Social Security Sends Out Urgent Email Over Trump Tax Bill Confusion: The Social Security Administration (SSA) recently sent out an email that’s stirred up quite the buzz. If you’re a retiree, close to retirement, or just trying to make sense of the ever-changing tax laws, this one’s for you. Let’s break it down in simple terms: the SSA email claimed that the “One Big Beautiful Bill” signed by former President Donald Trump eliminates federal taxes on Social Security benefits for almost 90% of recipients. But here’s the catch — that’s not exactly how the law works. This article will walk you through what the bill actually does, how it impacts your taxes, and what you should be looking out for. Whether you’re a professional financial advisor or just trying to help Grandma sort her tax papers, we’ve got your back.

Social Security Sends Out Urgent Email Over Trump Tax Bill Confusion

We all want to believe in good news, especially when it hits the wallet. But in this case, the SSA email told only part of the story. Yes, there’s a solid tax break for seniors. No, it’s not a magic wand that makes Social Security tax-free for everyone. The key takeaway? Don’t rely on headlines alone. The tax landscape is complex, and while this law helps most retirees, it’s not the sweeping change some believed it to be.

| Topic | Details |

|---|---|

| Law Referenced | “One Big Beautiful Bill” signed July 5, 2025 |

| SSA Email Claims | “Eliminates federal income tax on Social Security for 90% of recipients” |

| Actual Law Impact | Offers standard deductions: $6,000 (single) / $12,000 (married, 65+) |

| Deduction Phase-Out | Begins at $75K (single) / $150K (married); ends at $175K/$250K |

| Duration | Applies tax years 2025–2028 only |

| Official SSA Site | www.ssa.gov |

What the Email Said — and Why It’s Confusing

The SSA email, sent out to millions of beneficiaries, basically said: “No more federal taxes on your Social Security thanks to the new law!” For many older Americans, that sounds like a dream come true. But tax experts and policy professionals quickly flagged it as overstating the facts.

The email was framed in promotional language, highlighting that the government was “finally putting seniors first,” and many interpreted it as official confirmation that their tax obligations had ended. That’s where the confusion began.

So, What’s the Real Deal?

Here’s what the bill actually says:

- It adds a temporary standard deduction for seniors aged 65 and older.

- That deduction is $6,000 for individuals and $12,000 for married couples.

- It’s applied to total income, not just your Social Security benefits.

- It phases out for higher-income individuals starting at $75,000 (single) and $150,000 (married).

- Once you hit $175,000 (single) or $250,000 (married), the deduction goes away entirely.

- The change applies only between 2025 and 2028, after which it sunsets unless extended by future legislation.

So nope — this isn’t a total tax wipeout on Social Security. Instead, it’s a tax break that could help most, but not all.

Who Benefits the Most From Social Security Sends Out Urgent Email Over Trump Tax Bill Confusion?

Most Social Security beneficiaries have modest incomes, so a lot of folks will see savings. According to The Urban Institute, about 88% of Social Security recipients earn under the phase-out limits. That means they’ll qualify for the full deduction.

Here’s a quick example:

Mary, 68, earns $20,000 a year from Social Security and a small pension. With the new deduction, she owes zero federal income tax.

John and Lisa, both 70, earn $165,000 combined (Social Security + investments). They get a reduced deduction.

Sam, 72, earns $260,000 — he gets no deduction at all.

Why Did SSA Get It Wrong?

The SSA isn’t usually in the business of pushing politics. That’s why this email raised serious questions. Even respected outlets like The Washington Post and AP News criticized the messaging, calling it “misleading” and “uncharacteristic” of the traditionally neutral agency.

So, what happened? Insiders suggest the SSA may have felt pressure from policymakers to frame the bill in the most positive light possible. Others see it as a case of miscommunication or political overreach. Regardless of intent, the impact is clear — many Americans are now confused about what’s actually changed.

Background: A Long History of Taxing Social Security

Let’s take a quick step back. Many folks are surprised to learn that Social Security benefits can be taxed at all. But that’s been the case since 1984, when Congress passed reforms to keep the program solvent.

Today, depending on your income, up to 85% of your Social Security benefits can be subject to federal tax. This doesn’t mean you’re taxed 85% — just that up to 85% of the benefits you receive can be added to your taxable income.

This new law doesn’t remove that rule — it simply offers a broader deduction that reduces taxable income overall. That’s a key distinction.

Breaking Down the Math: How It Works

Here’s how this tax break would work in practice:

Step-by-Step Example:

- Calculate Total Income (Social Security + Pensions + Investments)

- Subtract the New Standard Deduction ($6,000 or $12,000)

- Subtract any other deductions you’re eligible for

- Calculate Taxable Income

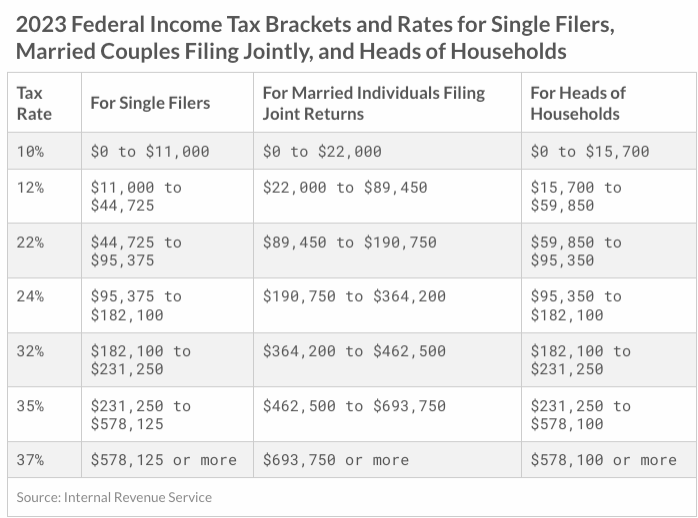

- Apply the IRS Tax Brackets

This is not a flat elimination of taxes, but it reduces the amount you’re taxed on.

How This Affects Retirement Planning?

If you’re planning to retire in the next few years, this deduction can affect several areas of financial planning:

- Whether to choose Roth vs. Traditional IRAs

- The timing and size of Roth conversions

- How much to withdraw from taxable accounts

- Planning for Required Minimum Distributions (RMDs)

Those using tax-advantaged strategies may need to update their projections. For retirees near the phase-out range, a few thousand dollars could mean the difference between keeping the full deduction or losing it entirely.

Pros and Cons of the New Deduction

Pros

- Reduces tax liability for the majority of seniors

- Simplifies tax filings (no new forms required)

- Benefits are automatic for most filers

Cons

- Only applies temporarily (2025–2028)

- Creates confusion due to SSA’s misleading email

- Doesn’t eliminate taxation on Social Security — only reduces total taxable income

- May encourage overconfidence in tax planning

Practical Advice: What Should You Do Now?

Here’s how to make sure you’re on track and not caught off guard by tax season:

1. Check Your Income Bracket

Use a tool like the IRS Tax Withholding Estimator to see if the deduction applies to you.

2. Talk to a Tax Professional

Even if you’re comfortable filing taxes, this year may be worth hiring a pro — especially if you’re near the deduction phase-out limits.

3. Adjust Withholding If Needed

If you’re having too much or too little tax withheld from Social Security, file IRS Form W-4V to make adjustments.

4. Stay Vigilant Against Scams

Whenever big news breaks about benefits or taxes, scammers strike. Never give personal info over the phone or via unsolicited emails.

5. Review State Tax Rules

Even if your federal taxes go down, you may still owe state income taxes on your benefits, depending on where you live.

6. Watch for Future Changes

With an election year approaching and more policy debates ahead, it’s likely that Social Security taxation will remain a hot topic.

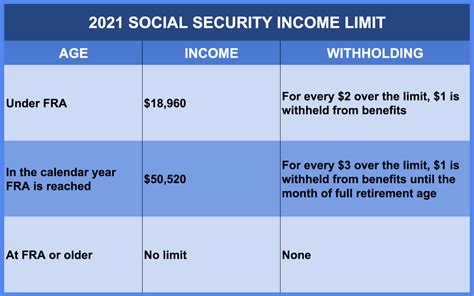

Why Some Social Security Recipients Might See Their Payments Slashed by 50%

Millions of Americans Could See Their Social Security Checks Cut by 50 Percent