Social Security Payments Up to $5,100:Some Americans are about to get a nice boost in their bank accounts — Social Security payments of up to $5,100 are set to go out next week. Whether you’re a retiree, a disability recipient, or planning your future, knowing how Social Security works — and what you’re entitled to — is essential. In 2025, the maximum Social Security benefit available is $5,108 per month. But how do you qualify for that? When will your payment arrive? What should you do if your check is delayed? In this guide, we’ll answer all those questions — and help you make sense of what Social Security means for your life, your finances, and your future.

Social Security Payments Up to $5,100

Social Security benefits up to $5,100 are hitting accounts in mid to late July 2025, but only a few high earners will see that maximum amount. For most Americans, Social Security provides a modest but critical source of income in retirement. Understanding how your benefits are calculated, how to claim wisely, and how to supplement with other income is key to building a secure financial future. Take time to review your earnings history and consider speaking with a financial advisor. Whether you’re just starting your career or preparing to retire, Social Security is too important to leave to chance.

| Topic | Details |

|---|---|

| Maximum Monthly Benefit in 2025 | $5,108 (for high earners claiming at age 70) |

| Average Retirement Benefit | Approximately $1,907/month |

| July 2025 Payment Dates | July 16 (birthdays 11–20), July 23 (birthdays 21–31) |

| 2025 Cost-of-Living Adjustment (COLA) | 2.5% |

| Required Work Years for Max Benefit | 35 years of earnings |

| Claiming Age for Max Benefit | Age 70 |

| Official Resource | ssa.gov |

What Is Social Security and How Does It Work?

Social Security is a federal program that provides monthly income to millions of Americans — mostly retirees, disabled individuals, and surviving spouses or children of deceased workers. The program was established in 1935 and has evolved into one of the largest and most relied-upon financial systems in the United States.

Social Security benefits are based on:

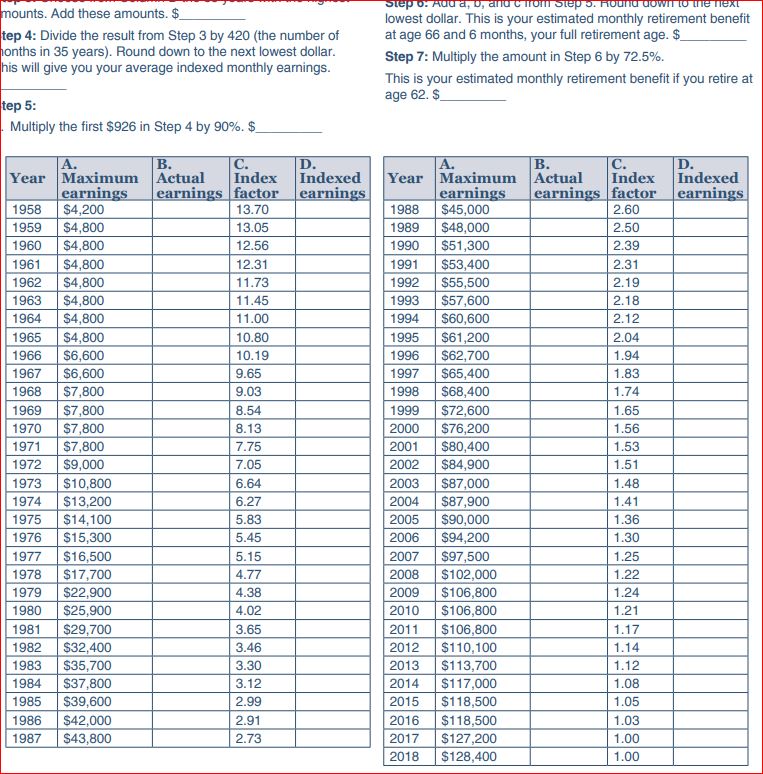

- Your highest 35 years of earnings

- The age you start claiming

- The type of benefit (retirement, disability, survivor, spousal)

The more you earn (up to the taxable cap), and the longer you wait to claim, the more you receive.

Why Are Some Social Security Checks Worth Over $5,100?

You might be wondering, “Who’s actually getting over $5,000 a month?”

The truth is, only a small number of retirees qualify for the maximum Social Security benefit of $5,108 in 2025. To earn that amount, you must:

- Work and pay into Social Security for at least 35 years

- Earn the maximum taxable wage each year ($168,600 in 2024, $175,200 in 2025)

- Wait until age 70 to start collecting benefits

This means high-income earners who delayed retirement — such as executives, doctors, and high-earning professionals — are most likely to see these larger checks.

Most people, however, get less than half that amount.

Here’s a breakdown of maximum benefits based on claiming age:

| Age You Start Claiming | Maximum Monthly Benefit |

|---|---|

| Age 62 | $2,710 |

| Age 67 (Full Retirement Age) | $3,822 |

| Age 70 | $5,108 |

July 2025 Payment Schedule: When Will You Get Paid?

Social Security sends payments out based on your date of birth. Here’s how it works:

- If your birthday falls between the 1st and 10th, you get paid on the second Wednesday of the month (July 9 in 2025).

- If your birthday is between the 11th and 20th, you’re paid on the third Wednesday (July 16).

- If your birthday falls between the 21st and 31st, your payment comes on the fourth Wednesday (July 23).

People receiving Supplemental Security Income (SSI) usually get paid on the first of the month, unless that falls on a weekend or holiday.

Those who receive both SSI and Social Security typically get their Social Security benefit on the third of the month.

How Are Payments Sent?

Most Social Security recipients get their payments via direct deposit, which is faster and more secure. Paper checks are still an option, but they can be delayed due to mail delivery issues.

To set up or check your payment details:

- Log into your My Social Security account

- Go to your payment settings

- Make sure your bank account information is current

If you’re using Direct Express, the payment goes directly onto your prepaid debit card.

Historical Perspective: How Benefits Have Grown Over Time

Social Security benefits have steadily increased over the decades, thanks in part to inflation and cost-of-living adjustments.

| Year | Maximum Monthly Benefit (Age 70) |

|---|---|

| 2000 | $1,433 |

| 2010 | $2,323 |

| 2020 | $3,790 |

| 2025 | $5,108 |

The 2025 COLA (Cost-of-Living Adjustment) of 2.5% helps protect purchasing power as living expenses rise. These increases are automatic and based on inflation metrics calculated by the Bureau of Labor Statistics.

Real-Life Example: Meet Linda

Linda is a 69-year-old retired teacher from North Carolina. She began teaching in 1985, retired in 2022, and started receiving Social Security benefits at age 67. She didn’t earn the max wage every year but contributed steadily to the system for 37 years.

Her current monthly Social Security check? Around $2,800.

“I didn’t wait until 70,” she says. “But I also didn’t want to keep working just for a few hundred extra dollars a month. This amount works for me — and I supplement it with a teacher pension and my 403(b).”

Linda’s situation shows that most people don’t need the maximum benefit to retire comfortably. The key is having multiple income sources and planning ahead.

How to Maximize Social Security Payments Up to $5,100?

Want to boost your benefits? Here are steps you can take:

- Work at least 35 years: Any year you don’t work counts as $0 — dragging down your average.

- Earn more: The higher your income (up to the taxable cap), the more you’ll receive.

- Delay claiming: Every year you wait past full retirement age (up to age 70) adds about 8% per year to your monthly check.

- Coordinate spousal benefits: If your spouse earns more, you may qualify for up to 50% of their benefit.

Planning Beyond Social Security

Social Security is a valuable source of retirement income, but it shouldn’t be your only one. Financial advisors recommend the “three-legged stool” approach:

- Social Security

- Employer-sponsored retirement plans (like 401(k)s)

- Personal savings or investments

Depending solely on Social Security could leave you with income gaps, especially with rising health care and housing costs. Having backup savings and other income sources gives you more freedom and flexibility in retirement.

Social Security’s Future: Is It Safe?

You may have heard that Social Security is “running out of money.” That’s partially true — but it’s not the full story.

According to the 2024 Social Security Trustees Report, the trust fund that supports retirement benefits will be depleted by 2034 if no changes are made. After that, payroll taxes will still cover around 80% of benefits, unless Congress takes action.

Possible solutions being debated in Washington include:

- Raising the retirement age

- Increasing payroll tax rates

- Reducing benefits for high-income earners

- Lifting the taxable wage cap

For now, benefits will continue — but it’s wise to plan conservatively, especially if you’re under age 50.

Senior Couples Set to Get $3,089 Social Security Payment in July- Check Eligibility Criteria!

Recent Adjustment to Social Security Benefits Raises Questions- Check Details!

Age 65? You Could Get a $1,611 Social Security Payment This July – Check Eligibility Criteria!