Social Security Shake-Up Incoming: Social Security is a lifeline for millions of Americans, providing essential benefits during retirement, disability, and for survivors. As we head into 2025, there are several significant updates to the program that could impact how you receive and manage your benefits. Whether you’ve been collecting Social Security for years or are just starting to navigate the system, understanding these upcoming changes is key. In this article, we will break down these changes in a clear, approachable way—ensuring you’re prepared for the shifts ahead. The federal government has announced major changes to Social Security that will take effect in 2025, from cost-of-living adjustments (COLA) to the elimination of paper checks. These changes are important, and it’s essential for recipients to stay informed about them. This article will walk you through what you need to know and how to take action to maximize your benefits.

Social Security Shake-Up Incoming

As we head into 2025, Social Security recipients should be aware of several significant changes, from higher payments due to COLA adjustments to the elimination of paper checks. By staying informed about these updates, you can better plan for your financial future and make the most of your Social Security benefits. Be proactive by setting up direct deposit, adjusting for tax relief, and budgeting for any increase in Medicare premiums. With the right preparation, these changes can work to your advantage, helping you maintain financial stability in the years to come.

| Change | Description | Action for Recipients |

|---|---|---|

| Cost-of-Living Adjustment (COLA) | Social Security benefits will rise by 2.5% in 2025. | Expect an increase in your payments to help offset inflation. |

| Paper Check Elimination | By September 30, 2025, paper checks for Social Security will be phased out. | Switch to direct deposit or a prepaid debit card to ensure you continue to receive payments on time. |

| Tax Relief for Seniors | The new tax law provides a $6,000 deduction for individuals aged 65+ making $75,000 or less, and $12,000 for couples. | Adjust your withholding to take advantage of this benefit. |

| Repeal of WEP and GPO | The Windfall Elimination Provision (WEP) and Government Pension Offset (GPO) will be repealed, helping millions of retirees and their families. | If affected by WEP or GPO, you’ll now receive the full Social Security benefits. |

| Medicare Part B Premium Increase | Medicare premiums will rise by 11.5%, impacting your overall expenses. | Prepare for higher premiums and plan your budget accordingly. |

| Earnings Limits for Working Beneficiaries | For those under full retirement age, earning limits are set to $23,400. Once full retirement age is reached, the limit rises to $62,160. | Be mindful of your earnings if you plan to work while receiving Social Security benefits to avoid having them reduced. |

What’s Changing in Social Security Shake-Up Incoming?

1. Cost-of-Living Adjustment (COLA)

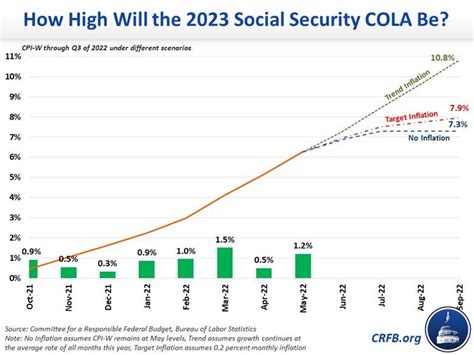

The Social Security Administration (SSA) has announced that benefits will increase by 2.5% in 2025. This annual adjustment helps ensure that your Social Security benefits keep up with rising prices. With inflation rates fluctuating, the COLA increases are vital in maintaining purchasing power.

For instance, if you receive a typical benefit of $1,500 a month, you’ll see an increase of about $37.50 per month. While this isn’t a massive increase, it can help offset the rising costs of essentials such as groceries, healthcare, and utilities. Social Security is a lifeline for many seniors, and adjustments like COLA help it fulfill that role in uncertain economic times.

2. Paper Check Elimination

Starting September 30, 2025, the federal government will stop sending paper checks for Social Security payments. This is part of a larger push to streamline payments and encourage more efficient, secure methods of delivering funds.

If you’re still receiving paper checks, it’s time to make the switch to direct deposit or an approved prepaid debit card. Direct deposit is not only faster but also more secure—there’s no risk of your check being lost in the mail or delayed. Plus, you’ll have quicker access to your funds.

To set up direct deposit, visit the SSA website or call their helpline to ensure a smooth transition. You can also select an approved prepaid card if you don’t have a bank account.

3. Tax Relief Under the “Big Beautiful Bill”

In an effort to help seniors who may be struggling with higher living costs, a new tax law provides $6,000 in tax relief for individuals aged 65 or older making $75,000 or less. Couples who file jointly can receive up to $12,000 in tax deductions. This is part of the broader American Rescue Plan designed to give tax breaks to seniors and reduce the burden of taxation on their Social Security benefits.

This provision is only available until 2029, so be sure to adjust your withholding or file your taxes accordingly. Seniors who qualify should take full advantage of this deduction, as it can significantly lower your taxable income.

4. Repeal of WEP and GPO

The Windfall Elimination Provision (WEP) and Government Pension Offset (GPO) are two provisions that previously reduced Social Security benefits for individuals who worked in non-Social Security-covered jobs, such as certain government positions. These provisions will be repealed with the passage of the Social Security Fairness Act, which means millions of individuals who were receiving reduced benefits will now get the full amount they are entitled to.

If you were affected by WEP or GPO, this change could mean a significant increase in your monthly benefits. For example, someone who worked in a public sector job and had their benefits reduced by WEP may now see those reductions lifted, bringing their benefits closer to what they would have been without the penalty.

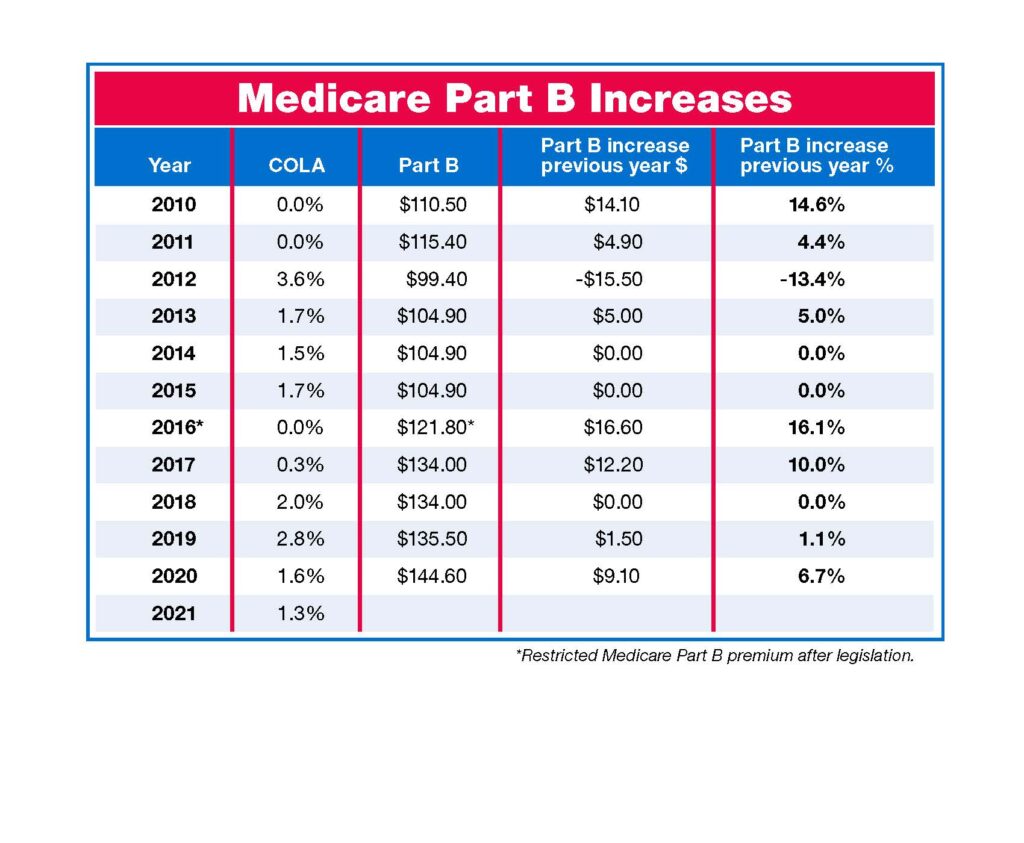

5. Medicare Part B Premium Increase

For those enrolled in Medicare Part B, premiums are set to increase by 11.5% in 2026, which means that seniors will face higher out-of-pocket costs for their healthcare. The monthly premium for Medicare Part B will increase to $206.20 in 2026. This increase could offset some of the benefits from the 2.5% COLA adjustment, so it’s important to factor this into your budget planning.

As healthcare costs continue to rise, understanding your Medicare premiums and how they impact your overall finances is crucial for maintaining financial stability in retirement.

6. Earnings Limits for Working Beneficiaries

If you are still working while collecting Social Security, be aware of the earnings limits in 2025. If you’re under full retirement age, the earnings limit is $23,400. This means that for every $2 you earn over that limit, $1 in Social Security benefits will be withheld. Once you reach full retirement age, the earnings limit rises to $62,160.

These limits are designed to encourage people to retire and begin collecting benefits, but if you’re still working, it’s essential to track your earnings and understand how it could impact your monthly Social Security payments.

How Social Security May Evolve Under President Trump’s Proposed Changes

2026 Social Security COLA Forecast Updated — Here’s the Estimated Benefit Increase

Republican Senator Lays Out Social Security Changes That Could Reshape Future Benefits