Social Security Recipients Could Lose $18,000 a Year: If you or someone in your family is counting on Social Security to retire comfortably, there’s serious news you need to know: Social Security recipients could lose $18,000 a year by 2032, according to a sobering new analysis from the Committee for a Responsible Federal Budget (CRFB). If Congress doesn’t act fast, automatic benefit cuts of up to 24% could begin as early as 2033. In this article, we’ll break it all down for you in clear, everyday language—what’s happening, why it’s happening, who it affects, and what you can do to prepare. Whether you’re a young professional just entering the workforce or a retiree on a fixed income, these changes could shape your future.

Social Security Recipients Could Lose $18,000 a Year

The projection that Social Security recipients could lose $18,000 a year by 2032 isn’t just a warning—it’s a wake-up call. The system that millions rely on is unsustainable in its current form. But it’s not too late. With timely reforms, smart planning, and public pressure, we can protect the retirement security of millions of Americans. Whether you’re already retired or just entering the workforce, now’s the time to educate yourself, prepare, and advocate for long-term solutions.

| Key Point | Details |

|---|---|

| Projected Benefit Cut | 24% across-the-board Social Security benefit cut if Congress doesn’t act |

| Estimated Loss | Up to $18,100/year for medium-income dual-earner couples |

| Trust Fund Depletion Year | Late 2032, with cuts starting early 2033 |

| Programs Affected | Old-Age and Survivors Insurance (OASI); Medicare Trust Fund also at risk |

| Impact | Over 62 million Americans may see cuts; poverty among seniors could double |

| Required Fix | Legislative reform—adjust tax revenue, raise retirement age, or cut benefits |

| Official Source | SSA.gov and CRFB.org |

What’s Going on with Social Security Recipients Could Lose $18,000 a Year?

The Social Security system works like this: when you work, part of your paycheck (specifically 6.2%, matched by your employer) goes to fund the current retirees. It’s not a savings account with your name on it—your money pays for someone else now, and when you retire, someone else’s taxes will pay for you.

But that system only works as long as there are enough workers to support retirees. Right now, that balance is breaking.

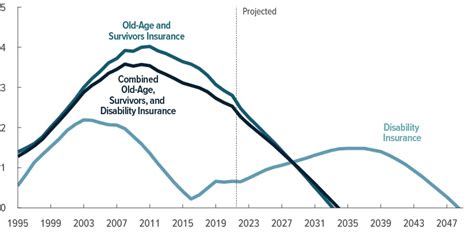

According to the Social Security Trustees’ 2024 report, the OASI Trust Fund—the main fund that pays benefits to retirees and their families—is on track to run out of reserves by 2032. After that, Social Security will still collect payroll taxes, but only enough to pay about 76% of scheduled benefits. That’s where the 24% cut comes in.

Historical Context: How We Got Here

Back in 1940, there were 16 workers for every Social Security beneficiary. Fast forward to today, and there are only 2.7 workers per beneficiary. Americans are living longer and having fewer children, which means the number of retirees is growing faster than the number of working-age people.

Adding to the stress:

- The baby boomer generation is retiring en masse.

- Wages have stagnated, which slows growth in payroll tax contributions.

- Congressional inaction has failed to modernize the system since 1983—the last major reform.

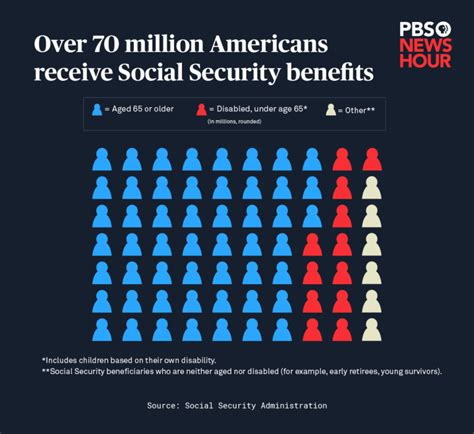

Who Will Be Affected by the Cut?

The short answer? Almost everyone.

As of 2024, over 62 million Americans receive Social Security benefits, and the vast majority of them rely on those payments to cover daily living expenses. A 24% cut could devastate the financial stability of:

- Middle-income retirees

- Low-income seniors

- Widows and widowers

- Disabled Americans

- Veterans on Social Security Disability Insurance (SSDI)

Breakdown: How Much Could You Lose?

The CRFB study estimates that a dual-earner couple retiring in early 2033 would lose approximately $18,100 annually, or $1,508 per month.

Here’s a closer look at different scenarios:

| Household Type | Projected Annual Loss |

|---|---|

| Medium-income dual-earner couple | $18,100 |

| Single-earner couple | $13,600 |

| Low-income dual-earner couple | $11,000 |

| High-income dual-earner couple | Up to $24,000 |

For many retirees, losing even a few hundred dollars per month could mean choosing between buying groceries or paying utility bills.

Real-Life Example: Meet Tom and Sandra

Tom and Sandra, a married couple in their late 60s, retired two years ago. Together, they receive about $3,000 a month in Social Security—roughly $36,000 a year. If a 24% cut goes into effect, their annual income drops by $8,640, leaving them with just $27,360.

Their monthly rent is $1,200. Add in healthcare, groceries, car insurance, and prescription meds, and they’re stretched to the breaking point. Now imagine that happening to 62 million people.

Why Is Social Security in Trouble?

Several long-term trends are driving Social Security’s financial issues:

- Demographics: Fewer workers are supporting more retirees.

- Increased Longevity: People are living longer, meaning they collect benefits for more years.

- Tax Revenue Shortfalls: Payroll taxes are not keeping pace with the promised benefits.

- Policy Changes: Legislation like the proposed One Big Beautiful Bill Act (OBBBA) expands deductions and reduces Social Security’s funding stream, speeding up insolvency.

- Lack of Reform: Congress has delayed necessary changes for decades.

Medicare’s Trust Fund Is Also at Risk

It’s not just Social Security that’s on the ropes. The Medicare Hospital Insurance Trust Fund is projected to be depleted by 2031. Once that happens, the program will only be able to cover 89% of hospital expenses for Medicare beneficiaries.

So, this is more than just a Social Security issue—it’s a retirement security crisis.

What Congress Could Do to Fix It?

Despite the grim forecast, experts agree the situation is fixable—but only if lawmakers act before the crisis hits.

Here are some common reform ideas being floated in Washington:

| Solution | Description |

|---|---|

| Raise Payroll Tax Rate | Increasing the 12.4% combined payroll tax slightly (e.g., to 14%) could close the shortfall. |

| Lift Taxable Income Cap | Currently, only wages up to $168,600 are taxed. Removing or raising that cap means higher earners pay more. |

| Increase Full Retirement Age | Gradually raising the age from 67 to 68 or 70 could reduce long-term costs. |

| Modify COLA Calculations | Changing how Cost-of-Living Adjustments are calculated could save money. |

| Introduce Means Testing | Reduce or eliminate benefits for wealthy retirees who don’t need them. |

Each of these changes comes with trade-offs, but most experts agree that doing something now is better than waiting for an emergency fix.

What You Can Do Right Now?

Even if you can’t control policy, you can still take control of your own retirement future.

- Check Your Benefits: Create a “my Social Security” account at ssa.gov/myaccount to see your projected benefits.

- Start Saving More: Max out your employer’s 401(k) or your Roth IRA contributions.

- Diversify Retirement Income: Consider annuities, investments, or rental income to supplement Social Security.

- Work Longer if Possible: Every year you delay claiming Social Security (up to age 70) boosts your monthly payout.

- Talk to a Financial Planner: A pro can help create a retirement plan that accounts for potential benefit cuts.

Expert Opinions

Alicia Munnell, director of the Center for Retirement Research at Boston College, says:

“If we act now, the changes needed to fix Social Security can be moderate and manageable. But if we wait until the trust fund runs dry, the fix will be much more painful.”

Maya MacGuineas, President of CRFB, warns:

“Doing nothing is a choice—a choice to cut benefits by nearly a quarter. That’s unacceptable for millions of Americans who paid in and expect to receive what was promised.”

Social Security Claims Are Surging — 5 Alarming Reasons You Should Act Fast

Social Security Is Running Out of Cash — Here’s the Shocking Timeline

Your Fall Benefits May Arrive Differently — Major Social Security, VA Payout Change Ahead

How to Advocate for Change?

Want to make a difference?

- Call your representatives through www.house.gov and www.senate.gov.

- Support advocacy groups like AARP, CRFB, and Social Security Works.

- Stay informed and vote—retirement policy may not be flashy, but it affects every American.