Mondays or right after holidays—those are peak hold-time days.

Real-Life Example: Meet Gloria

Gloria is a 69-year-old retired nurse. She delayed claiming her benefits until age 68 and worked her entire career in the public sector. After the WEP repeal, her monthly benefit increased by $650.

Her birthday is July 5. She’s expecting her $2,003 benefit check to arrive on July 9. She tracks her payment in the My SSA app, and sets alerts through her bank. If her deposit is late, she knows to wait until July 12 before calling SSA.

Financial Planning Tips for Social Security Recipients

- Track COLA each year: Adjust your budget accordingly in December.

- Use SSA’s retirement calculator to project future benefits.

- Pair Social Security with other income streams, like 401(k), IRA, or pensions.

- Avoid early claiming unless necessary—maximize your benefit by waiting.

- Review your earnings record annually—errors can reduce your future benefit.

Why Some Social Security Recipients Might See Their Payments Slashed by 50%

Trump’s New Tax Bill Could Reshape How Social Security Benefits Are Taxed

Millions of Americans Could See Their Social Security Checks Cut by 50 Percent