Social Security Payment: Social Security payments are a lifeline for millions of Americans, helping retirees, the disabled, and others rely on financial support from the federal government. But understanding when and how those payments are made—and knowing your rights and options—is just as important. With July 2025 approaching, it’s time to get clear on when your Social Security payment will be issued, how benefits are calculated, and what updates you need to be aware of. This article covers everything you need to know to stay on top of your payments.

Social Security Payment

Social Security payments are crucial for millions of Americans. With July 2025 approaching, it’s important to know your payment date, understand how benefits are calculated, and be aware of changes, such as the new overpayment recovery rules. By following the simple steps outlined in this article, you can ensure your benefits are paid on time and without issue. Remember, if you have any concerns about your Social Security benefits, the SSA is there to help. Stay informed, keep track of your payments, and take full advantage of the services they provide to ensure your benefits continue to support you.

| Topic | Details |

|---|---|

| Payment Date | July 16, 2025 |

| Payment Range | For individuals born between the 11th and 20th of any month |

| Maximum Social Security Benefit | $5,108 per month (based on work history and age at claiming) |

| Average Monthly Benefit | $2,002 (for retirees) |

| Overpayment Changes | Starting July 24, 2025, SSA will withhold 50% for overpayment recovery, up from 10% previously |

| Official SSA Website | Social Security Administration |

When Will Social Security Payments Be Made in July 2025?

Social Security payments in July 2025 will be distributed on specific Wednesdays throughout the month. The dates are based on your birth date, which determines when you’ll receive your benefits. Here’s a quick breakdown:

- July 9, 2025: For individuals born between the 1st and 10th of any month.

- July 16, 2025: For individuals born between the 11th and 20th of any month.

- July 23, 2025: For individuals born between the 21st and 31st of any month.

For those receiving Supplemental Security Income (SSI), payments are made on the 1st of each month, with Social Security benefits following the schedule above. Individuals who began receiving benefits before May 1997 may have a slightly different schedule, depending on their unique circumstances.

Pro Tip: Always check your Social Security account or bank account to ensure your payment has been deposited. If you don’t see the payment by your designated date, contact the SSA immediately.

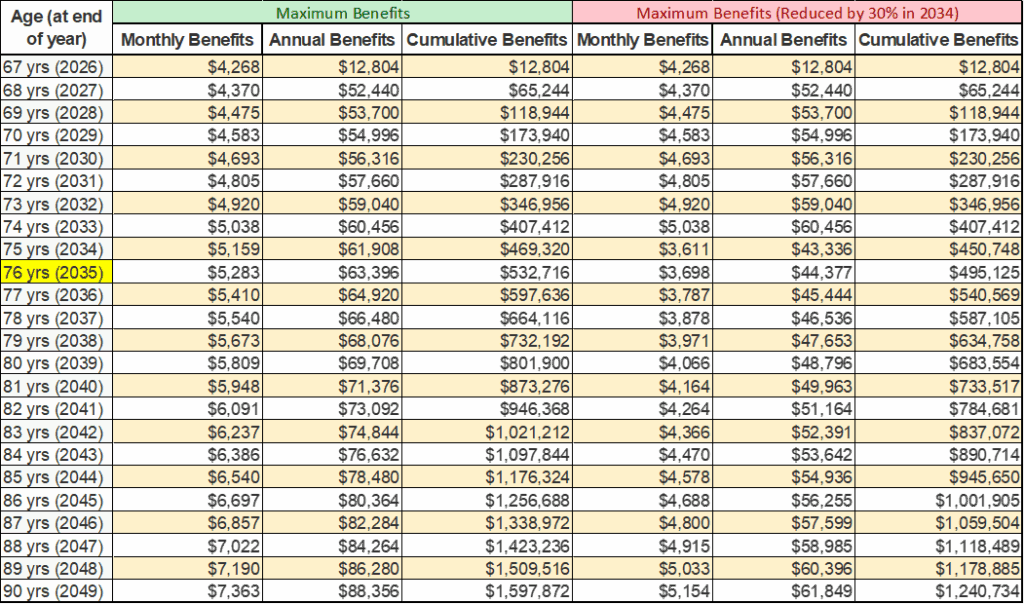

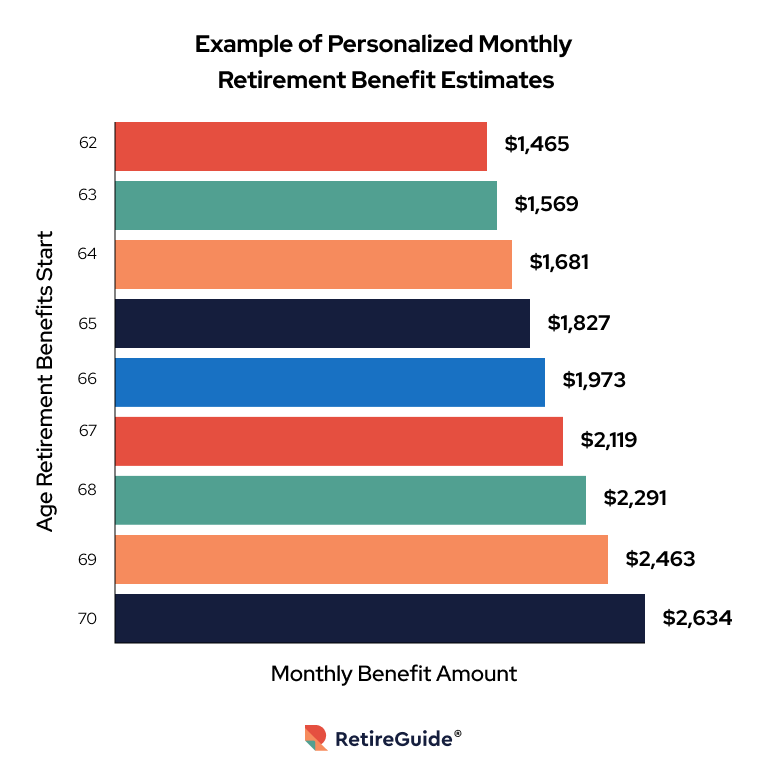

How Are Social Security Benefits Calculated?

Social Security benefits are primarily based on your lifetime earnings and the age at which you begin claiming your benefits. The SSA uses a complex formula to calculate your monthly payment, but here are the general steps:

- Work History: The more you work, the higher your benefits. SSA looks at your highest 35 years of earnings to calculate your benefits.

- Retirement Age: The age at which you claim Social Security is crucial. If you claim benefits before your full retirement age (FRA), your benefits will be reduced.

- Delayed Retirement: If you wait beyond FRA (up to age 70), your monthly benefits will increase by about 8% per year you delay.

Example:

Let’s say you earned an average of $50,000 per year over your best 35 years of work, and your FRA is 66. At FRA, you might receive around $2,000 per month in benefits. However, if you claim early at 62, your monthly payment might be reduced to around $1,400. If you wait until 70, your benefit could increase to around $2,700 per month.

Understanding Full Retirement Age (FRA)

Your Full Retirement Age (FRA) is the age at which you are eligible to receive your full Social Security benefits. For those born in 1960 or later, the FRA is 67. However, you can begin receiving benefits as early as age 62, though your benefits will be reduced.

Key Insights on Social Security Payment Delays

Social Security payments are typically made on time. However, delays do occur due to a variety of factors, such as banking issues or errors in your SSA account. Here are a few common problems:

- Incorrect Amount: Sometimes, people receive less than expected due to errors in the SSA system.

- Delayed Payments: Payments can be delayed if there’s an issue with your account or if you haven’t updated your information with the SSA.

- Suspended Payments: In rare cases, benefits may be suspended if you fail to follow SSA rules or if they find discrepancies in your financial records.

If you experience any issues, you should contact the SSA directly. They offer customer service through their website, by phone, or in person.

Alternative Ways to Receive Your Social Security Payment

While direct deposit is the most common and secure way to receive your benefits, there are a few alternatives if you prefer not to use a bank account:

- Direct Express Card: This prepaid card acts like a debit card, with funds automatically deposited each month.

- Paper Checks: For those who don’t use banks or prefer checks, paper checks are still an option, but they are slower than direct deposit.

Pro Tip: Direct deposit is generally faster and more reliable, so it’s a good idea to sign up for it if you haven’t already.

Overpayment Recovery: What You Need to Know

Starting on July 24, 2025, the Social Security Administration will begin withholding 50% of monthly benefits from those who have been overpaid, until the overpayment is fully repaid. This change reflects a policy adjustment from the previous 10% withholding rate.

If you’re concerned about overpayment, here’s what you can do:

- Check your SSA statements regularly to ensure your payment amounts are correct.

- If you believe there’s been an error, contact the SSA immediately and request a waiver or appeal.

- Set up direct deposit for faster payment resolution.

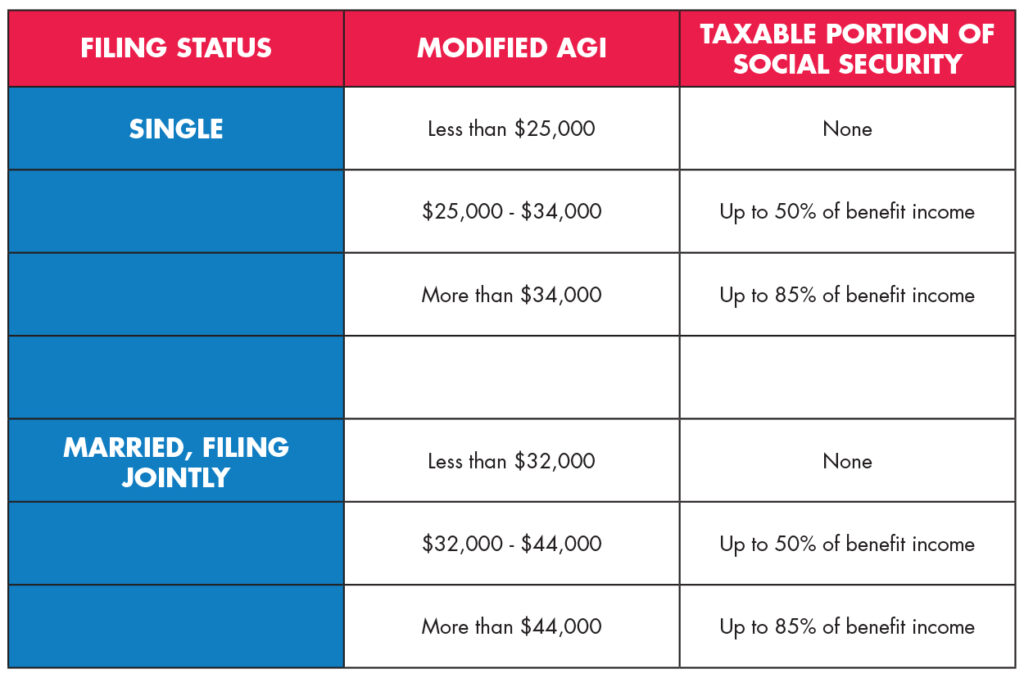

How Social Security Benefits Are Taxed?

Did you know your Social Security benefits may be taxable? It depends on your income. If your combined income (which includes Social Security benefits and any other sources of income) exceeds certain thresholds, you may owe taxes on a portion of your Social Security benefits.

- For individuals: If your combined income is between $25,000 and $34,000, up to 50% of your benefits may be taxable.

- For married couples filing jointly: If your combined income is between $32,000 and $44,000, up to 50% of your benefits may be taxable.

- If your income exceeds these thresholds, up to 85% of your benefits may be subject to tax.

It’s important to keep track of your overall income and consult a tax professional if you think your benefits may be taxed.

Future Projections and Social Security Policy Changes

The future of Social Security is a topic of ongoing debate. Several proposed changes could affect how benefits are calculated, the age at which people can claim, and how benefits are distributed. However, it’s important to note that Social Security is not going anywhere. The program is projected to continue paying benefits for many years, even if some changes occur.

For the most up-to-date information on policy changes and projections, it’s always best to refer to the official Social Security Administration website.

Recent Adjustment to Social Security Benefits Raises Questions- Check Details!

Trump’s ‘Big Beautiful Bill’ Could Reshape Social Security for Millions of Americans

Trump’s New Tax Bill Could Reshape How Social Security Benefits Are Taxed