Social Security Slashing Benefits by Up to 50%: Let’s not sugarcoat it — Social Security is in trouble, and headlines claiming it’s “slashing benefits by up to 50%” are turning heads from Main Street to Wall Street. While that number sounds dramatic (and a bit clickbaity), the truth is somewhere in the middle — serious, but not quite doomsday. In this article, we’ll walk you through exactly what’s happening with Social Security, who’s most likely to get hit, and what you can do to stay ahead. Whether you’re a retiree, a Gen Xer inching toward retirement, or a millennial still thinking 401(k)s are a myth, this guide breaks it all down in plain English — no financial jargon, just real talk.

Social Security Slashing Benefits by Up to 50%

So, is Social Security slashing benefits by 50%? Not exactly. But unless Congress acts soon, a 24% cut could start as early as 2033. The people most likely to be affected are younger Americans who have years left before retirement. The key takeaway? You don’t need to panic — you need to plan. Social Security might face stormy weather, but with smart decisions, proactive savings, and political awareness, your retirement can still be secure. Use this article as your roadmap and start prepping today. The earlier you act, the better your chances of retiring comfortably, no matter what Washington decides.

| Topic | Details |

|---|---|

| Trust Fund Depletion Year | 2033 |

| Projected Benefit Cut | ~24% across the board if Congress doesn’t act |

| Who’s Most at Risk? | Younger workers (born after 1970s) |

| Why This Matters | Without reform, future retirees may get smaller monthly checks |

| Official Website | Social Security Administration |

| Suggested Action | Delay claiming, boost savings, track legislative changes |

| Legislation Involved | “One Big Beautiful Bill” – major tax impacts on benefits |

What’s Really Happening to Social Security?

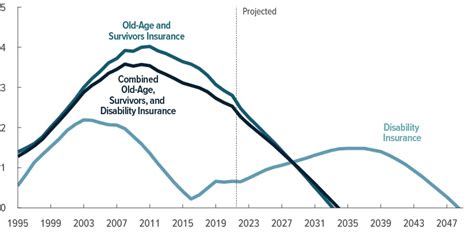

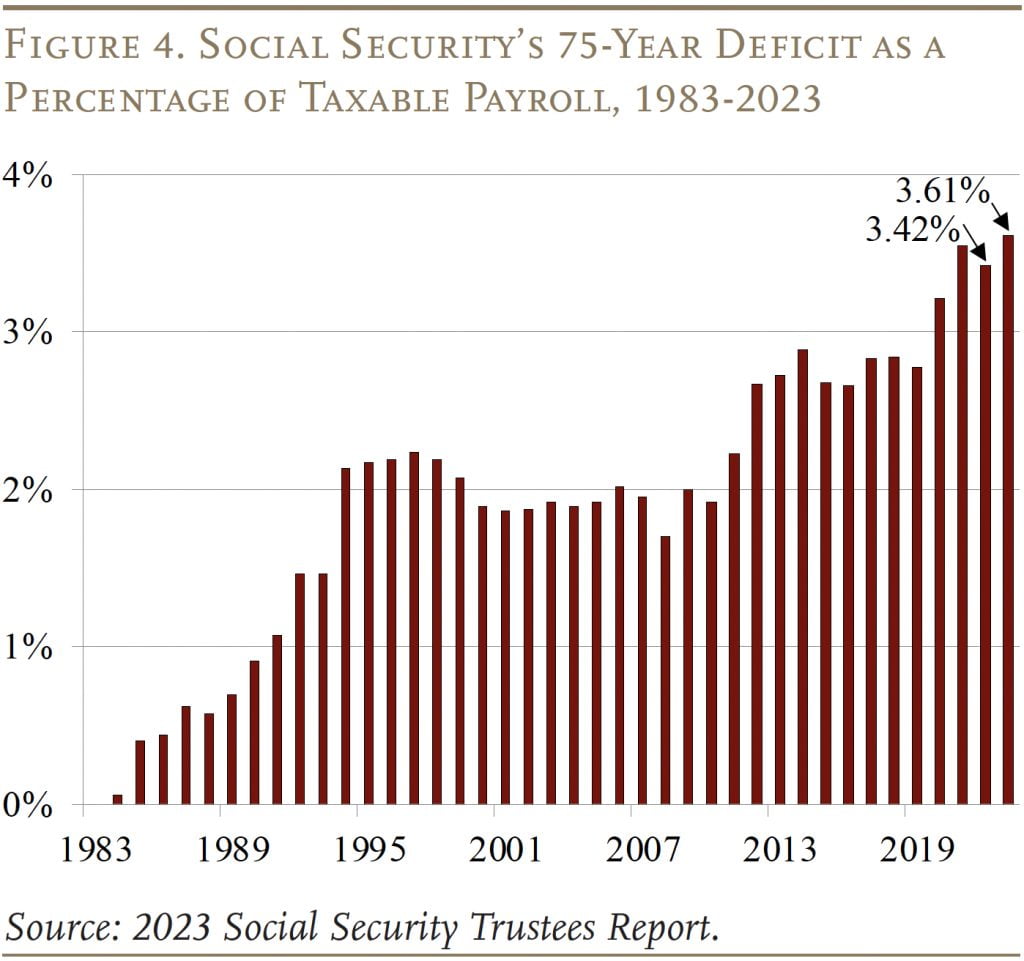

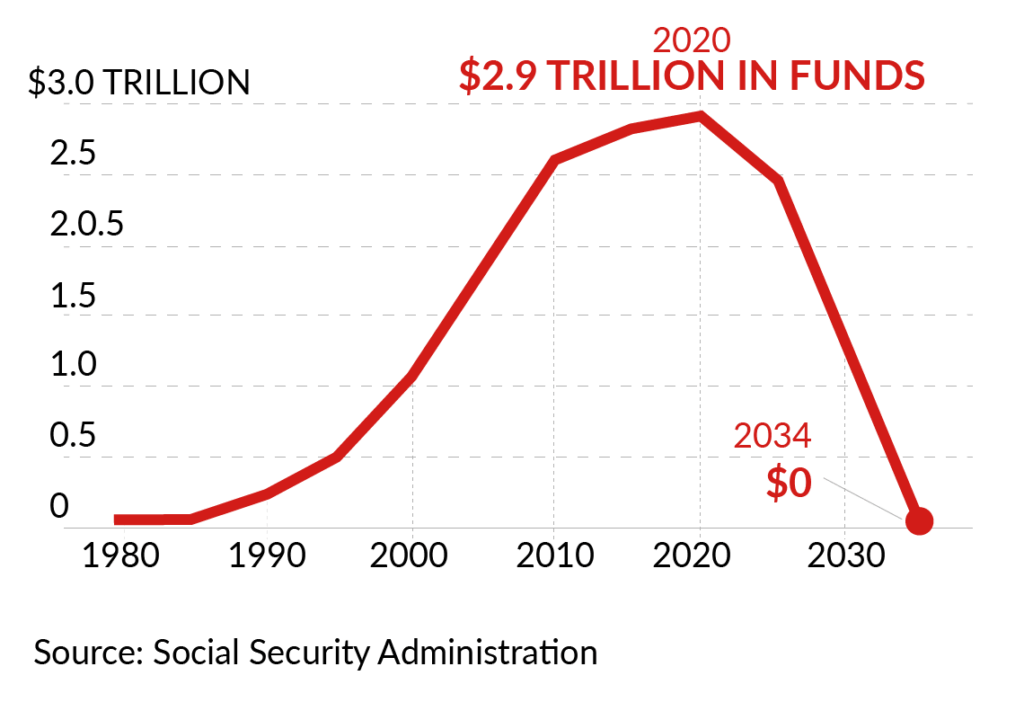

The Social Security trust fund, which pays retirement benefits, is projected to be depleted by 2033. This means that unless Congress steps in with a solution, the SSA will only be able to pay out about 76% of scheduled benefits. That’s a 24% automatic cut.

Some headlines suggest cuts of “up to 50%,” but that scenario would only happen in extreme cases — such as a combination of higher taxes, inflation eating into COLA adjustments, or across-the-board policy shifts targeting higher earners.

Let’s be clear: Social Security is not going bankrupt. However, the system is projected to pay out more in benefits than it takes in starting now. Without intervention, this imbalance grows each year, leading to an unsustainable model.

Who’s Getting Hit First?

Least Affected: Current Retirees

If you’re already receiving Social Security or will be within the next few years, you’re likely safe from benefit cuts. Historically, lawmakers have gone out of their way to protect current retirees during reforms. Think of it as a political “third rail” — too hot to touch.

Most at Risk: Younger Generations

The harshest blow will likely land on Gen Z, younger millennials, and Gen Alpha — those born after the late 1970s or early 1980s. They could see:

- Raised full retirement age (FRA)

- Lower lifetime payouts

- Altered benefit formulas based on means-testing

- Reduced COLAs (cost-of-living adjustments)

Example Scenario

Suppose you’re 35 years old in 2025, projected to receive $2,000/month in retirement benefits. If Congress does nothing and cuts hit in 2033, you’d only receive $1,520/month — a significant shortfall when compounded over a 20–30-year retirement.

Why Social Security Slashing Benefits by Up to 50%?

This isn’t a new problem. The causes are well-known and have been building for decades:

- Demographic Shift: In 1960, there were 5 workers supporting each retiree. As of 2025, it’s just 2.7. Fewer people paying in, more people drawing out.

- Aging Population: Baby Boomers are retiring in record numbers, and people are living longer — increasing benefit duration.

- Lower Birth Rates: Fewer workers entering the workforce means less revenue from payroll taxes.

- Tax Reform Impact: The 2025 “One Big Beautiful Bill” eliminated taxes on Social Security benefits for most Americans. That reduced revenue to the trust fund at a time it’s most needed.

Historical Context: This Isn’t the First Crisis

Social Security faced a similar crisis in the early 1980s. At the time, the system was weeks away from defaulting on benefits. Congress acted by:

- Raising the retirement age from 65 to 67 (phased over time)

- Increasing payroll tax rates

- Introducing taxation of benefits for higher-income retirees

These moves stabilized the system for decades — proving that bipartisan reform can work.

What You Can Do About It?

1. Delay Claiming Social Security

Claiming at age 70 instead of 62 can increase your monthly benefit by 76%. Every year you delay after your full retirement age (66–67), your benefit grows by 8%.

Pro Tip: If you’re healthy and expect to live past age 82, delaying benefits typically results in a higher lifetime payout.

2. Max Out Personal Savings Vehicles

Here’s your checklist:

- Max out your 401(k) and get your employer match

- Consider a Roth IRA or traditional IRA

- Use a Health Savings Account (HSA) to cover medical expenses tax-free in retirement

These accounts provide tax advantages and let you diversify your income sources.

3. Use the SSA’s Tools

The SSA provides powerful calculators to estimate your future benefits:

- Retirement Estimator

- Benefit Planner

Check in yearly. These estimates adjust based on earnings history and legislative changes.

4. Diversify Your Retirement Income

Don’t rely solely on Social Security. Consider:

- Dividend-paying stocks

- Real estate income

- Annuities

- Side gigs or part-time work in early retirement

Having multiple streams of income offers financial security if benefits are reduced.

5. Stay Politically Informed

Social Security reform is a hot topic in Congress. Keep an eye on:

- Proposals to raise the payroll tax cap

- COLA formula changes

- Retirement age adjustments

Voting for leaders who prioritize retirement security can shape the system’s future.

6. Work with a Financial Advisor

A fiduciary advisor can help you create a strategy tailored to your retirement timeline, expected expenses, and tax bracket. Ask them to model different “cut” scenarios so you’re not caught off guard.

Solutions on the Table in Washington

Raise or Remove the Payroll Tax Cap

Currently, income above $168,600 (2025 cap) isn’t taxed for Social Security. Raising or eliminating this cap could increase funding without touching benefits.

Increase the Retirement Age

Raising the retirement age to 68 or 70 for younger workers would reduce lifetime benefit payouts, but would need to be phased in gradually to avoid backlash.

Introduce Means-Testing

This could reduce or eliminate benefits for high-income retirees. While controversial, it would help direct resources to lower- and middle-income seniors.

Reform COLA Calculations

Switching from CPI-W to “Chained CPI” would result in smaller annual increases — slowing benefit growth to save money over time.

Expand Coverage

Currently, some state and local employees aren’t covered under Social Security. Expanding the system to include them could bring in new revenue.

Data Snapshot (2025 Estimates)

| Stat | Number |

|---|---|

| Americans Receiving Benefits | Over 67 million |

| Average Monthly Retirement Benefit | $1,907 |

| Social Security’s Annual Deficit | $100 billion+ |

| Trust Fund Exhaustion Date | 2033 |

| Post-2033 Funding Capacity | 76% of scheduled benefits |

Social Security Projected to Cut Benefits by 2033, Affecting Retired Workers

Millions of Americans Could See Their Social Security Checks Cut by 50 Percent

The Truth About Social Security Taxes and What You Can Still Do to Cut Them