Social Security Retirement Age Adjusted to 67: The U.S. Social Security Administration (SSA) has officially updated its full retirement age (FRA) guidelines: If you were born in 1960 or later, your FRA is now 67 years old. Those born in 1959 face a slightly earlier FRA of 66 years and 10 months. While this phased increase has been rolling out for decades, 2025 marks a major milestone when millions of Americans will feel its full impact. If you’re planning your retirement or advising others on it, it’s crucial to understand how these changes affect your Social Security benefits. In this guide, we’ll break it down clearly: what’s changing, who it impacts, why it’s happening, and—most importantly—what you can do right now to protect your future income.

Social Security Retirement Age Adjusted to 67

The shift to a full retirement age of 67 isn’t a future change—it’s happening now. If you’re born in 1960 or later, your retirement decisions must account for this. Whether you retire early, on time, or late, the choices you make today will define your income for decades. Take the time to evaluate your personal situation, use the tools available, and talk with a financial advisor. The Social Security system may be complex, but it’s your responsibility—and your right—to make it work for you.

| Key Info | Details |

|---|---|

| New Full Retirement Age (FRA) | 67 years old for those born in 1960 or later |

| Transitional FRA | 66 years and 10 months for those born in 1959 |

| Early Retirement | Still allowed at age 62, but with a 30% permanent benefit reduction |

| Medicare Eligibility | Still begins at age 65 |

| Delayed Retirement Credit | 8% yearly benefit increase for delaying retirement beyond FRA, up to age 70 |

| Impact Year | Fully effective in 2025 as 1960-born Americans reach 65 |

| Source | SSA Official Website |

Why the Retirement Age Is Changing?

The Social Security system was created in 1935, when life expectancy in the U.S. was about 61 years. At the time, the retirement age was set at 65, and most people didn’t live long past that. Fast forward to today, and the average American can expect to live until 78—and many live well into their 80s and 90s.

That increased lifespan means longer payouts and more pressure on Social Security’s financial reserves. To address that, Congress passed the Social Security Amendments of 1983, which introduced a gradual increase in the retirement age to 67. These changes have been rolling out ever since, and now we’ve reached the final stage.

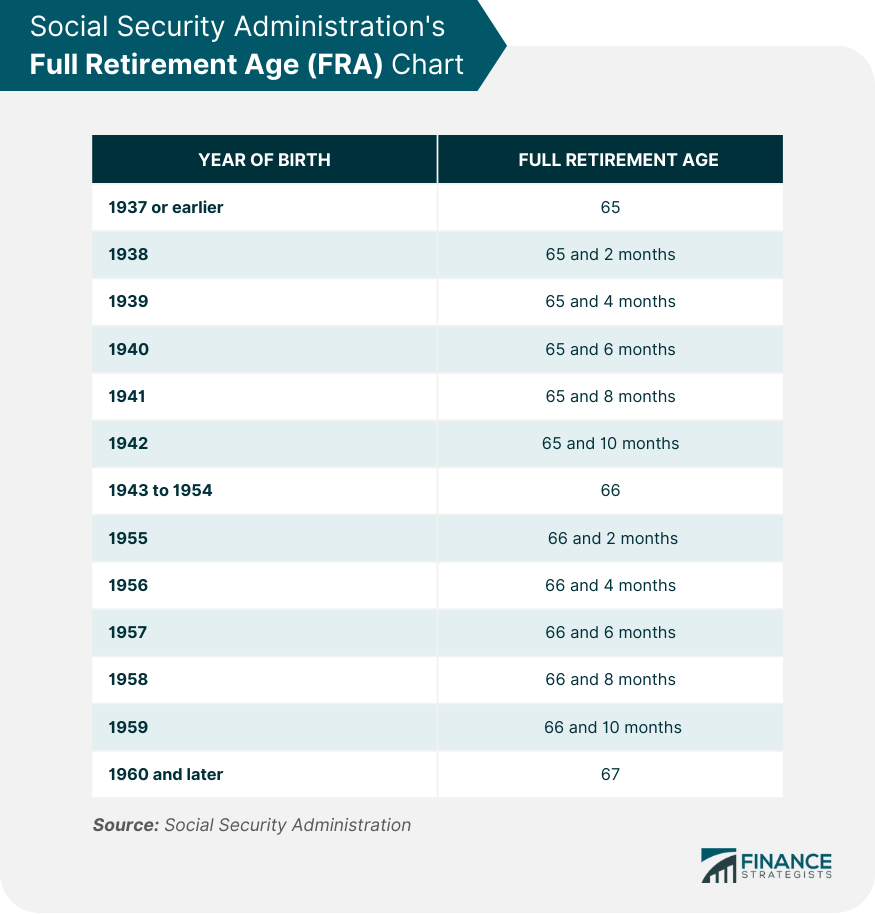

Social Security Retirement Age Timeline

To give more context, here’s how the full retirement age has increased over the years:

| Birth Year | Full Retirement Age |

|---|---|

| 1937 or earlier | 65 |

| 1943–1954 | 66 |

| 1955 | 66 and 2 months |

| 1956 | 66 and 4 months |

| 1957 | 66 and 6 months |

| 1958 | 66 and 8 months |

| 1959 | 66 and 10 months |

| 1960 or later | 67 |

What Social Security Retirement Age Adjusted to 67 Means for You?

If You Were Born Before 1959

You’re already past or near your FRA. This new update won’t affect you. You’re operating under previous rules.

Born in 1959?

You’ll reach full retirement age at 66 years and 10 months. So if you were born in December 1959, your FRA lands in October 2026.

Born in 1960 or Later?

Your full retirement age is now 67. If you retire at 62, you’ll get about 70% of your full monthly benefit—a 30% permanent reduction.

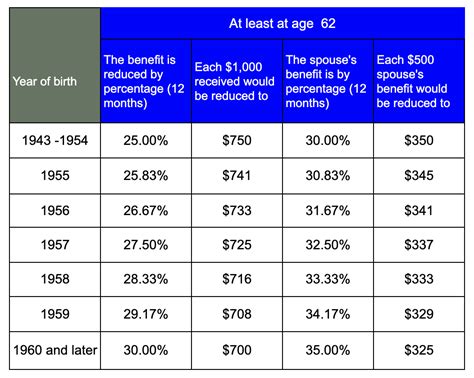

Why Early Retirement Can Cost You

You can still choose to retire as early as age 62, but doing so comes with a permanent reduction in benefits. Here’s what that looks like:

| Retirement Age | Benefit Received |

|---|---|

| 62 | ~70% of full benefit |

| 63 | ~75% |

| 64 | ~80% |

| 65 | ~86.7% |

| 66 | ~93.3% |

| 67 (FRA) | 100% |

| 68 | 108% |

| 69 | 116% |

| 70 | 124% |

By delaying benefits past your full retirement age, you can earn delayed retirement credits—an 8% increase in monthly payments for each year you wait, up to age 70.

The Hidden Costs: Health Insurance Gap Before Medicare

Social Security and Medicare are two separate programs. You become eligible for Medicare at age 65, regardless of your FRA.

That creates a coverage gap if you retire before 65. You may need private health insurance or ACA Marketplace coverage to bridge that gap, which can be costly.

This makes the decision to retire early not just a financial one, but also a health care planning challenge.

Pros and Cons of Delaying Social Security

Pros

- Higher monthly benefit (up to 32% more)

- Larger spousal and survivor benefits

- Financial flexibility later in retirement

Cons

- Delayed access to funds

- Risk of poor health or job loss before retirement

- May pay more taxes if working and claiming simultaneously

How It Affects Different Types of Workers?

Blue-Collar Workers

Physical demands make it harder to work into late 60s. These workers may claim early and take the hit on monthly benefits.

White-Collar Workers

Often have flexibility to delay retirement and maximize Social Security benefits. Knowledge of the system matters more than physical capacity.

Self-Employed and Gig Workers

May not contribute enough to earn substantial benefits. Need careful planning to ensure adequate contributions over time.

Native American and Underserved Communities

In many Native American communities, access to Social Security education is limited, and work histories may involve informal economies. That makes early claiming more common, even when it results in lower benefits.

This change highlights the need for better financial literacy programs tailored to Native and rural populations, where Social Security often forms the backbone of elder income.

Real-Life Example: How the Change Hits Home

Case Study: Sandra, Born 1960

Sandra, a nurse, plans to retire at age 62. Her estimated full benefit at 67 is $2,000/month. By retiring early, she’ll receive only $1,400/month—losing $600 monthly, or $7,200 annually. Over 20 years, that’s $144,000 in lost benefits.

If Sandra waits until 70, she could receive $2,480/month, giving her almost $1,000/month more than retiring early. This shows just how high the stakes are when timing your retirement.

What Congress Might Do Next?

Lawmakers have proposed several ideas to strengthen Social Security:

- Raise FRA beyond 67

- Increase payroll taxes on high earners

- Adjust cost-of-living formulas (COLA)

- Reduce benefits for wealthy retirees

None of these changes are law—yet. But with the Trust Fund projected to run dry by 2035, the political pressure is building.

Don’t Forget State Taxes

Not all states treat Social Security benefits the same. Some tax them partially or fully, depending on your income.

States that tax Social Security include:

- Colorado

- Minnesota

- Missouri

- Montana

- New Mexico

- Rhode Island

- Utah

- Vermont

- West Virginia

If you’re planning to relocate in retirement, factor this into your budget.

Why Your Social Security Retirement Checks Might Shrink Sooner Than Expected- Check Details

U.S. Retirement Age Set to Rise Again as Social Security Faces Major Funding Crisis

Trump’s ‘Big Beautiful Bill’ Sparks Debate Over Social Security and Benefits